India Automotive Lubricant Market Size, Share, Trends and Forecast by Product, Vehicle Type, and Region, 2025-2033

India Automotive Lubricant Market Overview:

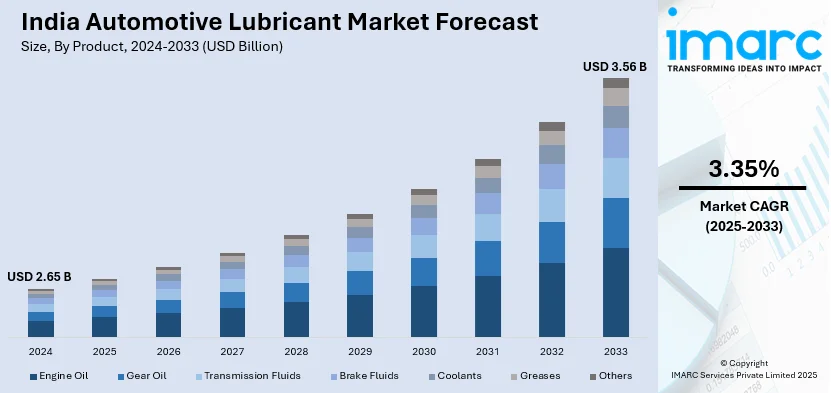

The India automotive lubricant market size reached USD 2.65 Billion in 2024. The market is expected to reach USD 3.56 Billion by 2033, exhibiting a growth rate (CAGR) of 3.35% during 2025-2033. The market growth is attributed to rising vehicle ownership, expanding transportation and logistics sectors, increasing consumer awareness of engine maintenance, advancements in synthetic and bio-based lubricants, and government regulations promoting fuel efficiency.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product, the market has been divided into engine oil, gear oil, transmission fluids, brake fluids, coolants, greases, and others.

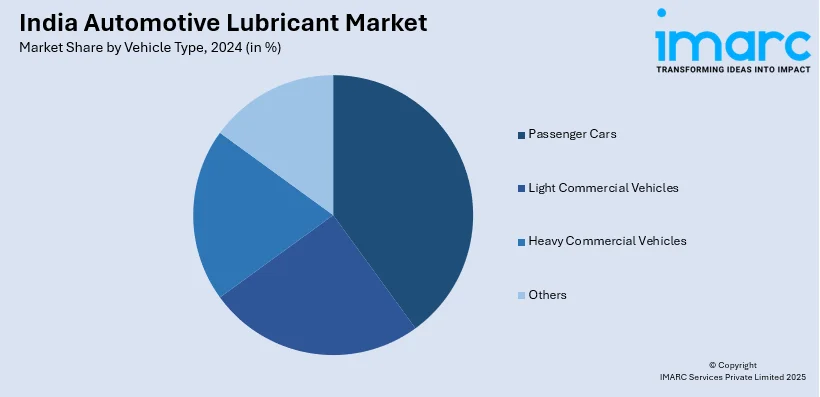

- On the basis of vehicle type, the market has been divided into passenger cars, light commercial vehicles, heavy commercial vehicles, and others.

Market Size and Forecast:

- 2024 Market Size: USD 2.65 Billion

- 2033 Projected Market Size: USD 3.56 Billion

- CAGR (2025-2033): 3.35%

India Automotive Lubricant Market Trends:

Advancements in Lubricant Technology

Technological innovations are reshaping the automotive lubricant landscape in India, leading to the development of high-performance and environmentally friendly products. The introduction of synthetic and bio-based lubricants is meeting the demand for superior engine protection and reduced environmental impact. These lubricants offer enhanced performance, longer oil change intervals, and improved fuel efficiency. In October 2023, BPCL, in partnership with Chevron, launched Caltex lubricants in India, introducing premium products under the Caltex brand, such as Chevron’s proprietary Havoline and Delo lubricant lines. This collaboration aims to enhance the lubricant offering, thereby augments the automotive lubricant market share in India. Furthermore, ExxonMobil announced a USD 110 Million investment to establish a lubricant manufacturing factory in Raigad, Maharashtra, India. The new factory is projected to generate 159,000 kiloliters of lubricants per year to address the country's increasing lubricant demand. This strategic step enables the firm to create India-specific lubricants and position itself as a high-performance lubricant provider in the nation. These advancements demonstrate the industry's dedication to innovation, sustainability, and addressing consumers' changing expectations in the automotive lubricant business.

