India Backhoe Loaders Market Size, Share, Trends, and Forecast by Type, End-Use, and Region, 2025-2033

India Backhoe Loaders Market Overview:

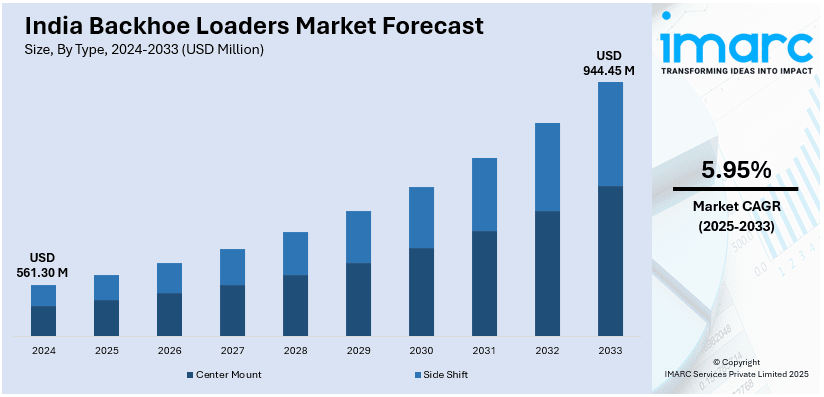

The India backhoe loaders market size reached USD 561.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 944.45 Million by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033. The market is experiencing steady growth, driven by increasing infrastructure development, urbanization, and construction projects. The demand for versatile, cost-efficient machinery in sectors like mining, agriculture, and construction is rising, with manufacturers focusing on advanced features and fuel efficiency to meet evolving market needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 561.30 Million |

| Market Forecast in 2033 | USD 944.45 Million |

| Market Growth Rate 2025-2033 | 5.95% |

India Backhoe Loaders Market Trends:

Rising Demand Due to Infrastructure Expansion

India's backhoe loader market is growing robustly due to growth in road expansion, urban planning, and rural connectivity initiatives. Policies like the National Infrastructure Pipeline (NIP) and Smart Cities Mission are further propelling the demand for construction equipment like backhoe loaders. For instance, as of April 2024, the transportation sector holds 58% of the total capital outlay under NIP, followed by energy at 24%, and water and sanitation at 12%. These machines are preferred for their versatility in excavation, trenching, and material handling across diverse construction sites. Increased investments in highways, railways, and irrigation projects are further contributing to higher sales volumes. Rural infrastructure development, including housing and sanitation projects under schemes like Pradhan Mantri Awas Yojana (PMAY), is also fueling the demand for compact and multi-purpose equipment. Additionally, the private sector’s increasing participation in infrastructure projects has strengthened the backhoe loader market, with major construction firms expanding their fleets. Manufacturers are responding by enhancing production capacities and introducing customized models tailored to India’s operating conditions. The rising focus on mechanization in small and medium-scale construction projects is further driving adoption, positioning backhoe loaders as an essential asset in India's evolving infrastructure landscape.

To get more information on this market, Request Sample

Technological Advancements and Equipment Electrification

Backhoe loader manufacturers in India are increasingly incorporating advanced technologies to enhance performance, fuel efficiency, and sustainability. The integration of GPS tracking, telematics, and IoT-based monitoring systems allows operators to optimize productivity, reduce downtime, and manage fleets more effectively. Improved hydraulic systems and load-sensing mechanisms are enhancing operational efficiency, while automation is streamlining construction activities. A major trend shaping the industry is the shift toward eco-friendly solutions, with manufacturers introducing electric and hybrid backhoe loaders to meet emission regulations. For instance, in December 2023, JCB announced the launch of its hydrogen-powered backhoe loader in India, focusing on carbon reduction. A team of 150 engineers developed 75 prototypes to create efficient, zero-carbon hydrogen combustion engines for sustainable construction. The growing push for sustainability, coupled with government policies encouraging the adoption of alternative energy vehicles, is expected to drive demand for electric construction equipment in the coming years. Additionally, modern backhoe loaders are being designed with advanced safety features, ergonomic controls, and reduced noise levels, improving operator comfort and workplace safety. Furthermore, as infrastructure projects demand higher efficiency and reduced environmental impact, the Indian market is witnessing a gradual transition towards technologically advanced and sustainable backhoe loaders.

India Backhoe Loaders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Center Mount

- Side Shift

The report has provided a detailed breakup and analysis of the market based on the type. This includes center mount and side shift.

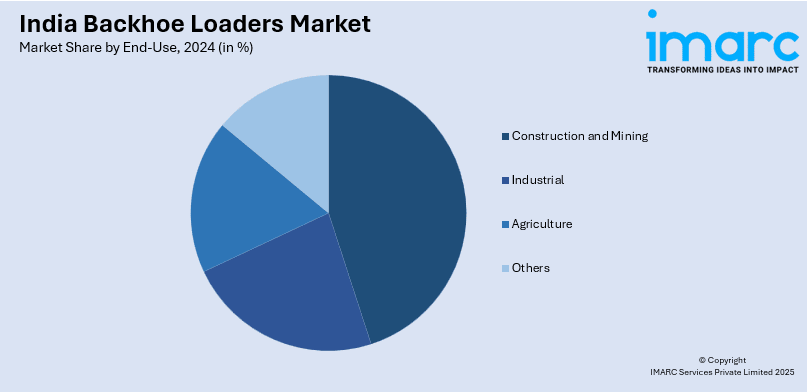

End-Use Insights:

- Construction and Mining

- Industrial

- Agriculture

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes construction and mining, industrial, agriculture, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Backhoe Loaders Market News:

- In December 2024, Action Construction Equipment Ltd (ACE) announced the launch of the AX124 BS-V(CE-V) backhoe loader at bauma CONEXPO INDIA 2024. It features a 74 hp Tata engine, delivering fuel efficiency, lower emissions, and a bold new design.

- In December 2024, Bobcat announced the development of the B900 Xtra CEV Stage V Backhoe Loader at Bauma Conexpo India 2024. It features a 74 HP Ashok Leyland engine, a 7,990 kg operating weight, and a variable displacement hydraulic pump for improved efficiency.

India Backhoe Loaders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Center Mount, Side Shift |

| End-Uses Covered | Construction and Mining, Industrial, Agriculture, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India backhoe loaders market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India backhoe loaders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India backhoe loaders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The backhoe loaders market in India was valued at USD 561.30 Million in 2024.

The India backhoe loaders market is projected to exhibit a CAGR of 5.95% during 2025-2033, reaching a value of USD 944.45 Million by 2033.

The India backhoe loaders market is driven by robust infrastructure development, government initiatives like the National Infrastructure Pipeline, and rising demand from construction, industrial, and agricultural sectors. Their versatility, efficiency, and increasing technological advancements further fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)