India Automotive Interior Materials Market Size, Share, Trends and Forecast by Component, Material, Vehicle Type, and Region, 2025-2033

India Automotive Interior Materials Market Overview:

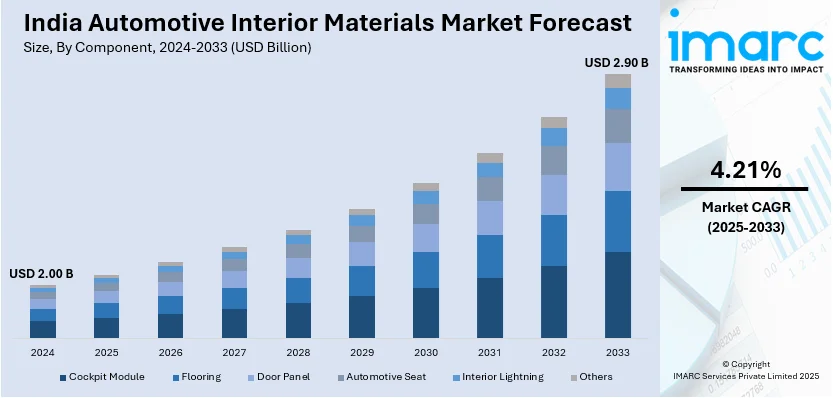

The India automotive Interior materials market size reached USD 2.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.90 Billion by 2033, exhibiting a growth rate (CAGR) of 4.21% during 2025-2033. The rising vehicle production, increasing consumer preference for premium interiors, growing demand for lightweight and sustainable materials, advancements in manufacturing technologies, stringent safety and emission regulations, expanding electric vehicle adoption, and rising disposable income are some of the factors positively impacting the India automotive interior materials market share

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.00 Billion |

| Market Forecast in 2033 | USD 2.90 Billion |

| Market Growth Rate 2025-2033 | 4.21% |

India Automotive Interior Materials Market Trends:

Shift Towards Eco-Friendly and Sustainable Materials

The shift to eco-friendly and sustainable materials on account of regulation pressures, eco-consciousness, and shifting preferences of consumers is positively influencing India automotive interior materials market outlook. Car makers are using bio-based plastics, recycled plastics, and natural fibers like coir and jute to decline their reliance on petroleum-based content. This approach aligns with the emission norms enforced in India, such as stringent emission levels as well as the country's sustainability goals. Carmakers are also exploring alternatives like polyurethane foams derived from soy and bamboo-based composites, which offer comparable strength and durability while minimizing environmental impact. Additionally, manufacturers are adopting closed-loop recycling processes and repurposing old vehicle interiors into new components to enhance circular economy practices. Businesses are spending money on research and development (R&D) activities to improve the functionality and durability of materials, thermal resistance, and affordability criteria needed for wide usage in mainstream and high-end auto segments. For instance, on January 9, 2025, Hyundai Motor India premiered the interiors of its upcoming Creta Electric SUV, with a two-tone Granite Gray and Dark Navy color palette complimented by ocean blue ambient illumination. Creta Electric focuses on sustainability by employing environmentally friendly materials for its seats, such as recycled plastic bottles and corn extract-based artificial leather.

To get more information on this market, Request Sample

Increasing Demand for Lightweight Materials for Fuel Efficiency and EV Adoption

The pressure towards increased fuel efficiency and the growing penetration of electric vehicles (EVs) are driving the demand for lighter interior materials, which is facilitating the India automotive interior materials market growth. As per an industry report, EV penetration in India stood at 7.4% in 2024, and the estimates suggest that by FY30, EVs will represent 30–35% of total car sales. The increasing electric vehicle demand leads to a high requirement for high-performance, lightweight materials that improve battery efficiency and provide a longer driving range. OEMs are substituting heavy conventional components with high-performance polymers, fiber-reinforced composites, and aluminum-based structures to shave weight off vehicles without affecting durability. Lightweight materials are helping to reduce fuel consumption in ICE vehicles and increase battery life in EVs. Thermoplastic polymers such as acrylonitrile butadiene styrene (ABS) and polycarbonate are used extensively in dashboards, door panels, and seat structures. Hybrid materials that are a blend of metal or carbon fiber and plastic are also being sought by manufacturers to meet the requirements of strength and weight saving. The need for creative lightweighting solutions is spurring material supplier and OEM collaborations to achieve best-in-class performance, sustainability, and cost-effectiveness.

