India Amino Acids Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2025-2033

India Amino Acids Market Overview:

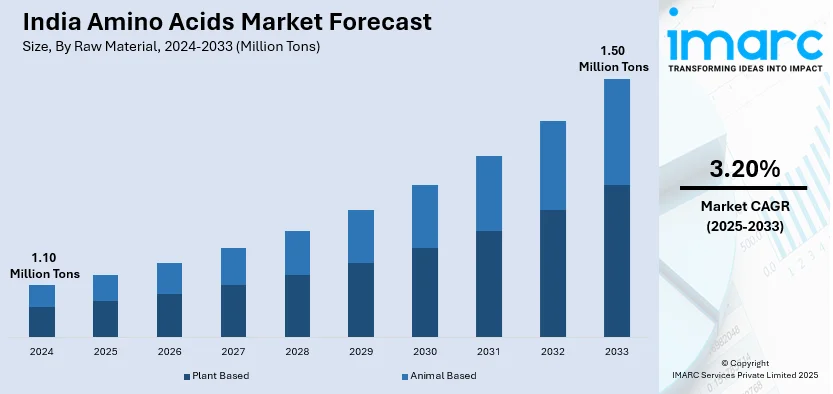

The India amino acids market size reached 1.10 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 1.50 Million Tons by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The increasing demand for dietary supplements, expanding livestock and poultry industries, rising consumer awareness about health and wellness, advancements in amino acid production technologies, and government support for biotechnology enhancing domestic production capabilities are contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.10 Million Tons |

| Market Forecast in 2033 | 1.50 Million Tons |

| Market Growth Rate 2025-2033 | 3.20% |

India Amino Acids Market Trends:

Rising Demand for Amino Acids in Animal Feed

India’s livestock industry is expanding rapidly, driving the demand for amino acids, which play a crucial role in enhancing animal nutrition. India is one of the world’s largest producers of milk and poultry meat. The India poultry industry is projected to grow at a CAGR of 12.60% during 2025-2033, leading to increased use of amino acids, such as lysine, methionine, and threonine, in animal feed. In line with this, farmers are increasingly adopting nutritionally balanced feed to enhance livestock productivity and ensure better meat and dairy quality. The surging demand for lysine and methionine in animal feed is acting as another significant growth-inducing factor. Moreover, supportive government programs, like the National Livestock Mission and the Rashtriya Gokul Mission, promoting better animal health are bolstering the adoption of amino acid-enriched feed formulations. With India's growing meat consumption and dairy exports, the amino acids market in animal nutrition is expected to expand significantly.

To get more information on this market, Request Sample

Expanding Use of Amino Acids in Pharmaceuticals and Nutraceuticals

The rising consumer awareness of health and wellness is fueling the demand for amino acids in the pharmaceutical and nutraceutical sectors. The India dietary supplement market is expected to reach $557.7 Billion by 2033, growing at a CAGR of 12.82%. Essential amino acids, like glutamine, arginine, and leucine, are key ingredients in sports nutrition and wellness supplements. Amino acids are widely used in drug formulations, especially for treating liver disorders, metabolic diseases, and neurological conditions. The flourishing expansion of the Indian pharmaceutical market, reaching USD 174.31 Billion by 2033, is boosting amino acid demand. In confluence with this, the adoption of plant-based protein sources is increasing in India, leading to a surge in amino acid-based vegan protein formulations. Plant-derived amino acids are gaining traction among health-conscious consumers and vegetarians. These trends highlight the critical role of amino acids in health, wellness, and medical applications, significantly driving market expansion.

India Amino Acids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, raw material, and application.

Type Insights:

- Glutamic Acids

- Lysine

- Methionine

- Threonine

- Phenylalanine

- Tryptophan

- Citrulline

- Glycine

- Glutamine

- Creatine

- Arginine

- Valine

- Leucine

- Iso-Leucine

- Proline

- Serine

- Tyrosine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes glutamic acids, lysine, methionine, threonine, phenylalanine, tryptophan, citrulline, glycine, glutamine, creatine, arginine, valine, leucine, iso-leucine, proline, serine, tyrosine, and others.

Raw Material Insights:

- Plant Based

- Animal Based

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes plant based and animal based.

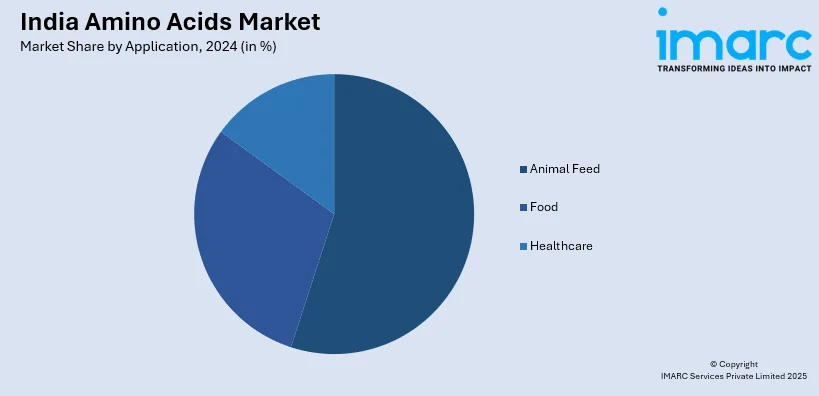

Application Insights:

- Animal Feed

- Food

- Healthcare

The report has provided a detailed breakup and analysis of the market based on the application. This includes animal feed, food, and healthcare.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Amino Acids Market News:

- October 2024: Protyze introduced Nitro Clear Whey Protein to improve performance. Branched-chain amino acids (BCAAs), creatine monohydrate, and glutamine are all included in the protein, which helps to preserve and recover muscle. It is manufactured at Protyze's cutting-edge research and development center, assuring high-quality standards. The protein comes in three flavors and is devoid of gums and thickeners, ensuring quick absorption and digestion.

- July 2024: Alpino Health Foods launched India's first-ever protein powder made entirely from peanuts, revolutionizing the health industry. Developed in the Netherlands, each scoop delivers 24 grams of premium-quality protein along with 5.1 grams of branched-chain amino acids (BCAAs). Crafted using only natural ingredients, it is free from artificial colors, flavors, preservatives, and sweeteners.

India Amino Acids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Glutamic Acids, Lysine, Methionine, Threonine, Phenylalanine, Tryptophan, Citrulline, Glycine, Glutamine, Creatine, Arginine, Valine, Leucine, Iso-Leucine, Proline, Serine, Tyrosine, Others |

| Raw Materials Covered | Plant Based, Animal Based |

| Applications Covered | Animal Feed, Food, Healthcare |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India amino acids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India amino acids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India amino acids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India amino acids market size reached 1.10 Million Tons in 2024.

The India amino acids market is projected to exhibit a CAGR of 3.20% during 2025-2033, reaching a volume of 1.50 Million Tons by 2033.

The India amino acids market is driven by increasing health consciousness, rising demand for dietary supplements, and expanding applications in pharmaceuticals, nutraceuticals, and animal feed. Advancements in production technologies, such as fermentation and plant-based methods, enhance sustainability and cost-effectiveness. Government support for biotechnology and infrastructure development further accelerates market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)