India Anime Market Size, Share, Trends and Forecast by Revenue Source, and Region, 2026-2034

India Anime Market Summary:

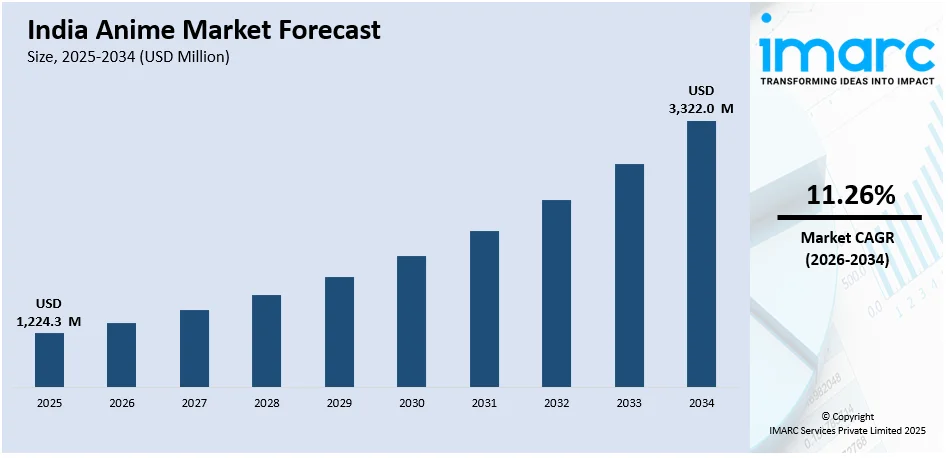

The India anime market size was valued at USD 1,224.27 Million in 2025 and is projected to reach USD 3,322.04 Million by 2034, growing at a compound annual growth rate of 11.26% from 2026-2034.

The India anime market is experiencing robust expansion driven by widespread digital content consumption, deepening cultural resonance among youth demographics, and expanding localization efforts across multiple Indian languages. Streaming platforms, television broadcasters, and live entertainment operators are intensifying investments to capture growing viewership. Proliferation of officially licensed merchandise, theatrical anime releases, and fan-driven community events are further strengthening revenue streams and enhancing India anime market share.

Key Takeaways and Insights:

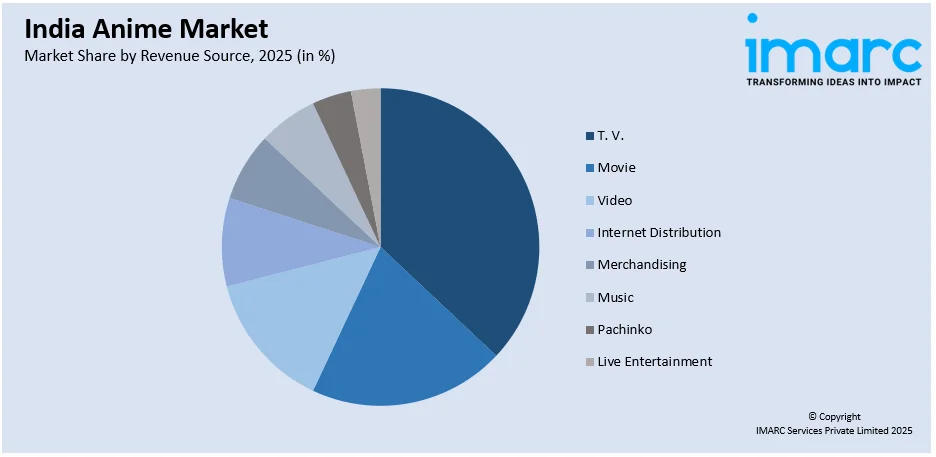

- By Revenue Source: T.V. dominates the market with a share of 28% in 2025, owing to the sustained broadcast presence of anime on dedicated television channels, growing availability of Hindi and regional language dubbed content, and rising advertiser interest in anime programming targeting younger demographics.

- By Region: North India is the largest region with 30% share in 2025, driven by the concentration of metropolitan anime fandom in Delhi-NCR, higher digital content consumption rates, robust e-commerce infrastructure for merchandise distribution, and strong presence of anime-focused community events and conventions.

