India Bathtub Market Size, Share, Trends and Forecast by Type, Application, Material Type, Shape, and Region, 2026-2034

India Bathtub Market Summary:

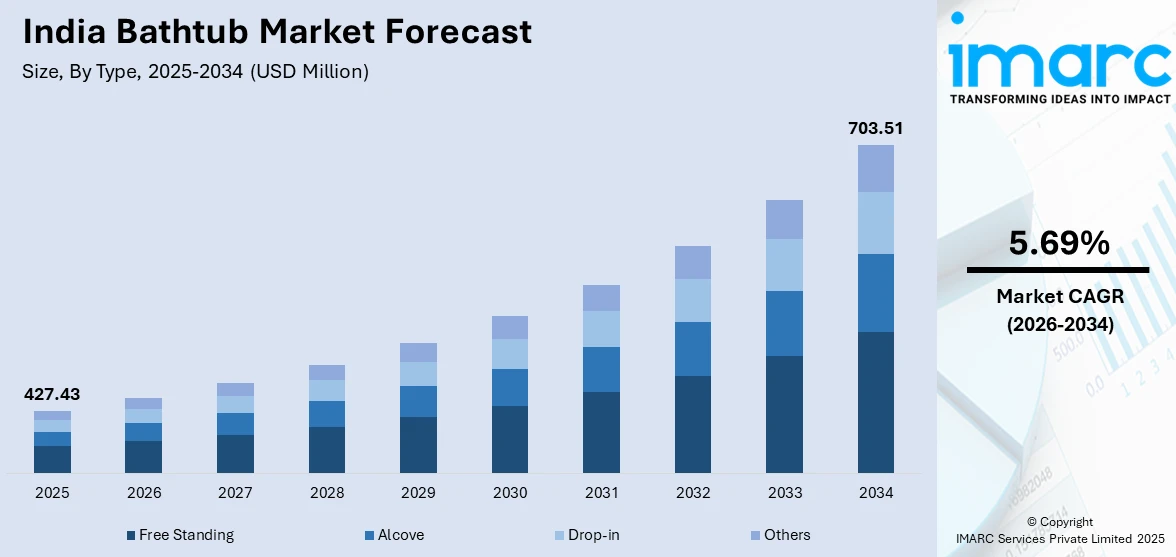

The India bathtub market size was valued at USD 427.43 Million in 2025 and is projected to reach USD 703.51 Million by 2034, growing at a compound annual growth rate of 5.69% from 2026-2034.

The India bathtub market is expanding steadily driven by rapid urbanization, increasing disposable incomes, and growing preference for premium bathroom experiences. Rising consumer awareness about wellness and self-care is transforming bathrooms into personal retreat spaces. The hospitality sector expansion, luxury residential developments, and evolving lifestyle aspirations among urban consumers are further accelerating demand for high-quality bathtub installations across the nation.

Key Takeaways and Insights:

- By Type: Free standing dominates the market with a share of 32% in 2025, owing to its design versatility, aesthetic appeal, and ability to serve as a centerpiece in modern bathroom designs. Rising consumer preference for therapeutic bathing experiences at home fuels demand.

