India Biologics Market Size, Share, Trends and Forecast by Source, Product, Disease, Manufacturing, and Region, 2026-2034

India Biologics Market 2025, Size and Share:

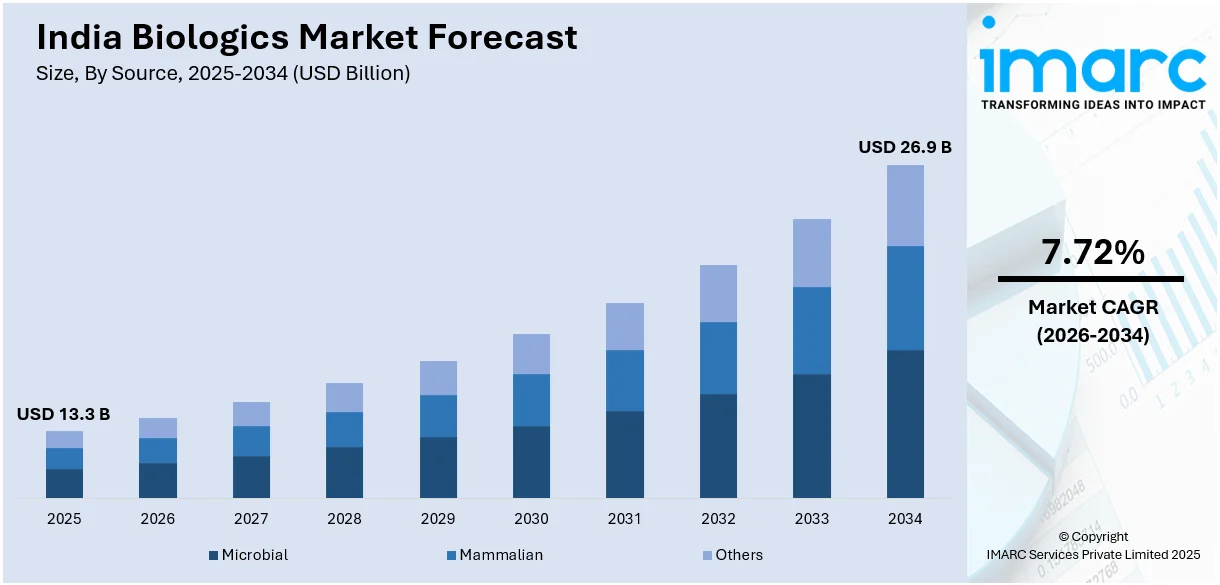

The India biologics market size was valued at USD 13.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 26.9 Billion by 2034, exhibiting a CAGR of 7.72% from 2026-2034. The market is growing notably, mainly impacted by government programs aiding biopharmaceutical research, innovations in biotechnology, and magnifying need for advanced therapies. Furthermore, the market profits from elevating healthcare investments, cost-efficient manufacturing abilities, and a skilled labor force, positioning the region as a crucial player in the global biologics industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13.3 Billion |

| Market Forecast in 2034 | USD 26.9 Billion |

| Market Growth Rate (2026-2034) | 7.72% |

India's biologics market is actively being propelled by heightening need for innovative therapies for the effective treatment of chronic diseases, mainly including autoimmune disorders, cancer, and diabetes. The amplifying cases of such disorders, together with an elevating awareness regarding biologic treatments among patients as well as healthcare providers, is fueling market expansion. For instance, according to the Press Information Bureau, India records around 800,000 new cancer cases annually, with tobacco-associated cancers ranging between 35% and 50% of all cancer detected among men. In additionally, government programs facilitating biotechnological research and advancements are prompting the formulation of groundbreaking biologics. The magnifying healthcare budget and proliferation of healthcare infrastructure further support the availability and utilization of biologics across the nation, fortifying its position in the pharmaceutical sector.

