India Bed Linen Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2026-2034

India Bed Linen Market Summary:

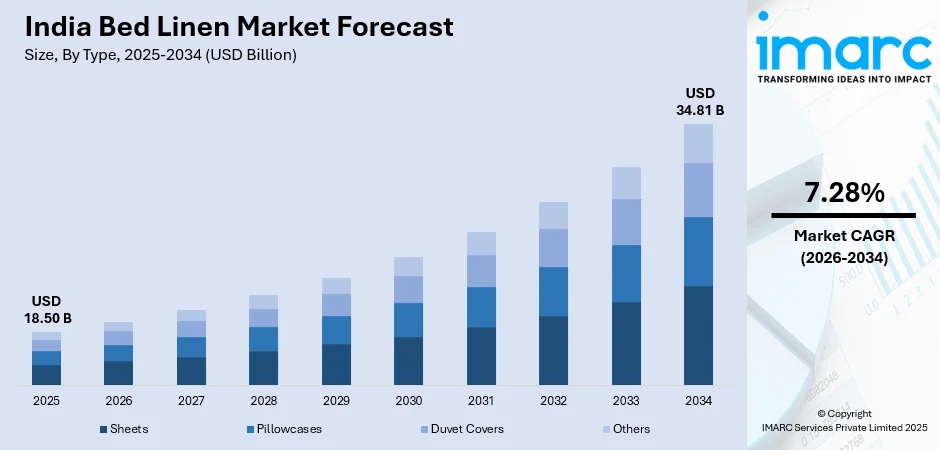

The India bed linen market size was valued at USD 18.50 Billion in 2025 and is projected to reach USD 34.81 Billion by 2034, growing at a compound annual growth rate of 7.28% from 2026-2034.

The India bed linen market is expanding steadily, driven by rising disposable incomes, urbanization, and evolving consumer preferences for premium and comfortable bedding products. Growing e-commerce penetration, hospitality sector expansion, and increased focus on home aesthetics are strengthening market momentum. Demand for sustainable and eco-friendly fabrics continues to shape purchasing patterns, positioning India as a key growth market for bed linen products.

Key Takeaways and Insights:

- By Type: Sheets dominate the market with a share of 41% in 2025, owing to their essential role in everyday bedding, widespread consumer preference for comfortable and breathable cotton variants, and consistent replacement cycles driven by hygiene awareness and home improvement trends across residential households.

