India Beauty and Personal Care Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

India Beauty and Personal Care Market Summary:

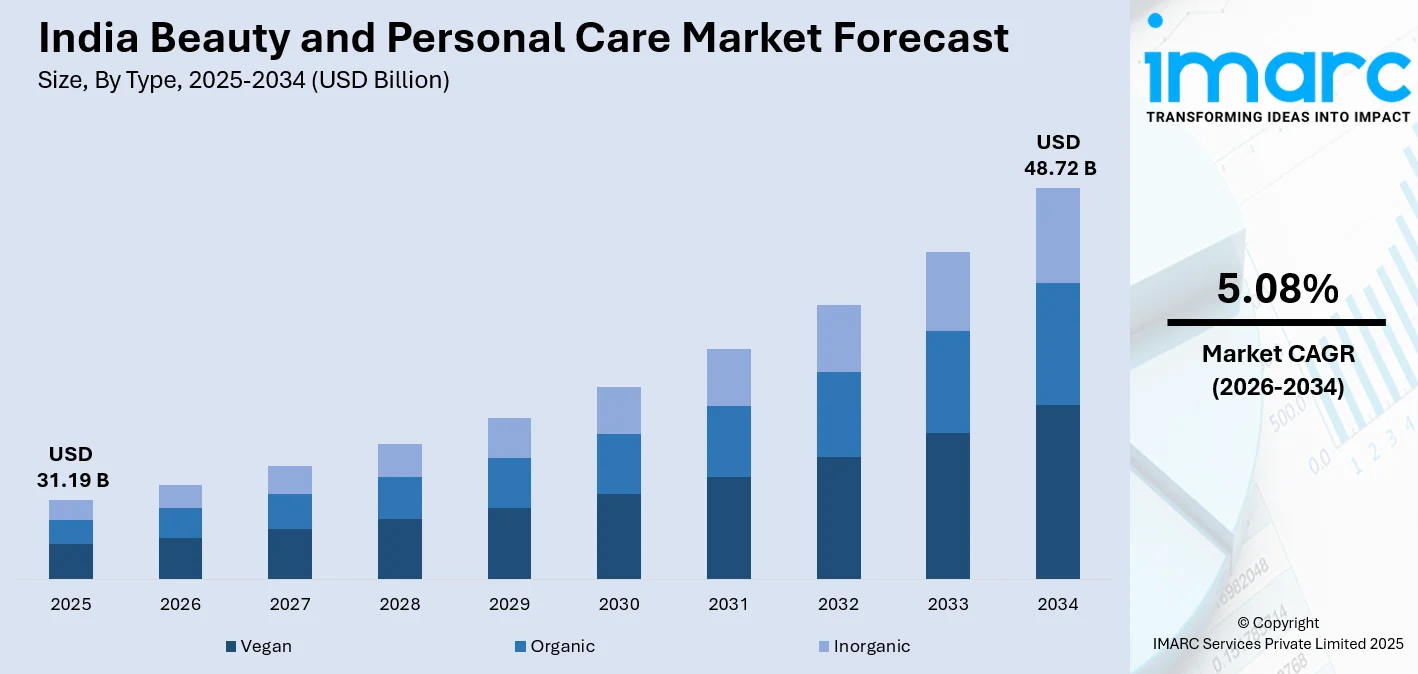

The India beauty and personal care market size was valued at USD 31.19 Billion in 2025 and is projected to reach USD 48.72 Billion by 2034, growing at a compound annual growth rate of 5.08% from 2026-2034.

The market is registering strong growth due to increasing disposable incomes, rapid urban modifications, and changing consumer preferences towards high-quality and natural products. The digital revolution has completely transformed the way product research and purchases are made, with online shopping platforms and social media influencers playing a major role in influencing consumer decisions. The availability of smartphones and internet connectivity is making beauty products more accessible to consumers, both in rural and urban areas, thus expanding the India beauty and personal care market share.

Key Takeaways and Insights:

- By Type: Organic dominates the market with a share of 42% in 2025, driven by rising consumer awareness regarding chemical-free formulations and natural ingredients.

- By Product: Skincare/sun care leads the market with a share of 35% in 2025, fueled by the growing concerns over pollution and ultraviolet (UV) exposure.

