India Aviation Crew Management Systems Market Size, Share, Trends and Forecast by Solution, Deployment, Application, and Region, 2025-2033

India Aviation Crew Management Systems Market Overview:

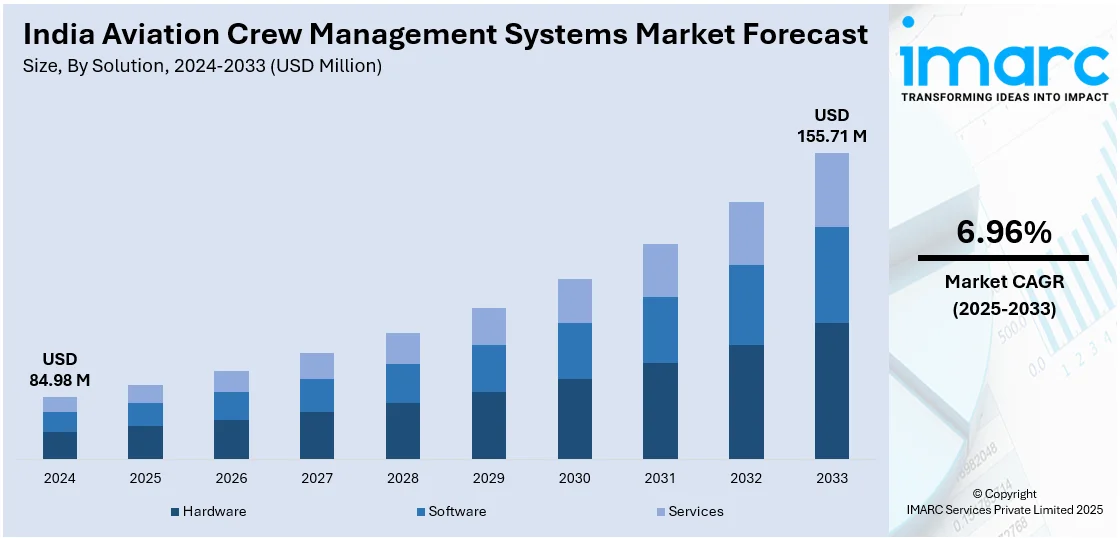

The India aviation crew management systems market size reached USD 84.98 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 155.71 Million by 2033, exhibiting a growth rate (CAGR) of 6.96% during 2025-2033. The market is driven by rising air traffic, rapid airline fleet expansion, increased route networks, stringent regulatory compliance, and the adoption of AI-driven automation, all of which enhance crew scheduling, optimize workforce utilization, reduce operational inefficiencies, and ensure real-time monitoring for seamless airline operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 84.98 Million |

| Market Forecast in 2033 | USD 155.71 Million |

| Market Growth Rate 2025-2033 | 6.96% |

India Aviation Crew Management Systems Market Trends:

Surge in Air Traffic

India has experienced a phenomenal development in air passenger traffic over the last decade due to reasons including growing disposable income, rapid urbanization, and government policies such as the UDAN (Ude Desh Ka Aam Nagrik) scheme, which seeks to make air fares more affordable and accessible. The Directorate General of Civil Aviation (DGCA) stated that domestic air passenger traffic in India rose by 43% year-on-year to 136 million passengers in 2023, from 95 million in 2022. This sudden surge in air traffic necessitates airlines to manage their flight crews effectively to maintain smooth operations, reduce delays, and comply with strict aviation safety regulations. Aviation Crew Management Systems (CMS) play a crucial role in managing these complexities. These systems computerize crew scheduling, rostering, and monitoring, allowing for maximum utilization of pilots and cabin crew while ensuring compliance with duty-hour regulations prescribed by aviation authorities such as DGCA and ICAO.

To get more information on this market, Request Sample

Integration of Artificial Intelligence (AI) and Automation in Crew Management

The implementation of Artificial Intelligence (AI) and automation is revolutionizing India's aviation crew management systems, optimizing efficiency, cost savings, and decision-making. Airlines are using AI-fostered solutions more often to streamline crew scheduling, anticipate disruptions, and enhance workforce management. AI-based predictive analytics can predict the availability of crews, identify fatigue risks, and automate shift allocations, minimizing manual intervention and errors. Automated crew management software assists airlines in adhering to DGCA regulations by monitoring duty hours, rest periods, and training in real-time. AI-powered chatbots and virtual assistants also enhance crew-to-management communication, simplifying shift exchange and leave approvals. Top airlines such as IndiGo, Vistara, and Air India are extensively investing in AI-driven crew management solutions to minimize expenses, enhance operational robustness, and improve crew satisfaction, driving the market.

