India Automotive Infotainment Market Size, Share, Trends and Forecast by Product Type, Vehicle Type, Operating System, Installation Type, Sales Channel, Technology, Connectivity, and Region, 2025-2033

India Automotive Infotainment Market Overview:

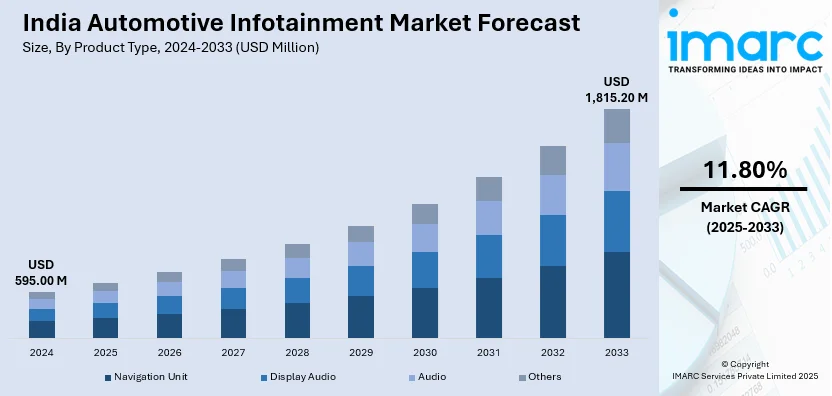

The India automotive infotainment market size reached USD 595.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,815.20 Million by 2033, exhibiting a growth rate (CAGR) of 11.80% during 2025-2033. The market is driven by rising vehicle sales, increasing consumer demand for in-car connectivity, growing smartphone integration, advancements in artificial intelligence (AI) and voice recognition, government regulations on safety, expanding electric vehicle (EV) adoption, and the surge in high-speed internet penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 595.00 Million |

| Market Forecast in 2033 | USD 1,815.20 Million |

| Market Growth Rate (2025-2033) | 11.80% |

India Automotive Infotainment Market Trends:

Increasing Integration of AI and Voice Assistants

The India automotive infotainment market is witnessing a significant shift toward AI-powered systems and voice assistants, driven by consumer demand for hands-free convenience and enhanced user experiences. Automakers now install AI-based voice recognition systems including Alexa Auto, Google Assistant, and OEM-specific solutions to provide uninterrupted control of navigation along with entertainment features and vehicle system operations. For instance, MG Motor India launched the Astor 2024 SUV, featuring a personal AI assistant and over 80 connected features, including wireless Android Auto and Apple CarPlay. This integration enhances user interaction and safety, highlighting the rising demand for AI-driven infotainment in the automotive market. Moreover, the multilingual consumer population of India has encouraged developers to create AI models that understand native languages and speak with regional accents. Besides this, real-time data processing capabilities have been enhanced to enable infotainment systems that provide predictive recommendations, customized content, and self-diagnostic features for vehicles. Furthermore, AI-driven infotainment solutions are widely being adopted in both mid-range and economy vehicles to expand the accessibility of advanced features. As a result, smart infotainment systems are projected to advance through automotive-manufacturer-tech company partnerships which will establish them as essential competitive features in India's automotive market. This trend is significantly boosting the India automotive infotainment market share.

To get more information on this market, Request Sample

Rising Demand for Connected Car Technology

The surge in connected car technology is a major trend enhancing the India automotive infotainment market outlook. In line with this, the rapid deployment of 4G and 5G networks prompts car manufacturers to build infotainment systems that use internet features including real-time navigation, OTA software updates, and V2X communication. For example, Hyundai Motor India Ltd (HMIL) reported cumulative sales of 675,204 connected cars between 2019 and 2024, expanding its Bluelink technology from 35 features to over 70, highlighting the rising consumer demand for integrated infotainment systems. Concurrently, smartphone users are favoring integrated smartphone systems delivered by Apple CarPlay and Android Auto along with infotainment systems developed by car manufacturers. In confluence with this, services based on telematics receive increased demand from customers because safety awareness and regulatory backing have led to better remote vehicle diagnostics, emergency assistance, and predictive maintenance alert capabilities. Additionally, the rising popularity of EVs encourages manufacturers to create advanced infotainment systems that deliver vital information about battery status and local charging stations to drivers. Apart from this, continuous technological progress in vehicle connectivity features allows automakers to dedicate their efforts towards enhancing their capabilities and eliminating the divide between digital lifestyles and in-car encounters, which is driving the India automotive infotainment market growth.