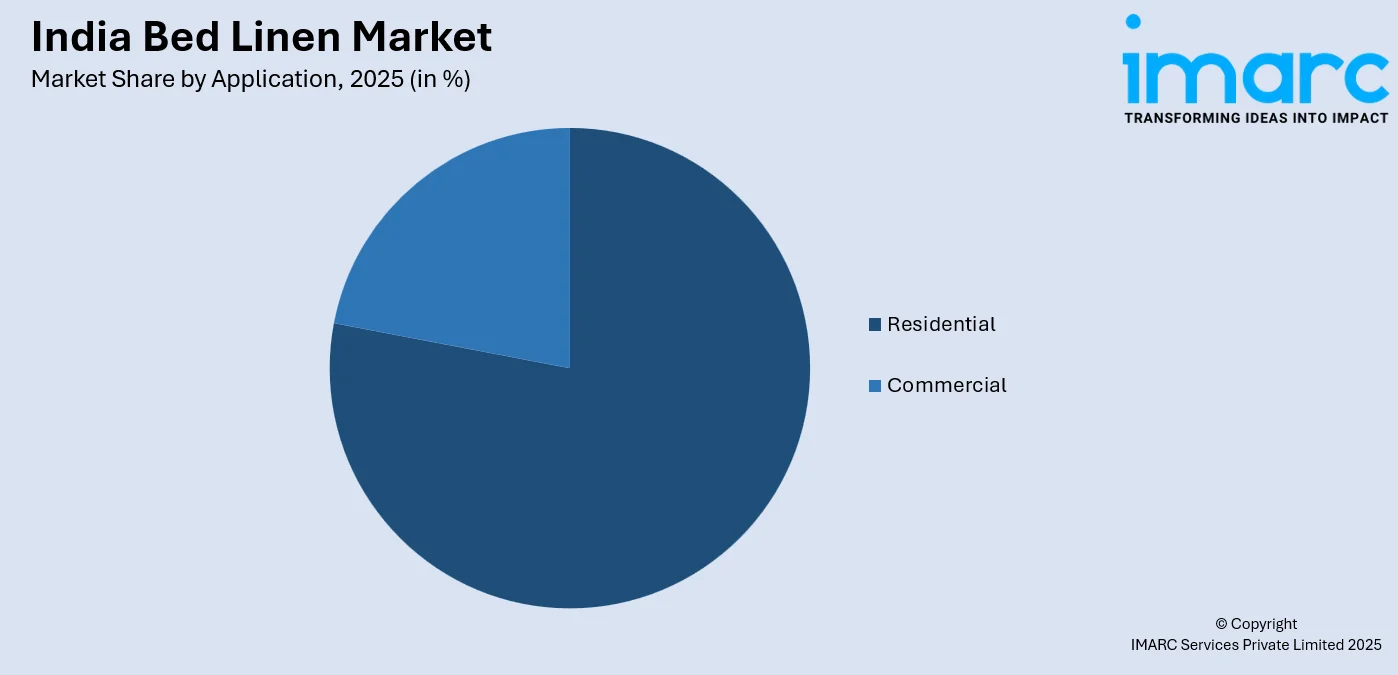

- By Application: Residential leads the market with a share of 78% in 2025, driven by rising homeownership rates, growing urban households, and increasing consumer spending on home furnishings. The expansion of nuclear families and heightened awareness of sleep quality are further propelling residential bed linen demand.

- By Distribution Channel: Offline represents the largest segment with a market share of 70% in 2025, reflecting strong consumer preference for tactile product evaluation, immediate purchase fulfillment, and the expanding presence of specialty stores and organized retail outlets across metropolitan and tier-two cities.

- By Region: North India comprises the largest region with 30% share in 2025, driven by the concentration of premium home décor consumption in Delhi-NCR, higher disposable incomes, and robust hospitality sector growth in religious tourism hubs across Uttar Pradesh.

- Key Players: Key players drive the India bed linen market by expanding product portfolios, investing in sustainable manufacturing technologies, and strengthening nationwide distribution networks. Their focus on premiumization, e-commerce integration, and strategic partnerships with hospitality chains boosts brand visibility, accelerates adoption, and ensures consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The India bed linen market is advancing steadily as consumers increasingly prioritize comfort, aesthetics, and quality in their bedding choices. Rising urbanization, growing nuclear family structures, and expanding middle-class purchasing power are reshaping demand patterns across residential and commercial segments. The hospitality sector serves as a significant demand driver, with branded hotels upgrading linen specifications to meet international quality standards. In the 2024–2025 fiscal year, the hotel industry in India had over 68% occupancy, which created ongoing demand for high-end bed linen goods. E-commerce platforms are democratizing access to branded bed linen in tier-two and tier-three cities, where traditional retail penetration remains limited. Sustainability concerns are prompting manufacturers to invest in organic cotton, bamboo fibers, and recycled materials, responding to environmentally conscious consumers willing to pay premium prices for eco-friendly products. Government initiatives supporting domestic textile manufacturing, combined with established production clusters in Tamil Nadu, Gujarat, and Maharashtra, strengthen supply chain efficiencies and export competitiveness, positioning India as a prominent global bed linen manufacturing hub.

India Bed Linen Market Trends:

Premiumization and Higher Thread Count Preferences

Indian consumers are nowadays increasingly gravitating toward premium bed linen, which features higher thread counts and superior fabric quality. Urban households now seek bedding products with enhanced softness, durability, and aesthetic appeal. Manufacturers are responding by introducing Egyptian cotton variants, sateen weaves, and luxury collections that command higher price points. This premiumization trend is particularly pronounced in metropolitan markets where disposable incomes support aspirational purchasing behavior and home décor investments.

Growing Demand for Sustainable and Organic Fabrics

Environmental consciousness is driving significant demand for sustainable bed linen made from organic cotton, bamboo, and recycled materials. Consumers increasingly prioritize products with certifications such as GOTS and Oeko-Tex, reflecting heightened awareness of chemical-free manufacturing processes. Manufacturers are developing eco-friendly product lines featuring natural dyes and biodegradable packaging. This sustainability transition is accelerating in metro cities where environmentally conscious consumers demonstrate willingness to pay premium prices for ethically produced bedding.

