India Biocatalyst Market Size, Share, Trends and Forecast by Type, Application, Source, and Region, 2025-2033

Market Overview:

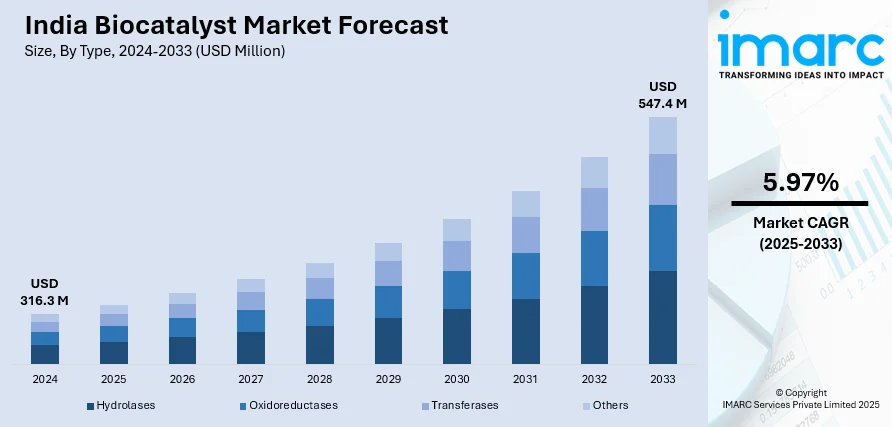

The India biocatalyst market size reached USD 316.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 547.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.97% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 316.3 Million |

|

Market Forecast in 2033

|

USD 547.4 Million |

| Market Growth Rate (2025-2033) | 5.97% |

A biocatalyst refers to an enzyme or microbe that possesses the ability to catalyze or initiate chemical reactions in a living body. It helps to modify the rate of chemical reactions and conversion of organic compounds in living organisms, including plants, animals and microorganisms. Apart from this, it is also utilized in the pharmaceutical industry to manufacture statins, antibodies, amino acids and vitamins.

To get more information of this market, Request Sample

The market in India is primarily driven by significant growth in the field of biotechnology. Along with this, numerous players in the country are engaging in strategic partnerships as well as joint ventures to strengthen their market presence. For instance, market players are entering into joint venture agreements to provide their clients access to simplified contract development and manufacturing organization (CDMO) supply chains. Some of the other factors contributing to the market growth include technological advancements in the production process and extensive research and development (R&D) activities.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India biocatalyst market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, application and source.

Breakup by Type:

- Hydrolases

- Oxidoreductases

- Transferases

- Others

Breakup by Application:

- Food and Beverages

- Cleaning Agent

- Biofuel Production

- Agriculture and Feed

- Biopharmaceuticals

- Others

Breakup by Source:

- Microorganisms

- Plants

- Animal

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, Application, Source, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India biocatalyst market to exhibit a CAGR of 5.97% during 2025-2033.

The rising demand for biocatalyst in the production of biofuels and biopharmaceuticals, owing to the growing awareness regarding its environment sustainability, is primarily driving the India biocatalyst market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation resulting in temporary halt in numerous production activities for biocatalysts.

Based on the type, the India biocatalyst market can be categorized into hydrolases, oxidoreductases, transferases, and others. Currently, hydrolases account for the majority of the total market share.

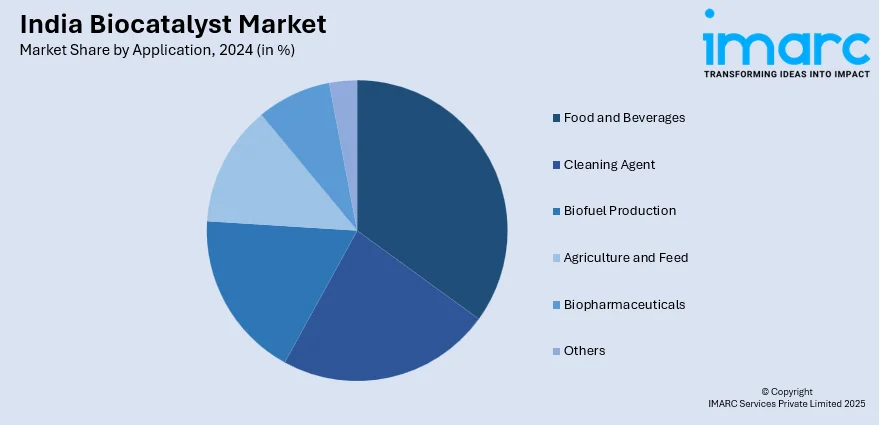

Based on the application, the India biocatalyst market has been segregated into food and beverages, cleaning agent, biofuel production, agriculture and feed, biopharmaceuticals, and others. Among these, food and beverages currently hold the largest market share.

Based on the source, the India biocatalyst market can be bifurcated into microorganisms, plants, and animals. Currently, microorganisms exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India biocatalyst market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)