India Baby Apparel Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Application, End User, and Region, 2025-2033

India Baby Apparel Market Overview:

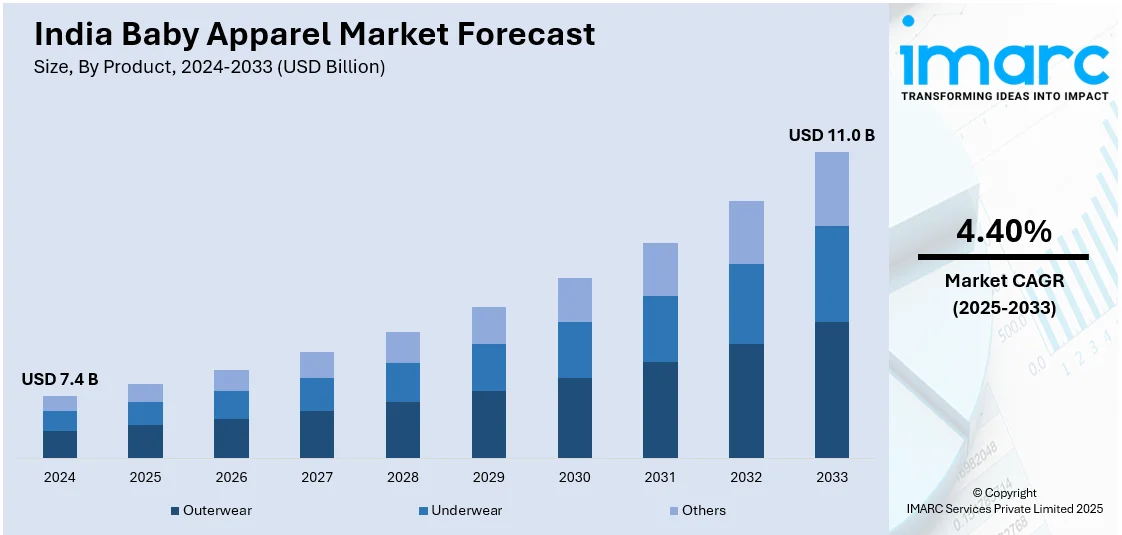

The India baby apparel market size reached USD 7.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market is propelled by rising birth rates, increasing disposable incomes, urbanization, changing fashion trends, growing e-commerce penetration, brand awareness, demand for organic fabrics, and social media influence, leading to higher consumer spending on stylish and comfortable baby clothing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.4 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Market Growth Rate 2025-2033 | 4.40% |

India Baby Apparel Market Trends:

Rising Birth Rates and Growing Infant Population

India has one of the highest birth rates globally, contributing to a consistently expanding infant population. According to a recent UNFPA report, India's population is projected to be 1.44 billion, with 24% falling within the 0-14 age range. As the number of newborns increases, the demand for baby apparel, including everyday wear, sleepwear, and festive outfits, also rises. Parents prioritize comfort, durability, and safety while choosing clothing for their babies. Additionally, improved healthcare facilities and declining infant mortality rates are leading to a steady rise in the number of infants, further boosting the market. The expanding middle-class population in India also plays a key role in increasing consumer spending on baby clothing, ensuring steady India baby apparel market growth.

To get more information on this market, Request Sample

Increasing Disposable Incomes and Urbanization

With rising disposable incomes and improving living standards, Indian parents are more willing to spend on premium and branded baby apparel. Urbanization has also contributed to higher purchasing power, with metro and tier-2 cities seeing increased demand for stylish, comfortable, and high-quality baby clothing. According to the World Bank Group, India’s urban areas will house 600 million residents, representing 40% of the population, an increase from 31% in 2011, with cities generating nearly 70% of GDP, by 2036. The effectiveness of India's handling of this urban transformation will be vital in achieving its goal of becoming a developed nation by 2047, the centenary of its independence. Dual-income households and working parents seek convenience, leading to a preference for branded and ready-made baby clothes. This economic growth has enabled parents to prioritize quality over cost, driving demand for international brands, designer wear, and specialized clothing, such as organic and hypoallergenic fabrics, thereby creating a positive India baby apparel market outlook.

