India Battery Management System Market Size, Share, Trends and Forecast by Battery Type, Type, Topology, Application, and Region, 2025-2033

India Battery Management System Market 2024, Size and Trends:

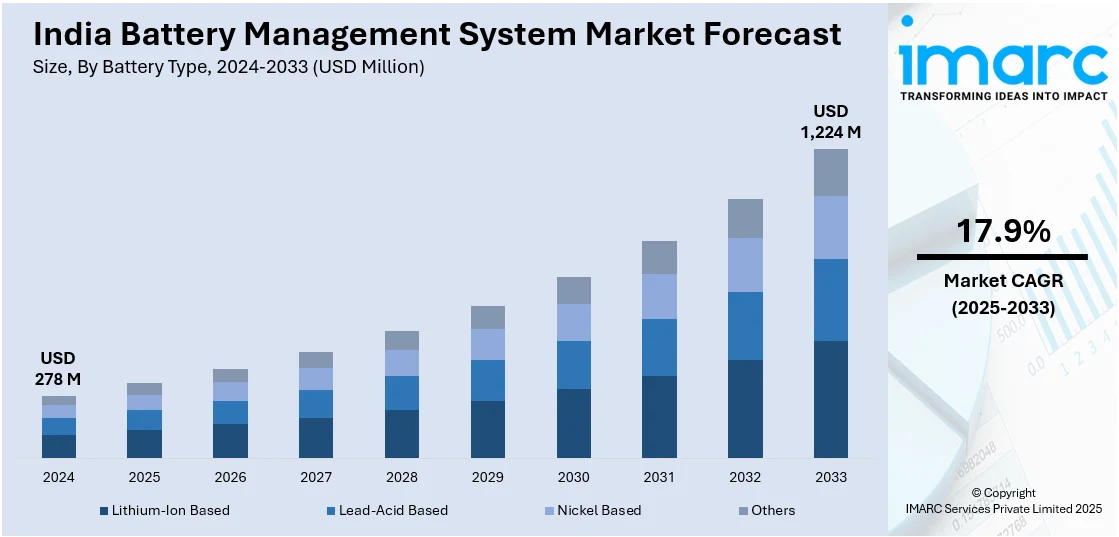

The India battery management system market size was valued at USD 278 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,224 Million by 2033, exhibiting a CAGR of 17.9% from 2025-2033. The market is driven by the growing adoption of electric vehicles, increasing renewable energy integration, and advancements in battery technologies. Government incentives for EVs and renewable energy projects further holding a significant India battery management system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 278 Million |

| Market Forecast in 2033 | USD 1,224 Million |

| Market Growth Rate (2025-2033) | 17.9% |

The India battery management system (BMS) market is experiencing rapid growth, fueled by the increasing adoption of renewable energy solutions as well as electric vehicles (EVs). The Indian government's push toward sustainable transportation through incentives for EV manufacturers and buyers under initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme is significantly increasing demand for efficient BMS solutions. Additionally, the growing penetration of solar and wind energy systems in India necessitates advanced energy storage solutions, driving the demand for BMS technologies to optimize battery performance and longevity. Rising awareness of energy efficiency and the need to reduce carbon emissions further propels the India battery management system market growth as industries and households transition to battery-powered applications.

To get more information on this market, Request Sample

In addition, the escalating India battery management system market demand for consumer electronics and portable devices, where compact and efficient battery systems are essential, is favoring the market. According to a research report by IMARC Group, the India power electronics market size reached USD 2.57 Billion in 2023. The market is expected to reach USD 4.37 Billion by 2032, exhibiting a growth rate (CAGR) of 5.50% during 2024-2032. The rapid expansion of industries such as telecom, data centers, and healthcare is increasing the need for uninterrupted power supplies, enhancing the adoption of BMS technologies. Moreover, advancements in battery technologies, such as lithium-ion and solid-state batteries, require sophisticated management systems to ensure safety, prevent overheating, and optimize performance. These factors, combined with a steady decline in battery costs, are creating a favorable environment for the BMS market in India, ensuring robust growth.

India Battery Management System Market Trends:

Integration of IoT and Smart BMS Solutions

The integration of Internet of Things (IoT) technologies with battery management systems is revolutionizing the market in India. On 17th October 2024, BatX Energies, a lithium-ion battery recycling startup, partnered with LW3 to revolutionize battery lifecycle management using blockchain and IoT-based digital product passports. The collaboration ensures traceability from production to end-of-life, streamlining compliance with global sustainability standards. This initiative aims to enhance transparency in recycling, enable cross-border scrap traceability, and help EV and battery manufacturers meet sustainability targets. Both companies plan joint fundraising to expand advanced recycling technologies. Smart BMS solutions enable real-time monitoring and predictive analytics, offering insights into battery health, usage patterns, and energy optimization. Industries and EV manufacturers are leveraging IoT-enabled BMS to enhance operational efficiency, reduce downtime, and improve safety. The rising adoption of connected devices and cloud-based platforms is further enhancing this trend, as businesses seek to integrate BMS into broader smart grid and smart home ecosystems. This shift is driving innovation in software capabilities, making BMS a key enabler of intelligent energy management across various sectors.

