India Automotive Lead-Acid Battery Market Size, Share, Trends and Forecast by Vehicle Type, Product, Type, Customer Segment, and Region, 2025-2033

India Automotive Lead-Acid Battery Market Overview:

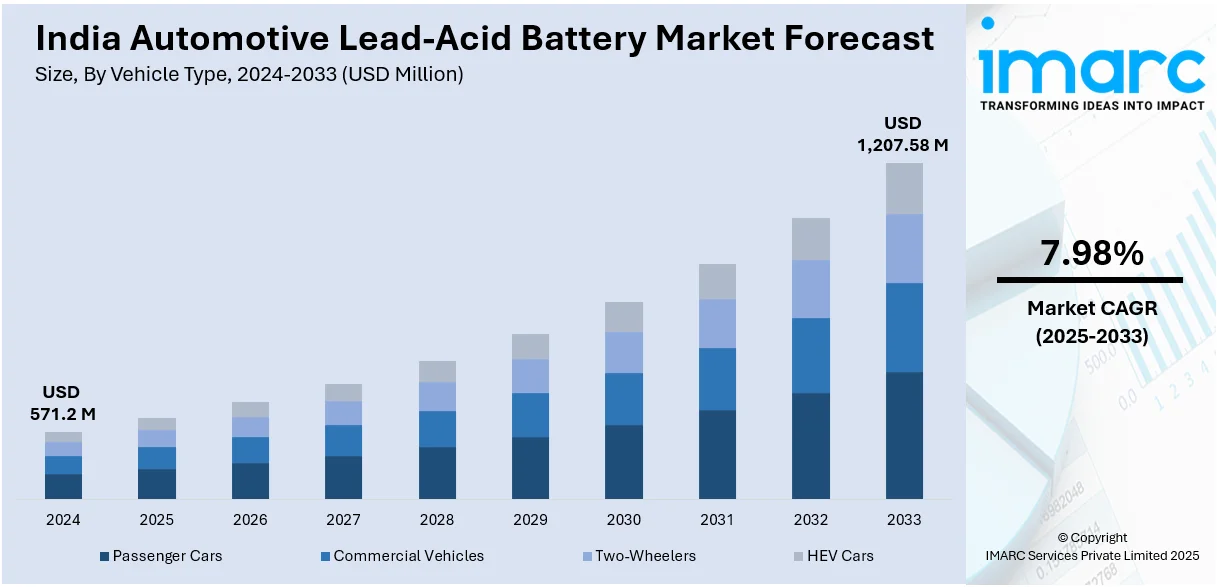

The India automotive lead-acid battery market size reached USD 571.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,207.58 Million by 2033, exhibiting a growth rate (CAGR) of 7.98% during 2025-2033. The rising vehicle production, increasing demand for two-wheelers and electric rickshaws, growing aftermarket sales, government support for battery recycling, rapid urbanization, infrastructure development, and the affordability of lead-acid batteries compared to lithium-ion alternatives are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 571.2 Million |

| Market Forecast in 2033 | USD 1,207.58 Million |

| Market Growth Rate (2025-2033) | 7.98% |

India Automotive Lead-Acid Battery Market Trends:

Expanding Adoption of Lead-Acid Batteries in Electric Three-Wheelers

The rise in electric three-wheeler adoption is driving demand for lead-acid batteries due to their affordability, reliability, and widespread availability. These batteries provide a cost-effective energy solution, ensuring longer operational hours and supporting last-mile mobility. Manufacturers are focusing on enhancing battery capacity to extend range per charge, improving efficiency for commercial applications. The inclusion of warranties on lead-acid batteries highlights growing confidence in their durability and performance. Despite advancements in lithium-ion technology, lead-acid batteries remain a preferred choice for cost-sensitive markets, ensuring accessibility for small-scale transport operators. As urbanization and e-mobility expansion continue, the role of lead-acid batteries in electric three-wheelers is expected to remain significant, supporting India's transition toward sustainable urban transportation solutions. For example, in August 2024, Mahindra Last Mile Mobility launched the e-Alfa Plus electric rickshaw, equipped with a 150 Ah lead-acid battery and a permanent magnet synchronous motor delivering 1.95 kW power and 26.9 Nm torque. The vehicle offers a real-world range exceeding 100 kilometers per charge, enhancing driver earnings. An 18-month warranty covers the vehicle, battery, and charger, underscoring Mahindra's commitment to reliability in the Indian automotive lead-acid battery market.

To get more information on this market, Request Sample

Growth in Battery Manufacturing for Automotive and Energy Storage

India is witnessing increased investment in large-scale battery manufacturing to meet rising demand for automotive, two-wheeler, and energy storage applications. With growing vehicle production and the push for localized manufacturing, companies are setting up advanced facilities to enhance supply chain efficiency and reduce import dependence. The focus is on producing high-quality lead-acid batteries at scale, catering to both domestic and global markets. Securing international orders highlights India's emerging role as a key supplier in the global battery industry. The shift toward domestic production aligns with government initiatives promoting self-reliance in critical sectors. As automotive electrification and renewable energy adoption accelerate, the demand for durable, cost-effective battery solutions is shaping the future of energy storage and mobility. For instance, in December 2024, Assurance International announced the establishment of a battery manufacturing facility in Haryana, India, with an annual capacity of 300,000 automotive batteries. The plant will also produce 1 million two-wheeler batteries, 250,000 tubular batteries, and 100,000 solar batteries. The company has secured global orders, reflecting its commitment to delivering high-quality, innovative battery solutions at scale.