To get more information on this market Request Sample

India's biologics market is further experiencing substantial expansion primarily because of the technological innovations and notable proliferation of manufacturing abilities. For instance, as per industry reports, India accounted for the production of 50% of the 8 billion vaccine doses distributed globally in 2023. The nation’s resilient pharmaceutical landscape is rapidly investing in biologics manufacturing, utilizing cutting-edge expertise as well as facilities. Moreover, incentives and highly beneficial regulatory protocols for biosimilars and drugs production are significantly appealing both global and domestic giants to establish a robust presence in India. For instance, as per industry reports, India launched Production Linked Incentive scheme to boost manufacturing of drugs, APIs domestically. Spanning 2022-2029, this scheme facilitated 89,545 million tons of production with an incentive outlay of INR 6,940 Cr. In addition, the high cost-efficiency of manufacturing in India in comparison to other regions is establishing the nation as a crucial hub for biologics production, catering to the overseas as well as domestic requirement while bolstering the market forward.

India Biologics Market Trends:

Rising Demand for Biosimilars

India's biologics market is witnessing notable growth trajectory, mainly owned to its amplifying need for biosimilars, further fueled by their exceptional cost-efficiency and. With patent expirations of major biologic drugs, Indian pharmaceutical firms are securing the opportunity to design value-driven biosimilars for both international and domestic markets. For instance, in August 2024, Biocon Biologics, an India-based firm, signed a deal with Janssen Biotech Inc. to commercialize its biosimilar Bmab 1200 in major markets, including Canada and Europe. Besides, a strong manufacturing landscape and regulatory aid further improve nation’s stance as a key supplier of biosimilars. This trend is also boosted by the accelerating incidents of chronic diseases, mainly encompassing cancer or diabetes, which demand prolonged biologic treatment, bolstering the consumption of biosimilars in India.

Government Support and Policy Initiatives

The Indian government’s solution-oriented policies are boosting the biologics market by prompting domestic manufacturing, research projects, and advancements. Ventures such as the "Make in India" intuitive and financial incentives for biotechnology firms are facilitating the formulation of biologic drugs. In addition, regulatory policies are being upgraded to guarantee quicker certifications, which is incentivizing domestic companies to heavily invest in biologics. Public-private collaboration and amplified funding for leading-edge biopharma infrastructure further influence this trend positively, establishing India as a competitive nation in the global biologics market while addressing the increasing domestic requirement for advanced medical treatments. For instance, as per industry reports, India's Biotechnology for Economy, Environment, and Employment (BioE3) policy was approved in 2024, following a remarkable over tenfold expansion of the nation's bioeconomy, which was projected to reach USD 130 billion in the same year. The BioE3 initiative aims to achieve a target of USD 300 billion by the year 2030.

Advancements in Biomanufacturing Technologies

Technological innovations in biomanufacturing are revolutionizing India’s biologics industry, facilitating expanded manufacturing of excellent-quality biologics. Several firms are actively opting for advanced techniques, including innovative cell culture technologies, single-use systems, and continuous bioprocessing, to improve production efficacy. For instance, in July 2024, Bioserve India launched innovative stem cell product line that target to aid advancements in drug designing and research projects, fostering innovations in therapeutic developments and regenerative medicine across India. Furthermore, such advancements guarantee adherence with global quality protocols, positioning the nation a preferable hub for biologics production. In addition, the incorporation of data analytics and artificial intelligence (AI) in biopharma operations is deducing costs as well as upgrading processes. This trend not only boosts biologic drug development but also fortifies India's competitive lead in exporting cost-effective biologics to global markets.

India Biologics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India biologics market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on source, product, disease, and manufacturing.

Analysis by Source:

- Microbial

- Mammalian

- Others

The microbial source segment holds a substantial share of the India biologics market, driven by its cost-effective production and scalability. Microbial systems, such as bacteria and yeast, are widely used in the development of biosimilars, vaccines, and other biologics due to their rapid growth rates and high protein expression capabilities. Moreover, Indian biopharmaceutical companies leverage advanced fermentation technologies to enhance yield and quality, meeting growing domestic and global demand. This segment's strong market position is further supported by its suitability for producing biologics that require simplified structures, reinforcing its significance in the biologics supply chain.

The mammalian source segment commands a significant share of the India biologics market, attributed to its ability to produce complex biologics, such as monoclonal antibodies and therapeutic proteins, with high efficacy and specificity. Mammalian cell cultures, particularly CHO (Chinese Hamster Ovary) cells, are widely utilized for their ability to replicate human-like post-translational modifications, ensuring better therapeutic outcomes. In addition, Indian manufacturers are investing in cutting-edge biomanufacturing facilities to expand their capacity for mammalian cell-based biologics, aligning with increasing demand for advanced treatments. This segment is pivotal for catering to the growing needs of chronic and life-threatening disease management.