Advancements in Battery Chemistries and Modular BMS Designs

As battery chemistry continues to change, the demand for flexible and modular battery management systems is on the rise. Innovations such as lithium iron phosphate (LFP) and solid-state batteries require advanced BMS designs to manage their unique characteristics. On 26th December 2023, Hindalco Industries partnered with US-based Charge CCCV (C4V) to supply 2,000 tons of battery-grade aluminum foils annually for lithium-ion battery production over five years. The collaboration also includes joint development of advanced materials and technologies to support India's EV market. Hindalco is investing INR 800 crore in a 25,000-ton battery foil manufacturing facility in Odisha. In India, the adoption of modular BMS, which allows for scalability and adaptability across diverse applications, is gaining momentum. These systems are particularly favored in sectors such as renewable energy, telecom, and e-mobility, where custom solutions are needed to meet specific energy demands. The trend toward modularity reduces costs, enhances efficiency, and facilitates seamless integration with changing battery technologies.

Growth in Energy Storage Solutions for Grid Applications

India's growing focus on energy security and renewable energy integration has fueled demand for large-scale energy storage solutions, such as grid-connected battery systems. On 17th June 2024, NTPC invited bids for 250MW/500MWh standalone battery energy storage systems (BESS) at sites in Madhya Pradesh and Maharashtra, aimed at supporting renewable energy integration. The projects, designed for a 12-year lifespan with high efficiency, include supply, grid integration, and maintenance of battery systems. Bidding closes on July 18, with eligibility requiring prior experience in grid-connected BESS projects of 40MW or more. In addition, battery management systems are integral to these applications, ensuring efficient energy distribution, system stability, and battery lifespan. The government’s ambitious renewable energy targets and initiatives to establish energy storage parks have further bolstered this India battery management system market trends. Additionally, increasing urbanization and industrialization are driving investments in grid infrastructure, where BMS plays a critical role in managing load fluctuations and maintaining uninterrupted power supply. This trend highlights the expanding role of BMS in supporting India’s energy transition and grid modernization efforts.

India Battery Management System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India battery management system market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on battery type, type, topology, and application.

Analysis by Battery Type:

- Lithium-Ion Based

- Lead-Acid Based

- Nickel Based

- Others

Lithium-ion batteries are in demand due to their high energy density, lightweight, and long lifespan. Their application spans electric vehicles, consumer electronics, and renewable energy storage, driving demand for advanced battery management systems.

Lead-acid batteries remain widely used in automotive and backup power systems due to their affordability and reliability. Despite competition from newer chemistries, advancements in BMS technologies continue to improve their efficiency and safety.

Nickel-based batteries, known for their durability and resilience under extreme conditions, are primarily utilized in industrial and aerospace applications. Sophisticated battery management systems are essential to optimize performance and ensure safety for these robust batteries.

Analysis by Type:

- Motive Battery

- Stationary Battery

Motive batteries power electric vehicles, forklifts, and industrial machinery, making them a critical segment in India’s growing e-mobility and logistics sectors. Battery management systems ensure these batteries operate efficiently, prolonging lifespan, enhancing safety, and optimizing performance under diverse operating conditions. The rising EV adoption is driving significant this India battery management system market outlook.

Stationary batteries are vital for backup power, grid energy storage, and renewable energy integration. They ensure reliability in telecom, data centers, and residential applications. Advanced BMS technologies are essential for monitoring performance, preventing failures, and extending life cycles, especially as India transitions toward sustainable energy solutions and infrastructure modernization.

Analysis by Topology:

- Centralized

- Distributed

- Modular

Based on the India battery management system market forecast, centralized battery management systems consolidate monitoring and control into a single unit, simplifying design and reducing costs. They are ideal for small-scale applications but may face scalability and reliability challenges in larger, more complex systems.

Distributed topology involves individual monitoring units for each battery cell or module, ensuring enhanced accuracy and safety. This system suits large-scale applications like electric vehicles and renewable energy storage, where precise management is crucial.

Modular topology combines centralized and distributed approaches, offering flexibility and scalability. It’s particularly effective in diverse applications requiring customized solutions, such as industrial systems and hybrid vehicles, ensuring efficient battery performance across varied operating conditions.

