India Automotive Wiring Harness Market Size, Share, Trends and Forecast by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, and Region, 2025-2033

Market Overview:

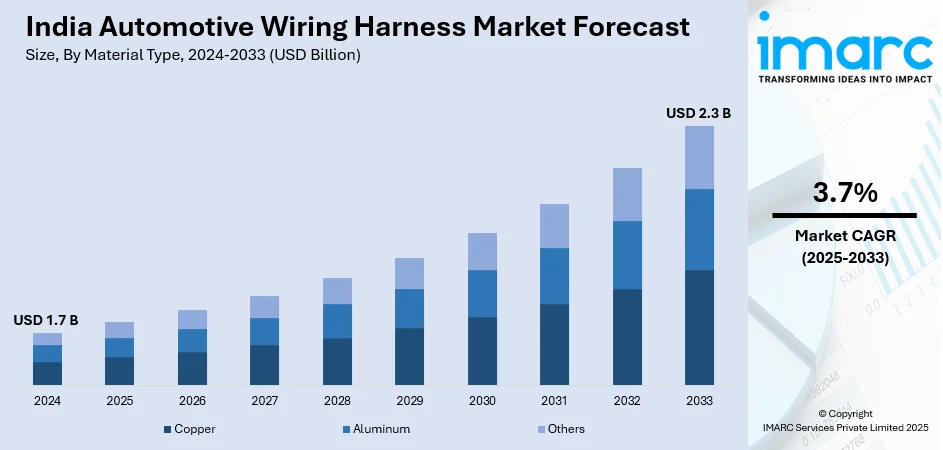

The India automotive wiring harness market size reached USD 1.7 Billion in 2024. The market is expected to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.7% during 2025-2033. The market growth is attributed to significant growth in the automotive industry, rising adoption of electric vehicles (EVs) due to inflating disposable incomes, increasing fuel prices and growing environmental concerns, increasing product demand due to rising number of road accidents, focus on introducing superior grades of conductors, insulators and sheaths, launch of aluminum harnesses for vehicle electrification, increasing demand for lightweight materials, and implementation of various government initiatives focusing on automotive safety.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East India.

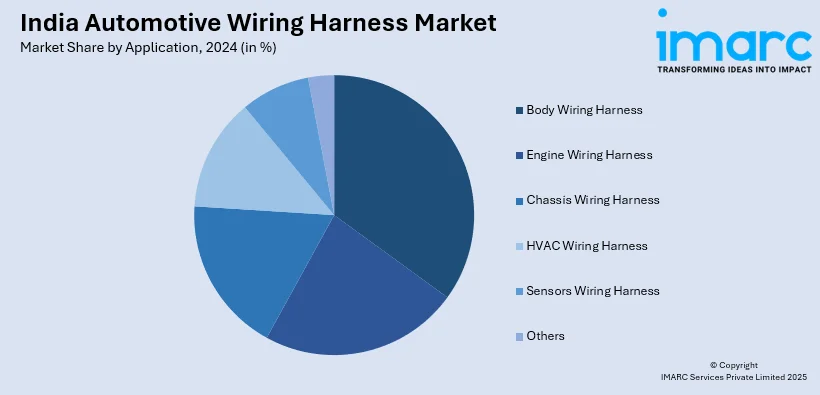

- On the basis of application, the market has been divided into Body Wiring Harness, Engine Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Sensors Wiring Harness, and Others.

- On the basis of material type, the market has been divided into Copper, Aluminum, and Others.

- On the basis of transmission type, the market has been divided into Data Transmission and Electrical Wiring.

- On the basis of vehicle type, the market has been divided into Two Wheelers, Passenger Cars, and Commercial Vehicles.

- On the basis of category, the market has been divided into General Wires, Heat Resistant Wires, Shielded Wires, and Tubed Wires.

- On the basis of component, the market has been divided into Connectors, Wires, Terminals, and Others.

Market Size and Forecast:

- 2024 Market Size: USD 1.7 Billion

- 2033 Projected Market Size: USD 2.3 Billion

- CAGR (2025-2033): 3.7%

An automotive wiring harness refers to an organized bundle of electric wires, terminals, and connectors that provide power throughout a vehicle. It is widely used for sending and receiving sensor signals, transmitting information, and supplying power. It acts as a safety casing and is designed to reduce the risks of short circuits, minimize installation time, and improve fuel and operating efficiency under high temperatures, vibration, moisture, and noise. As a result, it is widely used to harness the wiring of the chassis, engine, heating, ventilation, and air conditioning (HVAC) system and sensors in two-wheelers, three-wheelers, cars, utility vehicles, and commercial vehicles.

