India Biomedical Waste Management Market Size, Share, Trends and Forecast by Type, Service Type, and Region, 2025-2033

India Biomedical Waste Management Market Overview:

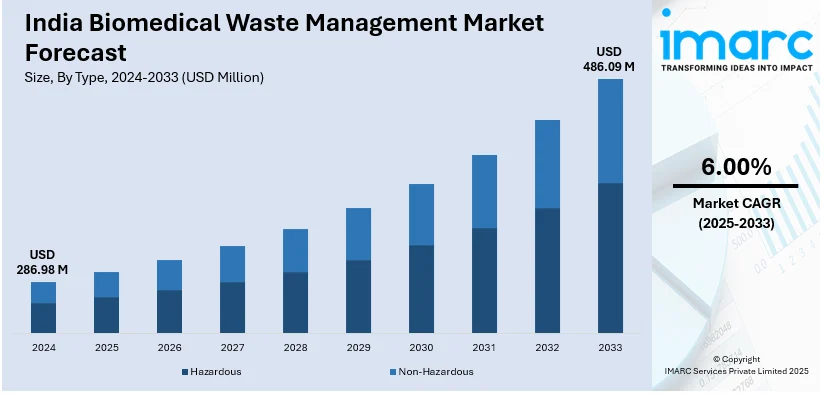

The India biomedical waste management market size reached USD 286.98 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 486.09 Million by 2033, exhibiting a growth rate (CAGR) of 6.00% during 2025-2033. The growing investments in waste treatment plants, regulatory compliance, training initiatives, private sector involvement, decentralized facilities, and eco-friendly disposal technologies are ensuring efficient biomedical waste management, enhanced transparency, reduced contamination risks, and improved accessibility of treatment solutions across healthcare institutions of India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 286.98 Million |

| Market Forecast in 2033 | USD 486.09 Million |

| Market Growth Rate (2025-2033) | 6.00% |

India Biomedical Waste Management Market Trends:

Increasing Investments in Waste Treatment Plants

The rise of biomedical waste treatment facilities is a major factor supporting the market expansion, as both public and private entities are investing in specialized sites to effectively handle hazardous medical waste. The creation of new treatment facilities is enhancing waste collection, sorting, and disposal, guaranteeing adherence to strict environmental standards. Capital is allocated to cutting-edge treatment methods like high-temperature incineration, autoclaving, and chemical disinfection for reducing the dangers linked to infectious and pathological waste. The creation of specialized processing units is tackling issues associated with improper disposal, lowering contamination risks for public health and the environment. Government initiatives and monetary incentives are promoting the establishment of decentralized treatment centers, enhancing waste management accessibility in neglected regions. The incorporation of contemporary tracking systems in these facilities is improving operational efficiency, guaranteeing transparency, and deterring illegal dumping. The participation of the private sector is increasingly speeding up infrastructure growth, as companies set up high-capacity treatment centers to support various healthcare facilities. The increasing need for sustainable waste disposal is spurring investments in waste-to-energy solutions and environment-friendly treatment technologies, bolstering the systematic expansion of the biomedical waste management sector. In 2024, the Kolkata Municipal Corporation (KMC) announced plans to set up a biomedical waste treatment and recycling plant at Dhapa. The facility was set to manage hazardous waste from government and private hospitals, addressing concerns about illegal recycling practices. The plant, which was expected to be operational by the end of 2025, was to include an incinerator for proper waste disposal.

To get more information on this market, Request Sample

Rising Awareness and Training Initiatives

The growing awareness about the environmental and health risks associated with improper biomedical waste disposal is fueling the need for organized waste management systems in India. Healthcare workers, hospital personnel, and waste management teams are undergoing formal training in waste segregation, management, and disposal procedures to guarantee adherence to safety regulations. Government agencies and non-profit groups (NPOs) are proactively holding workshops and awareness initiatives to inform healthcare professionals about best practices and regulatory standards. For instance, in 2025, the Environment Minister of Delhi launched a workshop focused on biomedical waste management, arranged by the Delhi Pollution Control Committee (DPCC) and the Centre for Occupational and Environmental Health (COEH), highlighting the importance of correct segregation and treatment for improving public health and safety for the environment. These initiatives are emphasizing the significance of adherence and making certain that healthcare institutions apply organized waste management methods. Certified training programs are improving the capabilities of waste handlers, minimizing contamination risks and workplace dangers. Public demand and legal responsibilities linked to improper waste disposal are driving hospitals and clinics to implement strict protocols. Educational institutions are incorporating biomedical waste management into their curricula, making sure future professionals recognize regulatory and ethical obligations. These initiatives together enhance compliance and promote market growth.

India Biomedical Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and service type.

Type Insights:

- Hazardous

- Non-Hazardous

The report has provided a detailed breakup and analysis of the market based on the type. This includes hazardous and non-hazardous.

Service Type Insights:

- Collection

- Transportation and Storage Services

- Treatment and Disposal

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes collection, transportation and storage services, treatment and disposal, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biomedical Waste Management Market News:

- In February 2025, Union Minister Dr. Jitendra Singh launched India's first indigenous Automated Biomedical Waste Treatment Plant, "Sṛjanam," at AIIMS, New Delhi. Developed by CSIR-NIIST, this eco-friendly technology efficiently disinfects biomedical waste without incinerators. The plant is a significant step towards sustainable waste management in healthcare, addressing the growing issue of biomedical waste disposal.

- In September 2024, the Bengal government launched a bar-coded tracking system for biomedical waste management at all government hospitals. This digital system aimed to monitor waste from its source to disposal, ensuring accountability and preventing illegal handling. It came amid concerns over biomedical waste smuggling and unsafe disposal practices.

India Biomedical Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hazardous, Non-Hazardous |

| Service Types Covered | Collection, Transportation and Storage Services, Treatment and Disposal, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biomedical waste management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biomedical waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biomedical waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India biomedical waste management market was valued at USD 286.98 Million in 2024.

The biomedical waste management market in India is projected to exhibit a CAGR of 6.00% during 2025-2033, reaching a value of USD 486.09 Million by 2033.

The Indian biomedical waste management market is driven by growing healthcare activity and medical waste production, stricter regulations (BMW Rules), and heightened environmental and public health awareness. Technological advancements like on-site treatment units, automation, and waste-to-energy systems combined with public–private partnerships and digital tracking platforms are also boosting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)