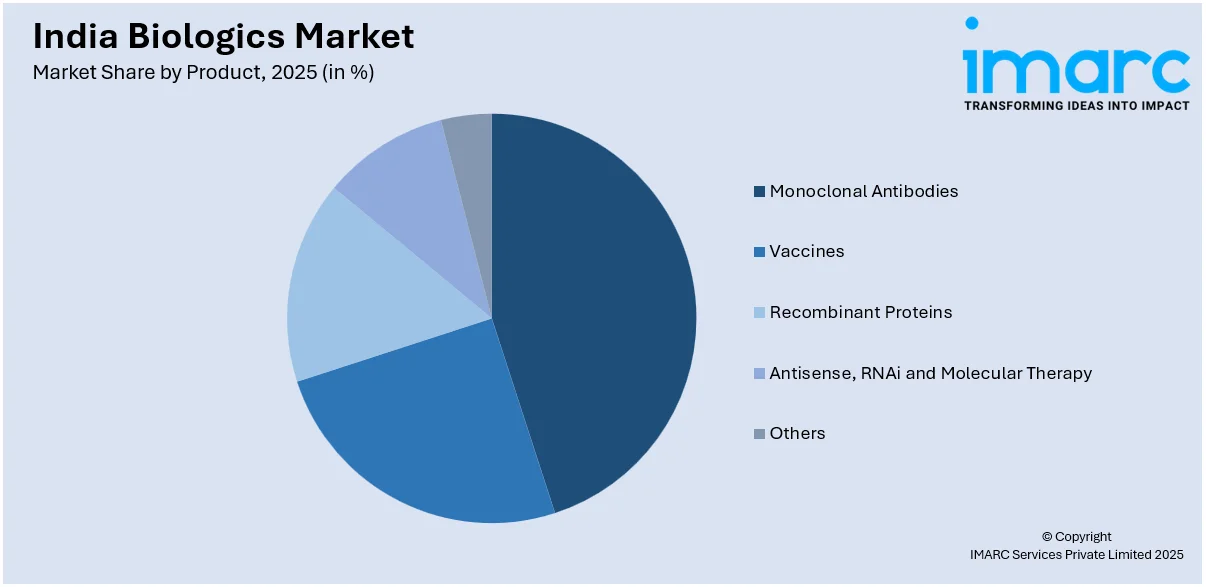

Analysis by Product:

Access the comprehensive market breakdown Request Sample

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Antisense, RNAi and Molecular Therapy

- Others

Monoclonal antibodies hold a substantial market share in India’s biologics sector, driven by their efficacy in treating chronic diseases such as cancer, autoimmune disorders, and infectious diseases. The increasing prevalence of these conditions, coupled with advancements in antibody engineering, supports their widespread adoption. Moreover, domestic pharmaceutical companies are expanding production capabilities to cater to growing demand, while partnerships with global firms enhance market accessibility. Regulatory approvals for biosimilar monoclonal antibodies further strengthen their presence, positioning them as a cornerstone of India’s biologics market.

Vaccines represent a significant segment in India’s biologics market, supported by the country's role as a global vaccine manufacturing hub. The rising focus on immunization programs, both domestically and globally, drives demand for traditional and next-generation vaccines. Government initiatives, including public-private partnerships and funding for vaccine development, further bolster the market. In addition, the increasing prevalence of infectious diseases and rising awareness about preventive healthcare contribute to sustained growth in this segment. Furthermore, India's strong manufacturing ecosystem ensures a competitive edge in producing high-quality, cost-effective vaccines for domestic and export markets.

The recombinant proteins segment is growing rapidly in India’s biologics market, driven by their applications in treating metabolic disorders, cancers, and hormone deficiencies. Technological advancements in genetic engineering and biomanufacturing have enabled the production of high-quality, cost-effective recombinant proteins. The demand is further fueled by increasing healthcare expenditure and the availability of advanced therapies. Moreover, domestic companies are focusing on scaling production and meeting global regulatory standards, enhancing their presence in international markets. This segment’s growth underscores its importance in expanding access to innovative biologic therapies in India.

