India Bath Soap Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Region, 2025-2033

India Bath Soap Market Size and Share:

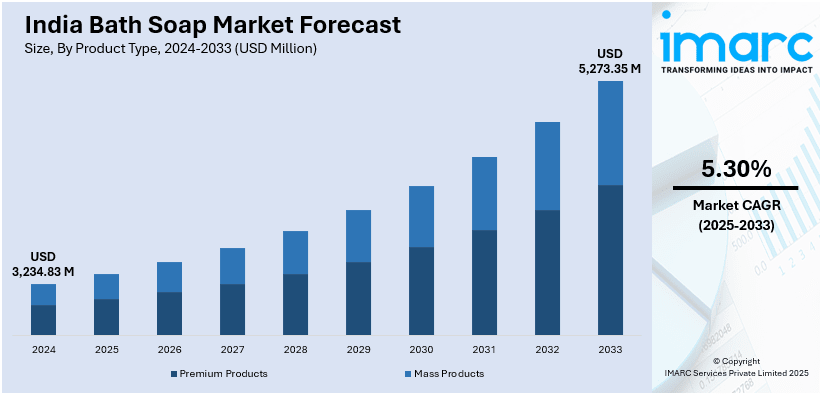

The India bath soap market size was valued at USD 3,234.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,273.35 Million by 2033, exhibiting a CAGR of 5.30% from 2025-2033. The market share is expanding due to rising hygiene awareness, increasing disposable income, urbanization, product innovation, demand for herbal formulations, growing e-commerce penetration, government sanitation initiatives, premiumization trends, and competitive strategies by key players focusing on affordability, sustainability, and specialized skincare benefits across mass and premium segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,234.83 Million |

|

Market Forecast in 2033

|

USD 5,273.35 Million |

| Market Growth Rate (2025-2033) | 5.30% |

The Indian bath soap industry is experiencing significant growth led by changing consumer tastes, economic conditions, and product development. Rising disposable incomes and altered lifestyles are promoting consumers to switch from generic soaps to premium, herbal, and dermatologically tested soaps. The urban population growth, with boosted exposure to international skincare trends, is driving demand for soaps containing vitamins, essential oils, and natural extracts. Rural penetration is also growing on account of better infrastructure and sanitation awareness, helped by government drives like Swachh Bharat Abhiyan. The role of digital marketing and celebrity endorsement is impacting brand attitudes, where consumers opt for brands, they know and trust and which deliver both quality and aspirational value. The expanding middle class is highly becoming brand loyal and opting for soaps that offer additional skincare value, such as moisturization, anti-aging, and acne prevention. For instance, in January 2025, moha launched Kesar Chandan Soap, blending saffron and sandalwood for a luxurious, Ayurvedic skincare experience, offering deep cleansing, hydration, and a radiant glow with a Grade-1 rating and 76% TFM. Additionally, the growth in the organized retail industry, which comprises supermarkets and internet retailing, additionally enhances availability and choice.

To get more information on this market, Request Sample

E-commerce is contributing a major way to changing the bath soap sector, providing consumers with easy access to both local and foreign brands. Home delivery convenience, competitive prices, and online-only product introduction are making an impact on buying decisions, especially among the younger consumers. Growing awareness of the health of the skin and harm caused by extreme chemicals is triggering the demand for paraben-free, sulfate-free, and cruelty-free soaps, compelling firms to formulate new, sustainable, and skin-supportive products. Eco-awareness is also encouraging brands to transition to biodegradable packaging materials and sustainable and ethically sourced ingredients to lure in green buyers. With intensifying competition, businesses are heavily investing in research and development to launch innovative goods especially suited to individual requirements, such as antibacterial, exfoliating, and pollution-protection soaps. The industry is also getting a boost from the growth of high-end and specialty segments, like handmade artisanal soaps and customized skin-care solutions, that tap into changing consumers' needs and support brand loyalty.

