India Automotive Parts Packaging Market Size, Share, Trends and Forecast by Component Type, Sales Channel, Vehicle Type, and Region, 2025-2033

India Automotive Parts Packaging Market Overview:

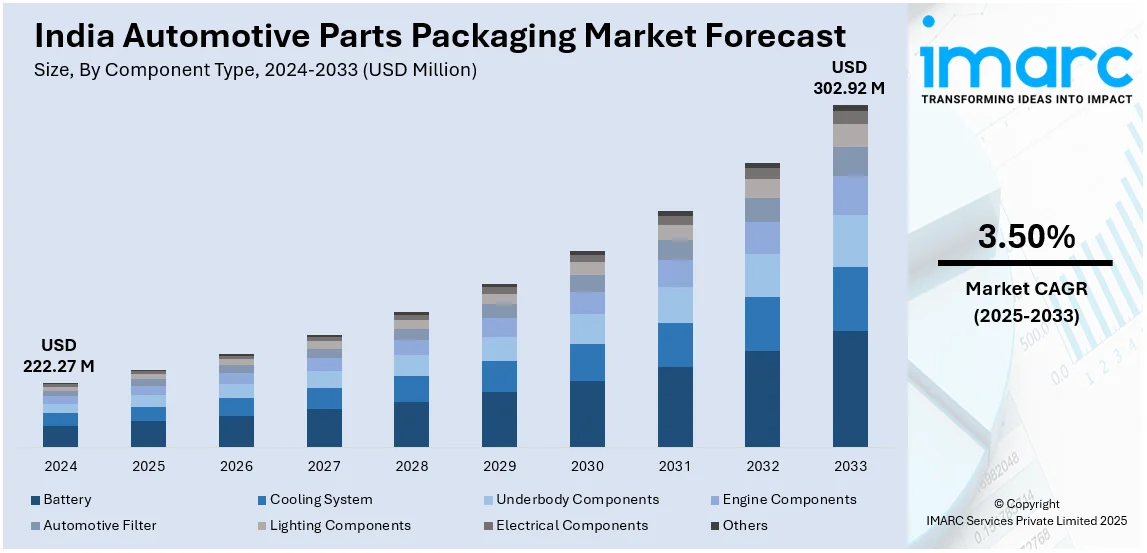

The India automotive parts packaging market size reached USD 222.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 302.92 Million by 2033, exhibiting a growth rate (CAGR) of 3.50% during 2025-2033. The market is expanding as a result of growing vehicle manufacturing, aftermarket demand, and the trend towards sustainable, smart, and modular packaging solutions. Developments in protective materials, environmentally friendly designs, and logistics optimization are leading to market expansion, underpinned by regulatory drives and changing supply chain requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 222.27 Million |

| Market Forecast in 2033 | USD 302.92 Million |

| Market Growth Rate (2025-2033) | 3.50% |

India Automotive Parts Packaging Market Trends:

Sustainable Packaging Solutions for Automotive Parts

The India automotive components packaging market is also moving towards ecofriendly solutions to mitigate environmental concerns. For instance, in August 2024, India's first ever carbon-neutralized automotive packaging firm, Econovus Packaging Pvt Ltd, became carbon neutral for FY2022-23 when it offset 912 t-CO2e emissions through the purchase of certified carbon credits in a hydro project. Moreover, as there is increased regulatory burden and customer sensitization, the companies are moving towards biodegradable, recyclable, and reusable materials. Corrugated fiberboard, molded pulp, and bioplastics are finding favor as alternative packaging options over conventional plastic packs. Innovations like water-based coatings, solvent-free adhesives, and minimal design further contribute towards greater sustainability without trading off protection. The drive towards sustainability is also impacting packaging designs that minimize space and minimize material waste. Government policies supporting Extended Producer Responsibility (EPR) are pushing automobile manufacturers and suppliers to invest in sustainable packaging solutions. Consequently, the industry is seeing a shift where sustainable packaging is not only a regulatory requirement but also a competitive edge. Furthermore, the uptake of ecofriendly packaging methods will further intensify due to India's encouragement for sustainability and a circular economy.

To get more information on this market, Request Sample

Increased Use of Smart and Protective Packaging

With India's automotive industry on the rise, there is greater demand for durable packaging that supports high-performance operations and safeguards valuable components during transit and storage. For instance, in August 2024, JTEKT India Limited made an announcement to set up its eighth factory for producing auto parts in Gujarat, investing 2,500 million INR to enhance its production capacity and consolidate its foothold in India's expanding market. Moreover, intelligent and safety-oriented packaging tools, including containers that are shock-resistant, static-protecting wraps, and humidity-controlled packagings, are highly popular to avoid harm to delicate components. RFID-savvy intelligent packaging is gaining popularity as it enables real-time tracking of cargo, minimizes losses, and enhances supply chain efficiency. Tamper-evident seals and QR codes for verification are becoming essential to product integrity, particularly in the aftermarket segment where counterfeit components continue to be a challenge. These applications are being used in foam inserts, vacuum-sealed pouches, and temperature-resistant packaging materials to achieve added durability for packaging delicate and high-cost components. These innovations assist the automotive suppliers in enhancing logistics, lowering return rates, and overall product quality, and hence protective and intelligent packaging is a necessity in India's auto component industry.

