India Biofertilizer Market Size, Share, Trends and Forecast by Type, Crop, Microorganism, Mode of Application, and Region, 2025-2033

India Biofertilizer Market Size and Share:

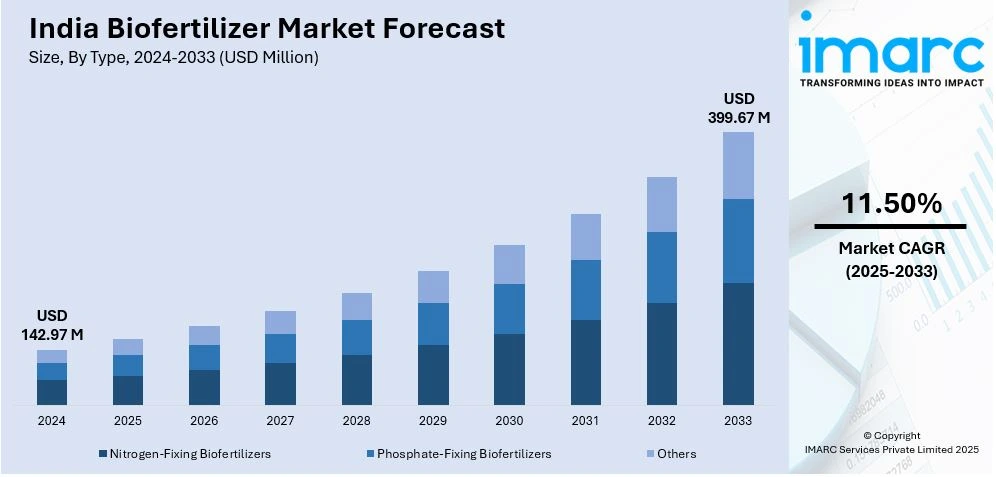

The India biofertilizer market size was valued at USD 142.97 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 399.67 Million by 2033, exhibiting a CAGR of 11.50% from 2025-2033. The market share is increasing due to the growing awareness about sustainable farming practices, government support through policies and subsidies, rising demand for organic products, and high emphasis on restoring soil health. Enhancements in biofertilizer formulations and a rising demand for eco-friendly, cost-effective alternatives to chemical fertilizers are further supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 142.97 Million |

|

Market Forecast in 2033

|

USD 399.67 Million |

| Market Growth Rate (2025-2033) | 11.50% |

The regulatory agency plays an integral role in facilitating the usage of biofertilizers via extensive subsidies, measures, and agrarian projects. Policies designed to promote organic farming and sustainable agriculture are creating a favorable environment for the growth of the biofertilizer market in India. The strategies ensure access to biofertilizers for greater numbers of farmers, which simplifies their transition to environmental-friendly alternatives. Moreover, farmers are increasingly becoming aware of the long-term benefits of sustainable farming practices, such as soil health improvement and reduced chemical use, resulting in a higher usage of biofertilizers. Training programs, workshops, and access to information about the environmental and economic gains of using biofertilizers are further catalyzing the demand in the agriculture sector.

To get more information on this market, Request Sample

In addition to this, developments in biofertilizer technology, including the development of more efficient and stable microbial strains, are improving the efficacy and dependability of such products. More refined formulations deliver better benefits, such as higher crop yield, improved disease resistance, and better tolerance to varying soil conditions. Such technological advancements are rendering biofertilizers a more attractive and effective option for farmers looking to improve crop yield and reduce dependency on chemical fertilizers. Besides this, biofertilizers provide a cheaper substitute for chemical fertilizers, particularly among small and medium-scale farmers. These products are inexpensive and offer an effective way of increasing productivity with minimal investment. The affordability of biofertilizers is the key factor determining their use, particularly among small-scale farmers living in rural communities where they yearn for a cheap means to enhance soil quality and boost outputs.

