India Anti-Fungal Drugs Market Size, Share, Trends and Forecast by Drug Class, Indication, Infection Type, Route of Administration, Distribution Channel, End User, and Region, 2025-2033

India Anti-Fungal Drugs Market Overview:

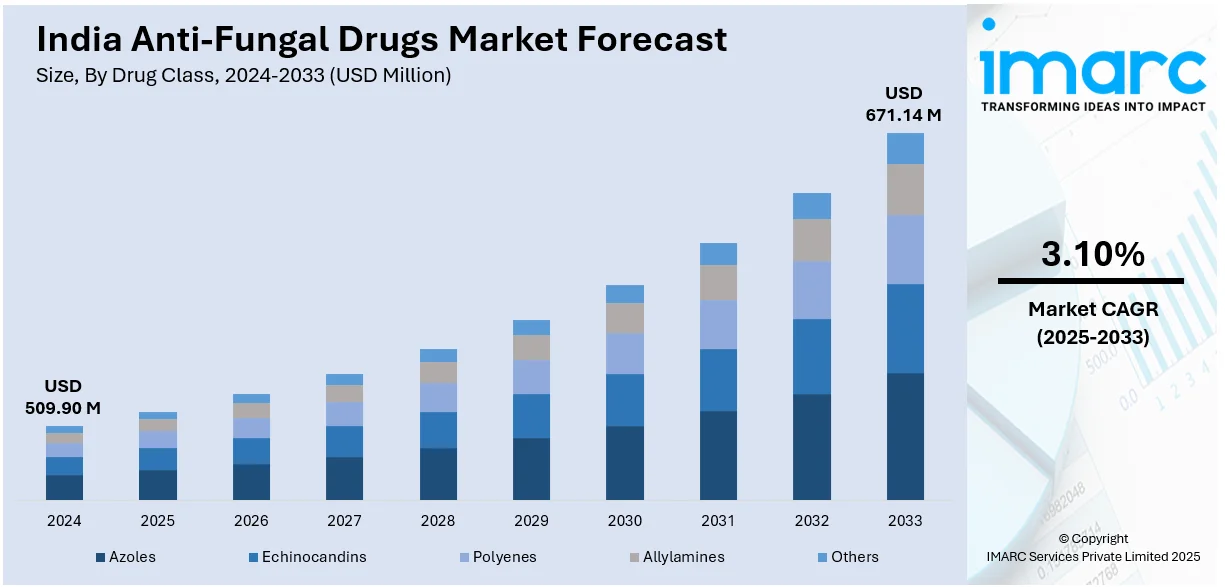

The India anti-fungal drugs market size reached USD 509.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 671.14 Million by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The India anti-fungal drugs market share is expanding, driven by the rising incidence of diabetes that creates an ideal environment for fungal growth, along with the increasing access to reliable treatment for fungal infections in hospitals, clinics, and diagnostic centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 509.90 Million |

| Market Forecast in 2033 | USD 671.14 Million |

| Market Growth Rate 2025-2033 | 3.10% |

India Anti-Fungal Drugs Market Trends:

Rising incidence of diabetes

The high prevalence of diabetes is fueling the India anti-fungal drugs market growth. As per the information published on the official website of the National Library of Medicine, the incidence of type 2 diabetes mellitus (T2DM) is increasing in India, with estimates reaching 134 million cases by 2045. Diabetic patients are more prone to fungal infections due to weakened immune systems and elevated blood sugar levels, which foster a suitable setting for fungal proliferation. Conditions like oral thrush, fungal nail infections, vaginal candidiasis, and mucormycosis (black fungus) are commonly seen in people with diabetes, driving the demand for effective anti-fungal medications. Poorly managed diabetes further raises the risk of severe and recurring fungal infections, making antifungal treatment a necessity for many patients. Additionally, the widespread use of broad-spectrum antibiotics and steroids in diabetes treatment can disrupt the body's natural microbial balance, leading to secondary fungal infections that require immediate care. The increasing awareness among diabetic patients about infection risks is encouraging the usage of both prescription and over the counter (OTC) antifungal treatments. Healthcare providers are emphasizing regular screenings for fungal infections in diabetic patients, further contributing to the market growth. As diabetes cases continue to rise, the requirement for reliable and effective antifungal drugs is rising, making it a key segment in India's pharmaceutical market.

To get more information on this market, Request Sample

Expanding healthcare infrastructure

The expansion of healthcare infrastructure is offering a favorable India anti-fungal drugs market outlook. Under the Indian Union Budget 2025-26, the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PM-ABHIM), designed to enhance healthcare facilities, experienced a 31.3% increase in funding, from INR 3,200 crore in FY2024-25 to INR 4,200 Crore. This rise is anticipated to aid in the creation of new primary and secondary healthcare facilities, especially in neglected areas. With better medical facilities in both urban and rural areas, more people are getting diagnosed and treated for fungal infections that might have previously gone unnoticed. The rise of specialized dermatology and infectious disease clinics is also driving the demand for antifungal medications, as doctors can identify and treat conditions like ringworm, candidiasis, and mucormycosis more efficiently. Government initiatives to strengthen healthcare services, including the construction of new hospitals and the broadening of primary healthcare centers, are ensuring that antifungal treatments reach a larger population. The increasing investments in medical research and development (R&D) activities is also leading to the availability of newer and more effective antifungal drugs.

