India Biodiesel Market Size, Share, Trends and Forecast by Feedstock, Application, Type, Production Technology, and Region, 2026-2034

Market Overview 2026-2034:

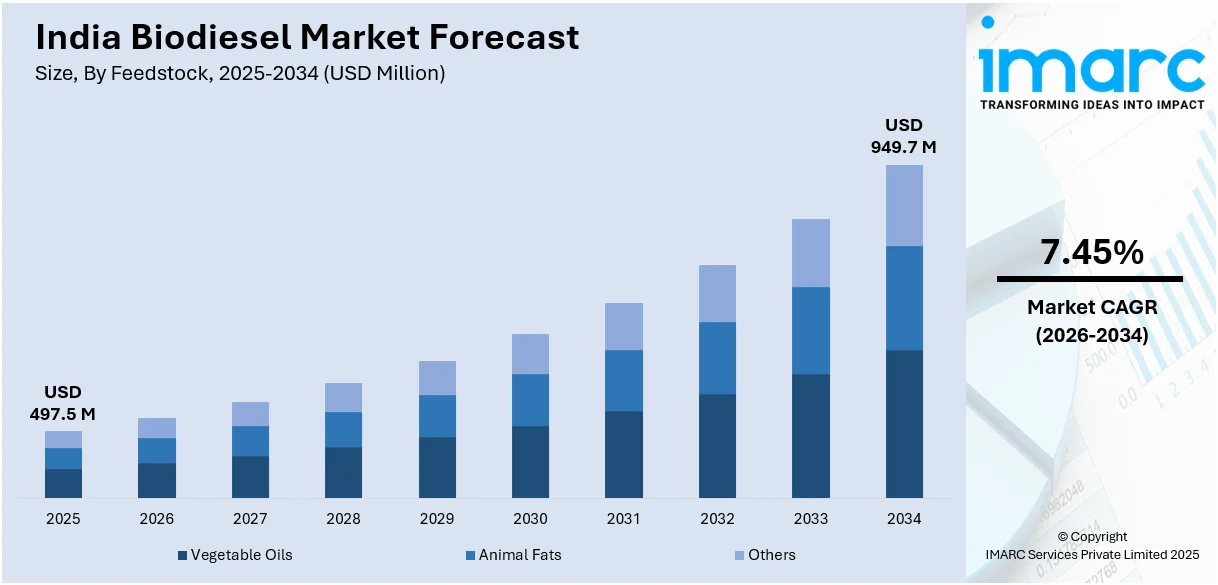

The India biodiesel market size reached USD 497.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 949.7 Million by 2034, exhibiting a growth rate (CAGR) of 7.45% during 2026-2034. The rising demand for sustainable and cleaner fuel, increasing adoption of biodiesel in transportation sector, and government initiatives to lower emissions represent some of the key factors driving the market in India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 497.5 Million |

|

Market Forecast in 2034

|

USD 949.7 Million |

| Market Growth Rate 2026-2034 | 7.45% |

Biodiesel refers to a renewable and biodegradable liquid fuel that is manufactured from vegetable oils, animal fats, and recycled restaurant grease and relies on a transesterification process. It is cost-effective, safer to use, non-toxic, and has a lower exhaust emission rate as compared to traditional sources of fuel. It is a suitable alternative to diesel fuel, can be easily mixed with petroleum diesel in any ratio, and does not produce acid rain. It assists in improving the lubrication of an engine and enhances its life. Besides this, it provides more energy as the feedstock crop collects solar energy and transforms it into biodiesel feedstock oil. It can be utilized in all compression-ignition (CI) engines that are designed to be operated on diesel fuel. At present, it is widely employed in power generation and transportation purposes across India.

To get more information on this market Request Sample

India Biodiesel Market Trends:

At present, the rising demand for biodiesel in the transportation industry as a fuel that provides better efficiency as compared to gasoline and is environment-friendly represents one of the primary factors supporting the growth of the market in India. Besides this, the growing adoption of high-quality biodiesel in construction and mining equipment is offering a positive market outlook in the country. Additionally, the Government of India is encouraging the adoption of cleaner fuels to reduce the harmful greenhouse gas (GHG) emissions in the environment. This, coupled with the rising demand for domestic fuel alternatives, such as biodiesel, due to the inflating crude oil prices, is propelling the growth of the market. Apart from this, various benefits offered by biodiesel, such as enhanced air quality and improved energy security, are offering lucrative growth opportunities to industry investors. Moreover, the increasing energy demand, along with the rising utilization of biodiesel as heating oil in domestic and commercial boilers, is bolstering the growth of the market in India. In addition, the growing demand for biodiesel to replace conventional fossil fuels in power generation is positively influencing the market. Furthermore, the rising awareness among the masses about the harmful impact of greenhouse gas emissions is strengthening the growth of the market in the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India biodiesel market report, along with forecasts at the country and regional level from 2026-2034. Our report has categorized the market based on feedstock, application, type and production technology.

