India Automotive PCB Market Size, Share, Trends and Forecast by Type, Level of Autonomous Driving, Application, Fuel Type, and Region, 2025-2033

India Automotive PCB Market Size and Share:

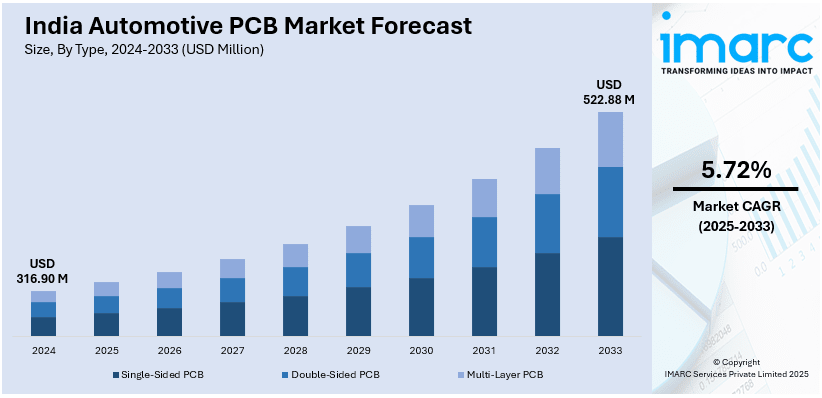

The India automotive PCB market size reached USD 316.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 522.88 Million by 2033, exhibiting a growth rate (CAGR) of 5.72% during 2025-2033. The market is fueled by growth in electric vehicle (EVs) adoption, expanding use of advanced driver-assistance systems (ADAS), and rising demand for in-vehicle infotainment and connectivity solutions. Further, government policies, changing consumer behavior toward smart features, and advancements in automotive electronics are propelling PCB use across vehicle types.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 316.90 Million |

| Market Forecast in 2033 | USD 522.88 Million |

| Market Growth Rate 2025-2033 | 5.72% |

India Automotive PCB Market Trends:

Rise of Electric Vehicles (EVs) Driving Demand for Advanced PCBs

India’s transition to electric mobility is driving significant growth in the automotive PCB market. EVs require advanced high-density interconnect (HDI) PCBs for battery management, power electronics, charging infrastructure, and drivetrain control. As adoption rises, manufacturers focus on PCBs with high thermal stability, enhanced current-carrying capacity, and compact designs. Government incentives, including the ₹11,500 crore FAME India Scheme Phase II, are accelerating EV manufacturing by supporting 7,090 e-buses, 5 lakh e-3 wheelers, 55,000 e-4 wheeler passenger cars, and 10 lakh e-2 wheelers. Additionally, the PLI scheme is boosting domestic production of EV components. The demand for lightweight, high-reliability circuit boards is pushing innovations in materials and multilayer PCB designs, ensuring durability and efficiency in India’s evolving electric vehicle ecosystem.

To get more information on this market, Request Sample

Growing Integration of Advanced Driver-Assistance Systems (ADAS)

The growing adoption of ADAS technologies in Indian vehicles is a key trend transforming the automotive PCB market. Automakers are adding features such as lane departure warning, adaptive cruise control, blind-spot detection, and autonomous emergency braking, and hence, there is increasing demand for high-performance PCBs that are capable of accommodating radar, lidar, and camera modules. Multilayer and rigid-flex PCBs with enhanced signal integrity and heat dissipation are needed for such systems. As safety requirements become more stringent and consumer sentiment turns toward secure vehicles, Tier-1 vendors are emphasizing PCB innovation to cope with the increasing electrical architecture challenges of ADAS. This evolution is speeding the need for PCBs that are compact, efficient, and immunity-resistant and developed specifically for emerging safety technologies.

Expansion of In-Vehicle Infotainment and Connectivity Solutions

India's automobile industry is undergoing tremendous digitalization with the spread of in-vehicle infotainment (IVI) systems and connected vehicle technologies. Customers increasingly desire features such as touchscreen displays, navigation systems, voice assistants, telematics, and smartphone connectivity, all of which are totally dependent on advanced PCBs. This is forcing the demand for high-speed, multilayer boards with the ability to support faster data transmission and advanced software programs. In addition, the transition toward 5G-capable connected vehicles and V2X technology is driving needs for sophisticated PCB designs with robust EMI shielding and signal dependability. In response to the OEMs' focus on faultless digital experience, PCB providers are shifting their focus toward offering flexible and denser circuits to support next-gen infotainment ecosystems.

India Automotive PCB Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, level of autonomous driving, application, and fuel type.