- Key Players: Key players drive the India anime market by expanding content libraries, securing regional dubbing and licensing rights, investing in merchandise partnerships, and strengthening distribution through both digital streaming and traditional broadcast channels to accelerate fandom growth and ensure consistent content availability across diverse consumer segments.

To get more information on this market Request Sample

The India anime market is advancing rapidly as streaming platforms, broadcasters, and content distributors embrace the growing appetite for Japanese animation across the country. A significant factor shaping this expansion is the deepening penetration of digital content among younger cohorts, which supports sustained engagement across multiple revenue channels including television, streaming, merchandising, and live entertainment. For instance, India has emerged as the second-largest anime viewership market globally, with an estimated 118 Million active viewers across digital and broadcast platforms, according to a report by Economic Times. This positions India just behind China in global rankings and underscores the remarkable reach of anime content. Policy support for creative industries, expansion of regional language dubbing, and the growing integration of anime into mainstream youth culture are contributing to a more favorable environment for market growth. Collaborations between Japanese studios and Indian content platforms, alongside rising fan engagement through conventions and community-driven events, are further reinforcing the commercial viability and cultural relevance of anime across India.

India Anime Market Trends:

Expansion of Regional Language Dubbing and Localization

India is witnessing a significant surge in anime content being localized into Hindi, Tamil, Telugu, and other regional languages, making the genre accessible to audiences beyond English-speaking demographics. The push toward multi-language accessibility is transforming anime from an urban niche into a nationwide entertainment phenomenon, contributing to India anime market growth. Broadcasters and streaming services are expanding their dubbed anime libraries to tap into vernacular-speaking audiences across tier-two and tier-three cities, thereby broadening the consumer base and driving higher engagement rates across diverse linguistic regions.

Rise of Anime-Themed Live Events and Community Engagement

Fan-driven conventions and anime-focused events are expanding rapidly across Indian cities, reflecting the genre's deepening cultural footprint. These gatherings are evolving into commercial ecosystems bridging fan engagement with brand activations and merchandise sales. Pop culture conventions are increasingly incorporating dedicated anime segments featuring cosplay competitions, artist showcases, and exclusive merchandise launches. The expansion of such events beyond metropolitan centers into emerging cities is creating new touchpoints for audience engagement and revenue generation within the broader anime entertainment value chain.

Growing Integration of Anime into Mainstream Theatrical Releases

Anime films are increasingly securing wide theatrical distribution in India with multi-language dubbing, marking a shift from niche screenings to mainstream cinema presence. The frequency and scale of anime theatrical releases underscore the genre's transition into a recognized pillar of Indian entertainment consumption. Distributors are leveraging premium large-format screens and regional language premieres to attract broader audiences beyond traditional anime fans, positioning animated feature films as viable commercial offerings alongside mainstream domestic and international cinema releases.

Market Outlook 2026-2034:

The India anime market is poised for sustained advancement, supported by expanding digital infrastructure, growing multilingual content availability, and increasing institutional investments from both Japanese studios and Indian platforms. The market generated a revenue of USD 1,224.27 Million in 2025 and is projected to reach a revenue of USD 3,322.04 Million by 2034, growing at a compound annual growth rate of 11.26% from 2026-2034. Deepening collaborations between global anime producers and Indian streaming services are enabling simulcast models and exclusive content delivery that drive subscriber acquisition. The expansion of anime into television, cinema, merchandising, and live entertainment verticals is diversifying revenue streams and building a self-sustaining ecosystem. Rising youth engagement, proliferation of fan communities, and the maturation of licensed merchandise channels are expected to create long-term commercial opportunities, positioning India as one of the most dynamic anime markets in the Asia-Pacific region.

India Anime Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Revenue Source |

T.V. |

28% |

|

Region |

North India |

30% |

Revenue Source Insights:

Access the comprehensive market breakdown Request Sample

- T. V.

- Movie

- Video

- Internet Distribution

- Merchandising

- Music

- Pachinko

- Live Entertainment

T.V. dominates with a market share of 28% of the total India anime market in 2025.