To get more information on this market, Request Sample

Impact of Electric Vehicle (EV) Adoption

The rise of electric vehicles (EVs) in India is influencing the automotive lubricant market, leading to both challenges and opportunities. Government initiatives, such as the Electric Mobility Promotion Scheme with a budget of ₹500 crore (approximately USD 60.18 Million), are driving the growth of green mobility and boosting electric vehicle production in India. This shift is reshaping the automotive lubricant industry size in India by reducing the demand for conventional lubricants. While EVs require less engine lubrication, there is a growing need for specialized fluids to manage battery cooling and electrical components. Additionally, India is establishing itself as a key global hub for auto component sourcing, with the industry exporting over 25% of its total production each year. This growing export activity is further driving market expansion. In addition to this, lubricant manufacturers are innovating to develop products tailored for EVs, such as coolants and greases compatible with electric drivetrains, to meet the evolving market demands. The transition to EVs is prompting the lubricant industry to adapt by creating specialized products, thereby sustaining market growth amidst changing automotive technologies.

Digital Integration and Smart Lubrication Solutions

The automotive lubricant industry in India is experiencing a remarkable shift with the integration of digital solutions and smart lubrication. Sophisticated IoT-based monitoring systems are being installed on commercial vehicle fleets to monitor lubricant performance, temperature fluctuations, and maintenance timelines in real-time. Smart solutions allow predictive maintenance, minimizing downtime and maximizing lubricant usage efficiency. Digital platforms are enabling remote engine health monitoring and lubricant wear, enabling fleet owners to make informed decisions on oil change intervals. Artificial intelligence integration in lubricant management systems is assisting OEMs in creating tailored solutions for particular operating conditions common in Indian markets. Mobile apps and cloud-based technologies are making the supply chain smoother by linking lubricant distributors to end users directly and giving real-time access to product details, usage instructions, and technical assistance services.

Expansion of Premium and High-Performance Lubricant Segment

The India automotive lubricant market share is being fueled considerably by the growth of the premium and high-performance lubricant segment. Preferences among customers are changing in favor of higher-quality lubricants that provide better protection to the engine and longer drain intervals. Urban market growth in sales of luxury vehicles is generating significant demand for high-performance lubricants with sophisticated additive packages. Performance bikes and sports vehicles need proprietary formulations that meet severe operating conditions and provide peak power output. Consumer realization of the link between high-end lubricants and vehicle life is driving this segment's growth. Motor sports enthusiasts and professional race communities are increasingly using high-performance synthetic lubricants, establishing a niche but fast-growing market segment within the market.

Some of the other market trends include,

- Used Oil Recycling and Circular Economy Schemes: Rising emphasis on environmentally sound lubricant lifecycle management via cutting-edge recycling technologies. Increasing use of re-refined base oils in order to minimize environmental footprint and resource utilization. Creation of collection networks for used lubricants in urban and rural areas. Practice of circular economy schemes in lubricant manufacturing processes.

- Climate-specific Products: Product development of specialized lubricants for high-temperature and dusty operating conditions. Designing products specifically for monsoon and humid climate conditions. Designing lubricants for stop-and-go traffic conditions in metropolitan cities. Innovation in cold-start performance lubricants for north Indian winter conditions.

- Domestic Sourcing of Base Materials and Regulatory Enhancements: Greater focus on indigenization of sourcing base oils and additives from local vendors. Meeting changing emission standards and fuel quality requirements. Aligning with new government regulations encouraging indigenization of the auto industry. Establishing India-specific testing methods and quality guidelines.

- Lubricants for Hybrid Cars and Biodegradable Variants: Development of specialized lubricants for hybrid powertrains and two-mode engines. Research and development of environmentally friendly lubricants that are biodegradable for eco-sensitive applications. Low-viscosity lubricant innovation to enhance fuel efficiency in hybrid cars. Creation of specially formulated cooling fluids for electric and hybrid car battery systems.

