India Bath & Shower Products Market Size, Share, Trends and Forecast by Type, Form, Sales Channel, and Region, 2025-2033

India Bath & Shower Products Market Overview:

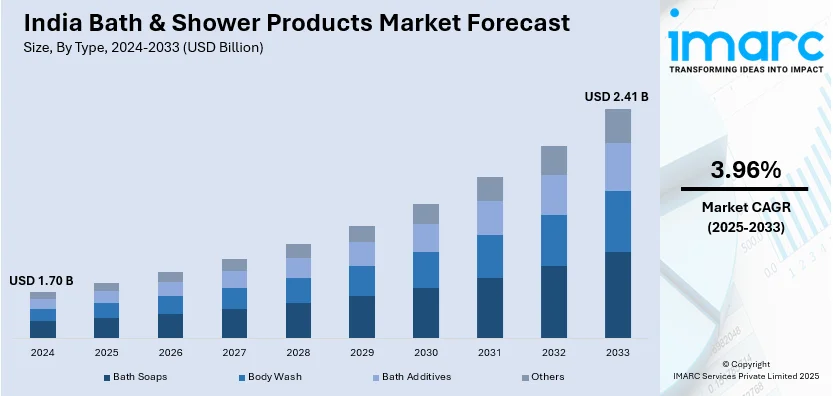

The India bath & shower products market size reached USD 1.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.41 Billion by 2033, exhibiting a growth rate (CAGR) of 3.96% during 2025-2033. The market is growing due to the rising hygiene awareness, demand for natural and premium products, and expanding e-commerce penetration. Sustainable packaging and Ayurvedic formulations, rapid urbanization and increasing disposable incomes further provide a positive impact to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.70 Billion |

| Market Forecast in 2033 | USD 2.41 Billion |

| Market Growth Rate 2025-2033 | 3.96% |

India Bath & Shower Products Market Trends:

Growing Demand for Natural and Herbal Products

The demand for natural and herbal bath and shower products in India is rising as consumers shift toward Ayurveda-based and chemical-free formulations. Increasing awareness about skin health and concerns over synthetic ingredients have fueled the preference for plant-based extracts, essential oils, and dermatologically safe products. Brands are responding with sulfate-free, paraben-free, and cruelty-free formulations, catering to evolving consumer preferences and driving India bath & shower market growth. Leading players and emerging startups are introducing herbal body washes, soaps, and shower gels enriched with turmeric, neem, sandalwood, and aloe vera, leveraging India’s traditional wellness heritage. For instance, in January 2025, moha announced the launch of its Kesar Chandan Soap, a luxurious blend of saffron and sandalwood designed for radiant skin. Grounded in Ayurvedic tradition, the soap cleanses while maintaining moisture, promoting a soft and refreshed complexion. With its soothing qualities, it aims to enhance both skin vitality and tranquility. Growing disposable income and urbanization further contribute to the premiumization of these products. With a surge in demand for sustainable and skin-friendly options, the India bath & shower products market share is increasingly dominated by herbal and natural brands, shaping the industry’s competitive landscape.

To get more information on this market, Request Sample

Introduction of Eco-Friendly Product Packaging

The growing emphasis on sustainability is driving a shift toward eco-friendly packaging in India’s bath and shower products market. Consumers are increasingly choosing brands that prioritize biodegradable, plastic-free, and recyclable packaging solutions. Companies are responding by introducing paper-based soap wrappers, refillable body wash bottles, and plant-based bioplastics to reduce environmental impact. Many premium and emerging brands are also adopting minimalistic packaging with water-based inks and compostable materials. This trend is further fueled by regulatory policies encouraging sustainable production and waste reduction. Additionally, refill stations and reusable packaging models are gaining traction in urban areas, promoting a circular economy. Several leading brands are actively launching sustainability initiatives to reduce plastic waste and promote environmentally responsible packaging. For instance, in April 2023, ITC Savlon introduced sustainable packaging for its Glycerin Soap, using wrappers made from 70% recycled PET film. This initiative, part of their Sustainability 2.0 vision, aims to reduce plastic waste and promote responsible consumer choices, marking a significant step in the FMCG sector towards eco-friendly practices. As eco-consciousness continues to shape purchasing decisions, brands integrating sustainability into their packaging strategies will gain a competitive edge. These innovations and evolving consumer preferences are creating positive India bath & shower products market outlook.

India Bath & Shower Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, form and sales channel.

Type Insights:

- Bath Soaps

- Body Wash

- Bath Additives

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bath soaps, body wash, bath additives and others.

Form Insights:

- Solid

- Liquid

- Gels

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes solid, liquid, gels and others.

Sales Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, online and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bath & Shower Products Market News:

- In August 2024, Godrej Consumer Products Ltd. launched Cinthol Foam Bodywash, an innovative product offering instant foam without the need for a loofah. Addressing consumer concerns about body wash adoption, it features a playful TVC showcasing a girl and monkeys enjoying the product.

- In March 2024, Wipro's Yardley London launched a new range of shower gels and clear gel bars infused with natural floral oils. Dermatologically tested and pH-balanced, these products provide a luxurious cleansing experience.

India Bath & Shower Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bath Soaps, Body Wash, Bath Additives, Others |

| Forms Covered | Solid, Liquid, Gels, Others |

| Sales Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bath & shower products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bath & shower products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bath & shower products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India bath & shower products market was valued at USD 1.70 Billion in 2024.

The India bath & shower products market is projected to exhibit a CAGR of 3.96% during 2025-2033, reaching a value of USD 2.41 Billion by 2033.

India’s bath and shower products market is driven by changing lifestyles, increased focus on personal hygiene, and growing preference for natural and premium products. Expanding urbanization, product innovation, and rising influence of beauty and wellness trends also contribute, along with the convenience of online and modern retail shopping options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)