India Automotive Interior Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, material, and vehicle type.

Component Insights:

- Cockpit Module

- Flooring

- Door Panel

- Automotive Seat

- Interior Lightning

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes cockpit module, flooring, door panel, automotive seat, interior lighting, and others.

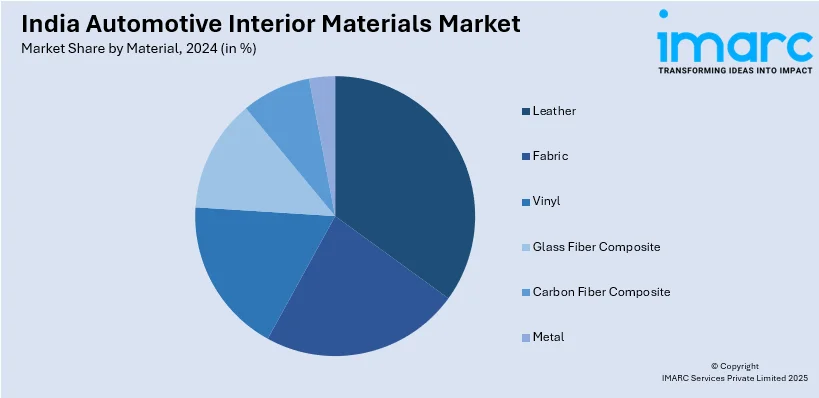

Material Insights:

- Leather

- Fabric

- Vinyl

- Glass Fiber Composite

- Carbon Fiber Composite

- Metal

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes leather, fabric, vinyl, glass fiber composite, carbon fiber composite, and metal.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Interior Materials Market News:

- On September 19, 2024, Toyoda Gosei Co., Ltd. announced plans to establish a new manufacturing facility in Harohalli, Karnataka, India. This plant, a branch of Toyoda Gosei South India Pvt. Ltd., is scheduled to commence production of safety systems, including airbags and steering wheels, as well as interior and exterior automotive components, starting in January 2026. The initiative aims to optimize the company's production network in southern India, leveraging advanced automation technologies and energy-efficient equipment.

- On January 25, 2025, Lexus India showcased its future-forward products at the Bharat Mobility Global Expo 2025 in New Delhi, reflecting its vision of "Making Luxury Personal." At the occasion, the Lexus LF-ZC Electrified concept was unveiled, showcasing the company's dedication to cutting-edge mobility solutions and sustainable luxury. With its emphasis on cyclical material usage and creative interior design, the Bamboo CMF (Color, Material, Finish) concept in the interiors embodies Lexus' distinctive environmental initiatives while providing clients with new experiential value.

India Automotive Interior Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Cockpit Module, Flooring, Door Panel, Automotive Seat, Interior Lightning, Others |

| Materials Covered | Leather, Fabric, Vinyl, Glass Fiber Composite, Carbon Fiber Composite, Metal |

| Vehicles Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive Interior materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive Interior materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive Interior materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive interior materials market in India was valued at USD 2.00 Billion in 2024.

The India automotive interior materials market is projected to exhibit a (CAGR) of 4.21% during 2025-2033, reaching a value of USD 2.90 Billion by 2033.

Surging auto production, growing premium vehicle aesthetic demand, and a transition towards light, robust, and environmentally friendly materials propel the India auto interior materials industry. End-user demand for increased comfort and safety, as well as regulatory emphasis on fuel efficiency and recyclability, propels uptake. Progress in intelligent and customizable interiors also impacts market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)