Customization and Modular Packaging for Efficient Logistics

Modular packaging and customization are emerging as key solutions to enhance the efficiency of logistics in India's automotive components industry. As the electric vehicle (EV) and intricate supply chains gain traction, there is boosted need for packages that can suit varying shapes, sizes, and fragility of components. Modular packaging enables adjustments with ease so that maximum storage and transportation space is utilized optimally. Returnable and reusable packaging systems also gain intensifying attention, lowering costs and environmental burden. Custom-fit packages with cutting-edge technologies, such as thermoforming and foam molding provide parts with secure housing, minimizing damage risks. Collapsible and stackable designs also optimize warehouse efficiency, enabling improved space control. The transition towards bespoke packaging solutions not only makes supply chain operations leaner but also aids in the pursuit of sustainability through the reduction of material loss and transportation expenditure. As India's automotive industry keeps growing, bespoke and modular packaging will play an integral role in making logistics optimal

India Automotive Parts Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component type, product type, and packaging type.

Component Type Insights:

- Battery

- Cooling System

- Underbody Components

- Engine Components

- Automotive Filter

- Lighting Components

- Electrical Components

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes battery, cooling system, underbody components, engine components, automotive filter, lighting components, electrical components, and others.

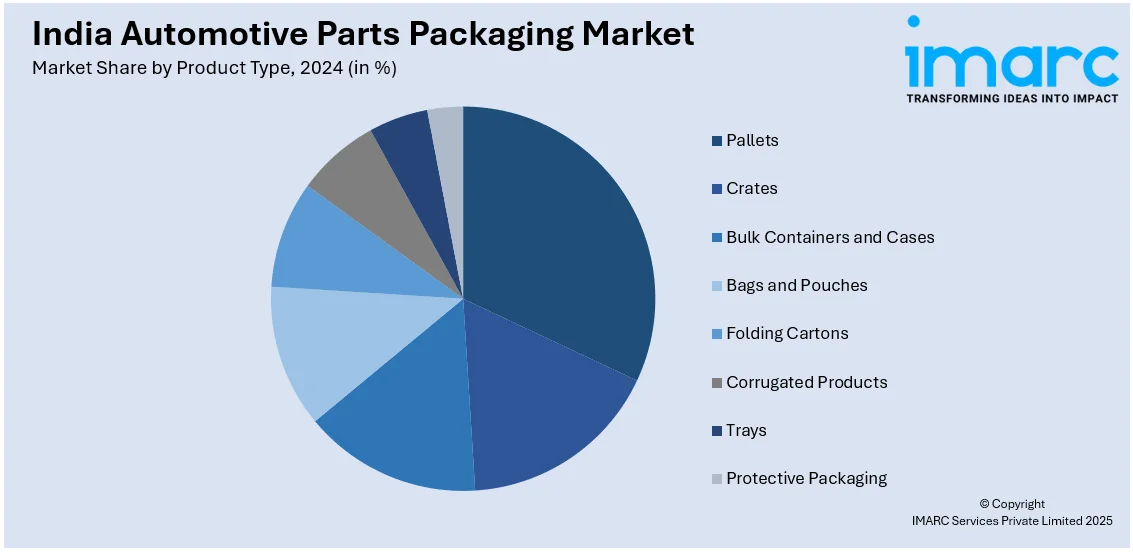

Product Type Insights:

- Pallets

- Crates

- Bulk Containers and Cases

- Bags and Pouches

- Folding Cartons

- Corrugated Products

- Trays

- Protective Packaging

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pallets, crates, bulk containers and cases, bags and pouches, folding cartons, corrugated products, trays and protective packaging.

Packaging Type Insights:

- Disposable

- Reusable

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes disposable and reusable.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Parts Packaging Market News:

- In September 2024, REE Automotive secured $45 million in funding from M&G Investment as the lead and joined forces with India's Samvardhana Motherson for supply chain management. The transaction is expected to improve production efficiency for REE's electric truck models, bolstering global EV supply chains in the face of economic uncertainty.

India Automotive Parts Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Battery, Cooling System, Underbody, Engine Components, Automotive Filter, Lighting Components, Electrical Components, Others |

| Product Type Covered | Pallets, Crates, Bulk Containers and Cases, Bags And Pouches, Folding Cartons, Corrugated Products, Trays and Protective Packaging |

| Packaging Type Covered | Disposable, Reusable |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive parts packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive parts packaging market on the basis of component type?

- What is the breakup of the India automotive parts packaging market on the basis of product type?

- What is the breakup of the India automotive parts packaging market on the basis of packaging type?

- What is the breakup of the India automotive parts packaging market on the basis of region?

- What are the various stages in the value chain of the India automotive parts packaging market?

- What are the key driving factors and challenges in the India automotive parts packaging?

- What is the structure of the India automotive parts packaging market and who are the key players?

- What is the degree of competition in the India automotive parts packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive parts packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive parts packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive parts packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)