India Ambulance Services Market Size, Share, Trends and Forecast by Transport Vehicle, Emergency Services, Equipment, and Region, 2025-2033

India Ambulance Services Market Overview:

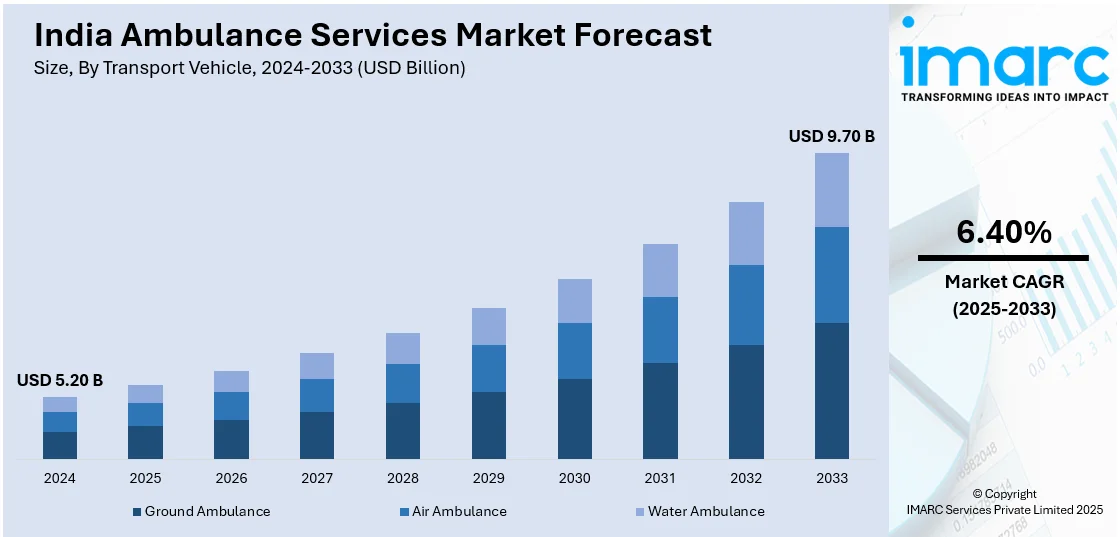

The India ambulance services market size reached USD 5.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.70 Billion by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033. The rising emergency medical needs, increasing road accidents, growing demand for advanced life support (ALS) and air ambulance services, technological advancements in ambulance equipment, and government initiatives to improve emergency response systems are contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.20 Billion |

| Market Forecast in 2033 | USD 9.70 Billion |

| Market Growth Rate 2025-2033 | 6.40% |

India Ambulance Services Market Trends:

Rising Prevalence of Chronic Diseases

India is experiencing a sharp rise in chronic non-communicable diseases (NCDs), such as cardiovascular diseases, diabetes, and respiratory disorders, driving the demand for efficient ambulance services. Cardiovascular diseases account for nearly one-fourth of all deaths in the country, with conditions like heart attacks requiring rapid emergency response and immediate hospital transport. Diabetes is another major health concern, with around 77 million cases currently reported—expected to surge to 134 million by 2045. Diabetes-related complications often necessitate urgent medical attention, increasing the reliance on ambulance services. Additionally, NCDs contribute to 53% of all deaths and 44% of disability-adjusted life years lost in India, underscoring the critical need for timely medical interventions. With the growing burden of chronic illnesses, strengthening ambulance infrastructure is essential for ensuring swift emergency care, improving patient outcomes, and enhancing India’s healthcare system.

To get more information on this market, Request Sample

Increasing Number of Road Accidents

India is witnessing a significant rise in road accidents, leading to an increased demand for immediate medical support and ambulance services. According to the National Crime Records Bureau (NCRB), the total number of reported road accident cases surged from 354,796 in 2020 to 403,116 in 2021, highlighting the growing risks on Indian roads. Two-wheelers remain the most vulnerable category, accounting for 69,240 fatalities in 2021, which contributed to 44.5% of all road accident-related deaths. With urbanization, increasing vehicle density, and inadequate road safety measures, the likelihood of accidents has risen sharply. This escalating crisis underscores the urgent need for well-equipped and responsive ambulance services to ensure timely medical interventions, minimize fatalities, and enhance survival rates. Advanced emergency response infrastructure, including GPS-enabled ambulances and paramedic-equipped vehicles, can significantly improve accident victims' chances of receiving life-saving treatment in the crucial hour. As India continues to develop its road networks, investing in ambulance services remains a critical step in strengthening emergency healthcare and reducing the growing toll of road accidents.