India Bath Soap Market Trends:

Surging Demand for Herbal and Natural Soaps

India bath soap market analysis is witnessing a change towards herbal, ayurvedic, and natural products as consumer awareness about the advantages of chemical-free skincare is on the rise. Consumers are highly aware of the long-term consequences of using synthetic chemicals like sulfates and parabens and thus demand soaps with natural extracts like neem, turmeric, sandalwood, and aloe vera. Ayurveda-validated brands and traditional players alike are riding the wave by bringing out plant-based products with curative advantages like anti-inflammatory, moisturizing, and antibacterial properties. Increased preference for organic personal care is also leading to demand for vegan-friendly and cruelty-free soaps, forcing players to follow eco-friendly ingredient procurement. For instance, in August 2024, Indore-based Kheoni launched organic soaps made from beeswax, sourced from its 35,000-tree reforestation project at Keshar Parvat, promoting chemical-free, sustainable skincare products. Furthermore, this trend is also supported by strong marketing efforts highlighting purity and effectiveness, with companies leveraging online channels to inform consumers about ingredient transparency. Premiumization of herbal soaps is growing the market, drawing in both urban and rural consumers seeking traditional yet effective skincare products.

Expansion of Online and Direct-to-Consumer (DTC) Channels

The speedy penetration of e-commerce is revolutionizing the India bath soap market to enable consumers to shop from a wider spectrum of brands, formulations, and price points. Online portals, brand websites, and social media-fueled DTC platforms are offering customers easy shopping, competitive pricing, and visibility into exclusive product lines. Digital native brands are using influencer marketing, engaging content, and recommendations to improve customer interactions and generate online sales. Subscription-based strategies are picking up pace, with customers getting tailored soap collections at periodic intervals, guaranteeing repeat buying and building brand loyalty. The spread of cashless payments and quicker delivery infrastructure is also fueling e-commerce expansion. Rural consumers are also majorly using online shopping thanks to better internet connectivity and penetration of smartphones, allowing smaller, local brands to reach wider. Limited-edition introductions, trial kits, and focused online advertising are propelling web-based sales, which has become a fundamental distribution channel for mass and premium soap categories.

Sustainability and Eco-Friendly Packaging Innovations

The trend towards sustainability is defining the India bath soap market, with customers valuing environmentally friendly brands that support ecofriendly values. Intensifying anxiety regarding plastic waste is compelling the use of biodegradable, recyclable, and plastic-free packaging options. For example, in January 2024, ITC Savlon implemented 70% recycled plastic in the PET film of Savlon Glycerin Soap wrappers, establishing a category-first initiative in sustainable packaging within the bath soap segment. Moreover, soap companies are getting creative with paper wraps, compostable cartons, and refillable soap bars to reduce environmental footprint. Further, there is a growing tendency towards cold-processed and handmade soap, which consumes less energy-intensive production and has fewer synthetic additives. Ethical sourcing approaches are also being integrated in many firms by collaborating with farmers locally for raw materials like coconut oil and essential oils, promoting fair trade and reduced carbon imprint. Water-conserving production methods and cruelty-free testing are emerging as industry norms, especially in the high-end segment. Brands that effectively convey their sustainability promises using labeling and certifications are winning consumer confidence, affirming the trend towards responsible consumption in the bath soap market.

India Bath Soap Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India bath soap market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, form, and distribution channel.

Analysis by Product Type:

- Premium Products

- Mass Products

Mass products segment dominates the India bath soap market in terms of affordability, extensive reach, and bulk consumption in both urban and rural areas. Consumers seek affordable options that deliver basic hygiene value, resulting in immense demand for popular brands with value packs and multipurpose soaps. Firms target price-conscious consumers by launching economy packs, family packs, and bundling options to push market penetration. The accelerating rural demand, with the support of government sanitation schemes and rising income levels, is also fueling mass soap consumption. FMCG majors use deep discounting, wide distribution channels, and judicious advertising to consolidate their presence in this space. Soaps with traditional antibacterial properties of neem and turmeric are especially favored in the mass segment. Small kirana shops, wholesalers, and rural outlets are still the major retail channels, making it readily accessible. This category remains strong as producers weigh affordability against functional attributes such as germ protection, moisturizing, and scent.