Television continues to serve as a foundational revenue pillar in India's anime ecosystem, anchored by the increasing number of channels dedicating programming slots to dubbed anime content. The proliferation of Hindi and regional language broadcasts on networks has broadened anime's reach beyond digitally connected urban audiences to mainstream television households across the country. In August 2025, Dish TV India launched Anime Top Active, a dedicated anime channel in collaboration with Crunchyroll, offering popular titles in Hindi and Tamil at an affordable daily rate of INR 1.67 plus GST, expanding anime accessibility through traditional broadcast infrastructure.

The television segment benefits from sustained advertiser interest as anime programming consistently attracts younger demographics that represent a high-value audience cohort for consumer brands. Free-to-air and direct-to-home platforms are expanding their anime libraries with structured broadcast schedules, seasonal content rotations, and exclusive premiere windows that drive viewership loyalty. The India government's National Centre of Excellence for Animation, Visual Effects, Gaming, and Comics, approved by the Cabinet in September 2024, is further expected to strengthen the domestic animation infrastructure and boost the quality and volume of anime content available on Indian television networks.

Regional Insights:

- South India

- North India

- West & Central India

- East India

North India leads the India anime market with a share of 30% in 2025.

North India commands the largest share of the country's anime market, driven by the concentration of digitally active youth populations across its major metropolitan areas and surrounding urban corridors who represent core anime consumption demographics. The region benefits from robust e-commerce infrastructure that facilitates merchandise distribution and a thriving pop culture events circuit. Prominent fan conventions and community-driven gatherings continue to serve as vital physical marketplaces for anime engagement, brand activations, and licensed merchandise sales, reinforcing the commercial ecosystem around Japanese animation content.

High internet penetration rates and substantial digital content consumption throughout the region's urban and tier-two cities further solidify North India's supremacy. The popularity of smartphones among younger audiences and dense urban connectivity have established a solid basis for anime streaming. Given that Hindi is the major language spoken in the area, the availability of anime in Hindi makes North India an ideal location for watching and streaming anime, buying items, and participating in fan-driven events. The anime fan base is growing across the region's various consumer categories thanks to increased exposure via social media platforms and digital recommendation engines.

Market Dynamics:

Growth Drivers:

Why is the India Anime Market Growing?

Proliferation of Digital Streaming Platforms and Content Accessibility

The rapid growth of digital streaming providers that are vying to create extensive anime collections is driving significant momentum in India's anime business. In order to optimize audience reach throughout India's linguistically diverse population, both local and international providers are actively compiling huge anime collections with regional language dubbing and subtitling. The addressable audience for anime programming is immediately growing beyond typical English-speaking metropolitan customers due to the growing rivalry among streaming platforms, opening up new growth avenues beyond vernacular-speaking audiences. Accessibility across digital and traditional broadcast media is also being expanded with the introduction of specialized anime channels and supplementary streaming services. A comprehensive content ecosystem that promotes subscriber acquisition and lengthens viewing hours is being created via the simultaneous release of simulcast episodes, back-catalog classics, and exclusive original anime content across several platforms.

Expanding Youth Demographics and Rising Internet Penetration

India's youthful demographics and quickly growing internet connectivity are laying a strong basis for the expansion of the anime business. Because of the country's favorable median age, a large demographic group is naturally drawn to anime programming, which appeals to younger people due to its varied storytelling, variety of genres, and eye-catching visuals. Anime may now be watched on personal devices at any time and from any location because to the democratization of digital entertainment in urban, semi-urban, and increasingly rural markets brought about by rising smartphone ownership and reasonably priced mobile connectivity. Anime's shift from niche entertainment to mainstream media consumption is being accelerated by this growing digital infrastructure. Affordable connectivity, rising digital literacy, and a young population that is open to new cultures are all coming together to give content producers and distributors previously unheard-of chances. Fan communities on popular video-sharing and social media platforms, social media amplification, and the production of anime-related content are all contributing to increased audience engagement and discovery.

Growing Institutional Investments and Cross-Border Collaborations

The structural basis of the Indian anime ecosystem is being strengthened by institutional investments from both Indian entertainment corporations and Japanese studios. Recognizing India as a critical growth market, international anime producers are investing in talent development programs, localized content creation, and license agreements. These investments involve enhancing the quality of localized content accessible to Indian audiences through a variety of revenue channels, developing new production capabilities, and growing distribution networks. Furthermore, it is anticipated that cross-border partnerships between well-known Japanese animation studios and Indian media firms will spur additional funding, draw in regional creative talent for the anime production process, and strengthen the incorporation of anime content into India's larger media and entertainment scene. Through specialized centers of excellence, skill-development initiatives, and supportive legislative frameworks, the government is bolstering private-sector investments in the animation and creative sectors and establishing sustainable growth avenues.