Growth Drivers of the India Automotive Lubricant Market:

The India automotive lubricant market growth is driven by several key factors. Rising vehicle ownership across urban and rural areas is creating sustained demand for automotive lubricants. The expanding transportation and logistics sectors, fueled by e-commerce growth and infrastructure development, are significantly contributing to market expansion. Increasing consumer awareness of engine maintenance and the importance of quality lubricants is driving premium product adoption. Government regulations promoting fuel efficiency and emission standards are encouraging the use of advanced synthetic and bio-based lubricants. The growing automotive manufacturing sector and India's emergence as a global auto component sourcing hub are further propelling market growth.

Opportunities in the India Automotive Lubricant Market:

Significant opportunities exist in the electric vehicle lubricant segment as EV adoption accelerates in India. The development of specialized fluids for battery cooling and electric drivetrain components presents new revenue streams for manufacturers. This supports the growth of the automotive lubricant market in India. Rural market penetration offers substantial untapped potential, particularly for two-wheeler and agricultural vehicle lubricants. The growing export market for automotive components creates opportunities for lubricant manufacturers to supply international markets. Technological advancements in synthetic and bio-based lubricants open doors for premium product segments. Strategic partnerships between global companies and local distributors can enhance market reach and customer accessibility.

Challenges in the India Automotive Lubricant Market:

As per the India automotive lubricant market analysis, the market faces several challenges that could impact growth trajectories. The shift towards electric vehicles poses a long-term threat to conventional lubricant demand as EVs require significantly less traditional engine oil. Intense competition among established players and new entrants is creating pricing pressures and margin compression. Fluctuating raw material costs, particularly crude oil prices, affect production costs and profitability. Counterfeit products in the market pose quality concerns and damage brand reputation for genuine manufacturers. Stringent environmental regulations and sustainability requirements necessitate continuous investment in research and development. The complexity of catering to diverse regional requirements across India's varied climate and operating conditions presents operational challenges.

India Automotive Lubricant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and vehicle type.

Product Insights:

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes engine oil, gear oil, transmission fluids, brake fluids, coolants, greases, and others.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, heavy commercial vehicles, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Lubricant Market News:

- August 2025: Shell India launched the latest iteration of its premium motor oil, Shell Helix Ultra, now compliant with the 2025 API SQ Standard. The upgraded formula, built on PurePlus Technology, delivers a 1.8% increase in engine power and a 3.4% improvement in throttle response, enhancing vehicle performance and driving experience. Additionally, Shell has modernized the packaging of the Helix Ultra range to attract new customers and reinforce brand identity.

- April 2025: Daewoo announced its entry into the Indian automotive lubricant market through a strategic licensing partnership with Mangali Industries Limited. The collaboration aims to introduce a comprehensive range of lubricants tailored for two-wheelers, passenger cars, commercial vehicles, and agricultural machinery, designed to enhance engine longevity and fuel efficiency. Manufactured at Mangali's facility in Maharashtra, the product line reflects Daewoo's commitment to international quality standards while addressing the specific needs of the Indian market.

- December 2024: Mumbai-based Gulf Oil Lubricants renewed its partnership agreement with Piaggio, covering lubricants, including advanced BS-VI oils and EV fluids.

- November 2024: EnerG Lubricants worked with GAT GmbH to launch the GAT X ENERG product line in India. The company also launched ENERG G1 Xtreme PLUS 5W30 API SP - ACEA C3 Fully Synthetic Engine Oil, making it the first India-developed lubricant to secure global approval from Mercedes-Benz.

India Automotive Lubricant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Engine Oil, Gear Oil, Transmission Fluids, Brake Fluids, Coolants, Greases, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive lubricant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive lubricant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive lubricant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India automotive lubricant market size reached USD 2.65 Billion in 2024.

The India automotive lubricant market is expected to reach USD 3.56 Billion by 2033, exhibiting a CAGR of 3.35% during 2025-2033.

Market growth is driven by the increasing number of vehicles on Indian roads, rising demand for synthetic and semi-synthetic lubricants, and growing awareness of the benefits of regular vehicle maintenance. Additionally, expansion in the automotive sector, rising disposable income, and stricter government regulations on emissions are encouraging the adoption of high-performance lubricants. The growth of electric vehicles and increased focus on sustainable lubricants also influence the market’s evolution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)