India Bioplastics Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

Market Overview:

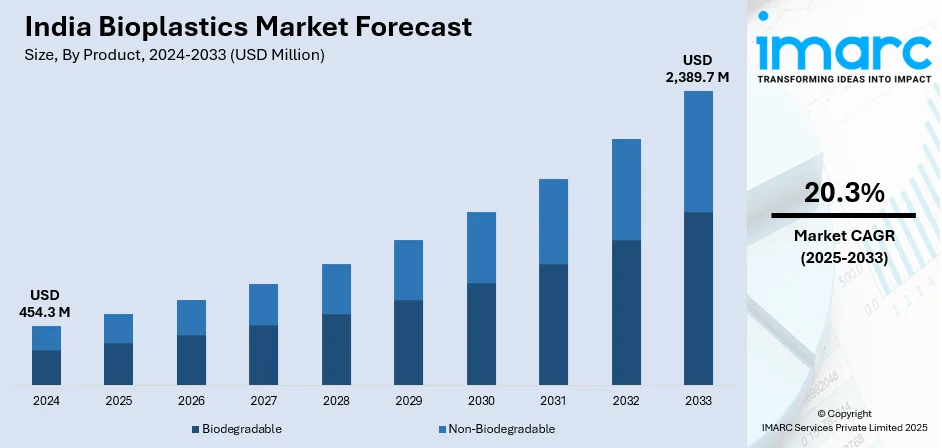

India bioplastics market size reached USD 454.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,389.7 Million by 2033, exhibiting a growth rate (CAGR) of 20.3% during 2025-2033. The growing awareness among individuals towards the importance of using sustainable practices, along with the inflating need for mitigating climate change, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 454.3 Million |

| Market Forecast in 2033 | USD 2,389.7 Million |

| Market Growth Rate (2025-2033) | 20.3% |

Bioplastics represent a category of plastic materials sourced from renewable origins, such as cornstarch, sugarcane, or algae, in contrast to the conventional petroleum-based plastics. The key advantage lies in their diminished environmental impact. Unlike traditional plastics, which can endure for centuries before decomposing, certain bioplastics are intentionally designed to be biodegradable, breaking down more rapidly. Additionally, the manufacturing process for bioplastics tends to release fewer greenhouse gases, enhancing their sustainability profile. This renders them a more eco-friendly choice across diverse applications, spanning from packaging to components in the automotive industry. Despite these merits, bioplastics currently constitute a relatively small fraction of the global plastics market. Nevertheless, they present a promising and environmentally friendly substitute for petroleum-based plastics, particularly amid escalating environmental apprehensions.

To get more information on this market, Request Sample

India Bioplastics Market Trends:

The India bioplastics market is experiencing significant growth, propelled by a heightened awareness of environmental sustainability and a growing emphasis on reducing the environmental impact of plastic materials. The primary advantage driving the adoption of bioplastics in this country is their reduced environmental footprint. Unlike conventional plastics that can persist for centuries, certain bioplastics are designed to be biodegradable, breaking down more rapidly and contributing to reduced plastic pollution. Moreover, the manufacturing process for bioplastics also tends to emit fewer greenhouse gases, aligning with India's commitment to mitigating climate change and reducing carbon emissions. Besides this, applications of bioplastics in India span various industries, including packaging, where they are used for bags, containers, and films. Additionally, the automotive sector is increasingly exploring bioplastics for components, contributing to sustainable practices in manufacturing. Besides this, the agricultural industry in India is also leveraging bioplastics for mulching films and other applications. Furthermore, government initiatives promoting eco-friendly alternatives and the development of advanced technologies in the bioplastics sector will contribute to bolster the India bioplastics market in the coming years.

India Bioplastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Biodegradable

- Polylactic Acid

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-Biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polytrimethylene Terephthalate

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes biodegradable, (polylactic acid, starch blends, polybutylene adipate terephthalate (PBAT), polybutylene succinate (PBS), and others) and non-biodegradable (polyethylene, polyethylene terephthalate, polyamide, polytrimethylene terephthalate, and others).

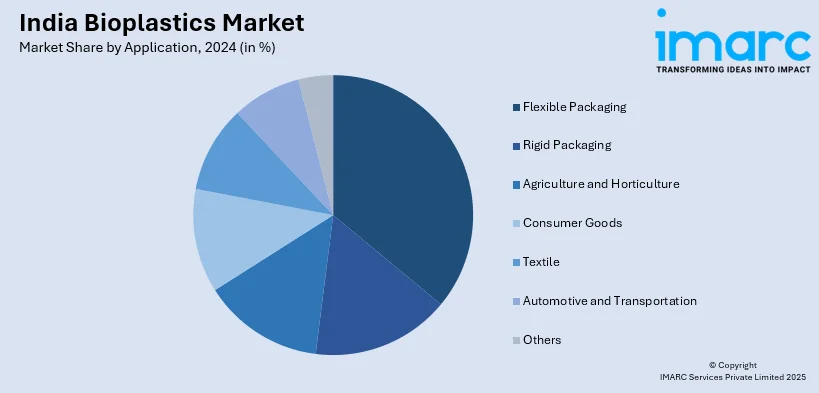

Application Insights:

- Flexible Packaging

- Rigid Packaging

- Agriculture and Horticulture

- Consumer Goods

- Textile

- Automotive and Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes flexible packaging, rigid packaging, agriculture and horticulture, consumer goods, textile, automotive and transportation, and others.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bioplastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Flexible Packaging, Rigid Packaging, Agriculture and Horticulture, Consumer Goods, Textile, Automotive and Transportation, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bioplastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bioplastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bioplastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India bioplastics market was valued at USD 454.3 Million in 2024.

The India bioplastics market is projected to exhibit a CAGR of 20.3% during 2025-2033, reaching a value of USD 2,389.7 Million by 2033.

The India bioplastics market is driven by growing environmental awareness, government bans on single-use plastics, and rising demand for sustainable packaging. Increased consumer preference for eco-friendly alternatives, corporate sustainability goals, and innovations in biodegradable materials support market growth. Agricultural waste availability further enhances domestic bioplastic production and circular economy potential.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)