Market Restraints:

What Challenges the India Anime Market is Facing?

Widespread Content Piracy and Unauthorized Distribution

Since illegal streaming websites and social media platforms disseminate copyrighted anime content without license agreements, widespread piracy continues to erode the commercial potential of the Indian anime sector. Even while anime piracy networks have been the target of enforcement efforts through court injunctions, new mirror sites are still popping up quickly. This ongoing infringement reduces the value of content owners' licenses, undermines subscription income for reputable platforms, and deters investment in high-end localization and dubbing initiatives throughout the Indian market.

Limited Awareness and Cultural Resistance in Non-Urban Markets

While anime has achieved mainstream acceptance in metropolitan areas, awareness and cultural receptivity remain limited in tier-three cities and rural regions. Traditional entertainment preferences, language barriers in areas where regional dubbing remains insufficient, and limited exposure to anime-related marketing reduce the genre's penetration outside established urban fandom centers. Overcoming these adoption barriers requires sustained investment in vernacular content, grassroots community building, and targeted outreach strategies that have yet to achieve adequate scale across the country.

Fragmented Licensing and Distribution Ecosystem

The complexity of anime licensing in India, involving multiple intermediaries between Japanese rights holders and Indian distributors, creates content availability gaps and geographic restrictions that frustrate consumers. Different platforms hold rights to different seasons or titles, leading to fragmented viewing experiences. This inconsistency in content availability, combined with delayed release windows compared to other markets, drives audiences toward unauthorized channels and limits the ability of legitimate platforms to build comprehensive subscriber loyalty.

Competitive Landscape:

As international streaming services, television networks, and goods distributors increase their footprint in an effort to draw in more viewers, the Indian anime business is become more competitive. To attract a variety of consumer categories, industry participants are concentrating on obtaining exclusive licensing agreements, growing regional language dubbing catalogs, and investing in specialized marketing methods. Investments in dedicated anime channels, fan interaction on social media and at conventions, and strategic alliances with Japanese studios for co-production and localization of material all contribute to increased competition. Innovation in content delivery and product offers is being stimulated by the rise of anime platforms and merchandise channels tailored to India. The competition among distribution channels is getting more intense as direct-to-home operators enter the market with specialized anime value-added offerings. In order to increase audience loyalty, diversify revenue streams, and profit from the nation's shift from a fringe anime fanbase to a mainstream entertainment sector, market participants are constantly improving their techniques.

Recent Developments:

- In June 2025, the first fully licensed anime merchandise site in India, Anime Originals, was introduced by AnimationXpress and offers a variety of authenticated goods, such as clothing, accessories, cosplay kits, and limited-edition collectibles. To cater to the nation's quickly growing anime fans, the platform incorporates creative collaborations, fan art competitions, and exclusive collector benefits.

India Anime Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Revenue Sources Covered | T.V., Movie, Video, Internet Distribution, Merchandising, Music, Pachinko, Live Entertainment |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India anime market size was valued at USD 1,224.27 Million in 2025.

The India anime market is expected to grow at a compound annual growth rate of 11.26% from 2026-2034 to reach USD 3,322.04 Million by 2034.

T.V. dominated the market with a share of 28%, driven by the expanding availability of Hindi and regional language dubbed anime across major television networks, growing advertiser interest in youth-focused anime programming, and increasing direct-to-home anime channel offerings.

Key factors driving the India anime market include proliferation of digital streaming platforms, expanding regional language dubbing, rising youth demographics with high internet penetration, growing institutional investments from Japanese studios, and increasing fan engagement through conventions and merchandise channels.

Major challenges include widespread content piracy through unauthorized streaming platforms, limited awareness in non-urban markets, fragmented licensing and distribution ecosystem, cultural resistance in certain demographics, and content availability gaps due to complex rights negotiations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)