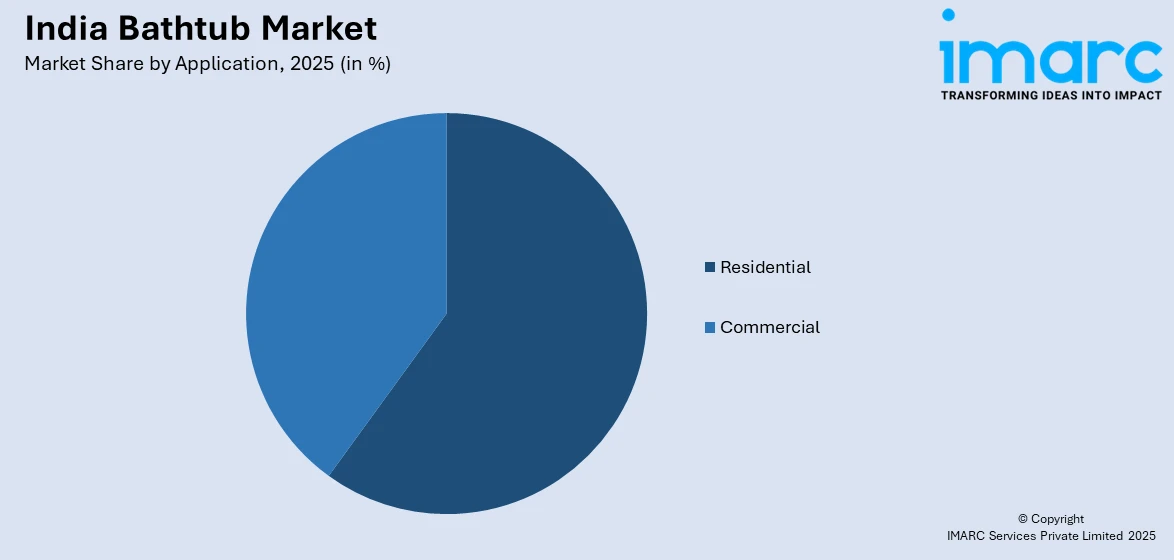

- By Application: Residential leads the market with a share of 71% in 2025. This dominance is driven by expanding housing construction, increasing nuclear families, rising purchasing power, and growing consumer aspirations for luxurious bathroom amenities in personal living spaces.

- By Material Type: Acrylic exhibits a clear dominance in the market with 38% share in 2025, reflecting strong consumer preference for lightweight, durable, and cost-effective bathroom fixtures that offer excellent heat retention and wide design customization options.

- By Shape: Rectangle holds the largest segment with a market share of 37% in 2025, reflecting practical space utilization in standard bathroom layouts and consumer preference for classic, timeless designs that complement various interior aesthetics.

- By Region: North India represents the largest region with 30% share in 2025, driven by rapid urbanization in Delhi-NCR, strong real estate development, high concentration of luxury housing projects, and growing affluent consumer base in metropolitan areas.

- Key Players: Key players drive the India bathtub market by expanding product portfolios, enhancing design innovations, and strengthening nationwide distribution networks. Their investments in premium quality, sustainable manufacturing, and strategic partnerships with real estate developers boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

In India, the bathtub market is growing at a considerable pace due to a favorable set of economic and demographic conditions. In India, there has been rapid urbanization in tier one and two cities, leading to a huge demand for contemporary bathroom fixtures. In India, there has been considerable growth in the residential construction industry, and demand for housing has been skyrocketing in major cities. This rise in demand for housing has increased the demand for upscale bathroom amenities, which were considered a luxury before. Hotel and resort development in the hotel industry is increasing and further leading to the growth of India bathtub market. India bathtub market shares are further fueled by the fact that modern consumers in India regard their bathrooms as their personal retreats rather than functional space. India bathtub market shares are fueled by government and real estate government initiatives.

India Bathtub Market Trends:

Growing Preference for Spa-Like Bathroom Experiences

Indian consumers are increasingly transforming bathrooms into personal wellness retreats, driving demand for premium bathtubs with therapeutic features. This trend reflects evolving lifestyle aspirations where self-care and relaxation at home have become priorities for modern households. Homeowners are investing in freestanding bathtubs, whirlpool systems, and soaking tubs that deliver spa-like experiences within residential settings. This shift is particularly prominent among urban households where demanding work schedules and hectic lifestyles necessitate convenient at-home relaxation solutions, significantly influencing India bathtub market growth.

Rising Adoption of Smart and Technology-Enabled Bathroom Fixtures

Technology integration in bathroom fixtures is gaining momentum as consumers seek enhanced convenience and personalized experiences. Smart bathtubs featuring temperature control, automated filling systems, and chromotherapy lighting are attracting tech-savvy homeowners. The growing smart home ecosystem in India is encouraging manufacturers to develop IoT-enabled bathroom solutions. This trend aligns with broader digitalization patterns where consumers expect connected devices throughout their living spaces. In September 2024, ABB India launched ABB-free@home, a wireless smart home automation solution designed to improve comfort, security, and energy efficiency in residential spaces, connecting with platforms like Apple HomeKit, Google Home, and Samsung SmartThings to enable seamless management of bathroom and household appliances.

Expansion of Luxury Residential and Hospitality Projects

The proliferation of premium housing developments and upscale hospitality establishments is significantly boosting bathtub adoption. Luxury apartments, villas, and boutique hotels are incorporating high-end bathroom fixtures as standard amenities to differentiate their offerings. Real estate developers increasingly recognize that well-appointed bathrooms influence purchasing decisions among affluent buyers. The hospitality sector's focus on creating distinctive guest experiences drives commercial demand for designer bathtubs. The market proportion of premium properties increased significantly from 52% of total sales from January to September 2024 to 62% during the same period in 2025, according to JLL's India Residential Market Dynamics Report (Q3 2025). This represents one of the biggest changes in market composition in recent years.