India Ambulance Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on transport vehicle, emergency services, equipment, and region.

Transport Vehicle Insights:

- Ground Ambulance

- Air Ambulance

- Water Ambulance

The report has provided a detailed breakup and analysis of the market based on the transport vehicle. This includes ground ambulance, air ambulance, and water ambulance.

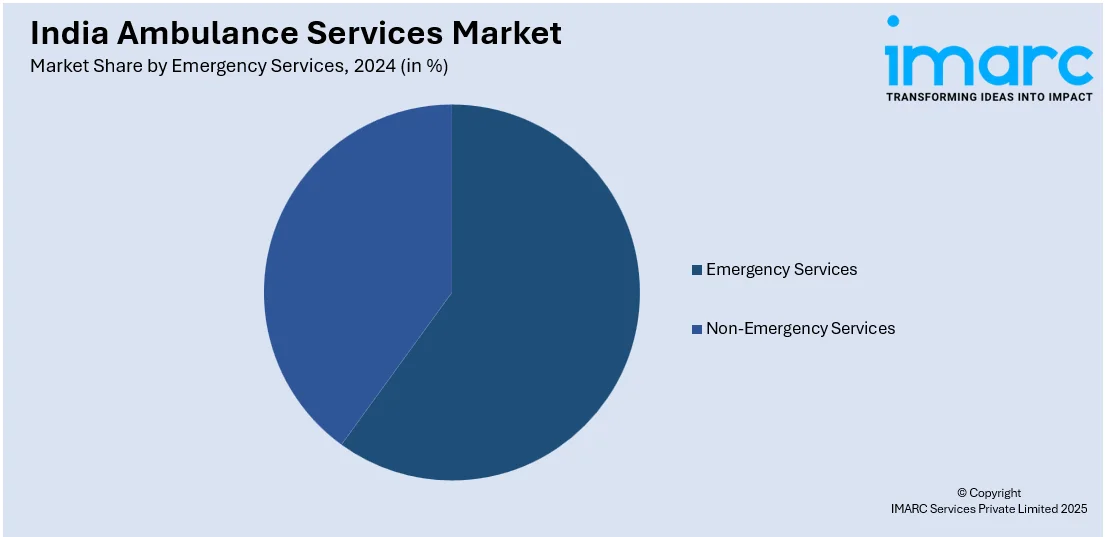

Emergency Services Insights:

- Emergency Services

- Non-Emergency Services

A detailed breakup and analysis of the market based on the emergency services have also been provided in the report. This includes emergency services and non-emergency services.

Equipment Insights:

- Advance Life Support Ambulance Services (ALS)

- Basic Life Support Ambulance Services (BLS)

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes advance life support ambulance services (ALS) and basic life support ambulance services (BLS).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ambulance Services Market News:

- March 2025: Blinkit, a quick-commerce business, announced that it would introduce a 10-minute ambulance service in Gurugram, India, with intentions to extend to additional cities over the next two years. The service will include medical equipment such as oxygen cylinders, AEDs, stretchers, monitors, suction machines, emergency medications, and injections. The ambulances will have a paramedic, an assistant, and a trained driver.

- March 2025: Zenzo, an emergency response service provider, developed a network of 25,000 private ambulances across 450 cities in India, with ambulance response times of less than 15 minutes each. The organization has collaborated with key delivery platforms like Zomato to raise awareness of emergency response, medical first aid, and CPR training

- January 2025: Pinnacle Industries introduced three new ambulances at BMGE 2025: AD-Gen Ultra, AD-Gen ambulance, and Neonatal ambulance. The AD-Gen Ultra features 5G connectivity, a 360-degree video system, and an antibacterial floor. The AD-Gen ambulance is affordable with a mobile data terminal, while the neonatal ambulance is designed for newborn care with essential medical equipment.

India Ambulance Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transport Vehicles Covered | Ground Ambulance, Air Ambulance, Water Ambulance |

| Emergency Services Covered | Emergency Services, Non-Emergency Services |

| Equipments Covered | Advance Life Support Ambulance Services (ALS), Basic Life Support Ambulance Services (BLS) |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ambulance services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ambulance services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ambulance services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ambulance services market in India was valued at USD 5.20 Billion in 2024.

The India ambulance services market is projected to exhibit a CAGR of 6.40% during 2025-2033, reaching a value of USD 9.70 Billion by 2033.

The India ambulance services market is driven by increasing healthcare demands, rising awareness about emergency medical services, and the growing prevalence of chronic diseases. Additionally, advancements in healthcare infrastructure, government support for medical transportation, and a shift toward private healthcare providers are contributing to the expansion of ambulance services across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)