Antisense, RNAi, and molecular therapies are emerging as promising segments within India’s biologics market, driven by their potential to treat genetic disorders and rare diseases. Advances in gene-silencing technologies and targeted therapies are accelerating their adoption. In addition, increasing investments in research and development, coupled with a growing focus on precision medicine, are key factors propelling this segment. Furthermore, the collaboration between biotech startups and established pharmaceutical firms enhances innovation and commercialization. These therapies are expected to play a pivotal role in shaping the future of biologics in India’s healthcare landscape.

Analysis by Disease:

- Oncology

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

The oncology segment holds a significant share in the India biologics market, driven by the increasing prevalence of cancer and the rising demand for targeted therapies. Biologics, including monoclonal antibodies and checkpoint inhibitors, are widely used for their efficacy in treating various cancer types. Advanced research and growing investments in biosimilar oncology drugs further boost the segment. Additionally, government initiatives for early cancer detection and access to biologic therapies enhance the availability of innovative treatments. Moreover, this segment’s growth is supported by collaborations between pharmaceutical companies and research institutions to develop cost-effective biologic solutions for cancer patients.

The immunological disorders segment is a key contributor to the India biologics market, fueled by the rising incidence of autoimmune diseases such as rheumatoid arthritis and psoriasis. Biologic therapies like TNF inhibitors and interleukin-targeting drugs are increasingly preferred for their precision in modulating immune responses. Expanding healthcare awareness and improved diagnostic capabilities are further driving demand for biologics in this segment. In addition, Indian pharmaceutical companies are also investing heavily in biosimilars to provide affordable treatment options. Furthermore, the government's focus on boosting healthcare accessibility and the adoption of innovative biologics strengthens this segment’s growth trajectory.

Cardiovascular disorders represent a growing market segment for biologics in India, driven by the increasing burden of heart disease and related conditions. Biologics such as anti-thrombotic agents and lipid-lowering therapies are gaining traction for their effectiveness in managing chronic cardiovascular issues. Besides, rising healthcare awareness, improved healthcare infrastructure, and access to advanced biologic treatments contribute to this segment’s expansion. Additionally, pharmaceutical companies are focusing on developing biosimilar biologics to cater to the affordability and accessibility needs of the Indian population, thereby enhancing the penetration of biologics in the cardiovascular segment.

The hematological disorders segment occupies a prominent position in the India biologics market due to the rising prevalence of conditions such as anemia, hemophilia, and leukemia. Biologics, including recombinant proteins and gene therapies, are increasingly utilized for their efficacy in addressing these disorders. In addition, enhanced diagnostic capabilities and supportive government initiatives to improve access to biologic treatments contribute to market growth. Pharmaceutical companies are actively developing biosimilars to address affordability challenges, further strengthening this segment. Moreover, collaborative efforts in research and clinical trials are driving innovation, ensuring the availability of advanced biologic therapies for hematological conditions.

Analysis by Manufacturing:

- Outsourced

- In-House

Outsourced manufacturing is prevalent in the India biologics market due to cost-efficiency, scalability, and access to specialized expertise. Contract manufacturing organizations (CMOs) play a critical role in streamlining production, allowing biopharma companies to focus on research and innovation. India's robust infrastructure and skilled workforce make it a preferred destination for global biologics outsourcing. Additionally, partnerships with CMOs help accelerate time-to-market and ensure compliance with international quality standards. The growing demand for biosimilars and biologics globally further reinforces the prominence of outsourced manufacturing as a strategic choice for companies in India’s biologics sector.

In-house manufacturing holds a significant market share in India’s biologics sector, driven by the need for greater control over production processes and quality assurance. Large biopharma companies are investing in state-of-the-art facilities to enhance production efficiency and reduce dependency on external vendors. The integration of advanced biomanufacturing technologies, such as single-use systems and continuous processing, supports cost-effective and scalable in-house operations. Additionally, in-house manufacturing enables faster response to market demands and regulatory compliance, making it a viable choice for companies aiming to maintain a competitive edge in the biologics market.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

North India holds a significant share in the India biologics market due to its strong healthcare infrastructure and concentration of research institutions. The region benefits from robust government initiatives and investment in biotechnology parks, particularly in states like Haryana and Uttar Pradesh. Moreover, the presence of leading pharmaceutical companies and academic institutions enhances innovation in biologics. Growing awareness of advanced therapies and increasing prevalence of chronic diseases, such as diabetes and cancer, further drive demand. In addition, North India’s strategic location and improving logistics also facilitate the distribution of biologic drugs across the country and neighboring markets.