Type Insights:

- Single-Sided PCB

- Double-Sided PCB

- Multi-Layer PCB

The report has provided a detailed breakup and analysis of the market based on the type. This includes single-sided PCB, double-sided PCB, and multi-layer PCB.

Level of Autonomous Driving Insights:

- Autonomous Vehicles

- Conventional Vehicles

- Semi-Autonomous Vehicles

A detailed breakup and analysis of the market based on the level of autonomous driving have also been provided in the report. This includes autonomous vehicles, conventional vehicles, and semi-autonomous vehicles.

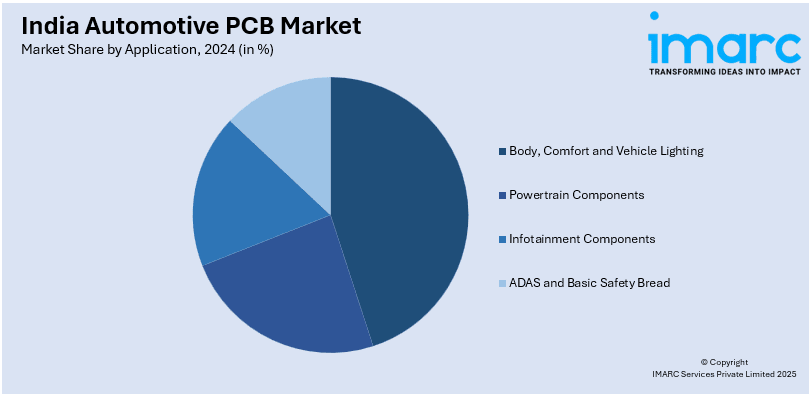

Application Insights:

- Body, Comfort and Vehicle Lighting

- Powertrain Components

- Infotainment Components

- ADAS and Basic Safety Bread

The report has provided a detailed breakup and analysis of the market based on the application. This includes body, comfort and vehicle lighting, powertrain components, infotainment components, and ADAS and basic safety bread.

Fuel Type Insights:

- ICE’s

- BEV’s

- HEV’s

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes ICE’s, BEV’s, and HEV’s.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive PCB Market News:

- In November 2024, Pantronics India Pvt Ltd, formerly Pankaj Electronica, marked its 50th anniversary at Electronica 2024 with new product launches and a refreshed brand identity. Key highlights included the launch of Hicool thermal solutions, Pulsiv Osmium microcontrollers, and Raythink’s thermal cameras. The company also showcased advanced semiconductors, capacitors, sensors, and testing equipment, emphasizing its commitment to energy-efficient, high-performance electronics and strengthening industry partnerships through innovation and customer engagement initiatives.

- In October 2024, Amber Enterprises India Ltd formed a 50:50 joint venture with Korea Circuit Co Ltd to establish advanced PCB manufacturing in India. Named Amber Korea Circuit Pvt Ltd, the JV will produce PCBs for automotive, industrial, medical, and consumer electronics. The project has a capital requirement of ₹200 crore for which it plans to invest, establishing a cutting-edge facility, employing more than 1,000 people, and consolidating the position of India as a leading PCB manufacturing country.

- In June 2024, BPL set up a state-of-the-art PCB manufacturing facility in Doddaballapur, Bengaluru, with an investment of Rs 20 crore. The plant includes upgraded single-side, double-side, and multi-layer PCB lines, generating 110 direct and 150 indirect jobs. Featuring a Class 100k cleanroom and in-house quality testing, the facility supports India’s push for domestic electronics manufacturing amid a rapidly growing PCB market projected to reach US$ 20.17 billion by 2032.

India Automotive PCB Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single-Sided PCB, Double-Sided PCB, Multi-Layer PCB |

| Level of Autonomous Drivings Covered | Autonomous Vehicles, Conventional Vehicles, Semi-Autonomous Vehicles |

| Applications Covered | Body, Comfort and Vehicle Lighting, Powertrain Components, Infotainment Components, ADAS and Basic Safety Bread |

| Fuel Types Covered | ICE’s, BEV’s, HEV’s |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive PCB market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive PCB market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive PCB industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive PCB market in India was valued at USD 316.90 Million in 2024.

The India automotive PCB market is projected to exhibit a CAGR of 5.72% during 2025-2033, reaching a value of USD 522.88 Million in by 2033.

The market is driven by rising vehicle electrification, increased use of electronic components in safety and comfort systems, and a shift toward connected mobility. Demand for reliable circuitry in harsh automotive environments and miniaturized designs is growing. Manufacturers are scaling up production for both two-wheelers and passenger vehicles to meet evolving consumer expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)