India Autoclaved Aerated Concrete Blocks Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Region, 2026-2034

India Autoclaved Aerated Concrete Blocks Market Overview:

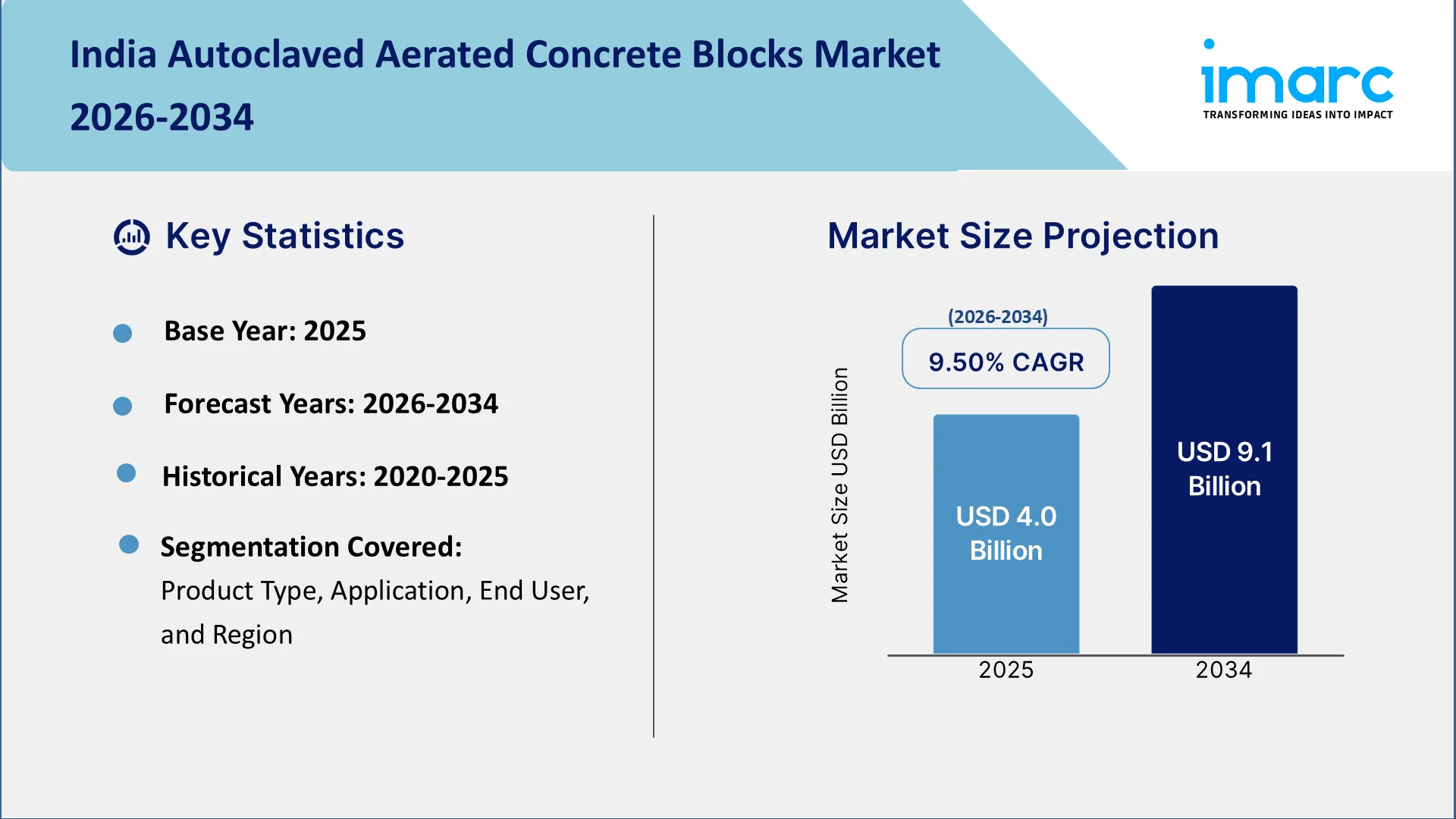

The India autoclaved aerated concrete blocks market size reached USD 4.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.1 Billion by 2034, exhibiting a growth rate (CAGR) of 9.50% during 2026-2034. The rising awareness about the environmental impact of traditional materials is catalyzing the demand for autoclaved aerated concrete blocks, which provide better insulation, faster construction, and energy efficiency, making them the preferred sustainable option for builders and developers focused on eco-friendly construction.