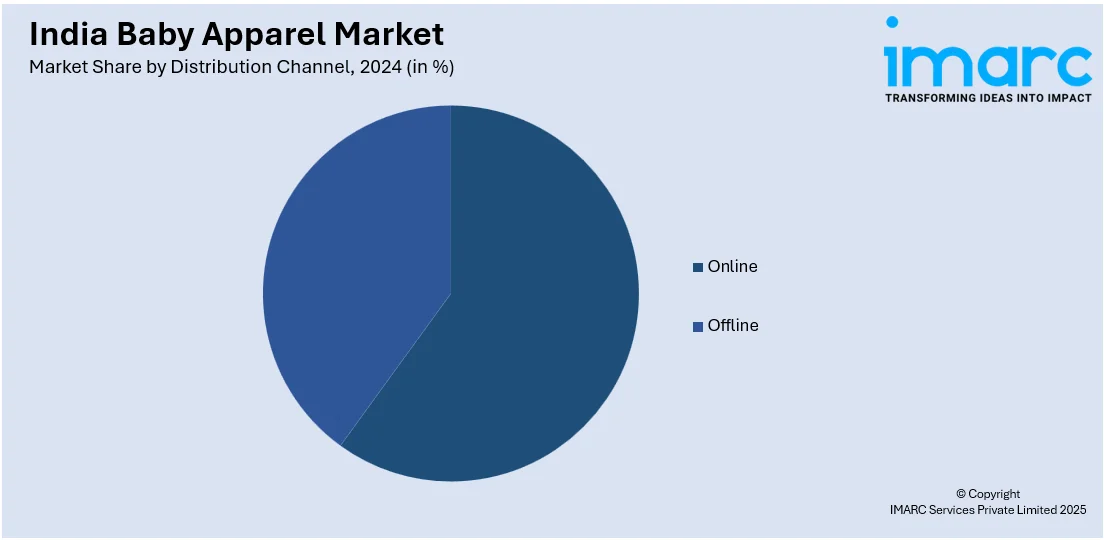

Growing E-commerce Penetration and Brand Awareness

The rapid expansion of e-commerce has transformed the baby apparel market in India, providing consumers with greater accessibility to a wide range of products. Online platforms like Amazon, FirstCry, and Myntra offer convenience, discounts, and a variety of choices, driving higher sales. The availability of international and premium brands online has also influenced purchasing trends. Social media marketing, influencer promotions, and digital advertising have further increased brand awareness, encouraging parents to explore new fashion trends, eco-friendly fabrics, and personalized baby clothing options. The ease of online shopping continues to fuel India baby apparel market share across urban and rural areas. For instance, in January 2025, Landmark Group introduced its multi-brand baby and children's fashion and lifestyle venture Babyshop in the Indian market, featuring a specialized section on its e-commerce platform and physical retail locations. The company intends to expand its retail presence in the nation by 20%.

India Baby Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional/country level for 2025-2033. Our report has categorized the market based on product, material, distribution channel, application, and end user.

Product Insights:

- Outerwear

- Underwear

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes outerwear, underwear, and others.

Material Insights:

- Cotton

- Wool

- Silk

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes cotton, wool, and silk.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Application Insights:

- 0-12 Months

- 12-24 Months

- 2-3 Years

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes 0-12 months, 12-24 months, and 2-3 years.

End User Insights:

- Girls

- Boys

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes girls and boys.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Baby Apparel Market News:

- In March 2025, Popees Baby Care, a top retailer of baby care products, intends to expand its presence in India by launching 42 new stores nationwide in FY26. Popees Baby Care has begun its domestic growth by opening a new store in Ranni, Kerala, and plans to open more locations in crucial markets such as Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, and significant metropolitan areas nationwide.

- In January 2024, Mothercare India, a retailer of the internationally recognized baby clothing and essentials brand, revealed its strategic partnership with Ed-a-Mamma, a brand focused on sustainable kids' and maternity fashion. Created specifically for Mothercare India, Ed-a-Mamma's collection of maternity and nursing clothing is now being sold at selected Mothercare outlets throughout India as well as on mothercare.in and edamamma.com.

India Baby Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Outerwear, Underwear, Others |

| Materials Covered | Cotton, Wool, Silk |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Months, 12-24 Months, 2-3 Years |

| End Users Covered | Girls, Boys |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India baby apparel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India baby apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India baby apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The baby apparel market in India was valued at USD 7.4 Billion in 2024.

The India baby apparel market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of USD 11.0 Billion by 2033.

The baby apparel market in India is influenced by factors such as increasing birth rates, higher disposable income among young parents, and a greater emphasis on comfort and fashion for babies. Additionally, urbanization, the growth of e-commerce, and a rising preference for organic and skin-friendly materials are contributing to the expansion of both premium and budget-friendly segments of the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)