India Basmati Rice Market Size, Share, Trends and Forecast by Type of Rice, Pack Size, Distribution Channel, and Region, 2025-2033

India Basmati Rice Market Size and Share:

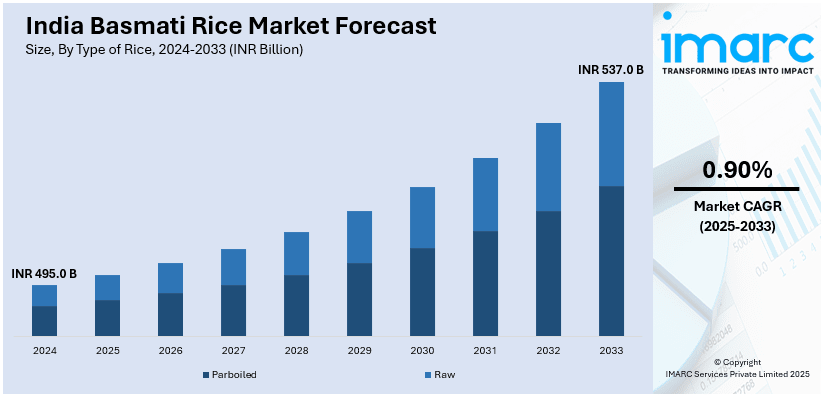

The India basmati rice market size was valued at INR 495.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 537.0 Billion by 2033, exhibiting a CAGR of 0.90% from 2025-2033. North India currently dominates the overall market due to favorable agro-climatic conditions, high-yield farming practices, and well-established export networks. Moreover, enhanced irrigation facilities and advancements in processing technology also contribute to increased production efficiency and quality standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 495.0 Billion |

|

Market Forecast in 2033

|

INR 537.0 Billion |

| Market Growth Rate (2025-2033) | 0.90% |

India’s Basmati rice market is seeing a shift towards brand marketing to strengthen consumer loyalty and regional market dominance. Companies are investing in targeted campaigns to build deeper cultural connections and influence purchasing decisions. In November 2024, KRBL launched the ‘Swaad Samriddhi Ka’ campaign for India Gate Basmati Rice in Maharashtra. The initiative reinforced regional consumer engagement, thereby driving brand preference over unbranded rice. Growing disposable incomes and evolving consumption habits are further pushing brands to differentiate their products through storytelling, influencer collaborations, and digital campaigns. On top of that, strategic branding will remain crucial in shaping demand and ensuring sustained market expansion for premium Basmati rice.

To get more information on this market, Request Sample

Also, the market is evolving beyond traditional consumption, with increasing demand for value-added products that cater to changing consumer preferences. Brands are expanding their product portfolios to include complementary offerings that enhance customer retention. In March 2024, India Gate ventured into Basmati rice biryani masalas, leveraging e-commerce and modern retail to boost branded Basmati loyalty by 9%. This strategy reduced unbranded rice sales while accelerating premium segment growth. With urbanization and a growing preference for convenience, pre-mixed spices, flavored rice, and fortified variants are gaining traction. Besides this, the Basmati rice industry is expected to witness an increasing shift toward integrated product lines that enhance overall consumption experiences as consumers seek curated meal solutions.

India Basmati Rice Market Trends:

Advancements in Basmati Rice Varieties

Innovation in rice cultivation is favoring efficiency and sustainability in India’s Basmati industry. In addition, the focus is on developing high-yield, climate-resilient, and resource-efficient varieties to improve production economics. In May 2024, IARI introduced Pusa Basmati 1979 and 1985, India’s first non-GM herbicide-tolerant Basmati strains designed for Direct Seeded Rice (DSR). Further, these varieties significantly reduce water consumption, labor costs, and environmental impact, improving farm productivity. At the same time, with rising input costs and regulatory challenges in global exports, advancements in rice breeding are crucial for maintaining India’s Basmati export sector. The adoption of new varieties is expected to expand as farmers seek cost-effective solutions, balancing sustainability concerns with the need for higher profitability and competitive pricing in global markets.

Government Policies Impacting Rice Trade

Policy interventions play a critical role in shaping India’s Basmati rice trade, influencing domestic pricing and export dynamics. The government’s focus on food security and price stabilization has led to significant regulatory measures affecting demand patterns. Moreover, export policies, including restrictions and floor price adjustments, continue to affect market performance. For example, in February 2024, the launch of ‘Bharat’ Rice at INR 29 per kg through Kendriya Bhandar, NAFED, and NCCF expanded affordable rice availability. While this initiative aimed to stabilize domestic rice prices, it also impacted demand for premium-priced Basmati rice. With fluctuating global trade conditions and geopolitical influences, government intervention will remain a determining factor in India’s ability to sustain its dominance in the international Basmati market.

