India Aviation Market Size, Share, Trends and Forecast by Aircraft Type and Region, 2025-2033

India Aviation Market Size and Share:

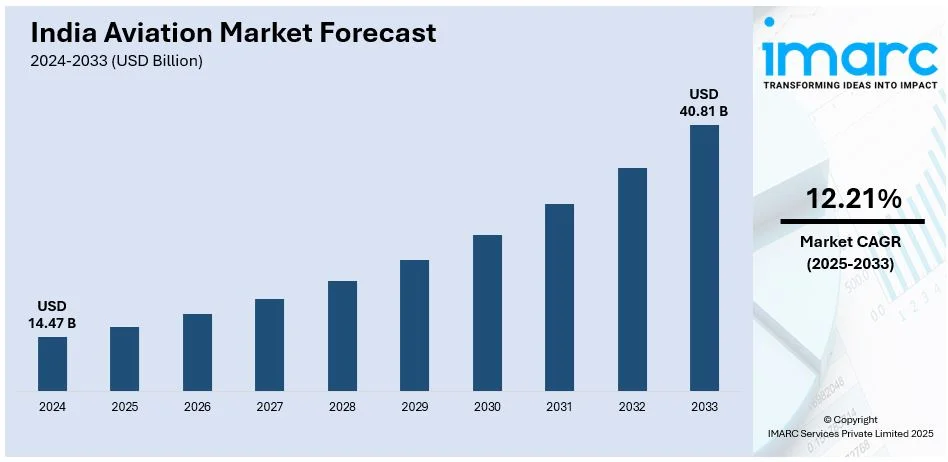

The India aviation market size was valued at USD 14.47 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.81 Billion by 2033, exhibiting a CAGR of 12.21% during 2025-2033. West currently dominates the market, holding a significant market share of 35.0% in 2024. The market is witnessing steady growth, driven by rising disposable incomes, increasing demand for both domestic and international travel, and expanding regional connectivity. Enhanced infrastructure, government support, and the rise of budget airlines are contributing to India aviation market share, further boosting its dominance in the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.47 Billion |

| Market Forecast in 2033 | USD 40.81 Billion |

| Market Growth Rate (2025-2033) | 12.21% |

The market has witnessed strong growth in domestic air transport, driven by increased disposable incomes, urbanization, and rising demand for regional connectivity. Air travel is becoming more affordable for a broader population thanks to the growing network of domestic airports and the launch of low-cost carriers. These advances have transformed flying into a first choice for most people since it ensures convenience, speed, and efficiency compared to rail and road transport. The growing number of passengers has also improved airline services, ensuring flying is an attractive mode of travel. Increased tourism within India has also reinforced the growth in air traffic, particularly to major cities and tourist places. The increase in global travel is one of the main drivers of the expansion of the India aviation industry.

To get more information on this market, Request Sample

As the Indian middle class keeps growing and more individuals attain higher disposable incomes, demand for travel overseas, both business and tourist, is growing at a very fast rate. This growth in demand has seen airlines add more international routes, linking Indian cities to principal hubs worldwide, particularly in the Middle East, Southeast Asia, and Europe. The rising number of Indian expats, students, and tourists going abroad has also increased international air traffic. Furthermore, India's growing number of international airports has offered the required infrastructure to support the growing number of international passengers. Major airports in cities such as Delhi, Mumbai, and Bengaluru have witnessed major upgradations and expansions to manage this influx

India Aviation Market Trends:

Expansion of Regional Connectivity and UDAN Scheme

India's domestic aviation industry is seeing tremendous growth, thanks to the government's Ude Desh Ka Aam Nagrik (UDAN) initiative aimed at improving air connectivity to Tier II and Tier III cities and rural areas. The scheme has resulted in the construction of new airports and the introduction of short-haul routes, making air travel affordable for a wider segment of the population. Regional carriers and budget airlines are increasing their fleet to meet the growing demand, mainly in smaller towns. Growth in small planes specifically designed for short distances is helping improve connectivity between isolated areas and big cities. By 2025, 625 UDAN routes, serving 90 airports, two water aerodromes, and 15 heliports across India, are operational, according to the Ministry of Civil Aviation. In addition, advances in airport facilities and navigational equipment have rendered it possible to fly into areas that were inaccessible before. With the expansion of the middle class and domestic tourism, regional connectivity is likely to continue increasing, restructuring India's aviation sector and driving economic growth in small towns.

Sustainability in Aviation and Green Initiatives

Sustainability is becoming a key focus in India aviation market growth, aligning with global efforts to reduce carbon emissions. Airports and airlines are adopting green technologies, renewable energy solutions, and energy-efficient systems to minimize their environmental impact. In May 2023, Vistara became the first airline in India to operate a long-haul international flight using 30% Sustainable Aviation Fuel (SAF), resulting in a reduction of around 68,000 kg of CO2 emissions, marking an important milestone in the push for sustainable aviation. SAF has become a central focus, with ongoing efforts to establish local biofuel production and SAF manufacturing facilities. Airports are increasingly adopting solar power and waste management technologies to boost energy efficiency. Various initiatives, such as reducing single-use plastics, optimizing flight routes for fuel conservation, and encouraging carbon offset programs, are being introduced. Aircraft design is also evolving, with new models incorporating better aerodynamics and fuel-efficient technologies. As environmental concerns grow among travelers and regulatory pressures increase, India’s aviation sector is expected to accelerate its transition to cleaner, more sustainable operations, setting new standards within the region.