India Biofertilizer Market Trends:

Government Support and Policy Incentives

The regulatory agency is actively encouraging biofertilizers through numerous policies and incentives to decrease chemical fertilizer dependence. Numerous initiatives and programs offering financial assistance and organic farming practices encouragement have been established to motivate farmers to use biofertilizers. The launch of a subsidy program for the production and dissemination of biofertilizers is increasing accessibility for farmers, especially in rural communities. In addition, the government's emphasis on research and development (R&D) in the industry is encouraging innovation in biofertilizer products, enhancing their use on various crops and types of soils. These policy initiatives are pivotal in speeding up the uptake of biofertilizers, which is key in driving market expansion. For example, in 2024, the Ministry of Chemicals and Fertilizers noted the efforts made by the government to encourage organic farming by initiating schemes such as PKVY and MOVCDNER, providing financial assistance to bio-fertilizers and organic manure. ICAR has formulated effective types of bio-fertilizers and liquid bio-fertilizers, which are disseminated through training and awareness.

Rising Demand for Sustainable Agriculture Practices

The increasing trend towards sustainable agriculture practices based on environmental considerations is providing a positive India biofertilizer market outlook. In the face of growing concern about soil erosion, pesticide overuse, and pollution, farmers are embracing biofertilizers as a green alternative to chemical fertilizers. Government programs, such as subsidies and public awareness campaigns, are facilitating the shift. Biofertilizers enhance soil conditions by enhancing the microbial population, leading to increased nutrient availability, higher crop output, and the decreased use of synthetic fertilizers. The spread of organic cultivation, primarily due to the increasing consumer demand for organic products, is encouraging people to use more biofertilizers. With India's farm sector being extremely important to its economy, there is a drive to adopt greener practices because it is being seen as an imperative strategy in addressing environmental challenges as well as economic problems. Super Crop Safe Ltd. launched "Super Gold WP+" in 2025, a bio-fertilizer that combines inoculant mycorrhiza with essential nutrients, intended to reduce chemical fertilizer use and increase crop yield. The product promotes sustainable farming by stimulating root growth and nutrient absorption.

Support from Private Sector and Startups

The increasing involvement of startups and private companies in the biofertilizer market is fueling market growth. The companies are introducing new, innovative biofertilizer products and solutions for Indian farmers' specifications. Agritech sector startups are developing innovative biofertilizers specific to individual crops, optimizing nutrient uptake and disease immunity. Furthermore, private sector investments are making biofertilizers more accessible by creating stronger distribution networks and cost-effective alternatives. Public-private partnerships, together with collaborations with research institutions, are driving the development of new technologies and strengthening the competitiveness of biofertilizers against their chemical counterparts. In 2024, Krishak Bharati Cooperative Limited (KRIBHCO) and Novonesis entered into a memorandum of understanding for launching the 'KRIBHCO Rhizosuper' biofertilizer using Novonesis' LCO technology. The Mycorrhizal Biofertilizer ais aimed at increasing crop yields, soil fertility, and eco-friendly farming in India. The collaboration looks to enhance plant vigor and reduce chemical dependency.

India Biofertilizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India biofertilizer market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, crop, microorganism, and mode of application.

Analysis by Type:

- Nitrogen-Fixing Biofertilizers

- Phosphate-Fixing Biofertilizers

- Others

Nitrogen-fixing biofertilizers dominate the market, because they facilitate the enhancement of nitrogen content in soil, which is a very important nutrient to plants. Microorganisms such as rhizobium, azotobacter, and cyanobacteria found in these biofertilizers naturally fix the nitrogen in the air and convert it into plant-accessible nitrogen. This cuts down on the use of artificial nitrogen fertilizers, which harm the environment. Nitrogen-fixing biofertilizers are best suited for crops with high nitrogen requirements such as cereals, legumes, and oilseeds. Their ability to increase soil fertility, promote crop production, and foster ecological agriculture has made them popular across the globe. Producers using nitrogen-fixing biofertilizers benefit from enhanced soil condition, increased root development, and improved plant stress tolerance. The growing demand for eco-friendly agricultural practices is resulting in increased use of nitrogen-fixing biofertilizers as a vital measure to address food security concerns.