India Aviation Crew Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on solution, deployment, application, and region.

Solution Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes hardware, software, and services.

Deployment Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud-based and on-premises.

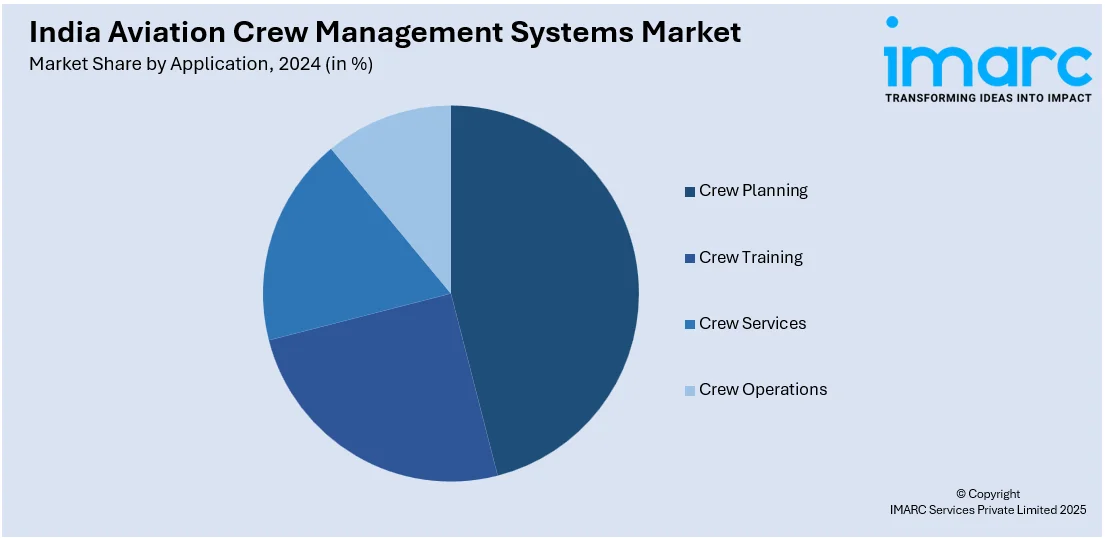

Application Insights:

- Crew Planning

- Crew Training

- Crew Services

- Crew Operations

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes crew planning, crew training, crew services, and crew operations.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aviation Crew Management Systems Market News:

- April 2024: Air India implemented the CAE Crew Management System to enhance crew rostering, training, and operational efficiency while ensuring compliance with regulations. This adoption reflects a broader trend of Indian airlines investing in advanced crew management solutions to handle growing fleet sizes and route expansions. The propelling demand for automated crew scheduling and compliance tracking is accelerating the development of India's aviation crew management systems market.

- June 2023: Air India is upgrading its crew rostering system to address delays caused by inefficient crew scheduling. The airline is investing in advanced software to automate crew reassignments and ensure compliance with duty hour regulations. This move highlights the rising need for aviation crew management systems in India, as airlines expand operations and require real-time crew tracking to improve efficiency and avoid disruptions.

India Aviation Crew Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Hardware, Software, Services |

| Deployments Covered | Cloud-based, On-premises |

| Applications Covered | Crew Planning, Crew Training, Crew Services, Crew Operations |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aviation crew management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aviation crew management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aviation crew management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aviation crew management systems market in India was valued at USD 84.98 Million in 2024.

The India aviation crew management systems market is projected to exhibit a CAGR of 6.96% during 2025-2033, reaching a value of USD 155.71 Million by 2033.

The India aviation crew management systems market is driven by rising air passenger traffic, expansion of airline fleets, and the need for efficient crew scheduling and compliance. Increasing adoption of digital solutions for real-time monitoring, cost optimization, and enhanced operational safety further accelerates demand across the aviation sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)