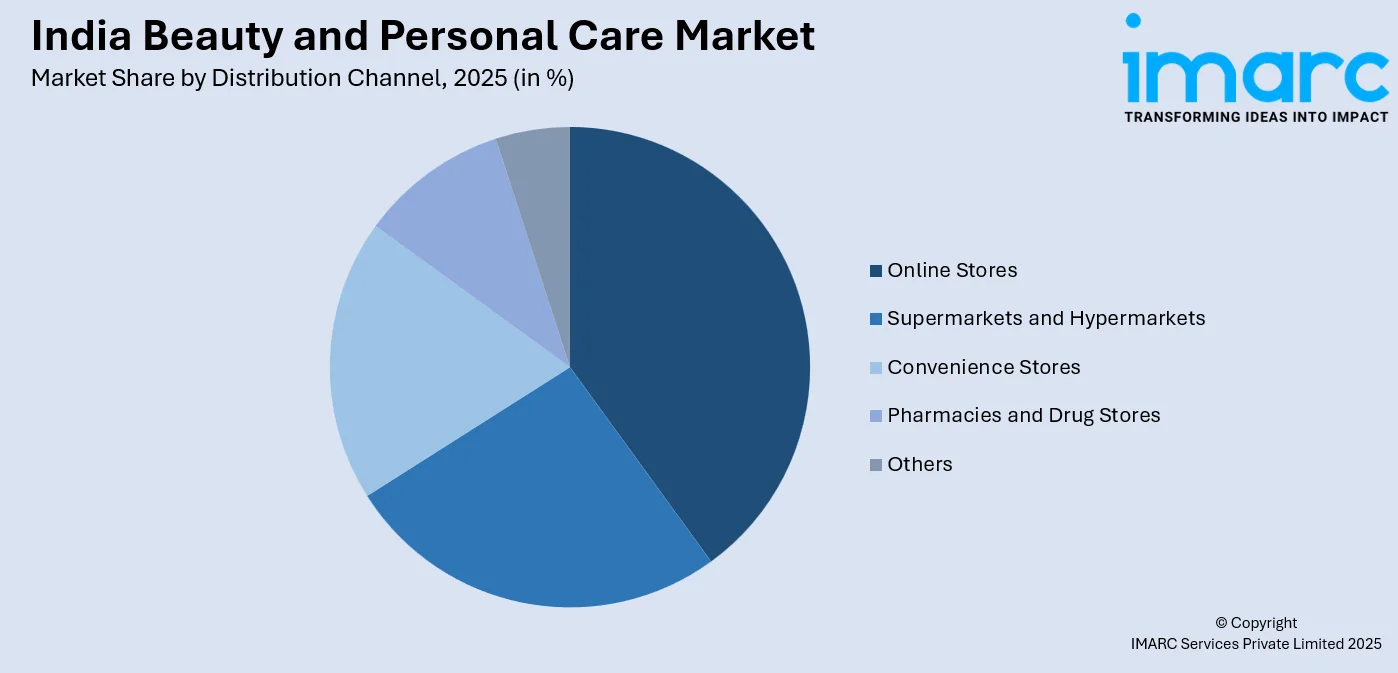

- By Distribution Channel: Online stores represent the largest segment with a market share of 30% in 2025, reflecting the structural shift toward digital commerce and convenience-driven purchasing.

- By Region: North India holds the largest market share of 29% in 2025, supported by branding-centric consumer behavior and strong urban concentrations.

- Key Players: The India beauty and personal care market exhibits intense competitive dynamics, with multinational corporations competing alongside homegrown brands across mass, mid-premium, and luxury segments through diverse distribution networks. Some of the key players include Avon Products Inc. (Natura & Co Holding S.A.), Beiersdorf AG, Colgate-Palmolive Company, Coty Inc., Hindustan Unilever Limited, Kao Corporation, L'occitane India, L'Oréal S.A, Revlon Inc., The Estée Lauder Companies Inc., and The Procter & Gamble Company.

