India Ambulatory Surgical Centers Market Size, Share, Trends and Forecast by Type, Application, Ownership, Specialty Type, and Region, 2025-2033

India Ambulatory Surgical Centers Market Overview:

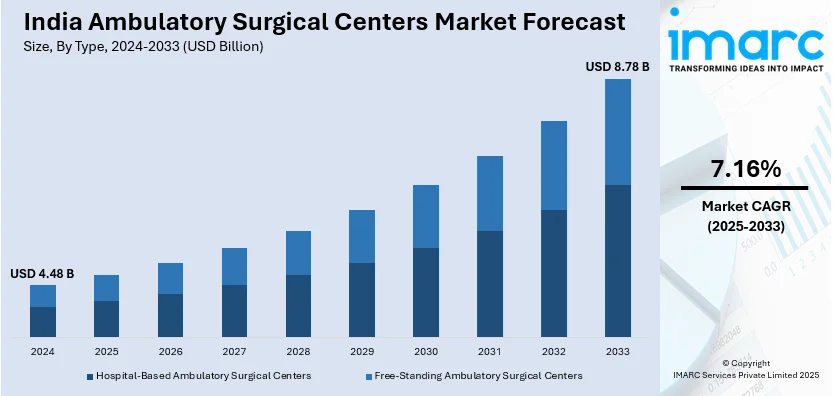

The India ambulatory surgical centers market size reached USD 4.48 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.78 Billion by 2033, exhibiting a growth rate (CAGR) of 7.16% during 2025-2033. The growing demand for cost-effective healthcare solutions, rising surgical procedures, increasing preference for outpatient services, advancements in medical technology, and government initiatives promoting healthcare infrastructure, along with a growing population and higher awareness of healthcare options, are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.48 Billion |

| Market Forecast in 2033 | USD 8.78 Billion |

| Market Growth Rate (2025-2033) | 7.16% |

India Ambulatory Surgical Centers Market Trends:

Growing Demand for Healthcare Services for the Elderly

Chronic illnesses are becoming more prevalent among India's elderly, with major variations between rural and urban locations. Hypertension and diabetes are the most frequent chronic disorders affecting the elderly. This increased healthcare need is propelling the growth of ambulatory surgery centers (ASCs) across the country, particularly in metropolitan areas where the senior population is more likely to develop chronic illnesses. ASCs are gaining momentum because they provide cost-effective, efficient, and less invasive treatment choices for older patients seeking outpatient care. As the older population grows, the demand for specialized, accessible healthcare services will drive the expansion of ASCs, boosting overall healthcare infrastructure and patient outcomes. According to industry reports published in 2022, around 21% of India's elderly population is reported to suffer from at least one chronic disease, with significant differences between rural and urban areas. In rural areas, 17% of seniors are affected, while the figure rises to 29% in urban regions. Hypertension and diabetes are the most prevalent chronic conditions, making up roughly 68% of all reported cases.

To get more information on this market, Request Sample

Expansion of Global Medical Tech Centers

The healthcare technology sector in India is witnessing growth as global companies establish specialized capability centers to enhance their services. These centers focus on various medical specialties, including orthopedics, ophthalmology, gastroenterology, pain management, plastic surgery, and ambulatory surgical centers. By integrating advanced technologies such as electronic health records, practice management, and analytics tools, these centers are optimizing healthcare delivery. They support a vast network of healthcare providers, enabling them to streamline operations and improve patient care. This expansion highlights India's growing role as a hub for healthcare innovation and digital solutions, contributing to the efficiency of the medical industry globally. The sector is expected to continue evolving, supporting both domestic and international healthcare needs. For instance, in March 2024, ModMed, a US-based company offering cloud solutions for various medical specialties, launched its first Global Capability Center (GCC) in Hyderabad, India. The center focuses on specialties including orthopedics, ophthalmology, gastroenterology, pain management, plastic surgery, and ambulatory surgery centers. ModMed provides electronic health records, practice management, and analytics tools and supports over 35,000 providers.

India Ambulatory Surgical Centers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, ownership, and specialty type.

Type Insights:

- Hospital-Based Ambulatory Surgical Centers

- Free-Standing Ambulatory Surgical Centers

The report has provided a detailed breakup and analysis of the market based on the type. This includes hospital-based ambulatory surgical centers and free-standing ambulatory surgical centers.

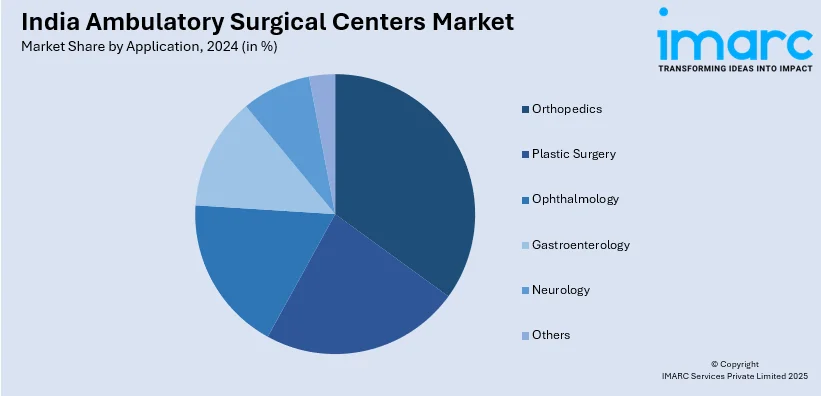

Application Insights:

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Gastroenterology

- Neurology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes orthopedics, plastic surgery, ophthalmology, gastroenterology, neurology, and others.

Ownership Insights:

- Physician Only

- Hospital Only

- Corporation Only

- Physician and Hospital

- Physician and Corporation

- Hospital and Corporation

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes physician only, hospital only, corporation only, physician and hospital, physician and corporation, and hospital and corporation.

Specialty Type Insights:

- Single

- Multispecialty

A detailed breakup and analysis of the market based on the specialty type have also been provided in the report. This includes single and multispecialty.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ambulatory Surgical Centers Market News:

- In March 2025, Narayana Health, W Health Ventures, and 2070 Health launched Everhope Oncology with a USD 10 Million seed investment to address India's rising cancer burden. The initiative would establish state-of-the-art medical and surgical cancer care centers in Delhi and Mumbai, expanding to 10 cities in three years. It aims to provide comprehensive cancer care, including chemotherapy, surgery, and palliative services, in a patient-friendly environment, aiming to reduce wait times and improve patient outcomes.

India Ambulatory Surgical Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hospital-Based Ambulatory Surgical Centers, Free-Standing Ambulatory Surgical Centers |

| Applications Covered | Orthopedics, Plastic Surgery, Ophthalmology, Gastroenterology, Neurology, Others |

| Ownerships Covered | Physician Only, Hospital Only, Corporation Only, Physician and Hospital, Physician and Corporation, Hospital and Corporation |

| Specialty Types Covered | Single, Multispecialty |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ambulatory surgical centers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ambulatory surgical centers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ambulatory surgical centers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ambulatory surgical centers market in India was valued at USD 4.48 Billion in 2024.

The India ambulatory surgical centers market is projected to exhibit a CAGR of 7.16% during 2025-2033, reaching a value of USD 8.78 Billion by 2033.

The growth of the India ambulatory surgical centers market is driven by rising demand for cost-effective, same-day surgical procedures and increasing patient preference for minimally invasive treatments. Improved healthcare infrastructure, advancements in surgical technology, and supportive government policies are encouraging private investments. An expanding middle-class segment with greater disposable income is further driving the growth of outpatient facilities in both urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)