India Biomass Market Size, Share, Trends and Forecast by Feedstock, Application, and Region, 2025-2033

India Biomass Market Overview:

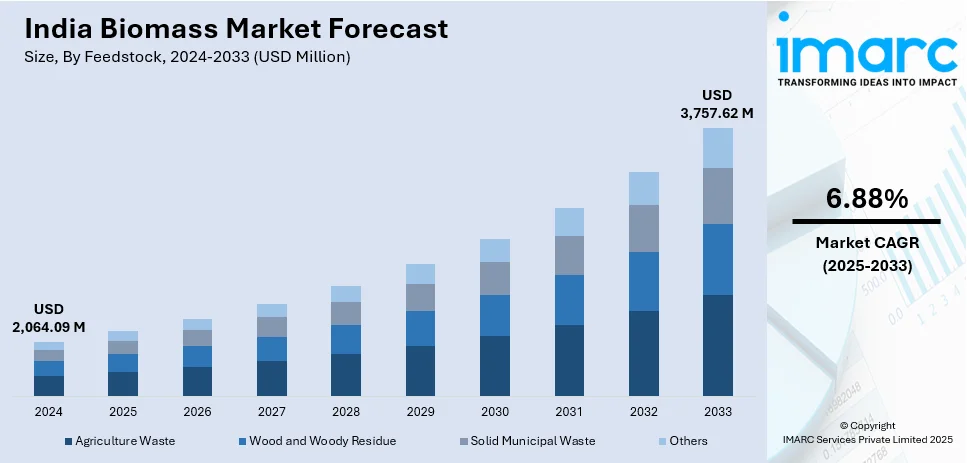

The India biomass market size reached USD 2,064.09 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,757.62 Million by 2033, exhibiting a growth rate (CAGR) of 6.88% during 2025-2033. Government incentives, rising energy demand, abundant biomass availability, technological advancements, and growing environmental concerns are key drivers in the market. Additionally, increased investments in waste-to-energy projects, supportive policies, and the push for sustainable alternatives to fossil fuels are expanding India biomass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,064.09 Million |

| Market Forecast in 2033 | USD 3,757.62 Million |

| Market Growth Rate 2025-2033 | 6.88% |

India Biomass Market Trends:

Growing Demand for Clean Energy Solutions

The India biomass market growth is driven by the rising demand for clean and sustainable energy solutions. For instance, on February 12, 2025, Suzlon Group stated that Oyster Renewable has placed an order for 201.6 MW of wind energy, their second partnership in nine months in Madhya Pradesh, for a total of 283.5 MW. The installation of 64 S144 wind turbine generators, each with a 3.15 MW capacity, is part of this order. Consequently, Suzlon's order book has grown to a record 5.7 GW, demonstrating its dedication to promoting India's transition to clean energy. With the government’s strong focus on reducing carbon emissions and increasing renewable energy sources, biomass has become a key component in India’s energy mix. Biomass energy is seen as a viable alternative to fossil fuels, with diverse feedstocks such as agricultural residues, wood, and municipal solid waste. The government’s initiatives, including subsidies and policy support, are driving investments in biomass power plants and bioenergy technologies, creating opportunities for growth in this sector. Notably, on February 12, 2025, India's potential to use biomass for electricity was highlighted in an article published by Renewable Watch. About 750 million metric tonnes (mmt) of biomass are produced in the nation each year, of which 228 mmt are considered surplus. Furthermore, India has a livestock population of 535.78 million, of which more than 56% are bovines, and produces 160,038.9 tonnes of municipal solid waste daily, offering substantial potential for the production of renewable energy.

