India Bedsheet Market Size, Share, Trends and Forecast by Type, Price Range, Application, Sales Channel, and Region, 2025-2033

India Bedsheet Market Overview:

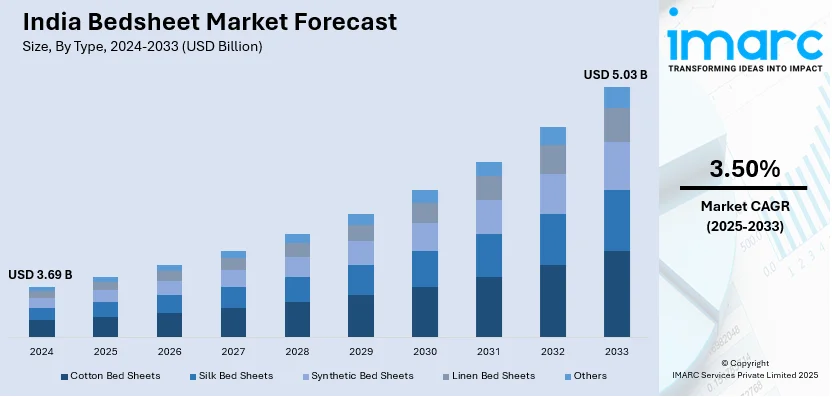

The India bedsheet market size reached USD 3.69 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.03 Billion by 2033, exhibiting a growth rate (CAGR) of 3.50% during 2025-2033. The market is growing due to rising disposable incomes, rapid urbanization, increasing demand for premium, eco-friendly, and designer bedding, e-commerce expansion, evolving consumer preferences, and increased hospitality sector investments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.69 Billion |

| Market Forecast in 2033 | USD 5.03 Billion |

| Market Growth Rate 2025-2033 | 3.50% |

India Bedsheet Market Trends:

Growing Preference for Premium and Eco-Friendly Bedsheets

The increasing demand for premium and eco-friendly bedsheets is boosting the India bedsheet market share, as consumers want better comfort, together with durability, and sustainable lifestyle choices. The market is witnessing an upward trend in demand for high-quality materials, including organic cotton, alongside bamboo fabric, and linen, because they provide both breathability, durability, and softness. Moreover, the growing concern about chemical-free textiles has pushed consumers toward looking for bedsheets with certified organic and hypoallergenic certifications. Buyers currently base their purchasing decisions on sustainability concerns by selecting products that protect the environment. Besides this, manufacturers now offer bedsheets that use natural dyes as well as package them in biodegradable materials and practice sustainable sourcing. For instance, the PM MITRA Park in Uttar Pradesh encourages the use of organic fibers and eco-friendly dyes, fostering a supply chain that values biodiversity and environmental conservation. This initiative positions India as a leader in sustainable textile production. Furthermore, the market premiumization occurs due to the expanding urban middle-class population, which shows readiness to purchase premium-quality home textiles. As a result, Indian consumers are evolving their product selection processes because they now emphasize both health aspects and beauty as well as sustainable production methods when choosing bedding items, thereby impelling the market growth.

To get more information on this market, Request Sample

E-Commerce and Customization Shaping Market Dynamics

The India bedsheet market growth is primarily driven by the expansion of e-commerce, which delivers broad choices of designs, together with fabrics and pricing options to consumers. For example, in 2023, Myntra reported a 50% year-on-year increase in demand for its home category, leading to the addition of 50,000 new products and over 20 new brands in anticipation of the festive season. The online market has become popular for consumers because they can access exceptional bedding products, which they discover through social media and digital promotions, offering affordable prices, and home delivery services. Concurrently, there is an increasing demand for custom-made bedsheets because customers want unique patterns and color options, along with embroidered designs that suit their home interior designs. Digital printing technology advancements also enable customers to obtain personalized products through quick production methods that ensure their fast delivery. Furthermore, changing buying behavior of the consumers demonstrates how personal style choices join aesthetic preferences as main criteria for deciding what to buy. The combination of enhanced digital retail presence coupled with product customization features creates a new market dynamic that results in improved consumer participation, thus enhancing the India bedsheet market outlook.

India Bedsheet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, price range, application, and sales channel.

Type Insights:

- Cotton Bed Sheets

- Silk Bed Sheets

- Synthetic Bed Sheets

- Linen Bed Sheets

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes cotton bed sheets, silk bed sheets, synthetic bed sheets, linen bed sheets, and others.

Price Range Insights:

- Under USD 50

- USD 50 to USD 100

- Between USD 100 and USD 200

- Above USD 200

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes under USD 50, USD 50 to USD 100, between USD 100 to USD 200, and above USD 200.

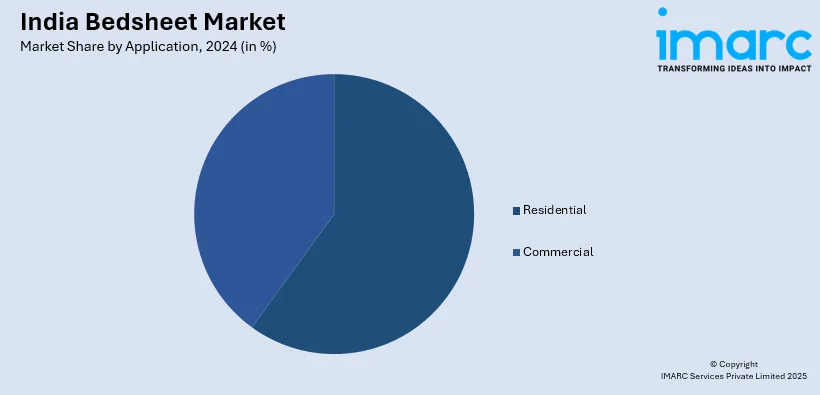

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sales Channel Insights:

- Supermarket/Hypermarket

- Specialty Store

- Online

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarket/hypermarket, specialty store, and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bedsheet Market News:

- In January 2025, Alok Industries launched innovative bed linen collections at Heimtextil, featuring premium and affordable options. These products cater to evolving consumer demand, enhancing quality standards and fueling growth in India's bedsheet market through innovation and affordability.

- In March 2023, VFI Group partnered with Serta Simmons Bedding to set up luxury mattress units in India, boosting premium bedding demand. This collaboration elevates quality standards, encouraging higher consumer spending and driving growth in India’s bedsheet and home textiles market.

India Bedsheet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cotton Bed Sheets, Silk Bed Sheets, Synthetic Bed Sheets, Linen Bed Sheets, Others |

| Price Ranges Covered | Under USD 50, USD 50 to USD 100, Between USD 100 to USD 200, Above USD 200 |

| Applications Covered | Residential, Commercial |

| Sales Channels Covered | Supermarket/Hypermarket, Specialty Store, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bedsheet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bedsheet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bedsheet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bedsheet market in the India was valued at USD 3.69 Billion in 2024.

The India bedsheet market is projected to exhibit a CAGR of 3.50% during 2025-2033, reaching a value of USD 5.03 Billion by 2033.

The India bedsheet market is fueled by growing urbanization, higher disposable income, and higher consumer interest in home décor and comfort. Growing organized retail, online platforms for shopping, and high demand for premium and green fabrics also fuel it. Moreover, seasonal and festival-based sales also significantly support market growth, abetted by changing lifestyles and higher awareness of quality beddings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)