India Asset Performance Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Industry Vertical, and Region, 2025-2033

Market Overview:

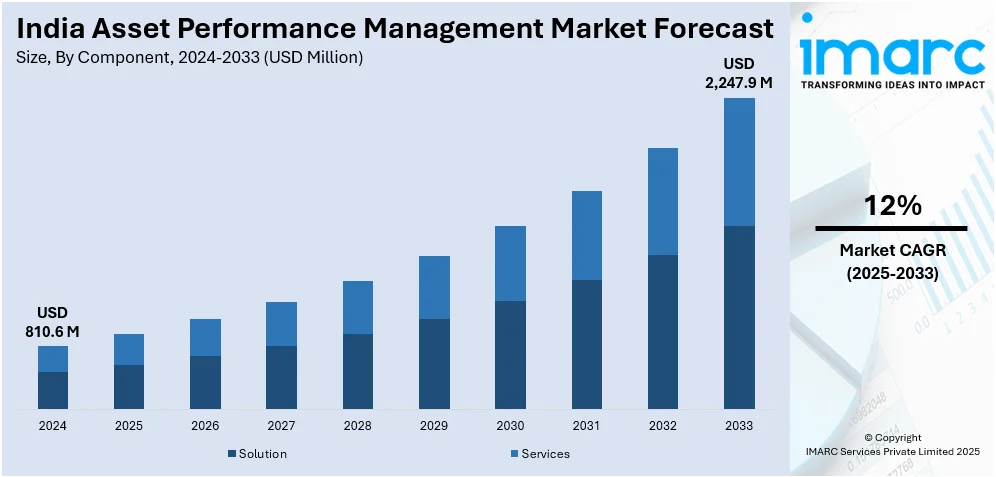

India asset performance management market size reached USD 810.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,247.9 Million by 2033, exhibiting a growth rate (CAGR) of 12% during 2025-2033. The growing focus among businesses to offer comprehensive solutions for managing and optimizing their physical assets in a dynamic and competitive landscape is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 810.6 Million |

| Market Forecast in 2033 | USD 2,247.9 Million |

| Market Growth Rate (2025-2033) | 12% |

Asset performance management (APM) utilizes pattern recognition, artificial intelligence (AI), machine learning (ML), and the capture, integration, visualization, and analytics of data to enhance the reliability and availability of physical assets. Its aim is to diminish instances of unplanned downtime, reduce maintenance costs, and lower the overall cost of ownership (TCO) for assets, plants, and potential environment, health, and safety (EH&S) risks. Additionally, asset performance management is instrumental in elevating return on assets (ROA) and enhancing operational visibility. Consequently, it is widely applied across diverse industries, including manufacturing, healthcare, information technology (IT), and telecommunications.

To get more information on this market, Request Sample

India Asset Performance Management Market Trends:

The asset performance management market in India is experiencing substantial growth, driven by the inflating need among industries to enhance operational efficiency and mitigate risks associated with physical assets. One of the primary objectives of this solution in India is the reduction of unplanned downtime, which has a direct impact on operational productivity. Additionally, by harnessing the power of data capture, integration, visualization, and analytics, asset performance management helps industries in India minimize unexpected disruptions and improve the overall reliability of assets. This, in turn, leads to a reduction in maintenance costs, contributing to a more efficient and cost-effective operation. Moreover, the holistic approach of asset performance management extends beyond minimizing downtime to encompass the total cost of ownership (TCO) for assets, plants, and addressing environment, health, and safety (EH&S) concerns, thereby acting as another significant growth-inducing factor. Besides this, APM strategies in India are designed to optimize asset performance, increase the return on assets (ROA), and enhance the visibility of operations, enabling businesses to make informed decisions and mitigate risks effectively, which is positively influencing the market growth. Apart from this, as the digital transformation journey gains momentum in the country, the asset performance management market is poised for continued expansion in the coming years.

India Asset Performance Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and industry vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component This includes solution and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

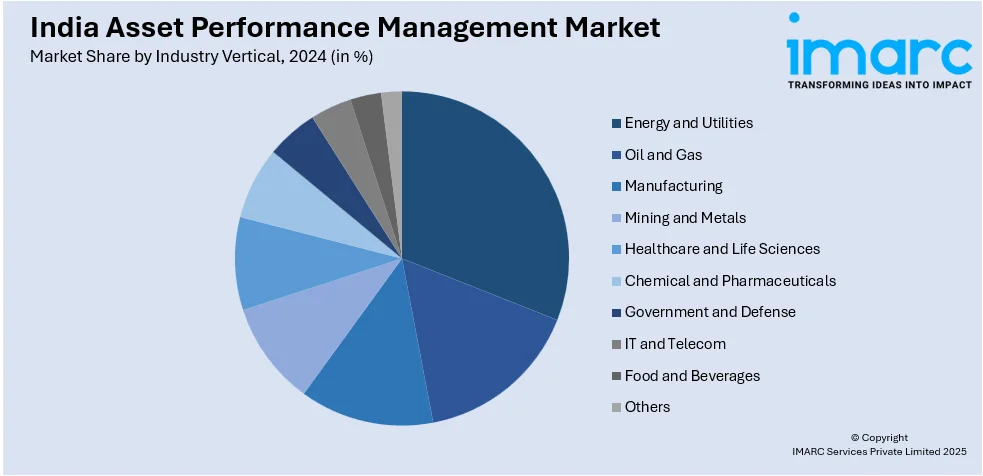

Industry Vertical Insights:

- Energy and Utilities

- Oil and Gas

- Manufacturing

- Mining and Metals

- Healthcare and Life Sciences

- Chemical and Pharmaceuticals

- Government and Defense

- IT and Telecom

- Food and Beverages

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes energy and utilities, oil and gas, manufacturing, mining and metals, healthcare and life sciences, chemical and pharmaceuticals, government and defense, IT and telecom, food and beverages, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Asset Performance Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | Energy and Utilities, Oil and Gas, Manufacturing, Mining and Metals, Healthcare and Life Sciences, Chemical and Pharmaceuticals, Government and Defense, IT and Telecom, Food and Beverages, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India asset performance management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India asset performance management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India asset performance management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The asset performance management market in India was valued at USD 810.6 Million in 2024.

The India asset performance management market is projected to exhibit a CAGR of 12% during 2025-2033, reaching a value of USD 2,247.9 Million by 2033.

As businesses are aiming to decrease downtime and optimize the lifecycle of critical assets, they are adopting asset performance management solutions that use data analytics to monitor asset health and predict failures. Besides this, the rise in industrial automation and digital transformation is encouraging companies to integrate asset performance management tools with their existing systems to gain real-time insights and make informed decisions. Regulatory pressure for safety and compliance is also motivating organizations to maintain asset reliability and performance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)