To get more information on this market Request Sample

With the opening of flagship stores by luxury multinational companies, the market environment is characterized by increasing premiumization. On the other hand, domestic players are leveraging the Ayurvedic heritage of India by developing formulations that blend traditional ingredients with the latest skincare research. Unparalleled development opportunities are being created by the integration of influencer marketing platforms, e-commerce infrastructure, and evolving beauty trends. For instance, India emerged as the fastest-growing online beauty market globally in 2024. E-commerce and quick-commerce sales rose by 39% between June and November, compared to the same period in the previous year, while sales of physical stores rose by only 3%, clearly indicating a shift in consumer behavior towards digital platforms. The demographic dividend of India, with a large youth population that emphasizes self-care and beauty enhancement, also supports the sector. For instance, the growing adoption of male grooming products indicates a shift in cultural attitudes towards spending on wellness and beauty, which go beyond the boundaries of gender.

India Beauty and Personal Care Market Trends:

Premiumization and International Brand Expansion Accelerating Across Metropolitan Markets

The premium category landscape is evolving as the significant emergence and expansion of luxury cosmetic brands in India. By utilizing both independent shops and partnerships with local platforms, global cosmetic giants are creating intricate retail ecosystems. Expanding wealthy consumer groups, access to international beauty norms via digital platforms, and an increasing readiness to spend on superior formulas are the key motivators of this premiumization movement. To enhance its position in the Indian market, global beauty and fragrance brand Chanel collaborated with Nykaa in 2025. Due to this collaboration, Chanel's beauty products and perfumes will be accessible on the Nykaa app and website, in addition to select Nykaa Luxe stores. By the end of 2025, Chanel plans to expand its retail presence to over ten Nykaa Luxe sites across the country. The arrival of renowned brands is raising consumer expectations, fostering refined retail experiences, and contributing to overall market value growth via increased average transaction values.

Digital Commerce Revolution Reshaping Beauty Product Discovery and Purchase Behavior

The way Indian consumers find, assess, and buy beauty items is getting completely changed by e-commerce platforms, making India the world's fastest-growing online beauty sector. Through home delivery, virtual try-on technologies, tailored recommendations, and thorough product reviews that boost customer confidence, digital channels provide unmatched convenience. Platforms can now supply beauty items in a matter of hours thanks to the inclusion of rapid commerce capabilities, which has further increased adoption. Sales of rapid commerce and beauty e-commerce in India skyrocketed, far exceeding the expansion of traditional retail. Nykaa's operational excellence in 2024, fulfilling 70% of beauty orders in a single day, is a prime example of how speed and dependability are emerging as crucial differentiators in the digital beauty sector.

Natural, Organic, and Ayurvedic Formulations Gaining Mainstream Consumer Acceptance

Beauty products with natural ingredients, organic certifications, and Ayurvedic formulas based on traditional wellness practices are becoming increasingly popular. Growing health consciousness, worries about exposure to synthetic chemicals, and cultural pride in indigenous beauty history are all reflected in this movement. Younger consumers who place a high value on ethical purchasing are drawn to brands that emphasize ingredient transparency, sustainability credentials, and cruelty-free testing. As an example of how companies are successfully blending traditional and modern beauty paradigms, Jivada introduced a holistic wellness line in January 2025 that specifically targets maturing skin by fusing Ayurvedic wisdom with contemporary scientific formulae.

Market Outlook 2026-2034:

The India beauty and personal care market is positioned for sustained expansion driven by demographic dividends, digital infrastructure maturation, and evolving consumer sophistication. Rising middle-class incomes, particularly in tier-two and tier-three cities, will democratize access to premium products previously concentrated in metropolitan markets. Social media's influence will continue intensifying, with beauty influencers and content creators shaping purchasing decisions through authentic engagement and product demonstrations. The market generated a revenue of USD 31.19 Billion in 2025 and is projected to reach a revenue of USD 48.72 Billion by 2034, growing at a compound annual growth rate of 5.08% from 2026-2034. Government initiatives including the Startup India program and Production Linked Incentive schemes for manufacturing will catalyze domestic innovation and reduce import dependencies.

India Beauty and Personal Care Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Organic | 42% |

| Product | Skincare/Sun Care | 35% |

| Distribution Channel | Online Stores | 30% |

| Region | North India | 29% |

Type Insights:

- Vegan

- Organic

- Inorganic

Organic dominates with a market share of 42% of the total India beauty and personal care market in 2025.

