India AR and VR Smart Glasses Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

India AR and VR Smart Glasses Market Overview:

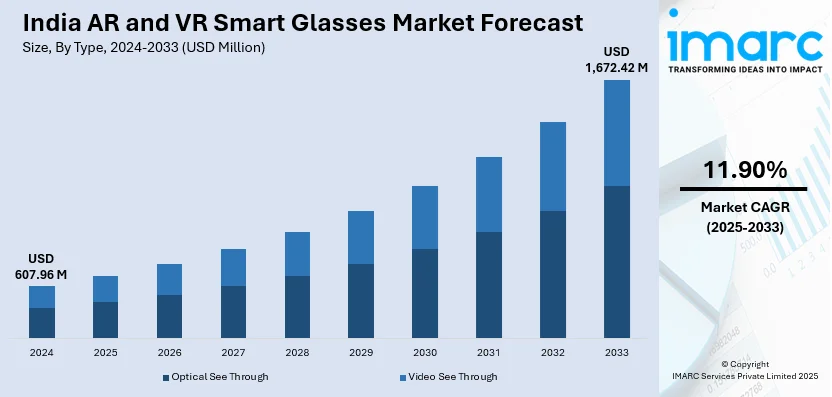

The India AR and VR smart glasses market size reached USD 607.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,672.42 Million by 2033, exhibiting a growth rate (CAGR) of 11.90% during 2025-2033. The rising demand across the gaming, healthcare, and education sectors, increasing investments in immersive technologies, expanding 5G infrastructure, growing adoption of remote collaboration tools, and enhanced user experience through improved hardware and software advancements are impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 607.96 Million |

| Market Forecast in 2033 | USD 1,672.42 Million |

| Market Growth Rate (2025-2033) | 11.90% |

India AR and VR Smart Glasses Market Trends:

Increasing Adoption across Diverse Sectors

The increasing use of augmented reality (AR) and virtual reality (VR) smart glasses in the enterprise and industrial sectors is propelling market expansion in India. Manufacturing, healthcare, logistics, and retail are using these technologies to boost productivity, training, and operational efficiency. In the manufacturing industry, AR smart glasses are utilized for remote support, quality monitoring, and equipment maintenance. According to a PwC India report, AR-based remote assistance solutions can improve productivity by 30% and reduce error rates by up to 90% in complex assembly tasks. Similarly, in healthcare, AR smart glasses are enhancing surgical precision, remote consultations, and medical training. The Indian telemedicine sector expanded by 31% between 2023 and 2025, fueling demand for AR-enabled medical products. In addition, the logistics industry is using AR smart glasses to improve warehouse management. Companies, for example, are installing AR-assisted picking systems, which have a 25% improvement in order fulfillment efficiency. With India's Industry 4.0 transition gaining traction, AR and VR smart glasses are projected to witness greater use across a wide range of industries, greatly driving market growth.

To get more information on this market, Request Sample

Expansion of Immersive Gaming and Entertainment Platforms

The booming gaming and entertainment sector is driving substantial demand for AR and VR smart glasses in India. Immersive gaming platforms are gaining popularity as consumers seek enhanced virtual experiences. The growth is fueled by advancements in 5G connectivity, improved graphics, and interactive content. In 2023, India became the world's largest gaming market, boasting 568 million gamers and achieving a remarkable 9.5 billion gaming app downloads. AR and VR smart glasses are key enablers, offering enhanced realism in virtual gaming environments. Popular gaming platforms such as Meta Quest, HTC Vive, and Sony PlayStation VR are expanding their presence in India, aligning with this trend. In addition to gaming, the demand for VR experiences in virtual concerts, live sports events, and interactive content is also on the rise. For instance, VR-based immersive movie experiences have gained traction, with several Indian multiplex chains exploring VR-powered entertainment zones. With 5G connectivity disseminating throughout Indian cities, allowing for quicker data transfer rates and higher streaming quality, AR and VR smart glasses are becoming more accessible and providing better user experiences.

India AR and VR Smart Glasses Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type,and end use.

Type Insights:

- Optical See Through

- Video See Through

The report has provided a detailed breakup and analysis of the market based on the type. This includes optical see through and video see through.

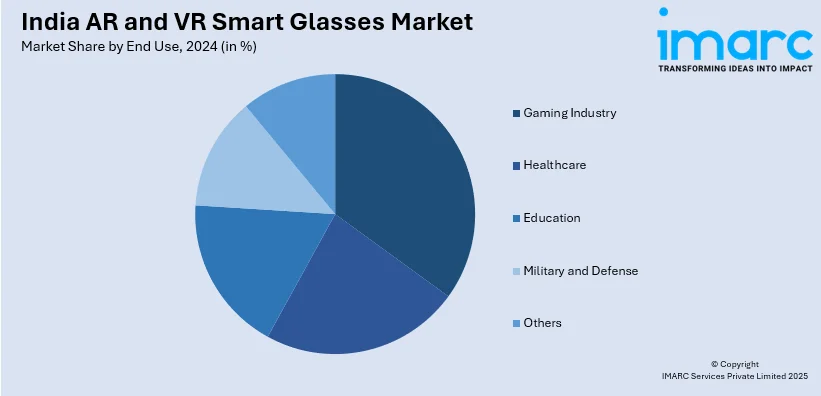

End Use Insights:

- Gaming Industry

- Healthcare

- Education

- Military and Defense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes gaming industry, healthcare, education, military and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India AR and VR Smart Glasses Market News:

- January 2025: NVIDIA applied for a patent for new smart glasses with a compact form factor, visually indistinguishable from regular glasses. The patent reveals plans to build an AR display with better power efficiency, a more compact form factor, and improved contrast for more realistic visuals.

- September 2024: Meta introduced its first augmented reality (AR) glasses, named Orion, featuring advanced silicon-carbide architecture that transforms display technology. These innovative glasses support holographic projections that seamlessly integrate with the physical surroundings.

India AR and VR Smart Glasses Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Optical See Through, Video See Through |

| End Uses Covered | Gaming Industry, Healthcare, Education, Military and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India AR and VR smart glasses market performed so far and how will it perform in the coming years?

- What is the breakup of the India AR and VR smart glasses market on the basis of type?

- What is the breakup of the India AR and VR smart glasses market on the basis of end use?

- What are the various stages in the value chain of the India AR and VR smart glasses market?

- What are the key driving factors and challenges in the India AR and VR smart glasses?

- What is the structure of the India AR and VR smart glasses market and who are the key players?

- What is the degree of competition in the India AR and VR smart glasses market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India AR and VR smart glasses market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India AR and VR smart glasses market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India AR and VR smart glasses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)