E-commerce Penetration Expanding Market Accessibility

Digital commerce is transforming bed linen distribution by enabling brands to reach previously underserved tier-two and tier-three markets. Online platforms offer extensive product variety, competitive pricing, and convenient delivery options that attract digitally savvy consumers. Social media marketing and influencer collaborations are significantly influencing purchasing decisions, particularly among younger demographics. Flash sales and easy return policies continue driving online adoption, positioning e-commerce as an increasingly important channel for India bed linen market growth.

Market Outlook 2026-2034:

The India bed linen market outlook remains positive, supported by sustained economic growth, rising consumer aspirations, and expanding organized retail infrastructure. Urbanization continues driving household formation and subsequent demand for quality bedding products across residential segments. The hospitality sector presents significant opportunities as hotel chains upgrade linen specifications to enhance guest experiences and maintain brand standards. The market generated a revenue of USD 18.50 Billion in 2025 and is projected to reach a revenue of USD 34.81 Billion by 2034, growing at a compound annual growth rate of 7.28% from 2026-2034. Government support through textile industry incentive schemes, combined with established manufacturing clusters, strengthens production capabilities and export competitiveness. E-commerce expansion democratizes market access, enabling brands to penetrate smaller cities where traditional retail presence remains limited. Innovation in sustainable materials and smart textiles positions manufacturers to capture evolving consumer preferences for eco-friendly and functional bedding solutions.

India Bed Linen Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Sheets |

41% |

| Application | Residential |

78% |

| Distribution Channel | Offline |

70% |

| Region | North India |

30% |

Type Insights:

- Sheets

- Pillowcases

- Duvet Covers

- Others

Sheets dominate with a market share of 41% of the total India bed linen market in 2025.

Sheets represent the fundamental bedding product category, commanding significant market share due to their essential role in everyday household use and frequent replacement requirements driven by hygiene considerations and wear patterns. Indian consumers demonstrate strong preference for cotton sheets owing to the fabric's breathability, softness, and suitability for tropical climate conditions that characterize most regions throughout the year. Urban households increasingly demand higher thread count variants, with 300-thread count cotton-poly blends gaining popularity for their enhanced durability and comfortable texture that withstands repeated washing cycles. Manufacturing clusters across Tamil Nadu and Gujarat maintain competitive production costs through vertically integrated operations while meeting growing domestic and export demand volumes.

The sheets segment benefits from consistent replacement cycles driven by hygiene awareness and home improvement trends across residential segments. Organized retailers allocate substantial shelf space to sheet products, recognizing their high turnover potential and consumer appeal. In January 2025, Alok Industries launched its Leap Bedding Collection at Heimtextil featuring affordable high-performance sheets made with Recron branded fibers, demonstrating manufacturer focus on value-driven innovation. Premium variants featuring anti-microbial finishes and temperature-regulating properties are capturing market attention among health-conscious consumers seeking enhanced sleep quality through functional bedding solutions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential leads with a share of 78% of the total India bed linen market in 2025.

The residential segment dominates bed linen demand, driven by India's expanding homeownership rates, growing nuclear family structures, and increasing disposable income levels across urban and semi-urban households throughout major metropolitan regions. Consumers prioritize comfort, aesthetics, and fabric quality when selecting bedding products, demonstrating willingness to invest in premium offerings that enhance bedroom environments and contribute to overall home décor themes. The segment benefits from seasonal purchasing patterns, with festive periods including Diwali and regional celebrations generating significant sales spikes as households upgrade home furnishings to welcome guests and refresh living spaces.

E-commerce platforms enable residential consumers to access diverse product ranges previously unavailable in local retail outlets, expanding market reach beyond metropolitan boundaries into tier-two and tier-three cities where traditional retail presence remains limited. Social media influences purchasing decisions significantly, with design trends and influencer recommendations shaping consumer preferences toward specific brands, colors, and fabric choices. Home renovation activities and interior design awareness continue driving residential bed linen demand as households increasingly view bedding as integral components of overall home aesthetics rather than merely functional necessities. The work-from-home culture established during recent years has reoriented consumer budgets toward home comfort investments, with bedrooms serving dual purposes as relaxation and workspace environments. Consumers increasingly seek bedding products that deliver both visual appeal and practical comfort benefits, supporting demand for premium offerings across residential segments.