Organic beauty and personal care products have captured significant market leadership through consumer demand for transparency, sustainability, and wellness-oriented formulations. This segment's dominance reflects growing awareness about potential health implications of synthetic chemicals, parabens, and artificial additives commonly found in conventional beauty products. Consumers are actively seeking certifications, natural ingredient listings, and eco-friendly packaging that align with broader lifestyle choices emphasizing environmental responsibility and personal health optimization.

The organic segment benefits from regulatory support, media coverage highlighting chemical concerns, and educational initiatives by advocacy groups that have increased consumer literacy about ingredient safety. Premium pricing acceptance within this category demonstrates consumer willingness to prioritize health considerations over cost savings, particularly among educated urban professionals and health-conscious millennials who view organic products as preventive investments rather than discretionary expenses. Brand authenticity and ingredient sourcing transparency have become critical differentiators within this competitive space.

Product Insights:

- Skincare/Sun Care

- Hair Care

- Makeup and Color Cosmetic Products

- Deodorants/Fragrances

- Others

Skincare/sun care leads with a share of 35% of the total India beauty and personal care market in 2025.

Skincare and sun care products command market leadership driven by increasing dermatological awareness, rising pollution concerns, and growing recognition of preventive skincare importance across age groups. This segment's dominance reflects consumer shift from reactive to proactive skincare approaches, with sun protection emerging as fundamental daily ritual rather than seasonal consideration. Urban consumers particularly prioritize products addressing specific concerns such as hyperpigmentation, premature aging, and environmental damage caused by ultraviolet exposure and atmospheric pollutants.

The segment has benefited significantly from dermatologist endorsements, clinical efficacy demonstrations, and educational campaigns highlighting long-term benefits of consistent skincare regimens. Product innovation in specialized formulations addressing diverse Indian skin tones, humidity-resistant textures, and multi-benefit solutions has expanded consumer adoption beyond traditional premium segments. The integration of technology through skin analysis tools and personalized product recommendations has further strengthened consumer engagement and category growth across digital and physical retail channels.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies and Drug Stores

- Online Stores

- Others

Online stores exhibit a clear dominance with a 30% share of the total India beauty and personal care market in 2025.

Online retail channels have emerged as dominant distribution platforms transforming how Indian consumers discover, evaluate, and purchase beauty products. This segment's leadership reflects fundamental shifts in shopping behaviors driven by smartphone penetration, affordable internet access, and logistics infrastructure improvements enabling reliable delivery across diverse geographies. E-commerce platforms provide unparalleled product selection, competitive pricing through direct brand partnerships, and convenience that resonates particularly with time-constrained urban professionals and digitally native younger consumers.

The online channel's success stems from unique advantages including customer reviews providing social validation, virtual try-on technologies reducing purchase uncertainty, and subscription models ensuring product continuity. Flash sales, exclusive online launches, and influencer collaborations create engagement opportunities difficult to replicate in traditional retail environments. The channel also enables emerging brands to bypass expensive physical retail barriers, democratizing market access and fostering innovation through direct consumer feedback mechanisms that inform product development and marketing strategies.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India leads with a share of 29% of the total India beauty and personal care market in 2025.

North India commands regional market leadership supported by dense population concentrations in metropolitan hubs including Delhi NCR, substantial middle-class consumer bases, and cultural emphasis on grooming and personal presentation. The region benefits from higher per capita incomes in urban centers, robust retail infrastructure spanning modern trade and traditional channels, and strong presence of both domestic and international brands that have established deep distribution networks. Consumer preferences in North India demonstrate receptivity to product innovation, premium positioning, and international beauty trends that influence purchasing decisions.

The region's dominance reflects diverse demographic composition spanning affluent consumers seeking luxury products, aspirational middle-class segments trading up to premium offerings, and value-conscious buyers maintaining consistent category engagement. Climatic variations across the region create demand for specialized products addressing seasonal concerns such as winter dryness and summer sun protection. Marketing investments concentrated in North India's major markets create brand visibility that influences consumption patterns, while extensive retail presence ensures product accessibility across income segments and geography types from metropolitan centers to smaller cities.

Market Dynamics:

Growth Drivers:

Why is the India Beauty and Personal Care Market Growing?