To get more information on this market, Request Sample

India Automotive Wiring Harness Market Trends:

Significant growth in the automotive industry in India is creating a positive outlook for the market. Additionally, the rising adoption of electric vehicles (EVs), owing to inflating disposable incomes, increasing fuel prices, and growing environmental concerns, is favoring the market growth. Moreover, the increasing product demand due to the rising number of road accidents is driving the growth of the market. Furthermore, wiring harnesses are used for securing safety sensors, such as automated control systems and blind-spot detection, for superior vehicle performance, which, in turn, is supporting the market growth. Apart from this, manufacturers are focusing on introducing superior grades of conductors, insulators, and sheaths for wires and cables in automotive wiring harness systems that help enhance high-temperature resistance, thus providing an impetus to the market growth. In line with this, the launch of aluminum harnesses utilized for vehicle electrification and minimizing vehicular weight are positively impacting the market growth. Other factors, including the increasing demand for lightweight materials for vehicle manufacturing and the implementation of various government initiatives focusing on automotive safety, are anticipated to drive the market toward growth.

Integration of Advanced Electronics

The India automotive wiring harness market share is experiencing significant transformation driven by the integration of advanced electronic systems in modern vehicles, including infotainment systems, advanced driver assistance systems (ADAS), and sophisticated engine management units. Contemporary automobiles require complex wiring architectures to support features such as adaptive cruise control, lane departure warning systems, automatic emergency braking, and multi-zone climate control systems. The market growth is particularly evident in the premium and mid-segment vehicle categories, where manufacturers are incorporating cutting-edge technologies that demand high-performance wiring solutions, as per the India automotive wiring harness market analysis. These advanced electronics require specialized harnesses with enhanced signal integrity, electromagnetic interference (EMI) shielding, and increased data transmission capabilities to ensure reliable operation of critical safety and comfort systems. The trend towards vehicle connectivity, including Internet of Things (IoT) integration and over-the-air updates, further amplifies the need for sophisticated wiring infrastructure capable of handling high-speed data transmission while maintaining electrical safety standards and regulatory compliance.

Automation and Industry 4.0 in Manufacturing

There is a significant shift towards automation and Industry 4.0 technologies in manufacturing processes as per the India automotive wiring harness market analysis, which is fundamentally transforming production efficiency and quality standards. Modern wiring harness manufacturing facilities are incorporating robotic assembly systems, automated testing equipment, and artificial intelligence-driven quality control mechanisms to enhance precision and reduce production costs. The market research report indicates sustained growth driven by these technological advancements, which enable manufacturers to meet the increasing complexity requirements of modern vehicles while maintaining competitive pricing. The market is witnessing investments in smart manufacturing solutions, including predictive maintenance systems, real-time production monitoring, and digital twin technologies that optimize manufacturing workflows, as per the India automotive wiring harness market forecast. These Industry 4.0 implementations not only improve production efficiency but also enable mass customization capabilities, allowing manufacturers to produce specialized harnesses for different vehicle models and customer requirements while maintaining cost-effectiveness and ensuring consistent quality standards across production batches.

Growth, Opportunities, and Challenges in the India Automotive Wiring Harness Market:

- Growth Drivers of the India Automotive Wiring Harness Market: Significant growth in the automotive industry in India is creating positive market outlook. The rising adoption of electric vehicles (EVs) due to inflating disposable incomes, increasing fuel prices, and growing environmental concerns is favoring market growth. Additionally, increasing product demand due to rising number of road accidents and focus on introducing superior grades of conductors, insulators, and sheaths are driving the automotive wiring harness market in India.

- Opportunities in the India Automotive Wiring Harness Market: The electric vehicle segment presents substantial growth opportunities as India transitions towards sustainable mobility solutions, requiring specialized high-voltage wiring systems. The increasing adoption of autonomous and semi-autonomous vehicle technologies creates demand for advanced wiring architectures supporting complex sensor networks and communication systems. Additionally, export opportunities to emerging markets and the development of lightweight, high-performance materials offer significant revenue potential.

