India Antimony Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Antimony Market Overview:

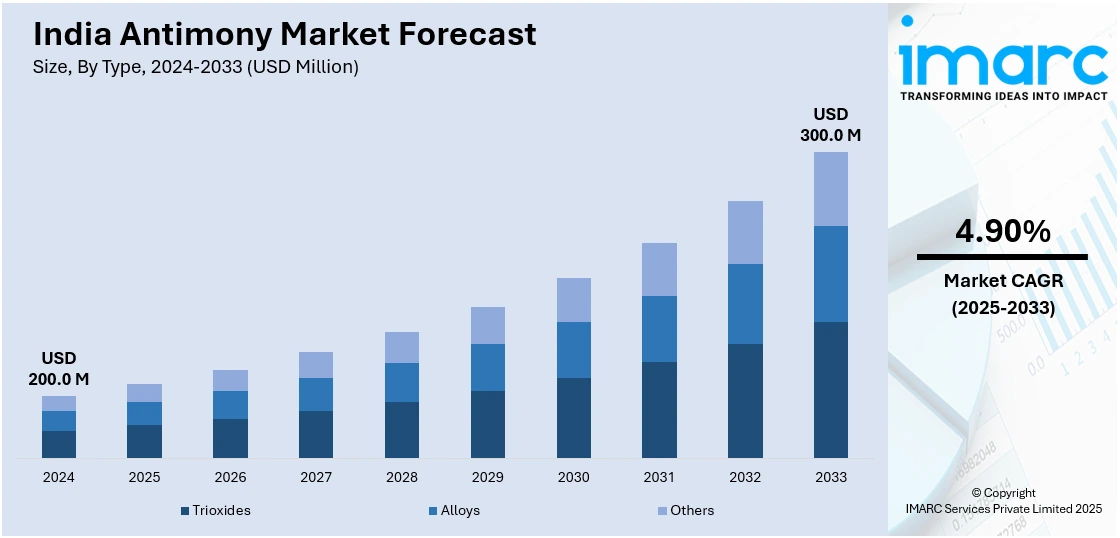

The India antimony market size reached USD 200.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 300.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The rising demand in flame retardants, expanding applications in lead-acid batteries, increasing usage in ceramics and glass, government initiatives promoting domestic mining, and the growing electronics sector, which relies on antimony-based semiconductors, alloys, and conductive coatings for enhanced performance and durability are some of the major factors expanding the India antimony market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 200.0 Million |

| Market Forecast in 2033 | USD 300.0 Million |

| Market Growth Rate 2025-2033 | 4.90% |

India Antimony Market Trends:

Expanding Demand for Antimony in Flame Retardants

India’s industrial and construction sectors are driving demand for flame retardants, where antimony trioxide is a critical additive, which is facilitating the India antimony market growth. According to IBEF, the construction sector is growing by 9.5% in India. The rising infrastructure projects, increased urbanization, and stringent fire safety regulations are further accelerating the adoption of fire-resistant materials in residential, commercial, and industrial buildings. Antimony trioxide, used with halogenated compounds, enhances fire resistance in insulation materials, electrical enclosures, and upholstered furniture. Moreover, the implementation of government initiatives mandating fire safety compliance in high-risk environments, such as commercial buildings and factories, is accelerating demand for flame-retardant solutions. The expanding electronics industry also fuels growth, as circuit boards and plastic components require fire-resistant coatings. In addition to this, environmental concerns regarding halogenated flame retardants are prompting a shift toward non-toxic alternatives. Also, research into sustainable antimony-based formulations is gaining traction, which is influencing future market trends. Companies are focusing on low-toxicity and halogen-free flame retardants to align with global environmental regulations while maintaining fire safety standards in India’s growing industrial landscape.

To get more information on this market, Request Sample

Increasing Utilization of Antimony in Lead-Acid Batteries

India’s demand for lead-acid batteries is rising, driven by the automotive, telecom, and energy storage sectors. Antimony is essential in these batteries, improving grid strength, corrosion resistance, and charge retention. According to IBEF, the passenger vehicle (PV) market in India grew impressively in 2024, with total sales of 4.3 million units, a 4.2% rise over the previous year. The rising vehicle growth continues to drive the need for lead-acid batteries, as they are an affordable energy storage option. As a key component in these batteries, antimony plays a crucial role in enhancing durability and performance, thereby supporting the expanding automotive sector. In line with this, the widespread inverter usage and growing backup power needs are also positively influencing the India antimony market outlook. Besides this, the implementation of government policies supporting renewable energy integration, including solar and wind power are further driving demand for energy storage, where lead-acid batteries play a key role. Also, rapid urbanization and digitalization lead to higher reliance on backup power solutions in telecom towers and data centers, reinforcing market expansion. Moreover, continual innovations in lead-acid battery technology, such as advanced alloys with lower antimony content for reduced maintenance, are keeping demand steady. Recycling infrastructure improvements and policies promoting circular economy practices are also supporting market sustainability and long-term antimony demand in India.