Rising Disposable Incomes and Rapid Urban Development

India's economic expansion has generated substantial growth in middle-class household incomes, particularly within metropolitan and tier-two urban centers, fundamentally altering consumer spending patterns toward discretionary beauty and personal care investments. Urbanization has concentrated populations in cities where employment opportunities, higher wage structures, and exposure to global lifestyle trends converge, creating ideal conditions for beauty market expansion. Young urban professionals increasingly view personal grooming and appearance enhancement as essential rather than optional, driving systematic adoption of skincare routines, premium cosmetics, and specialized hair care regimens. This demographic shift is accompanied by nuclear family structures where dual-income households possess greater financial flexibility for beauty product experimentation and brand exploration. The proliferation of modern retail formats including shopping malls, specialty beauty stores, and luxury boutiques in urban centers has made premium products more accessible and socially normalized. In 2025, FutureMe, an ultra-premium skincare brand that debuted in South Africa last year following five years of thorough research and development, has now been launched in the Indian market to serve the needs of affluent individuals. The company has established The House of FutureMe, an experience center located in Breach Candy, Mumbai, where its products, priced between ₹20,000 and ₹65,000, are for sale and can be experienced. Small 15 gram packets are available for prices between ₹6,000 and ₹18,000.

Social Media Influence and Beauty Consciousness Revolutionizing Consumer Engagement

Digital platforms have fundamentally transformed how Indian consumers discover beauty products, learn application techniques, and make purchase decisions, creating unprecedented market dynamism and consumer sophistication. Social media influencers and beauty content creators have emerged as trusted advisors, demonstrating product usage, sharing honest reviews, and building engaged communities around specific brands and beauty philosophies. Platforms like Instagram, YouTube, and emerging short-video applications enable viral beauty trends to spread rapidly across diverse consumer segments, democratizing access to beauty education previously confined to professional salons or magazine editorials. Celebrity brands are also gaining prominence in the market, encouraging people to invest in their brands. As per the recent report provided to the National Stock Exchange by the beauty platform, Katrina’s brand achieved a GMV (Gross Merchandise Value) of Rs 240 crore in Financial Year 2025. By FY 2026, the brand's total sales have reached Rs 350 crore. GMV refers to the overall value of all items the brand has sold prior to subtracting factors such as discounts or returns.

E-Commerce Infrastructure Expansion Democratizing Beauty Product Access

Digital commerce platforms have revolutionized beauty product distribution by eliminating geographic barriers, expanding product assortment beyond physical retail limitations, and offering personalized shopping experiences that enhance consumer confidence and satisfaction. E-commerce enables international and niche brands to enter the Indian market without establishing expensive physical retail networks, dramatically lowering market entry barriers and fostering competitive innovation. Consumers benefit from comprehensive product catalogs, detailed ingredient information, customer reviews, and beauty tutorials that facilitate informed purchasing decisions. Virtual try-on technologies using augmented reality help consumers visualize cosmetic products before purchase, addressing traditional hesitation around online beauty shopping. IMARC Group predicts that the India e-commerce market is projected to attain USD 651.10 Billion by 2034.

Market Restraints:

What Challenges the India Beauty and Personal Care Market is Facing?

Price Sensitivity Across Mass Market Segments

Despite growing affluence, significant consumer portions remain highly price-conscious, limiting premium product penetration and constraining revenue growth potential. Economic volatility and inflation pressures cause consumers to prioritize essential categories over discretionary beauty spending during periods of financial uncertainty. The proliferation of unorganized players offering low-priced alternatives creates competitive pressure on organized brands attempting to maintain pricing integrity while investing in quality formulations, sustainable practices, and regulatory compliance that increase cost structures.

Counterfeit Products and Quality Concerns

The widespread availability of counterfeit and substandard beauty products through informal retail channels undermines consumer trust and brand equity while posing health risks. Inadequate regulatory enforcement and porous distribution networks enable unauthorized sellers to distribute fake products mimicking established brands, creating consumer confusion and potential safety issues. These counterfeit products erode legitimate brand revenues while damaging category reputation through adverse experiences that discourage repeat purchases and create skepticism toward new product innovations.