Technology Adoption in Retail & Packaging

India’s Basmati rice market is undergoing a digital transformation, with brands integrating AI-driven retail experiences and advanced packaging solutions to enhance consumer engagement. As competition in the packaged rice segment intensifies, companies are investing in smart retail technologies to improve shopping experiences. Smart labeling, QR code-based authentication, and personalized shopping recommendations are improving product differentiation. For instance, In February 2025, KRBL launched a multi-phase AI-enabled retail campaign for India Gate Basmati Rice, featuring interactive packaging and nationwide activations to boost consumer trust. As e-commerce expands and consumer expectations shift towards transparency and convenience, the adoption of technology-driven retail solutions is expected to drive premium Basmati rice sales, reinforcing market leadership and consumer loyalty.

India Basmati Rice Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Basmati rice market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on the type of rice, pack size, and distribution channel.

Analysis by Type of Rice:

- Parboiled

- Raw

Parboiled accounted for the largest Indian Basmati rice market demand due to its enhanced nutritional profile, extended shelf life, and high consumer preference in both domestic and export markets. The parboiling process improves rice texture, making it more resistant to breakage, which increases its commercial viability. Furthermore, demand for parboiled rice remains strong across key export destinations, particularly in the Middle East and Africa, where it is widely consumed. In October 2024, India removed the export tax on parboiled and husked brown rice, significantly boosting global supply. This policy shift stabilizes international rice prices, strengthens India’s position in global trade, and indirectly supports Basmati rice demand by reinforcing its premium pricing. Additionally, expanding trade opportunities further drives market growth for both segments.

Analysis by Pack Size:

- Retail Packaging

- Institutional Packaging

Retail packaging in India plays an important role in surging the demand for Basmati rice, ensuring product freshness, quality, and brand differentiation. Leading brands like India Gate, Daawat, and Fortune focus on innovative packaging solutions, including resealable bags and vacuum-sealed packs, to enhance shelf life. The growing shift from loose to packaged rice in urban and semi-urban areas is boosting demand. Attractive packaging with clear labeling, nutritional information, and QR codes for authenticity verification is further driving consumer trust and preference.

Institutional packaging plays a crucial role in bulk supply for hotels, restaurants, and catering services, ensuring consistent quality and cost efficiency. Large packs of 10 kg to 50 kg are widely preferred in food service establishments. Brands like Kohinoor and Lal Qilla offering customized packaging solutions tailored for commercial kitchens. The expanding HoReCa (Hotel, Restaurant, Catering) sector and increasing exports to foodservice chains continue to strengthen demand for institutional Basmati rice packaging.

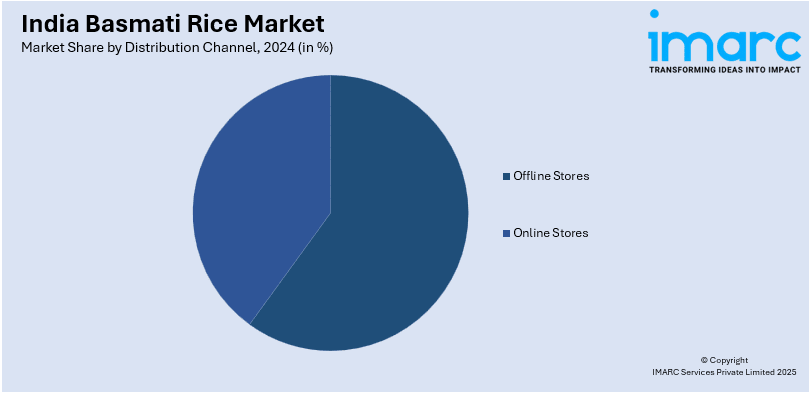

Analysis by Distribution Channel:

- Offline Stores

- Online Stores

Offline stores, lead the market driven by strong consumer preference for physical retail purchases and trust in traditional trade. General trade, including local grocery stores and wholesale markets, accounts for a significant share of sales, particularly in rural and semi-urban regions. These stores offer direct product visibility, allowing consumers to assess quality before purchase. In March 2024, India Gate Basmati Rice expanded its retail presence, securing a place in the offline market share in general trade. KRBL’s efforts to shift consumers from loose to packaged Basmati rice have strengthened retailer engagement, improved product accessibility, and accelerated sales. This shift enhances brand loyalty, ensuring sustained demand growth for packaged Basmati rice across India.