- Challenges in the India Automotive Wiring Harness Market: Raw material price volatility, particularly copper and aluminum, creates cost management challenges for manufacturers and affects profit margins. The complexity of modern vehicle electronics requires continuous investment in research and development, increasing operational costs. Additionally, stringent automotive safety regulations and the need for specialized skilled labor pose compliance and operational challenges for market participants.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India automotive wiring harness market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on application, material type, transmission type, vehicle type, category and component.

Breakup by Application:

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

Breakup by Material Type:

- Copper

- Aluminum

- Others

Breakup by Transmission Type:

- Data Transmission

- Electrical Wiring

Breakup by Vehicle Type:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Breakup by Category:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

Breakup by Component:

- Connectors

- Wires

- Terminals

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape in the India Automotive Wiring Harness Market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Dhoot Transmission Pvt. Ltd.

- LEONI India

- Miracle Electronic Devices Pvt. Ltd.

- Motherson Sumi Wiring India Limited

- Radicon (Gaurav Industries)

- Spark Minda

- Sparsh Electronics India Pvt. Ltd.

- Yazaki India Pvt. Ltd

Latest News and Developments:

- In April 2025, Japanese auto component giant Yazaki announced the establishment of a new wire harness manufacturing plant at Chengalpattu Industrial Park, Tamil Nadu, in partnership with Blackstone’s Horizon Industrial Parks. Covering 3.16 lakh sq. ft., the facility will feature rooftop solar panels and create jobs for over 2,000 people. This marks Yazaki’s third facility within Horizon’s network in India, strengthening its footprint beyond the existing 11 plants and two R&D centers.

- In March 2025, the Competition Commission of India (CCI) approved Bain Capital’s proposed acquisition of a shareholding in Dhoot Transmission Pvt. Ltd. (DTPL) through its investment arms BC Asia Investments XV and XVI. DTPL is a key auto-components player specializing in wiring harnesses, automotive switches, electronic sensors, connectors, and cables. This approval paves the way for Bain Capital to deepen its presence in India’s automotive wiring harness and E&E components market.

- In September 2024, Minda Corporation signed a technology licensing agreement with Sanco Connecting Technology (China) to co-develop Electrical Distribution System (EDS) solutions for India’s growing EV market. The partnership covers EV connecting systems, charging gun assemblies, bus bars, cell contact systems, Power Distribution Units (PDU), and Battery Distribution Units (BDU), all to be localized for Indian OEMs.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Application, Material Type, Transmission Type, Vehicle Type, Category, Component, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Dhoot Transmission Pvt. Ltd., LEONI India, Miracle Electronic Devices Pvt. Ltd., Motherson Sumi Wiring India Limited, Radicon (Gaurav Industries), Spark Minda, Sparsh Electronics India Pvt. Ltd., Yazaki India Pvt. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India automotive wiring harness market to exhibit a CAGR of 3.7% during 2025-2033.

The increasing number of road accidents, along with the growing adoption of wiring harnesses for securing safety sensors, such as automated control systems and blind-spot detection, for superior vehicle performance, is primarily driving the India automotive wiring harness market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation resulting in the temporary closure of numerous manufacturing units for automotive wiring harness.

Based on the application, the India automotive wiring harness market has been bifurcated into body wiring harness, engine wiring harness, chassis wiring harness, HVAC wiring harness, sensors wiring harness, and others. Among these, chassis wiring harness currently accounts for the largest market share.

Based on the material type, the India automotive wiring harness market can be segmented into copper, aluminum, and others. Currently, copper holds the majority of the total market share.

Based on the transmission type, the India automotive wiring harness market has been divided into data transmission and electrical wiring, where electrical wiring currently exhibits a clear dominance in the market.

Based on the vehicle type, the India automotive wiring harness market can be categorized into two wheelers, passenger cars, and commercial vehicles. Currently, two wheelers account for the majority of the total market share.

Based on the category, the India automotive wiring harness market has been segregated into general wires, heat resistant wires, shielded wires, and tubed wires. Among these, general wires currently hold the largest market share.

Based on the component, the India automotive wiring harness market can be bifurcated into connectors, wires, terminals, and others. Currently, wires exhibit a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, East India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)