India Automotive Cooling Systems Market Size, Share, Trends and Forecast by Vehicle Type, Engine Type, and Region, 2025-2033

India Automotive Cooling Systems Market Overview:

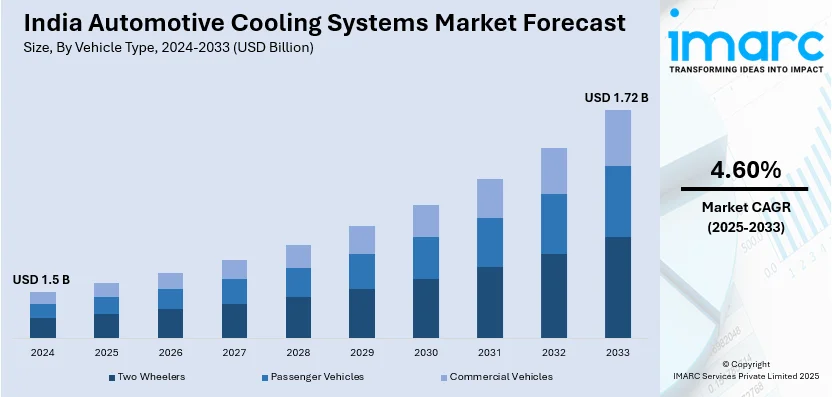

The India automotive cooling systems market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.72 Billion by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The India automotive cooling systems market is evolving with advancements in thermal management, electric water pumps, and battery cooling solutions. Moreover, emission norms, rising EV adoption, and efficiency demands are driving innovations in smart cooling technologies, thereby favoring market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 1.72 Billion |

| Market Growth Rate (2025-2033) | 4.60% |

India Automotive Cooling Systems Market Trends:

Rise in Demand for Advanced Thermal Management

Growing fuel efficiency rules and pollution standards are causing a change in the Indian automotive cooling systems market toward advanced thermal management technologies. In addition, modern cars need precise temperature regulation to maximize engine performance and minimize wear. Also, to increase cooling efficiency, automakers are incorporating sophisticated heat exchangers, variable coolant pumps, and computerized thermostats. For example, in order to improve fuel efficiency and thermal efficiency, Tata Motors and Maruti Suzuki are integrating electronically controlled cooling systems into their latest vehicles. Furthermore, electric water pumps are also becoming popular, especially in hybrid and electric cars, driven by their superior energy management over traditional mechanical pumps. Furthermore, to maintain emission requirements, the drive for BS6-compliant engines has raised the demand for cooling components that are optimized. To further increase thermal efficiency, innovations, including heat recovery systems and active grille shutters, are being evaluated. Advanced cooling modules that adjust to various driving circumstances are being incorporated into Ashok Leyland's latest truck models, which reduces energy loss. In order to dynamically modify coolant flow in response to engine load and ambient temperatures, smart cooling control devices are being investigated. The future of automotive cooling is being shaped by these developments, which are pushing the sector toward clever thermal management strategies that improve sustainability and performance.

To get more information on this market, Request Sample

Shift Toward Electric and Hybrid Cooling Systems

The growing demand for electric and hybrid vehicles is driving the development of specialized cooling technologies in India’s automotive sector. Unlike traditional internal combustion engines, EVs and hybrids rely on battery thermal management systems (BTMS) to regulate temperature and prevent overheating. Companies like Mahindra Electric and Hyundai India are focusing on liquid cooling solutions for their electric models to ensure consistent battery performance. Advanced phase-change materials and dedicated coolant loops are being used to enhance battery longevity and efficiency. The increasing adoption of fast-changing technology also demands efficient cooling mechanisms to dissipate excess heat generated during rapid charging. Tata Nexon EV and MG ZS EV have implemented integrated cooling and heating systems to optimize battery temperature in extreme weather conditions. Moreover, automakers are experimenting with thermal interface materials (TIMs) to improve heat dissipation in compact battery packs. Developments in dual-circuit cooling systems are allowing more precise thermal regulation, particularly for high-performance electric cars. Additionally, integrated thermal management systems that combine cabin and battery cooling are being developed to optimize energy usage in EVs. These innovations are expected to become industry standards as India transitions toward sustainable mobility solutions driven by stringent efficiency goals.

India Automotive Cooling Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type and engine type.

Vehicle Type Insights:

- Two Wheelers

- Passenger Vehicles

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes two wheelers, passenger vehicles, and commercial vehicles.

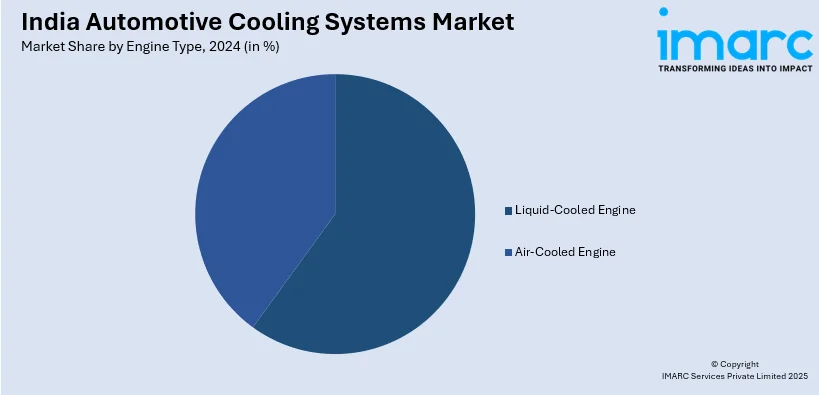

Engine Type Insights:

- Liquid-Cooled Engine

- Air-Cooled Engine

The report has provided a detailed breakup and analysis of the market based on the engine type. This includes liquid-cooled engine, and air-cooled engine.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Cooling Systems Market News:

- December 2024: TVS Motor Company introduced the TVS RT-XD4 engine platform with a dual cooling jacket system (water and oil) for improved thermal management. This enhances engine efficiency, durability, and emission control, strengthening India's automotive cooling systems market by advancing next-gen cooling technologies for high-performance engines.

- March 2024: Delta unveiled advanced thermal management solutions for EVs at Electronica 2024, featuring liquid-cooled cold plates, electric pumps, and cooling fans for powertrains, ADAS, and intelligent cockpits. This innovation boosts efficiency, system reliability, and OEM compliance, accelerating India's automotive cooling systems industry.

India Automotive Cooling Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Two Wheelers, Passenger Vehicles, Commercial Vehicles |

| Engine Types Covered | Liquid-Cooled Engine, Air-Cooled Engine |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive cooling systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive cooling systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive cooling systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive cooling systems market in India was valued at USD 1.5 Billion in 2024.

The India automotive cooling systems market is projected to exhibit a (CAGR) of 4.60% during 2025-2033, reaching a value of USD 1.72 Billion by 2033.

The market is driven by growing vehicle manufacturing, fuel-efficient engine demands, and increasing emission regulations. Heightening use of electric and hybrid vehicles, along with thermal management technology advancements, increases efficiency in systems. Growth in urban mobility and infrastructure development also drive long-term market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)