Analysis by Region:

- North India

- West and Central India

- South India

- East India

North India dominates the India Basmati rice market size, due to its ideal climatic conditions, fertile alluvial soil, and extensive agricultural expertise. States like Punjab, Haryana, and Uttar Pradesh lead in production, ensuring consistent supply for both domestic consumption and exports. These regions benefit from well-developed irrigation infrastructure and government support through initiatives promoting high-yield Basmati varieties. Farmers in Punjab widely cultivate PUSA 1121 and 1509 varieties, known for their superior grain length and aroma, driving premium pricing in global markets. Haryana, with strong export-oriented policies, further strengthens India’s international trade position. Additionally, Uttar Pradesh’s expanding cultivation areas contribute to growing supply, reinforcing North India’s dominance. Further, strong farmer networks, advanced milling facilities, and established trading hubs continue to propel regional market leadership.

Competitive Landscape:

The Indian Basmati rice market is highly competitive, with numerous players focusing on quality enhancement, branding, and global expansion. Companies invest in advanced milling technologies, sustainable sourcing, and premium packaging to strengthen their market presence. Strong distribution networks, including offline retail and e-commerce, drive consumer reach. Export competitiveness remains crucial, with businesses leveraging trade policies and certifications to expand in key regions like the Middle East and Europe. Moreover, innovation in organic and specialty rice varieties further intensifies competition.

The report provides a comprehensive analysis of the competitive landscape in the India basmati rice market with detailed profiles of all major companies, including:

- Adani Wilmar

- KRBL Limited

- LT Foods

- Tilda Basmati Rice

- India Gate Foods

- Amira Nature Foods

- Kohinoor Rice

- Matco Foods

Latest News and Developments:

- February 2025: KRBL launched a high-impact OOH campaign for India Gate Basmati Rice, featuring 3D anamorphic billboards and dynamic hoardings. Strengthening brand transformation, boosts engagement, and enhances visibility in key cities.

- January 2025: KRBL launched redesigned consumer-friendly packaging for India Gate Basmati Rice, enhancing transparency with QR codes and segmentation by consumer preferences. This 360-degree campaign boosts engagement through digital, retail, and cinema activations, reinforcing India Gate’s leadership and driving premium Basmati rice market growth.

- August 2024: Crown Basmati Rice expanded to 30+ countries and launched Diet Rice, a low-GI Basmati with double fiber. Using Satake technology, it enhances gut health and nutrition, strengthening premium Basmati’s market appeal among health-conscious consumers and driving demand for healthier rice options.

- July 2024: India began commercial cultivation of herbicide-tolerant Pusa Basmati, approved by ICAR and regulatory bodies. These non-transgenic varieties support Direct Seeded Rice (DSR), reducing water use and carbon emissions, but concerns over superweeds may impact long-term adoption and sustainability.

- February 2024: India Gate Basmati Rice launched an INR 200 crore regional rice expansion, introducing Sona Masoori, Kolam, and Gobindobhog rice. Targeting packaged rice growth, it aims to shift consumers from loose rice, enhance brand penetration, and strengthen its leadership in India's INR 500 billion Basmati rice market.

India Basmati Rice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Rice Covered | Parboiled, Raw |

| Pack Sizes Covered | Retail Packaging, Institutional Packaging |

| Distribution Channels Covered | Offline Stores, Online Stores |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Adani Wilmar, KRBL Limited, LT Foods, Tilda Basmati Rice, India Gate Foods, Amira Nature Foods, Kohinoor Rice, Matco Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India Basmati rice market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India Basmati rice market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India Basmati rice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Basmati rice market in the region was valued at INR 495.0 Billion in 2024.

The growing international demand, rising consumer preference for premium rice varieties, and government initiatives supporting rice exports are acting as growth-inducing factors for the Basmati rice market in India.

The Basmati rice market is projected to exhibit a CAGR of 0.90% during 2025-2033, reaching a value of INR 537.0 Billion by 2033.

Parboiled accounted for the largest India Basmati rice market share, supported by its enhanced nutritional profile, extended shelf life, and high consumer preference in both domestic and export markets.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the India Basmati rice market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)