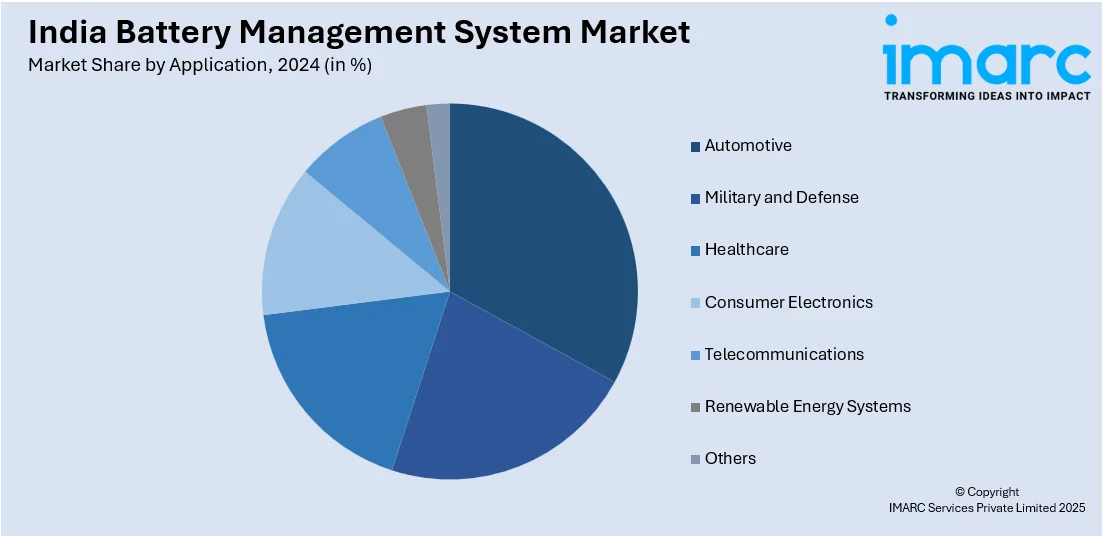

Analysis by Application:

- Automotive

- Electric Vehicles

- E-Bikes

- Golf Carts

- Military and Defense

- Healthcare

- Consumer Electronics

- Telecommunications

- Renewable Energy Systems

- Others

The automotive segment is a significant driver of the battery management system market, driven by the rapid adoption of electric vehicles. Advanced BMS ensures battery efficiency, safety, and longevity, crucial for sustainable and reliable transportation.

In military and defense applications, battery systems require robust management for critical operations. BMS enhances performance, reliability, and safety in challenging environments, supporting applications like portable equipment, unmanned systems, and renewable-powered defense infrastructure.

The healthcare sector increasingly relies on battery-powered devices like portable medical equipment and backup power systems. BMS ensures uninterrupted functionality, prolonging battery life and maintaining critical reliability for devices used in patient care and diagnostics.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

North India is a leading region in the market due to industrial hubs and government-backed EV adoption initiatives. Expanding solar energy projects further boost demand for advanced battery management systems in the region.

West and Central India is witnessing a rising BMS adoption due to significant industrialization, urbanization, and renewable energy integration, particularly in Gujarat and Maharashtra, fostering strong market potential across sectors.

South India’s thriving IT sector, renewable energy initiatives, and EV adoption contribute to strong BMS demand. The region leads in technological innovation and green energy projects, fueling sustained India battery management system market share.

East and Northeast India are emerging markets, driven by renewable energy projects and infrastructure development. Government incentives for energy storage solutions foster BMS adoption in these growing regions.

Competitive Landscape:

The competitive landscape of the India battery management system market is characterized by increasing innovation and strategic partnerships. Key players are focusing on developing advanced and customizable BMS solutions to meet diverse industry demands, including electric vehicles, renewable energy, and industrial applications. Companies are making substantial investments in research and development (R&D) activities to enhance battery performance, safety, and lifespan while integrating features like real-time monitoring and predictive maintenance through IoT-enabled solutions. Many are entering collaborations with automotive manufacturers and energy providers to expand their market reach. Additionally, local manufacturers are improving cost competitiveness to cater to the domestic market, while global entrants focus on introducing technologically superior products to maintain a competitive edge in this rapidly evolving sector.

The report provides a comprehensive analysis of the competitive landscape in the India battery management system market with detailed profiles of all major companies.

Latest News and Developments:

- October 4, 2024: JSW MG Motor India, in association with Vision Mechatronics, unveiled an industrial UPS system running on repurposed EV batteries and powered by its indigenous Battery Management System in Pune. The system falls under 'Project Revive,' which is based on the idea of the concept of a circular economy-the idea of extending the lifetime of EV batteries, giving it a second life towards energy storage applications. This project will be featured at The Battery Show in Greater Noida.

India Battery Management System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Based, Lead-Acid Based, Nickel Based, Others |

| Types Covered | Motive Battery, Stationary Battery |

| Topologies Covered | Centralized, Distributed, Modular |

| Applications Covered |

|

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India battery management system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India battery management system market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India battery management system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A battery management system (BMS) is an electronic system designed to monitor and control battery performance, ensuring safety, efficiency, and longevity. It regulates charging/discharging processes, prevents overheating, and provides real-time insights into battery health. BMS applications span electric vehicles, renewable energy systems, consumer electronics, and backup power solutions.

The India battery management system market was valued at USD 278 Million in 2024.

IMARC estimates the India battery management system market to exhibit a CAGR of 17.9% during 2025-2033.

The market is driven by the growing adoption of electric vehicles, increased renewable energy integration, advancements in battery technologies, government incentives for EVs and renewable projects, and the rising need for energy-efficient storage solutions across industrial, residential, and commercial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)