Market Outlook 2026-2034:

The India bathtub market outlook remains positive as multiple growth catalysts continue strengthening demand across residential and commercial segments. Sustained urbanization, rising affluence among the middle class, and evolving consumer preferences toward premium bathroom experiences are expected to drive market expansion throughout the forecast period. Government initiatives supporting housing development, including affordable housing schemes and urban infrastructure projects, are creating favorable conditions for bathroom fixture manufacturers. The hospitality industry's continued expansion, particularly in wellness tourism and premium accommodation segments, presents significant commercial opportunities. Manufacturers are responding with diversified product portfolios, enhanced distribution networks, and innovative designs catering to varied consumer preferences and budget segments. The market generated a revenue of USD 427.43 Million in 2025 and is projected to reach a revenue of USD 703.51 Million by 2034, growing at a compound annual growth rate of 5.69% from 2026-2034.

India Bathtub Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Free Standing |

32% |

|

Application |

Residential |

71% |

|

Material Type |

Acrylic |

38% |

|

Shape |

Rectangle |

37% |

|

Region |

North India |

30% |

Type Insights:

- Free Standing

- Alcove

- Drop-in

- Others

Free standing dominates with a market share of 32% of the total India bathtub market in 2025.

Freestanding bathtubs have emerged as the preferred choice among Indian consumers seeking to create luxurious bathroom environments that serve as personal wellness retreats. These fixtures offer exceptional design versatility, allowing homeowners to position them as striking statement pieces within larger bathroom spaces. The growing popularity of open-concept bathroom designs in premium residential projects has significantly boosted demand for freestanding models. Additionally, rising affluence and increasing exposure to international interior design trends through digital platforms have accelerated consumer preference for these elegant bathroom centerpieces.

The segment's growth is further supported by manufacturers offering diverse styles ranging from contemporary minimalist designs to classic clawfoot options. Urban consumers particularly appreciate the sculptural quality these bathtubs bring to modern interiors, transforming functional spaces into wellness retreats. The hospitality industry's adoption of freestanding bathtubs in premium hotel suites has also influenced residential consumer preferences. Real estate developers increasingly incorporate these fixtures in luxury apartment projects to enhance property values and attract discerning buyers.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential leads with a share of 71% of the total India bathtub market in 2025.

The residential segment dominates the India bathtub market, driven by expanding housing construction activities and increasing consumer investment in home improvement projects. Indian households are progressively allocating larger budgets toward bathroom upgrades as part of broader home renovation initiatives, viewing bathrooms as personal sanctuaries rather than purely functional spaces. The segment benefits from favorable demographic shifts including rising nuclear families and dual-income households who prioritize modern amenities and contemporary lifestyle conveniences in their living spaces.

Growing affluence among the middle class has democratized access to premium bathroom products previously considered exclusive to luxury segments. Homeowners in metropolitan areas and emerging tier-two cities are incorporating bathtubs as standard features in master bathroom designs. The influence of global interior design trends disseminated through digital platforms has raised consumer expectations regarding bathroom aesthetics and functionality. Real estate developers respond by including bathtub provisions in residential projects to differentiate their offerings in competitive housing markets.

Material Type Insights:

- Fiberglass

- Acrylic

- Cast Iron

- Others

The acrylic exhibits a clear dominance with a 38% share of the total India bathtub market in 2025.

Acrylic bathtubs command the largest material segment share owing to their exceptional combination of affordability, durability, and design flexibility. These fixtures offer superior heat retention properties, ensuring comfortable bathing experiences while maintaining water temperature effectively. The lightweight nature of acrylic simplifies installation and reduces structural requirements compared to heavier alternatives.

Manufacturers leverage acrylic's moldability to create diverse designs spanning contemporary to traditional styles, catering to varied aesthetic preferences. The material's non-porous surface resists staining and bacterial growth, addressing hygiene considerations increasingly important to Indian consumers. Acrylic bathtubs also offer easier maintenance compared to cast iron or fiberglass alternatives, appealing to practical-minded homeowners. The availability of acrylic fixtures across wide price ranges ensures accessibility for both budget-conscious buyers and premium segment consumers seeking customized features.

