India Automotive Suspension Systems Market Size, Share, Trends, and Forecast by Component Type, Type, Vehicle Type, and Region, 2025-2033

India Automotive Suspension Systems Market Overview:

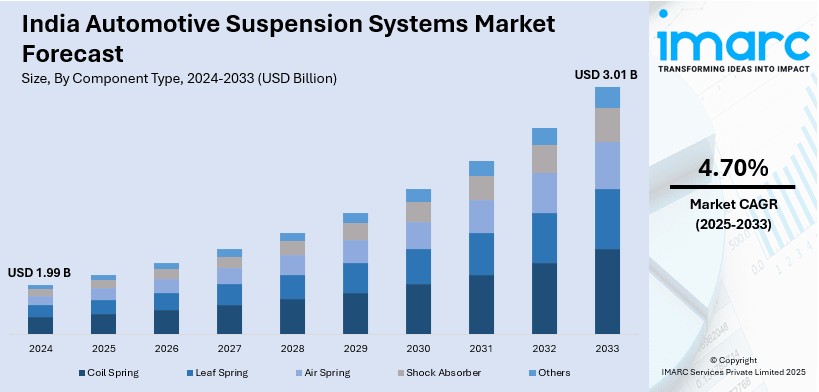

The India automotive suspension systems market size reached USD 1.99 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.01 Billion by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The market is expanding due to rising vehicle production, increased consumer demand for comfort and safety, and advancements in automotive technology. The market is also driven by the widespread adoption of electric vehicles (EVs) and government regulations promoting vehicle safety and performance standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.99 Billion |

| Market Forecast in 2033 | USD 3.01 Billion |

| Market Growth Rate 2025-2033 | 4.70% |

India Automotive Suspension Systems Market Trends:

Rising Demand for Advanced Suspension Systems in Passenger Vehicles

The Indian automotive suspension systems market is experiencing the rising demand for sophisticated suspension technologies, especially in the passenger vehicle segment. With changing consumer expectations towards enhanced ride comfort, stability, and handling, companies are concentrating on incorporating advanced suspension solutions. The change is fueled by increasing disposable incomes, urbanization, and an expanding preference for personal mobility. Additionally, the rising penetration of electric vehicles (EVs) in India is affecting suspension design because EVs need optimized weight distribution and improved damping to support battery placement. For instance, in November 2024, Mahindra announced the launch of the BE 6e and XEV 9e electric SUVs, equipped with an 'i-Link' front suspension and a five-link rear independent suspension featuring intelligent semi-active dampers, enhancing ride quality and overall handling performance. Automakers are also investing in electronically controlled suspension systems, such as adaptive and air suspension, to enhance ride quality and safety. These advancements are further fueled by government regulations on vehicle safety and comfort, pushing manufacturers to improve suspension performance. Furthermore, with the expansion of highway infrastructure and a growing focus on road safety, demand for advanced suspension systems is expected to rise, making it a key driver in the Indian automotive industry’s technological evolution.

To get more information on this market, Request Sample

Expansion of the Electric and Autonomous Vehicle Market Driving Suspension Innovation

India’s push towards electrification and autonomous driving is transforming the automotive suspension systems market. The rapid adoption of electric vehicles (EVs) is compelling manufacturers to develop suspension systems tailored for EV dynamics, addressing factors such as battery weight distribution and regenerative braking effects. For instance, as per industry reports, in the first 11 months of 2024, EV sales in India surpassed 1.8 Million units, reflecting a nearly 45% year-on-year increase. EVs require enhanced suspension tuning to maintain ride stability while minimizing energy consumption. Additionally, the rise of connected and semi-autonomous vehicles is leading to increased investment in intelligent suspension systems. Technologies such as active suspension and adaptive damping are being integrated to enhance vehicle safety, stability, and passenger comfort. Automakers are also developing electronically controlled suspension components that interact with advanced driver-assistance systems (ADAS) to improve overall driving dynamics. Moreover, the Indian government’s incentives for EV adoption and smart mobility solutions are further accelerating innovation in the suspension sector. As vehicle automation advances, suspension systems are expected to incorporate greater sensor integration and real-time adaptability, ensuring optimal performance across various driving conditions.

India Automotive Suspension Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component type, type, and vehicle type.

Component Type Insights:

- Coil Spring

- Leaf Spring

- Air Spring

- Shock Absorber

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes coil spring, leaf spring, air spring, shock absorber, and others.

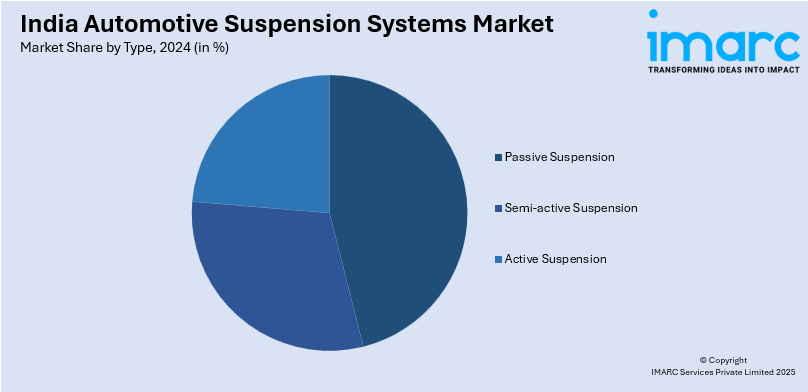

Type Insights:

- Passive Suspension

- Semi-active Suspension

- Active Suspension

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes passive suspension, semi-active suspension, active suspension.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Suspension Systems Market News:

- In July 2023, Hendrickson announced the launch of advanced air and mechanical suspensions and axles for trailers in India to enhance vehicle performance and durability. This launch aims to continue delivering customized solutions for commercial transportation while expanding its manufacturing and research footprint globally.

- In February 2025, Gabriel India, a notable manufacturer of suspension components, announced a partnership with TracTive, a Dutch company specializing in electronically adjustable suspension systems. This collaboration aims to introduce advanced suspension technologies to the Indian market, enhancing vehicle performance and ride comfort.

India Automotive Suspension Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Coil Spring, Leaf Spring, Air Spring, Shock Absorber, Others |

| Types Covered | Passive Suspension, Semi-active Suspension, Active Suspension |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive suspension systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive suspension systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive suspension systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive suspension systems market in India was valued at USD 1.99 Billion in 2024.

The India automotive suspension systems market is projected to exhibit a CAGR of 4.70% during 2025-2033, reaching a value of USD 3.01 Billion by 2033.

The India automotive suspension systems market is driven by growing vehicle sales (especially SUVs), rising demand for comfort and safety, and technological advancements, including lightweight materials, adaptive/active suspensions, and EV-specific designs. Additionally, government safety and EV regulations are accelerating adoption and innovation across OEM and aftermarket segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)