India Anti-Fungal Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on drug class, indication, infection type, route of administration, distribution channel, and end user.

Drug Class Insights:

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes azoles, echinocandins, polyenes, allylamines, and others.

Indication Insights:

- Candidiasis

- Aspergillosis

- Dermatophytosis

- Mucormycosis

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes candidiasis, aspergillosis, dermatophytosis, mucormycosis, and others.

Infection Type Insights:

- Superficial Fungal Infection

- Systemic Fungal Infection

The report has provided a detailed breakup and analysis of the market based on the infection type. This includes superficial fungal infection and systemic fungal infection.

Route of Administration Insights:

- Parenteral

- Topical

- Oral

- Others

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes parenteral, topical, oral, and others.

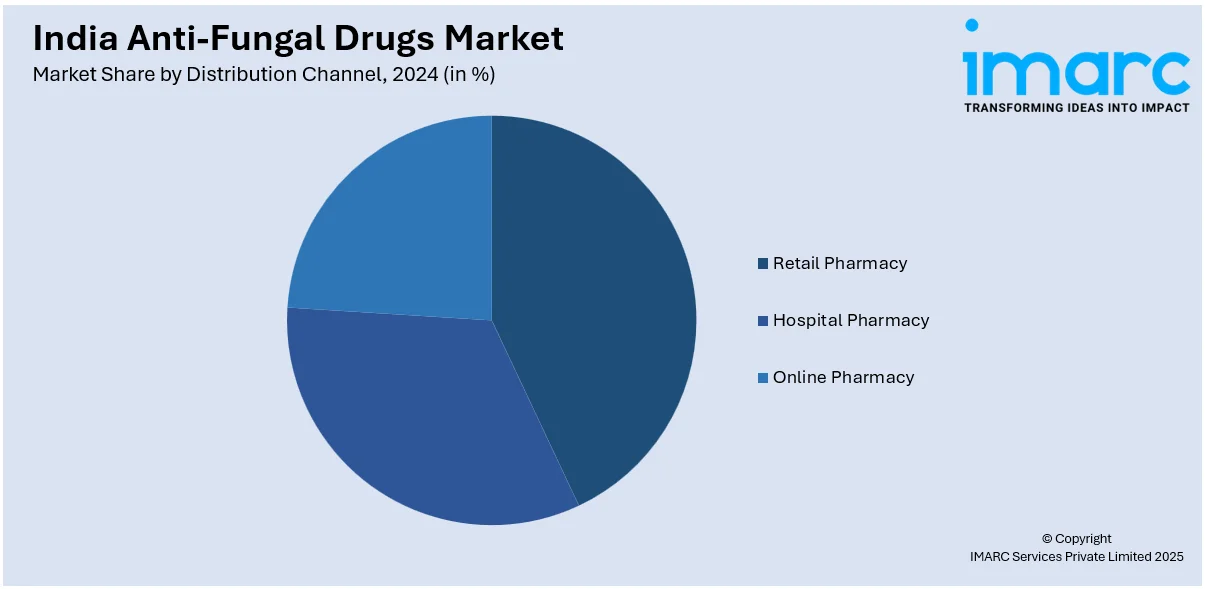

Distribution Channel Insights:

- Retail Pharmacy

- Hospital Pharmacy

- Online Pharmacy

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacy, hospital pharmacy, and online pharmacy.

End User Insights:

- Homecare

- Hospitals and Clinics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes homecare, hospitals and clinics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Anti-Fungal Drugs Market News:

- In August 2024, a group of researchers from Agharkar Research Institute, an independent establishment under the Indian Department of Science & Technology (DST), utilized a chitin synthesis fungicide, Nikkomycin, derived from the bacterium Streptomyces spp. to create Nikkomycin-loaded polymeric nanoparticles. The nanoparticles loaded with drugs were shown to hinder the development of Aspergillus spp and proved effective against the fungal disease Aspergillosis caused by the fungi Aspergillus flavus and Aspergillus fumigatus.

- In September 2023, BDR Pharmaceutical revealed the introduction of Zisavel capsules to treat invasive aspergillosis and mucormycosis, two types of fungal infections. This drug, categorized as an azole antifungal, was available at a third of the cost of the existing treatment supplied by the original manufacturers in India.

India Anti-Fungal Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Azoles, Echinocandins, Polyenes, Allylamines, Others |

| Indications Covered | Candidiasis, Aspergillosis, Dermatophytosis, Mucormycosis, Others |

| Infection Types Covered | Superficial Fungal Infection, Systemic Fungal Infection |

| Route of Administrations Covered | Parenteral, Topical, Oral, Others |

| Distribution Channels Covered | Retail Pharmacy, Hospital Pharmacy, Online Pharmacy |

| End Users Covered | Homecare, Hospitals and Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India anti-fungal drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India anti-fungal drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India anti-fungal drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anti-fungal drugs market in India was valued at USD 509.90 Million in 2024.

The India anti-fungal drugs market is projected to exhibit a CAGR of 3.10% during 2025-2033, reaching a value of USD 671.14 Million by 2033.

Rising cases of fungal infections, growing numbers of immunocompromised patients, drug-resistant strains, better healthcare access, and new treatment combinations drive India’s anti-fungal drugs market. COVID-19 also raised awareness of secondary infections, boosting demand for effective antifungal therapies across hospitals and pharmacies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)