Shape Insights:

- Rectangle

- Oval

- Square

- Others

Rectangle represents the leading segment with a 37% share of the total India bathtub market in 2025.

Rectangular bathtubs maintain market leadership owing to their practical compatibility with standard bathroom layouts prevalent in Indian residential construction. These fixtures optimize space utilization in typical rectangular bathroom floor plans, making them preferred choices for both new construction and renovation projects across the country. The shape's versatility allows seamless integration with alcove installations, shower-tub combinations, and drop-in configurations. Architects and interior designers frequently specify rectangular models for their timeless aesthetic appeal and functional advantages that accommodate diverse design requirements in modern Indian homes.

The classic aesthetic appeal of rectangular bathtubs complements diverse interior design themes from traditional to contemporary settings. Consumers appreciate the straightforward installation process and availability of matching accessories designed specifically for rectangular fixtures. Architects and interior designers frequently specify rectangular bathtubs for residential projects due to their space efficiency and familiar proportions. The segment also benefits from competitive pricing across various quality tiers, enabling broad market accessibility.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates the market with a share of 30% of the total India bathtub market in 2025.

North India leads the bathtub market driven by concentrated urbanization in the Delhi-National Capital Region and surrounding metropolitan areas. The region hosts India's highest concentration of luxury residential developments, premium housing societies, and upscale hospitality establishments. Strong economic activity, high per capita income levels, and aspirational consumer attitudes create favorable conditions for premium bathroom fixture adoption. Housing prices in top eight Indian cities including Delhi-NCR rose approximately seven percent year-over-year, indicating robust real estate activity supporting bathroom fixture demand.

The region's established retail infrastructure featuring brand showrooms and dealer networks ensures convenient product accessibility for consumers. North India's cultural emphasis on home aesthetics and entertainment spaces influences investment in premium bathroom amenities. The hospitality sector's growth with new hotel developments in religious tourism circuits like Ayodhya further augments commercial bathtub demand. Climate considerations favoring indoor relaxation during extreme weather conditions also contribute to residential bathtub adoption patterns in northern states.

Market Dynamics:

Growth Drivers:

Why is the India Bathtub Market Growing?

Rapid Urbanization and Residential Construction Boom

Accelerating urbanization is now changing the basic housing pattern and consumer expectations of amenities in residential spaces in India. Millions of people are still moving to cities for job opportunities and living standards, thus placing housing construction in unprecedented demand. This change in demography presents huge opportunities to the bathroom fixture manufacturers, since all new residential construction is designed to fit in with fashionable bathroom needs. Metropolitan growth into suburbia and the growth of satellite townships are also driving construction activities. As quality bathrooms become symbols of lifestyle achievement, urban households have bigger budgets to spend on bathroom fixtures. Construction activity thus rises to develop integrated bathroom solutions with bathtubs as part of middle-range to high-end projects. Government initiative on housing supports urban development policies and provides a conducive policy environment for the growth of the construction sector. Real estate developers view well-appointed bathrooms as influencing customer buying decisions and promote bathtub provisions to make properties more marketable.

Inflating Income Levels and Evolving Consumer Lifestyles

India's economic growth has significantly expanded the middle class, creating a substantial consumer base with discretionary income for home improvement investments. Rising household incomes enable consumers to upgrade living spaces with premium amenities previously considered luxury items. The growing awareness regarding wellness and self-care has transformed bathrooms from purely functional spaces into personal retreats for relaxation. Consumers increasingly view bathtub ownership as reflecting lifestyle aspirations and personal achievement. Exposure to global living standards through travel, media, and digital platforms influences domestic expectations regarding bathroom quality. Dual-income households with higher combined purchasing power allocate resources toward creating comfortable home environments. The cultural shift toward experiential living encourages investment in amenities that enhance daily quality of life. Home renovation activities targeting bathroom upgrades represent significant market opportunities as existing homeowners modernize aging fixtures.