Analysis by Form:

- Solid Bath Soaps

- Liquid Bath Soaps

Solid bath soaps remain the leaders in the Indian market due to their low price, longer life, and convenience over liquid body washes. Solid soaps have a wide consumer base with appeal to rural families where access to water and bathing facilities can restrict the use of liquid soap. Products based on specific requirements, like moisturizing, antibacterial, and herbal types, have consolidated customer loyalty towards solid soaps. Upscale brands are differentiating their products by adding organic ingredients, essential oils, and skin-replenishing extracts to appeal to health-aware consumers. Furthermore, environmentally aware consumers also opt for solid soaps rather than plastic-packaged body washes, pushing demand for biodegradable ones. Cold-processed and handcrafted artisanal soaps have established a niche market within the larger market, appealing to sustainability-oriented consumers. Solid bath soaps still dominate sales in both mass and premium segments, with established brands innovating to improve product quality and customer experience.

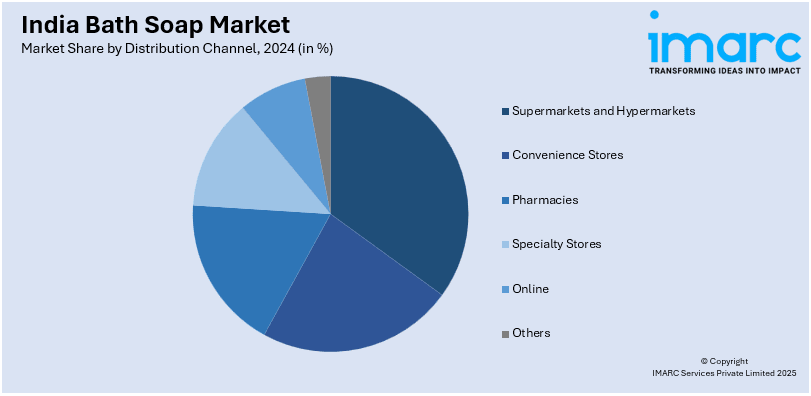

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Specialty Stores

- Online

- Others

Convenience stores continue to be an important distribution channel for bath soaps in India, with the advantages of instant availability, smaller pack sizes, and coverage across urban and semi-urban locations. Convenience stores are used for daily or impulse buys, and thus they are crucial for mass-market soap brands with an emphasis on price and brand recall. Consumers use convenience stores due to their proximity, fast transaction, and variety of choices offered, ranging from economy to premium soaps. Kirana outlets and local shops control this segment, providing extensive market reach, particularly in areas where supermarkets and e-commerce penetration are low. Top FMCG players concentrate on building robust retailer relationships by offering competitive trade margins, promotions, and effective supply chains. Small pack sizes and single-use sachets perform exceptionally well in this segment, targeting low-income consumers and travelers. The segment keeps growing as chain-organized retail stores add digital payment modes and optimize store layouts to enhance customer experience.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

West and Central India are are emerging as key markets for bath soaps because of growing urbanization, rising incomes, and rising demand for premium and herbal brands. Maharashtra and Gujarat are leaders in demand within the western zone, backed by robust retail penetration and the availability of key cities such as Mumbai, Pune, and Ahmedabad. The cities witness high buying power, propelling sales of premium and niche soap products such as skincare-oriented and green versions. In Central India, the likes of Madhya Pradesh and Chhattisgarh contribute towards bath soap demand, rural reach growing with government sanitation schemes and direct consumer engagement initiatives. Soaps based on traditional and ayurvedic properties witness good demand in the respective areas, wherein cultural demands play a decisive role in the decision to purchase. Growing e-commerce and new trade models further enhance sales, enabling high-end brands to penetrate new consumers. Favorable economic conditions in the region, along with growing skin health awareness, underpin steady market growth.