Digital Advancements and Enhanced Passenger Experience

India’s civil aviation industry is rapidly incorporating digital technologies to streamline operations and improve the passenger experience. Innovations such as automated check-in counters and biometric-based boarding are transforming airport procedures, reducing wait times, and improving security efficiency. Artificial intelligence (AI) and data analytics are being deployed to optimize various aspects of airline operations, including flight scheduling, predictive maintenance, and customer service. Machine learning (ML) plays a key role in real-time decision-making, which helps reduce delays and increase on-time performance. For example, in December 2023, India’s DigiYatra biometric system was expanded to 25 more airports, bringing the total to 38 in 2024. This system, introduced in 2022, uses Facial Recognition Technology (FRT) to simplify passenger entry, enhancing the overall travel experience. Additionally, airlines are leveraging chatbots and mobile apps to offer personalized services, such as real-time flight updates and contactless interactions. The demand for in-flight connectivity and entertainment is also rising, prompting airlines to upgrade their fleets to provide high-speed internet and customized content. As digital technologies continue to evolve, India’s aviation industry is expected to integrate them seamlessly into operations, creating a more convenient, comfortable, and accessible travel experience. Furthermore, these India aviation market trends are contributing in the market expansion.

India Aviation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India aviation market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on aircraft type.

Analysis by Aircraft Type:

.webp)

- Commercial Aviation

- General Aviation

- Military Aviation

As per the India aviation market outlook, in 2024, the commercial aviation segment led the market, accounted for the 62.2%. This dominance is driven by the increasing demand for air travel, spurred by an expanding middle class, rising disposable incomes, and growing consumer preference for air travel over other modes of transport. The government’s UDAN (Ude Desh Ka Aam Naagrik) initiative has been crucial in connecting smaller, regional airports to major cities, improving air accessibility and affordability for more passengers. The rise of low-cost carriers (LCCs) has made air travel more affordable, attracting more customers. Additionally, increased business travel, tourism, and the growth of e-commerce further contributed to the growth of this segment. New flight routes, improved services, and the launch of additional aircraft by airlines are expected to continue driving the growth of commercial aviation in India.

Regional Analysis:

- North India

- South India

- East India

- West India

Based on the India aviation market forecast, in 2024, the West led the market, accounting for the market share of 35.0%. This region benefits from the economic significance of cities like Mumbai, Ahmedabad, and Pune, which are prominent business and industrial hubs, contributing substantially to air traffic. Mumbai, being India’s financial capital, remains a key player in both domestic and international air travel, while regional airports have seen increasing traffic due to growing tourism and business activity. Infrastructure upgrades such as the expansion of Mumbai’s Chhatrapati Shivaji Maharaj International Airport have bolstered capacity, enhancing passenger and cargo movement. Moreover, tourism in Goa and Maharashtra has fueled demand for both domestic and international flights. These factors combined ensure that the Western region maintains its leadership in the aviation market, with continuous expansion expected in the coming years.

Competitive Landscape:

Indian aviation companies are significantly adopting advanced manufacturing techniques to address increasing technical complexities and produce highly intricate aircraft components. These organizations employ sophisticated design and simulation software to translate detailed engineering specifications into precise production processes, thereby enhancing accuracy and reducing defects. Efforts are underway to improve the integration between digital modeling and manufacturing equipment, ensuring seamless coordination across design, tooling, and assembly phases without interruption. Collaborative initiatives with aerospace manufacturers focus on developing customized digital solutions that comply with rigorous performance requirements, optimize material usage, minimize waste, and ensure the timely delivery of reliable, complex parts vital to aviation safety and operational efficiency.

The report provides a comprehensive analysis of the competitive landscape in the Indian aviation market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: IndiGo announced operations from Navi Mumbai International Airport, starting with 18 daily flights to over 15 cities. The carrier planned to expand to 79 daily flights, including 14 international, by November 2025, with future growth to 140 flights by November 2026.

- April 2025: Amravati Airport was inaugurated by Maharashtra CM Devendra Fadnavis, marking its first commercial flight arrival from Mumbai via Alliance Air. Developed by MADC with extended infrastructure, the airport began regular operations with thrice-weekly flights. All seats on the inaugural flight were booked, signaling strong regional connectivity demand.

- April 2025: Air India Express announced plans to launch a direct flight between Indore and Coimbatore, addressing rising travel demand between northern and southern cities. Although launch dates remained unspecified, preparations were underway. This addition aimed to enhance Indore’s connectivity, which already saw new routes to Goa, Raipur, Delhi, Pune, and Jabalpur.

- March 2025: Maldivian Airlines launched direct flights between Hanimaadhoo International Airport and Bengaluru’s Kempegowda International Airport. Operating twice weekly, the service strengthened regional connectivity and highlighted the growing bilateral air travel between India and the Maldives, supporting tourism and economic ties between the two nations.

- January 2025: Tata Sons reiterated its intention to turn Air India into a world-class airline with improved service, technology, and international operations. The airline increased its order for the fleet to 570 aircraft, with a view to modernization and profitability. Tata also pushed semiconductor initiatives, with a USD 18 Billion investment in ecosystem development planned.

India Aviation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Commercial Aviation, General Aviation, Military Aviation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aviation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aviation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aviation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aviation market in India was valued at USD 14.47 Billion in 2024.

The India aviation market is projected to exhibit a CAGR of 12.21% during 2025-2033, reaching a value of USD 40.81 Billion by 2033.

The India aviation market is driven by rising middle-class income, growing domestic and international travel demand, increased connectivity to tier-2 and tier-3 cities, and government support through initiatives like UDAN. Expansion of low-cost carriers and airport infrastructure upgrades also fuel market growth.

West India accounts for the largest India aviation market share, supported by high passenger traffic through major hubs like Mumbai and strong airline operations across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)