To get more information on the market, Request Sample

India Autoclaved Aerated Concrete Blocks Market Trends:

Rising Awareness of Building Material Alternatives

As understanding about the drawbacks of conventional building materials expands, there is a rise in transition toward alternative, more effective construction solutions like autoclaved aerated concrete (AAC) blocks. Numerous architects, builders, and contractors are currently investigating various material choices to address the changing demands of contemporary construction. AAC blocks provide various benefits compared to traditional bricks, including superior insulation, quicker building times, and reduced shipping expenses owing to their light weight. Moreover, as awareness about the environmental effects of conventional materials grows, the need for sustainable options such as AAC blocks is increasing considerably. This recognition is proliferating throughout the construction industry, leading to an increased demand for AAC blocks as a favored building material in residential and commercial developments. Many leading companies are also advertising about the advantages of AAC, further supporting the market growth. In 2023, Magicrete introduced a fresh digital advertising campaign, "Kyunki Naya Ghar Banta Hai Magicrete se," showcasing four comedic ad films highlighting the advantages of AAC blocks. The campaign emphasized quicker building, improved insulation, and the sturdiness of AAC blocks, intending to promote awareness of eco-friendly construction options. Magicrete, the biggest AAC block manufacturer in India, has been utilized in more than 10 million residences, featuring notable structures such as the Reliance Refinery and Mumbai Metro.

Growing Demand for Sustainable Construction Materials

The rising focus on eco-friendly and sustainable construction methods is catalyzing the demand for AAC blocks in India. With the growing worries about environmental effects and resource preservation, construction firms are progressively looking for materials that can aid in reducing carbon emissions. AAC blocks are notable for their energy-efficient manufacturing method, which demands considerably less energy than conventional building materials, positioning them as a desirable option for environmentally conscious constructors. Alongside their eco-friendly manufacturing, AAC blocks improve the energy efficiency of structures by offering superior thermal insulation. This leads to decreased energy use for heating and cooling, resulting in lower operating expenses and a reduced carbon footprint throughout a building's lifespan. With an increase in green building certifications and sustainable construction methods, AAC blocks are emerging as a key material for developers looking to achieve these elevated environmental criteria. A significant illustration of this trend is Infra.Market's growth in 2024, as it emerged as India's top AAC block producer with nine facilities and an annual output capacity of 3 million cubic meters. The company's expansion highlights its dedication to advancing sustainable building methods and backing government programs such as Pradhan Mantri Awas Yojana, which strive to lessen the ecological footprint of the construction industry while offering affordable housing options.

India Autoclaved Aerated Concrete Blocks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, application, and end user.

Product Type Insights:

- Block

- Lintel

- Floor Elements

- Roof Panel

- Wall Panel

- Cladding Panel

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes block, lintel, floor elements, roof panel, wall panel, cladding panel, and others.

Application Insights:

- Construction Materials

- Road Construction

- Roof Insulation

- Bridge Sub-Structure

- Void Filling

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction materials, road construction, roof insulation, bridge sub-structure, void filling, and others.

End User Insights:

- Residential

- Commercial

- Industrial

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, industrial, and infrastructure.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Autoclaved Aerated Concrete Blocks Market News:

- In February 2025, BigBloc Construction's subsidiary, StarBigBloc Building Material, announced the acquisition of land in Indore, Madhya Pradesh, to set up a new manufacturing plant for AAC blocks. The facility aims to strengthen the company's presence in Madhya Pradesh and surrounding regions. This expansion is part of BigBloc's strategy to grow geographically and diversify its product offerings.

- In March 2024, Magicrete announced the completion of its acquisition of a majority stake in Maxlite, a South India-based AAC block manufacturer. This acquisition boosted Magicrete's AAC block production capacity to 1.8 million cubic meters annually. Maxlite operated two manufacturing plants in Karnataka and Tamil Nadu, with a combined capacity of 500,000 cubic meters per year.

India Autoclaved Aerated Concrete Blocks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Block, Lintel, Floor Elements, Roof Panel, Wall Panel, Cladding Panel, Others |

| Applications Covered | Construction Materials, Road Construction, Roof Insulation, Bridge Sub-Structure, Void Filling, Others |

| End Users Covered | Residential, Commercial, Industrial, Infrastructure |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India autoclaved aerated concrete blocks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India autoclaved aerated concrete blocks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India autoclaved aerated concrete blocks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India autoclaved aerated concrete blocks market was valued at USD 4.0 Billion in 2025.

The India autoclaved aerated concrete blocks market is projected to exhibit a CAGR of 9.50% during 2026-2034, reaching a value of USD 9.1 Billion by 2034.

India’s autoclaved aerated concrete (AAC) blocks market is driven by rising demand for sustainable and lightweight building materials. Growth in construction, government support for green buildings, and benefits like thermal insulation, fire resistance, and faster installation make AAC blocks a preferred choice over traditional bricks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)