Distribution Channel Insights:

- Online

- Offline

Offline exhibits a clear dominance with a 70% share of the total India bed linen market in 2025.

Offline retail channels maintain dominant market position, reflecting consumer preference for tactile product evaluation before purchase and the established presence of specialty home furnishing stores across Indian cities offering curated product selections and personalized service. Department stores, hypermarkets, and dedicated home textile outlets offer consumers immediate product availability and personalized shopping experiences that build purchasing confidence through direct fabric assessment and expert guidance from trained sales personnel. Organized retail expansion in tier-two cities strengthens offline channel accessibility, bringing branded bed linen products to previously underserved markets where consumers demonstrate strong appetite for quality home textiles.

Physical retail formats benefit from omnichannel strategies that integrate digital discovery with in-store purchase fulfillment, allowing consumers to research products online before completing transactions at physical locations where they can verify selections personally. Experience studios and flagship stores showcase premium product ranges within curated home settings, enabling consumers to visualize bedding solutions within realistic bedroom environments that demonstrate aesthetic potential and coordinate accessory options. Offline channels facilitate immediate purchase gratification and eliminate delivery waiting periods, advantages particularly valued during festive seasons when consumers seek instant product availability for home decoration purposes and gift-giving requirements.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents the leading segment with a 30% share of the total India bed linen market in 2025.

North India leads regional bed linen demand, capitalizing on Delhi-NCR's concentration of premium home décor consumption and higher disposable income levels among urban households that prioritize quality home furnishings as lifestyle statements. The region benefits from extensive organized retail presence, with major shopping malls and home furnishing chains establishing strong footprints across metropolitan and satellite cities including Gurugram, Noida, and Chandigarh where affluent consumer segments drive premium product demand.

The region's diverse consumer base encompasses premium segment buyers seeking luxury imported brands alongside value-conscious households prioritizing affordability, creating market opportunities across multiple price tiers for manufacturers with varied product portfolios. Cold winter climate drives seasonal demand for heavier bedding including quilts, comforters, and flannel sheets that provide warmth during December through February months when temperatures drop significantly across northern plains. Dedicated Freight Corridor infrastructure upgrades improve supply chain efficiencies, reducing transit times and logistics costs for manufacturers serving northern markets from production clusters located in western and southern India. The region's cultural emphasis on hospitality and home presentation during wedding seasons and festival periods generates predictable demand spikes that retailers and manufacturers anticipate through inventory planning. Growing awareness of international bedding trends through travel exposure and digital media influences consumer preferences toward contemporary designs and premium fabric specifications.

Market Dynamics:

Growth Drivers:

Why is the India Bed Linen Market Growing?

Expanding Hospitality Sector and Tourism Growth

India's hospitality industry expansion creates sustained demand for quality bed linen products as hotels, resorts, and accommodation facilities invest in bedding upgrades to meet international quality standards and enhance guest experiences. The sector's growth trajectory is supported by rising domestic tourism, increasing international visitor arrivals, and government initiatives promoting tourism infrastructure development across established and emerging destinations. Hotel operators are transitioning from basic thread count specifications to premium cotton-poly blends that withstand industrial laundering while maintaining comfort quality. Religious tourism growth in destinations such as Ayodhya, Varanasi, and Kedarnath generates substantial hospitality demand, with these pilgrimage centers requiring consistent bed linen supply to accommodate millions of annual visitors. Hotel brand signings reached historic highs as chains accelerate expansion into tier-two and tier-three cities, creating procurement pipelines for quality bed linen products across diverse market segments.