India Antimony Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Trioxides

- Alloys

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes trioxides, alloys, and others.

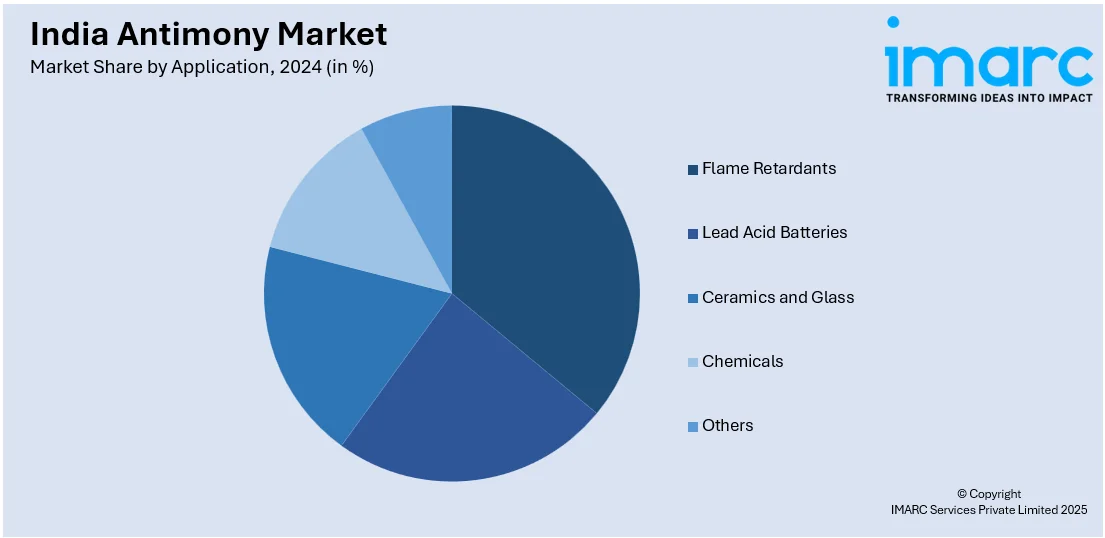

Application Insights:

- Flame Retardants

- Lead Acid Batteries

- Ceramics and Glass

- Chemicals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes flame retardants, lead acid batteries, ceramics and glass, chemicals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Antimony Market News:

- On January 29, 2025, the Union Cabinet approved the launch of the National Critical Mineral Mission (NCMM) with an expenditure of INR 16,300 Crore (about USD 1.96 Billion) and an expected investment of INR 18,000 Crore about (USD 2.16 Billion) by public sector undertakings. The 30 critical minerals include antimony, beryllium, bismuth, cobalt, copper, etc. The mission encompasses all phases, including exploration, mining, beneficiation, processing, and recovery from end-of-life goods, with the goal of creating a robust value chain for vital mineral resources necessary for green technology.

- On February 1, 2025, during the annual budget presentation, the Finance Minister of India declared the removal of customs taxes on waste and scrap of twelve essential minerals, such as lead, zinc, cobalt powder, lithium-ion batteries, copper, tungsten, cobalt, and antimony. The goal of this action is to guarantee that certain minerals will be available for domestic production. The government also intends to implement a policy for recovering essential minerals from mining waste.

India Antimony Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Trioxides, Alloys, Others |

| Applications Covered | Flame Retardants, Lead Acid Batteries, Ceramics and Glass, Chemicals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India antimony market performed so far and how will it perform in the coming years?

- What is the breakup of the India antimony market on the basis of type?

- What is the breakup of the India antimony market on the basis of application?

- What is the breakup of the India antimony market on the basis of region?

- What are the various stages in the value chain of the India antimony market?

- What are the key driving factors and challenges in the India antimony?

- What is the structure of the India antimony market and who are the key players?

- What is the degree of competition in the India antimony market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India antimony market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India antimony market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India antimony industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)