Feedstock Insights:

- Vegetable Oils

- Animal Fats

- Others

The report has provided a detailed breakup and analysis of the India biodiesel market based on the feedstock. This includes vegetable oils, animal fats, and others. According to the report, vegetable oils represented the largest segment.

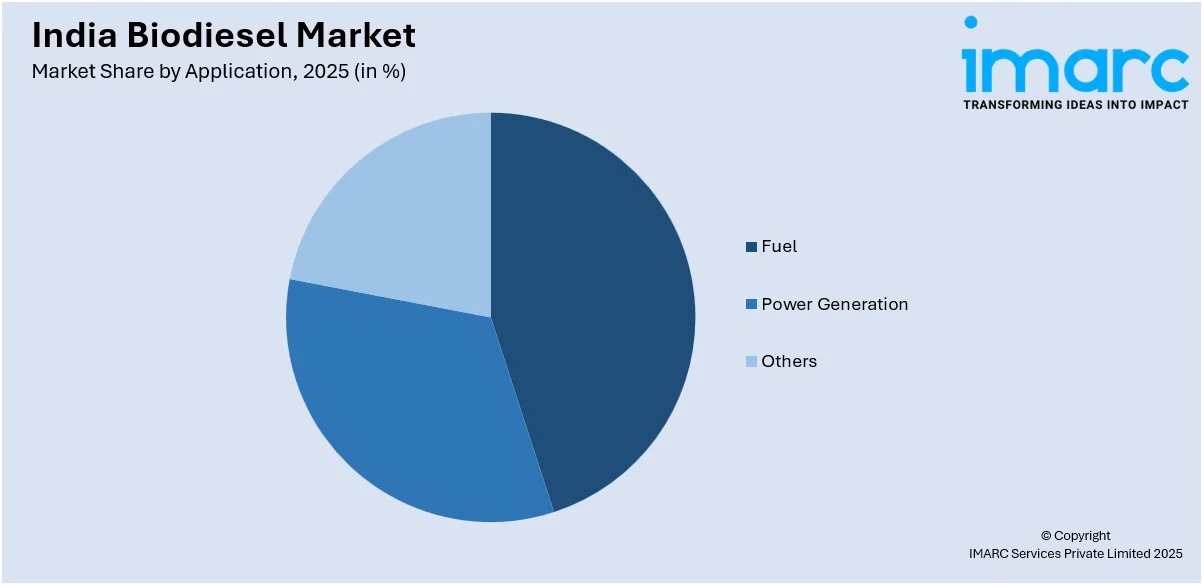

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fuel

- Power Generation

- Others

A detailed breakup and analysis of the India biodiesel market based on the application has also been provided in the report. This includes fuel, power generation, and others. According to the report, fuel accounted for the largest market share.

Type Insights:

- B100

- B20

- B10

- B5

A detailed breakup and analysis of the India biodiesel market based on the type has also been provided in the report. This includes B100, B20, B10, and B5. According to the report, B5 accounted for the largest market share.

Production Technology Insights:

- Conventional Alcohol Trans-esterification

- Pyrolysis

- Hydro Heating

A detailed breakup and analysis of the India biodiesel market based on the production technology has also been provided in the report. This includes conventional alcohol trans-esterification, pyrolysis, and hydro heating. According to the report, pyrolysis accounted for the largest market share.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India biodiesel market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Feedstock, Application, Type, Production Technology, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India biodiesel market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India biodiesel market?

- What is the impact of each driver, restraint, and opportunity on the India biodiesel market?

- What are the key regional markets?

- What is the breakup of the market based on the feedstock?

- Which is the most attractive feedstock in the India biodiesel market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the India biodiesel market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the India biodiesel market?

- What is the breakup of the market based on the production technology?

- Which is the most attractive technology in the India biodiesel market?

- What is the competitive structure of the India biodiesel market?

- Who are the key players/companies in the India biodiesel market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biodiesel market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India biodiesel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key region-level markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biodiesel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)