West and Central India are crucial regions in the India biologics market owing to their well-established pharmaceutical hubs in states like Maharashtra and Gujarat. These regions are home to advanced manufacturing facilities and R&D centers that contribute significantly to biologics production. Furthermore, strong export capabilities and regulatory compliance with global standards bolster their position in the market. The presence of large biotech parks and skilled professionals supports innovation and scalability. Additionally, rising healthcare expenditure and growing demand for biosimilars within these regions further enhance their contribution to the biologics sector’s growth in India.

South India plays a pivotal role in the India biologics market, driven by its thriving biotechnology ecosystem in cities like Bengaluru and Hyderabad. The region is a hub for cutting-edge research, housing leading biotech companies and academic institutions. Moreover, favorable government policies and the availability of a highly skilled workforce fuel innovation in biologics development. In addition, South India’s advanced manufacturing capabilities and focus on export-oriented production ensure a steady supply of biologics to domestic and international markets. Increasing healthcare awareness and the adoption of biologic therapies further reinforce the region's market share.

East and Northeast India represent an emerging segment in the India biologics market, with growing investments in healthcare infrastructure and biotechnology. The region is seeing rising demand for biologic therapies due to increasing disease awareness and expanding healthcare access. States like West Bengal are becoming focal points for pharmaceutical growth, supported by government initiatives to improve medical research and manufacturing facilities. Furthermore, the untapped potential in the Northeast offers opportunities for market expansion as healthcare systems develop. Improved logistics and connectivity are also facilitating the distribution of biologics across these regions.

Competitive Landscape:

The market is steered by the resilient presence of emerging biotechnology companies and well-established pharmaceutical actively emphasizing on affordability and advancements. Major players are significantly expanding their biosimilar production and utilizing innovations in biomanufacturing technologies to address the needs of both international and domestic markets. Furthermore, amplified research and developments investments, strategic partnerships, and public-private collaborations are boosting market expansion. Improved regulatory policies and government incentives further propel competition, while export opportunities establish Indian manufacturers as crucial global suppliers. For instance, in May 2024, Serum Institute of India commenced exporting malaria vaccine R21/Matrix-M to Africa, with around 1.63 million doses allocated particularly for the Central African Republic region. Moreover, the increasing focus on cost-efficient biologics and compliance to international quality frameworks fortify India's competitive edge in this industry.

The report provides a comprehensive analysis of the competitive landscape in the India biologics market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Serum Institute of India, a prominent India-based biotechnology company, strategically acquired 20% stake of IntegriMedical to enhance needle-free injection system. The partnership aims to elevate patient adherence, minimize needle-stick wounds, and improving efficiency of liquid drugs through needle-free system.

- In June 2024, Aurobindo Pharma collaborated with MSD, a leading pharmaceutical firm, to develop a manufacturing plant in India for the production of biologics. This includes a significant investment of INR 1,000 Cr.

India Biologics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Microbial, Mammalian, Others |

| Products Covered | Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense, RNAi and Molecular Therapy, Others |

| Diseases Covered | Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others |

| Manufacturings Covered | Outsourced, In-House |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biologics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India biologics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biologics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Biologics are advanced pharmaceutical products derived from living organisms, including proteins, antibodies, and cell-based therapies. They are used to treat complex conditions such as cancer, autoimmune diseases, and diabetes. Applications include vaccines, monoclonal antibodies, and gene therapies, offering targeted, effective solutions for a wide range of medical challenges.

The India biologics market was valued at USD 13.3 Billion in 2025.

IMARC estimates the India biologics market to exhibit a CAGR of 7.72% during 2026-2034.

The market is driven by increasing prevalence of chronic diseases, rising demand for biosimilars, supportive government policies, advancements in biomanufacturing technologies, and growing investments in research and development. Enhanced regulatory frameworks and export opportunities further boost the market's growth and competitiveness on a global scale.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)