Expansion of Hospitality and Tourism Sectors

India's hospitality industry continues expanding rapidly to accommodate growing domestic and international tourism, creating substantial commercial demand for bathtub installations. Hotels, resorts, and serviced apartments recognize that distinctive bathroom experiences differentiate their offerings in competitive markets. The luxury hospitality segment particularly emphasizes premium bathroom fixtures to meet expectations of discerning travelers. Wellness tourism growth drives demand for luxury bathroom amenities in specialized resort properties. Religious tourism circuits experiencing development feature new hotels incorporating modern bathroom facilities. The meetings, incentives, conferences, and exhibitions segment requires high-quality accommodation with contemporary bathroom standards. Budget hotel chains upgrading to mid-range positioning incorporate bathtubs to justify premium pricing. Commercial real estate developments including corporate housing and expatriate accommodations specify bathtub installations as standard amenities. The hospitality sector's quality standards influence residential consumer expectations, creating spillover demand in household markets.

Market Restraints:

What Challenges the India Bathtub Market is Facing?

High Installation and Product Costs

The initial investment cost associated with buying a bathtub, along with the setup, can act as a hindrance for budget-sensitive buyers, who comprise a large market in India. The cost associated with purchasing quality bathtubs, along with the setup charges such as plumbing, structural reinforcements and waterproofing, is high for a middle-class budget. Budget allocations for such fundamental needs, such as buying a bathtub, have been limited, mainly for the middle class, due to quality products associated with a high budget.

Space Constraints in Urban Housing

Small bathroom sizes in common Indian housing face great difficulties in accommodating bathtubs. The common design of city apartments promotes smaller designs in order to maximize the living space, leaving insufficient room for the bathtub. The average bathroom size in economical and middle-class housing ranges often does not facilitate bathtub installation together with the necessary fixtures. The existing housing structure creates obstacles for retrofitted bathtub installation.

Water Scarcity and Conservation Concerns

Accessibility of water in various Indian cities presents a tangible and intangible hurdle in the adoption of bathtubs. Consumers in regions where water availability is a concern view bathtub as a consumption-prone fixture that requires a large quantity of water per usage. Inability to provide consistent water supply for consumption in various cities presents two hurdles for bathtub adoption: feasibility and consumption. Increasing awareness about the environment presents a tangible hurdle in the adoption of bathtubs in favor of more environmentally friendly showering alternatives.

Competitive Landscape:

In the India bathtub market, the level of competition exists moderately in the fragmented market structure with local and global brands available in the market. Companies also compete with bathtubs developed with innovation in design, material quality, and support services. In the organized market, large companies have continued to support their manufacturing scale and brand equity to withstand the challenges of the unorganized sector. Companies have engaged in the development of showcases to allow direct customer touch and feel before acquiring the bathtubs. Partnerships with architects, interior designers, and builders in the real estate sector help in the specifications of the products in new builds. Distribution with exclusive and multi-brand outlets remains essential for penetrating the market. Online marketing and e-commerce sites stand to help in the reach of technologically advanced customer segments.

Recent Developments:

- In March 2025, TOTO India launched a new matte-finish washbasin range designed for modern, personalized bathrooms. Featuring an above-counter design and crafted with ultra-thin yet durable LINEARCERAM technology, the collection offers both elegance and strength. The company highlighted growing demand for luxury and style in home spaces and announced plans to expand offerings with diverse toilets, faucets, showers, and accessories in varied designs and colors.

- In November 2024, Ruhe announced plans to expand its presence across India with the launch of Exclusive Experience Centres for sanitaryware, bath and kitchen fittings. These centers provide a hands-on shopping experience, personalized assistance, and a comprehensive product range. Customers can access premium quality and innovation in their local markets while enjoying exclusive offers at these experiential retail locations.

India Bathtub Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Free Standing, Alcove, Drop-in, Others |

| Applications Covered | Residential, Commercial |

| Material Types Covered | Fiberglass, Acrylic, Cast Iron, Others |

| Shapes Covered | Rectangle, Oval, Square, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India bathtub market size was valued at USD 427.43 Million in 2025.

The India bathtub market is expected to grow at a compound annual growth rate of 5.69% from 2026-2034 to reach USD 703.51 Million by 2034.

Free standing dominated the market with a share of 32%, owing to its design versatility, aesthetic appeal, and growing consumer preference for spa-like bathroom experiences in modern residential settings.

Key factors driving the India bathtub market include rapid urbanization, rising disposable incomes, expanding residential construction, growing hospitality sector, and evolving consumer preferences toward premium bathroom experiences.

Major challenges include high installation and product costs, space constraints in urban housing, water scarcity concerns, limited awareness in tier-three cities, and competition from alternative bathing solutions like premium showers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)