India Automotive Lead-Acid Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, product, type, and customer segment.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- HEV Cars

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, commercial vehicles, two-wheelers, and HEV cars.

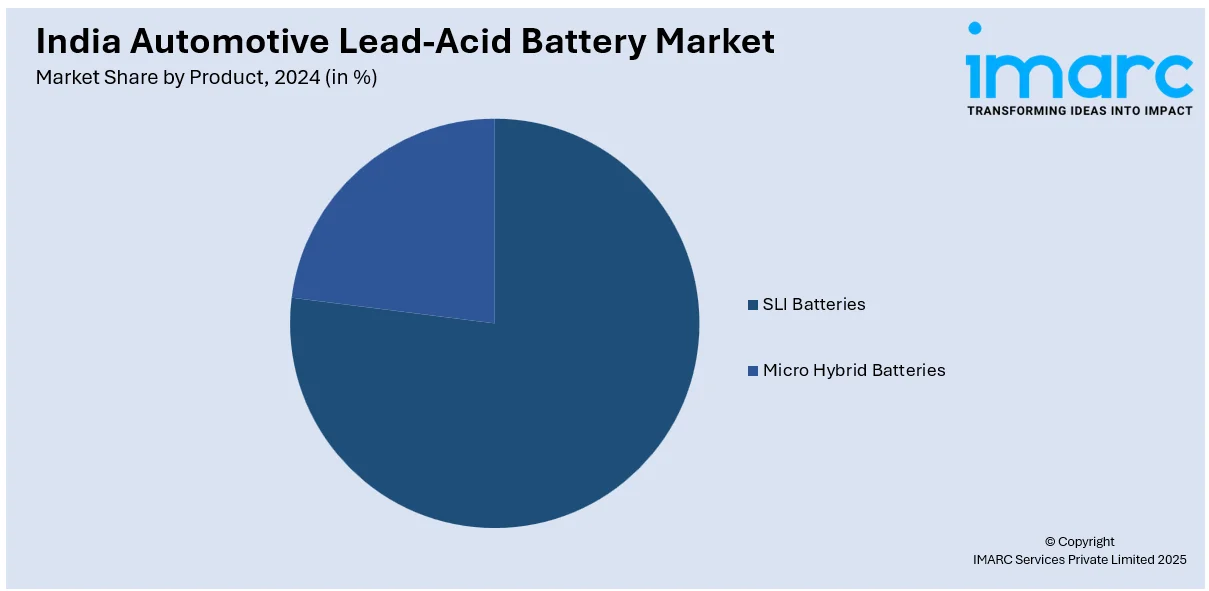

Product Insights:

- SLI Batteries

- Micro Hybrid Batteries

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes SLI batteries and micro hybrid batteries.

Type Insights:

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

The report has provided a detailed breakup and analysis of the market based on the type. This includes flooded batteries, enhanced flooded batteries, and VRLA batteries.

Customer Segment Insights:

- OEM

- Replacement

A detailed breakup and analysis of the market based on the customer segment have also been provided in the report. This includes OEM and replacement.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Lead-Acid Battery Market News:

- In December 2024, Amara Raja Energy & Mobility Limited partnered with Hyundai Motor India Limited (HMIL) to supply domestically manufactured absorbent glass mat (AGM) lead-acid batteries, enhancing advanced battery technology localization. These AGM batteries, surpassing conventional complete maintenance free (CMF) batteries by around 150% in durability tests, would be incorporated into Hyundai's Indian product lineup by Q4FY25.

- In March 2024, Exide Industries announced its plans to introduce premium absorbent glass mat (AGM) lead-acid batteries for fossil-fuel vehicles in India. Already exporting these batteries, Exide received a request for quotation from a major original equipment manufacturer and anticipates further interest. AGM batteries, though pricier, offer nearly double the shelf-life due to low discharge rates and are spill-proof.

India Automotive Lead-Acid Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, HEV Cars |

| Products Covered | SLI Batteries, Micro Hybrid Batteries |

| Types Covered | Flooded Batteries, Enhanced Flooded Batteries, VRLA Batteries |

| Customer Segments Covered | OEM, Replacement |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive lead-acid battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive lead-acid battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive lead-acid battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive lead-acid battery market in India was valued at USD 571.2 Million in 2024.

The India automotive lead-acid battery market is projected to exhibit a (CAGR) of 7.98% during 2025-2033, reaching a value of USD 1,207.58 Million by 2033.

Vehicle manufacturing growth, electric rickshaw and two-wheeler demand growth, and lead-acid battery cost-effectiveness are significant drivers. Battery replacement cycles and growing aftermarket are also key factors. Government incentives toward localized manufacturing under programs such as FAME and Make in India and rural vehicle adoption growth strongly support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)