Government Support Through Textile Industry Incentives

Government policy initiatives provide substantial support for bed linen manufacturing through Production Linked Incentive schemes, export promotion programs, and infrastructure development investments. PM-MITRA parks supply common utilities that reduce setup costs for integrated textile manufacturing facilities, attracting investments from domestic and international players. State-level incentive programs complement federal initiatives, with Gujarat and Tamil Nadu offering power tariff subsidies and tax holidays that improve project viability. These coordinated policy measures strengthen India's positioning as a preferred sourcing destination for global bed linen buyers seeking reliable manufacturing partners.

Rising Disposable Incomes and Urbanization

Economic growth translates into rising household incomes that enable greater spending on home furnishings including premium bed linen products. The expanding middle-class population demonstrates increasing willingness to invest in quality bedding that enhances sleep comfort and bedroom aesthetics. Urbanization accelerates household formation rates while concentrating purchasing power in metropolitan areas with established retail infrastructure. Nuclear family structures replace traditional joint households, multiplying individual bedding requirements per capita. Home improvement trends encourage periodic bedding upgrades aligned with interior design preferences and seasonal fashion cycles. Consumer awareness of sleep quality benefits drives demand for specialized products featuring hypoallergenic materials, temperature regulation properties, and antimicrobial finishes. This income-driven premiumization supports manufacturer strategies focused on value-added product development and brand building initiatives.

Market Restraints:

What Challenges the India Bed Linen Market is Facing?

Raw Material Price Volatility

Cotton price fluctuations create significant challenges for bed linen manufacturers, impacting production costs and profit margins. Global cotton market volatility, influenced by weather events, policy decisions, and trade dynamics, creates uncertainty in raw material procurement planning. Spot cotton prices experienced swings exceeding twenty percent during recent periods, requiring manufacturers to manage inventory carefully and implement hedging strategies. These cost pressures complicate pricing decisions, particularly for mid-market products where competitive intensity limit’s ability to pass through input cost increases to consumers.

Intense Competition from Unorganized Sector

The unorganized manufacturing sector, particularly power-loom clusters in regions such as Erode and Bhiwandi, presents significant competitive pressure through lower-priced products. These smaller producers operate with reduced overhead costs and flexible production schedules but face scaling limitations due to environmental compliance requirements and restricted credit access. Price-sensitive consumer segments continue purchasing from unorganized channels, limiting organized manufacturer market penetration in rural and semi-urban areas where brand awareness remains relatively lower.

Limited Rural Market Penetration

Branded bed linen manufacturers face challenges expanding into rural markets where distribution infrastructure remains underdeveloped and consumer awareness of organized brands is limited. Logistics costs and delivery complexities increase significantly for serving scattered rural populations, impacting margin viability. Lower rural income levels constrain purchasing capacity for premium-priced products, directing demand toward basic unbranded alternatives. Building rural retail networks requires substantial investment in dealer relationships and localized marketing efforts that extend payback periods.

Competitive Landscape:

The India bed linen market exhibits moderate concentration, with leading manufacturers leveraging vertically integrated operations to achieve cost advantages and quality consistency. Major players including Welspun, Trident, and Indo Count wield competitive strengths through fiber-to-fabric integration that lowers per-meter production costs compared to standalone processors. Companies focus on product innovation, sustainability certifications, and premium brand positioning to differentiate offerings in competitive market environments. Strategic investments in manufacturing capacity expansion, technology upgrades, and retail network development strengthen market positioning. Domestic players benefit from established relationships with global retailers while developing direct-to-consumer channels that improve margin realization. Competitive dynamics encourage continuous improvement in product quality, operational efficiency, and customer service capabilities.

India Bed Linen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sheets, Pillowcases, Duvet Covers, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India bed linen market size was valued at USD 18.50 Billion in 2025.

The India bed linen market is expected to grow at a compound annual growth rate of 7.28% from 2026-2034 to reach USD 34.81 Billion by 2034.

Sheets dominated the market with a share of 41%, driven by essential everyday use requirements, consumer preference for comfortable cotton variants, and consistent replacement cycles across residential households.

Key factors driving the India bed linen market include expanding hospitality sector demand, rising disposable incomes, urbanization trends, government textile industry incentives, growing e-commerce penetration, and increasing consumer preference for premium and sustainable bedding products.

Major challenges include raw material price volatility particularly cotton costs, intense competition from unorganized sector manufacturers, limited branded product penetration in rural markets, and pricing pressures from lower-cost alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)