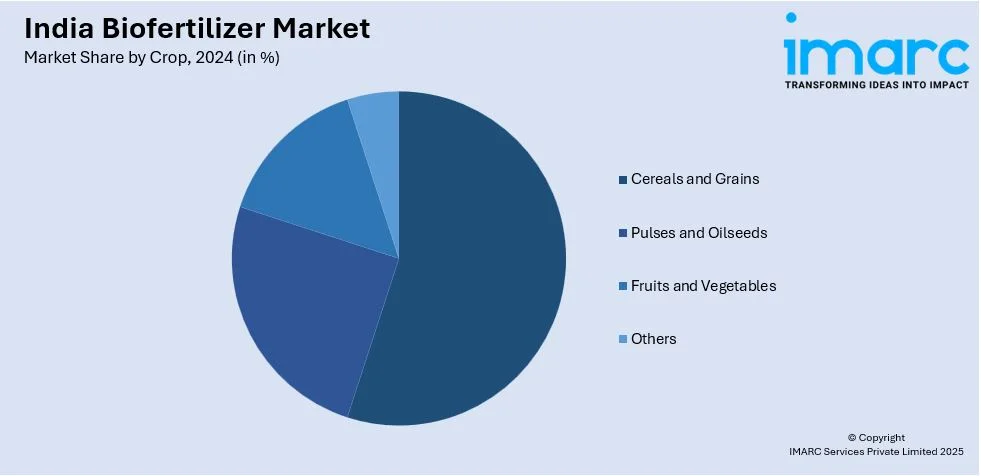

Analysis by Crop:

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Grains and cereals are the biggest segment due to their indispensable contribution to food production and the growing demand for sustainable farming practices. This segment consists of staple foods like wheat, rice, maize, and barley, which are widely cultivated in different regions. Biofertilizers used on grains and cereals aid in soil fertility improvement, increased nutrient absorption, and better crop health. The use of biofertilizers in such crops is driven by their capacity to minimize the use of chemical fertilizers, increase yields, and increase crop resistance to disease and environmental stress. Moreover, cereals and grains are also heavily rewarded by the use of nitrogen-fixing microorganisms, which contribute to soil nitrogen deficiency problems and enhance soil physical structure. As farmers increasingly look for environment-friendly and economical means of enhancing crop yields, the cereals and grains category continues to be the leading force behind the biofertilizer market, with the thrust from supportive agricultural policies and an increased focus on sustainable agricultural practices.

Analysis by Microorganism:

- Cyanobacter

- Rhizobium

- Phosphate Solubilizing Bacteria

- Azotobacter

- Others

Cyanobacteria lead the market because they are capable of nitrogen fixation and promoting soil fertility in a natural manner. These microbes serve an essential purpose in increasing soil health through the fixation of atmospheric nitrogen into a usable form for plants and are, hence, immensely beneficial in soils lacking nitrogen. Cyanobacteria are best applied in paddy fields and other water-saturated cropping schemes, where they have the advantage of growing there to enhance the higher yield of the crops. Their rapid usage is catalyzed by their cost-saving attributes, nature conservancy, and minimal environmental impact compared to artificial chemicals used as fertilizers. With their increasing utilization coupled with an interest in practicing organic farming coupled with their efficiency across various kinds of soils, the use of cyanobacteria-based biofertilizers gathers greater momentum. Moreover, cyanobacteria carry the additional advantage of enhancing soil composition, moisture retention ability, and nutrients uptake, which makes them an ideal option for both organic and conventional farming.

Analysis by Mode of Application:

- Seed Treatment

- Soil Treatment

- Others

Seed treatment represents the largest segment, as it is essential for improving seed germination and the initial growth of plants. This process makes sure that seeds are inoculated with useful microbes prior to sowing, so that a solid foundation for a healthy crop is established. Seed treatment biofertilizers are beneficial in numerous ways, such as increased vigor of the seed, immunity to soil-borne diseases, and improved nutrient acquisition, leading to improved crop yield. The increasing applications of precision agricultural practices and growing demand for improved agricultural products are driving the stronghold of this market. Additionally, seed treatment being an easy task and affordable alongside its flexibility toward various agricultural approaches have made it a popular choice among farmers. The segment is also driven by state initiatives promoting organic and sustainable modes of farming, evincing the importance of eco-friendly and effective agricultural solutions like biofertilizers for seed treatment.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

North India holds the largest biofertilizer market share, driven by a combination of favorable climatic conditions, a strong agricultural base, and extensive government support. The region is home to an array of crops, like cereals, legumes, and oilseeds, which require specific nutrient management techniques. Increased awareness of sustainable agriculture among farmers and the increased propensity towards organic farming are major drivers of biofertilizer adoption. Additionally, several states in North India are implementing policies to promote organic farming, which is creating an increased demand for biofertilizers. The area also enjoys a robust distribution network, guaranteeing convenient access to biofertilizer products for farmers. Initiatives by both private enterprises and government organizations to encourage sustainable farming practices are enhancing North India’s leadership in the market.