Regional Preference Diversity and Formulation Complexity

India's vast geographical diversity encompassing varied climatic conditions, water quality, cultural practices, and aesthetic preferences complicates product development and marketing standardization. Formulations effective in humid coastal regions may underperform in arid northern climates, while color cosmetics popular in urban metropolitan markets may not resonate with regional beauty standards. This complexity increases research and development costs, inventory management challenges, and marketing expenses as brands must develop localized strategies addressing specific regional requirements while maintaining operational efficiency and brand consistency.

Competitive Landscape:

The India beauty and personal care market exhibits dynamic competitive intensity characterized by strategic positioning across premium, mass, and value segments. Multinational corporations leverage global research capabilities, established brand equity, and extensive distribution networks to maintain market leadership, while domestic players capitalize on local consumer insights, agile innovation, and cost advantages. Competition centers on product differentiation through ingredient innovation, clinical validation, and targeted marketing communications addressing specific consumer concerns. The market demonstrates increasing consolidation as established players acquire emerging brands to access niche segments and innovative formulations. Distribution strategy remains critical competitive battleground, with companies investing simultaneously in traditional retail presence, exclusive brand outlets, and e-commerce partnerships. Brand authenticity, ingredient transparency, and sustainability credentials have emerged as key differentiators influencing consumer choice, particularly among educated urban consumers willing to pay premium prices for products aligning with personal values and demonstrable efficacy. Some of the key market players include:

- Avon Products Inc. (Natura & Co Holding S.A.)

- Beiersdorf AG

- Colgate-Palmolive Company

- Coty Inc.

- Hindustan Unilever Limited

- Kao Corporation

- L'occitane India

- L'Oréal S.A

- Revlon Inc.

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

Recent Developments:

- In November 2025, Naturals Salon has introduced a new direct-to-consumer (D2C) skincare line named NXTFACE, aimed at specific, younger demographics. The subsidiary marks Naturals' inaugural D2C brand, which operates a network of salons. It will feature a diverse selection of beauty items, including serums, sunscreens, lip balms, and day creams, and intends to use omni-channel distribution via a website, e-commerce platforms like Amazon, and Naturals Salon's brick-and-mortar stores.

- In July 2025, At Skinomics 2025, a major two-day salon conclave held on July 17 and 18 in Gurugram, India, Spanish dermo-cosmetic company Casmara unveiled its newest line of cutting-edge professional skincare treatments. Another significant milestone in the 17-year association between Casmara and Esskay Beauty Resources, the company's only distribution partner in India, was reached with the showcase.

- In February 2025, Ananya Birla announced her plans to enter the Indian beauty and personal care (BPC) market with the launch of multiple brands throughout 2025. Birla underlined that the brands will prioritize unique packaging, high-quality products, and consumer-focused tactics. Establishing a presence both domestically and abroad is the venture's goal.

India Beauty and Personal Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vegan, Organic, Inorganic |

| Products Covered | Skincare/Sun Care, Hair Care, Makeup and Color Cosmetic Products, Deodorants/Fragrances, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies and Drug Stores, Online Stores, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Avon Products Inc. (Natura & Co Holding S.A.), Beiersdorf AG, Colgate-Palmolive Company, Coty Inc., Hindustan Unilever Limited, Kao Corporation, L'occitane India, L'Oréal S.A, Revlon Inc., The Estée Lauder Companies Inc., The Procter & Gamble Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India beauty and personal care market size was valued at USD 31.19 Billion in 2025.

The India beauty and personal care market is expected to grow at a compound annual growth rate of 5.08% from 2026-2034 to reach USD 48.72 Billion by 2034.

Organic dominates the segment with a market share of 42% in 2025, driven by rising consumer awareness regarding chemical-free formulations and growing preference for natural ingredients rooted in Ayurvedic traditions.

Key factors driving the India beauty and personal care market include rising disposable incomes and rapid urbanization enabling premium product adoption, social media influence and beauty consciousness revolutionizing consumer engagement and product discovery, and e-commerce infrastructure expansion democratizing access to diverse beauty products across urban and rural markets.

Major challenges include persistent price sensitivity limiting premium product adoption across mass segments, widespread counterfeit product availability undermining consumer trust and brand equity, regional preference diversity complicating standardized product development, inadequate regulatory enforcement enabling substandard products, and infrastructure gaps constraining organized retail penetration in smaller cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)