India Automotive Infotainment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, vehicle type, operating system, installation type, sales channel, technology, and connectivity.

Product Type Insights:

- Navigation Unit

- Display Audio

- Audio

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes navigation unit, display audio, audio and others.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars and commercial vehicles.

Operating System Insights:

- QNX

- LINUX

- Microsoft

- Others

The report has provided a detailed breakup and analysis of the market based on the operating system. This includes QNX, LINUX, Microsoft and others.

Installation Type Insights:

- In-Dash Infotainment

- Rear Seat Infotainment

A detailed breakup and analysis of the market based on the installation type have also been provided in the report. This includes in-dash infotainment and rear seat infotainment.

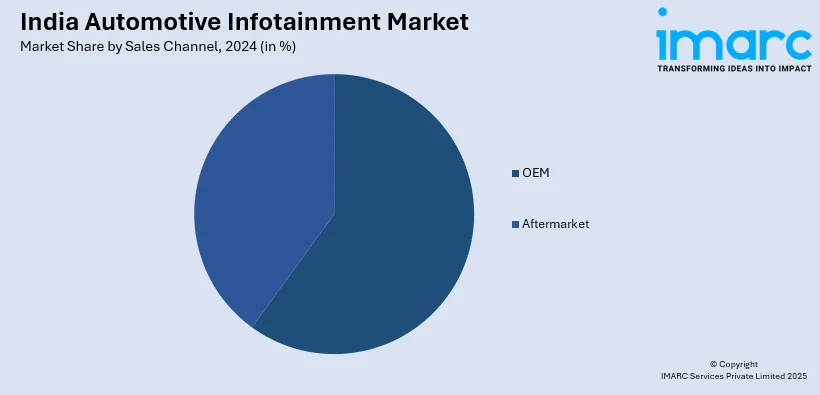

Sales Channel Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes OEM and aftermarket.

Technology Insights:

- Integrated

- Embedded

- Tethered

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes integrated, embedded and tethered.

Connectivity Insights:

- Bluetooth

- Wi-Fi

- 3G

- 4G

- 5G

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes Bluetooth, wi-fi, 3G, 4G and 5G.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Infotainment Market News:

- In October 2024, Mercedes-Benz launched the sixth-generation E-Class LWB in India, featuring a 14.4-inch touchscreen, a 12.2-inch digital cluster, and a passenger screen. Its advanced infotainment system significantly drives the market demand for high-tech, connected luxury vehicles.

- In January 2024, Tata Motors introduced the Punch EV, an affordable electric vehicle priced between INR 9.99 lakh and 14.29 lakh. It integrates two screens, a 26cm high-definition infotainment by HARMAN display alongside a 26cm digital cockpit, and offers over 75 connected car features, catering to the growing demand for connected vehicles.

India Automotive Infotainment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Navigation Unit, Display Audio, Audio, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Operating Systems Covered | QNX, LINUX, Microsoft, Others |

| Installation Types Covered | In-Dash Infotainment, Rear Seat Infotainment |

| Sales Channels Covered | OEM, Aftermarket |

| Technologies Covered | Integrated, Embedded, Tethered |

| Connectivities Covered | Bluetooth, Wi-Fi, 3G, 4G, 5G |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive infotainment market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive infotainment market on the basis of product type?

- What is the breakup of the India automotive infotainment market on the basis of vehicle type?

- What is the breakup of the India automotive infotainment market on the basis of operating system?

- What is the breakup of the India automotive infotainment market on the basis of installation type?

- What is the breakup of the India automotive infotainment market on the basis of sales channel?

- What is the breakup of the India automotive infotainment market on the basis of technology?

- What is the breakup of the India automotive infotainment market on the basis of connectivity?

- What is the breakup of the India automotive infotainment market on the basis of region?

- What are the various stages in the value chain of the India automotive infotainment market?

- What are the key driving factors and challenges in the India automotive infotainment?

- What is the structure of the India automotive infotainment market and who are the key players?

- What is the degree of competition in the India automotive infotainment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive infotainment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive infotainment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive infotainment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)