Competitive Landscape:

Major participants in the market are concentrating on broadening their product ranges by creating innovative and more effective formulations. They are putting funds into research efforts to refine microbial strains, boost product stability, and guarantee compatibility with various types of crops. Collaborative alliances with agricultural groups, governmental bodies, and research institutions are allowing stakeholders to expand their market presence and promote the advantages of biofertilizers. Major companies are also investing strategically in sustainable agriculture technologies and extensive production plants. Their focus on sustainable, efficient, and mechanized production processes is fueling market growth and meeting the growing demand for organic agriculture inputs. IPL Biologicals signed a Memorandum of Understanding with the Gujarat government in 2023 for setting up a Rs 400 crore bio-fertilizer and bio-pesticide plant. The completely automated facility will emphasize sustainable farming methods, starting with agricultural products.

The report provides a comprehensive analysis of the competitive landscape in the India biofertilizer market with detailed profiles of all major companies.

Latest News and Developments:

- April 2024: Dhanuka Agritech launched the insecticide 'LaNevo' and bio-fertilizer 'MYCORe Super' to enhance crop protection and yield. The products were introduced in key Indian cities and will expand nationwide.

- March 2024: IPL Biologicals unveiled its new brand identity and the innovative Microbot technology, marking 30 years of agricultural innovation. The revamped packaging highlights biofertilizers, with green triangles representing FCO standard-compliant products.

- January 2024: The Indian Biogas Association (IBA) proposed motivations to promote bio-fertilizers, such as a Rs 1.4 lakh crore 'Biogas-Fertilizer Fund' for promoting soil and human health. The IBA also recommended favorable policies, tax exemptions, and credit options to support organic fertilizers.

- May 2023: The Union Agriculture Minister inaugurated the Integrated Biological Control Laboratory at NIPHM, Hyderabad. The center focused on developing bio-pesticides, bio-fertilizers, and biocontrol agents to reduce chemical use and enhance soil health.

- February 2023: Punjab became the country's first state to set up a biofertilizer lab at Citrus Estate, Hoshiarpur, which Horticulture Minister Chetan Singh Jauramajra opened. The lab, set up at a cost of Rs 2.5 crore, aimed to reduce chemical fertilizer use by 15-20%, benefiting farmers and maintaining soil health.

- January 2023: Odisha University of Agriculture and Technology (OUAT) began producing liquid nitrogen bio-fertilizers to encourage low-cost farming in the state, especially for the production of pulse crops. The bio-fertilizer, made with Rs 1.5 crore Centre funding, increases yields without damaging soil health or the environment. The OUAT planned mass production to make it widely available to farmers at a significantly lower price than market rates.

India Biofertilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen-Fixing Biofertilizers, Phosphate-Fixing Biofertilizers, Others |

| Crops Covered | Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others |

| Microorganisms Covered | Cyanobacter, Rhizobium, Phosphate Solubilizing Bacteria, Azotobacter, Others |

| Mode of Applications Covered | Seed Treatment, Soil Treatment, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biofertilizer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India biofertilizer market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biofertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biofertilizer market in the India was valued at USD 142.97 Million in 2024.

The market growth is due to the increasing awareness about sustainable agriculture practices, government support through subsidies and initiatives, rising demand for organic produce, and the need to reduce chemical fertilizer dependency. Additionally, advancements in biofertilizer technologies and environmental concerns around soil health are further propelling market expansion.

The India biofertilizer market is projected to exhibit a CAGR of 11.50% during 2025-2033, reaching a value of USD 399.67 Million by 2033.

Nitrogen-fixing biofertilizers lead the market in 2024, mainly because they help increase nitrogen levels in soil, an essential nutrient for plant growth.

North India currently dominates the India biofertilizer market. North India holds the largest market share, driven by favorable climatic conditions, a strong agricultural base, and extensive government support

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)