To get more information on this market, Request Sample

Technological Advancements in Biomass Conversion

Technological advancements in biomass conversion processes are playing a crucial role in the expansion of the Indian biomass market. Innovations in thermochemical and biochemical conversion technologies, such as gasification, anaerobic digestion, and pyrolysis, are improving efficiency and reducing costs. For instance, the Department of Science and Technology (DST), IIT Delhi, and Thermax collaborated to launch India's first CO2-to-methanol pilot plant in Pune on September 17, 2024. At a cost of INR 31 Crore (USD 3.72 Million), the 1.4-ton-per-day (TPD) facility was built with the goal of developing Carbon Capture and Utilization (CCU) technologies. With a possible future policy for methanol-blended diesel, this initiative is a step toward technical self-reliance and decarbonization and is in line with India's environmental goals, which include lowering emissions in coal-based sectors. These advancements enable the production of biofuels, biogas, and other bio-based products with higher energy yields. The development of advanced technologies has also helped in overcoming challenges related to feedstock quality and supply chain issues. As the adoption of these technologies increases, this is positively impacting the India biomass market outlook.

India Biomass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on feedstock and application.

Feedstock Insights:

- Agriculture Waste

- Wood and Woody Residue

- Solid Municipal Waste

- Others

The report has provided a detailed breakup and analysis of the market based on the feedstock. This includes agriculture waste, wood and woody residue, solid municipal waste, and others.

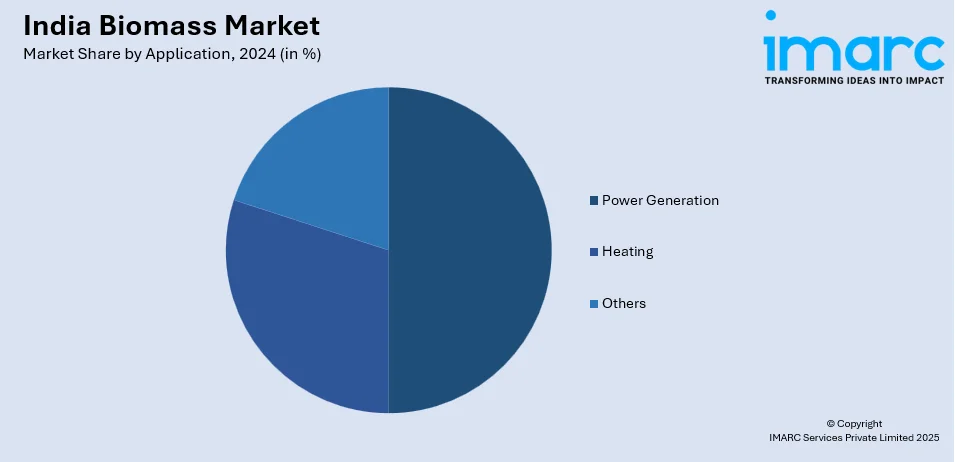

Application Insights:

- Power Generation

- Heating

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power generation, heating, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biomass Market News:

- On July 12, 2024, NLC India Limited (NLCIL) started a trial of biomass co-firing, at its Barsingsar Thermal Power Station (BTPS) in Rajasthan, which has two 125 MW units. Using Circulating Fluidized Bed Combustion (CFBC) technology, this is the first time biomass co-firing has been used in a boiler of this size in India. The project intends to lower carbon emissions and promote sustainable waste management by reducing lignite use through the blending of lignite with pelletized agricultural waste.

India Biomass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstocks Covered | Agriculture Waste, Wood and Woody Residue, Solid Municipal Waste, Others |

| Applications Covered | Power Generation, Heating, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biomass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biomass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biomass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India biomass market size reached USD 2,064.09 Million in 2024.

The India biomass market is expected to reach USD 3,757.62 Million by 2033, exhibiting a CAGR of 6.88% during 2025-2033.

Market growth is driven by increasing demand for renewable and sustainable energy sources, government incentives and policies promoting biomass energy, and rising awareness about environmental benefits. The growth of the agricultural sector provides abundant biomass feedstock, while the need to reduce carbon emissions and dependence on fossil fuels further supports market expansion. Additionally, advancements in biomass conversion technologies and increasing investments in rural electrification projects contribute to the market’s positive outlook.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)