Competitive Landscape:

India bath soap is a highly competitive market, with large FMCG giants, local players, and new direct-to-consumer players competing for share. Large companies control the market with extensive networks of distributors, push marketing, and a broad portfolio of products serving multiple price points. Mass soaps remain the highest selling ones, whereas premium and herbal versions are catching on with city-dwelling consumers looking for targeted skincare advantages. Regional brands use conventional ingredients and pricing to compete in rural economies, where familiarity and accessibility create brand loyalty. Amplified use of e-commerce and digital marketing has allowed smaller companies to access niche markets with organic, handmade, and sustainable products. Sustained competition has created persistent product innovation, with brands emphasizing ingredient transparency, sustainable packaging, and added functional value. Price battles, campaign promotions, and endorsements by famous celebrities are primary measures driving market dynamics, keeping existing as well as new entrants extremely competitive.

The report provides a comprehensive analysis of the competitive landscape in the India bath soap market with detailed profiles of all major companies, including:

- Baldha Industries Private Limited

- Hindustan Unilever Limited (Unilever plc)

- ITC Limited

- Johnson & Johnson Private Limited (Johnson & Johnson)

- Jyothy Laboratories Limited

- Kavit Soap Industries

- Mahavir Health

- Raymond Consumer Care Limited

- Vasa Cosmetics Private Limited

- Wipro Consumer Care Private Limited (Wipro Enterprises Private Limited)

Latest News and Developments:

- In December 2024, Karnataka Soaps and Detergents Limited (KSDL) is introducing a new logo and packaging for Mysore Sandal Soap after 40 years. The company is expanding into Jammu and Kashmir, Nagaland, Gujarat, and Punjab with 480 new distributors while strengthening its presence through e-commerce and metro retail outlets.

- In January 2024, Jyothy Labs expanded its Margo soap range with the launch of Margo Neem Naturals, reinforcing its commitment to natural skincare. The brand emphasizes neem’s antibacterial properties, sustainable ingredient sourcing, and biodegradable formulations. Additionally, Jyothy Labs pledged to make Margo soap cartons 100% plastic-free, supporting environmental sustainability.

- In December 2023, Bengaluru-based Wipro Consumer Care acquired Jo, Doy, and Bacter Shield soap brands from VVF Ltd in a deal estimated at ₹500-525 crore. The acquisition strengthens Wipro’s foothold in North and East India while enhancing its presence in the premium and antibacterial soap segments, intensifying competition with market leaders.

India Bath Soap Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Premium Products, Mass Products |

| Forms Covered | Solid Bath Soaps, Liquid Bath Soaps |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Specialty Stores, Online, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Baldha Industries Private Limited, Hindustan Unilever Limited (Unilever plc), ITC Limited, Johnson & Johnson Private Limited (Johnson & Johnson), Jyothy Laboratories Limited, Kavit Soap Industries, Mahavir Health, Raymond Consumer Care Limited, Vasa Cosmetics Private Limited and Wipro Consumer Care Private Limited (Wipro Enterprises Private Limited) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bath soap market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India bath soap market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bath soap industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bath soap market in the India was valued at USD 3,234.83 Million in 2024.

Rising personal hygiene awareness, increasing disposable income, urbanization, and product innovation drive India's bath soap market. Demand for herbal and organic soaps, aggressive marketing by key brands, expanding e-commerce penetration, and government sanitation initiatives further boost growth. Premiumization and customization trends also contribute to market expansion.

The India bath soap market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 5,273.35 Million by 2033.

Solid bath soaps accounted for the largest market share in the India bath soap market due to their affordability, widespread availability, longer shelf life, and strong consumer preference across both urban and rural regions. Their dominance is further supported by diverse formulations, traditional usage habits, and higher penetration in mass and premium segments.

Some of the major players in the India bath soap market include Baldha Industries Private Limited, Hindustan Unilever Limited (Unilever plc), ITC Limited, Johnson & Johnson Private Limited (Johnson & Johnson), Jyothy Laboratories Limited, Kavit Soap Industries, Mahavir Health, Raymond Consumer Care Limited, Vasa Cosmetics Private Limited and Wipro Consumer Care Private Limited (Wipro Enterprises Private Limited), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)