India Aluminum Extrusion Market Size, Share, Trends and Forecast by Product Type, Alloy Type, End Use Industry, and Region, 2025-2033

India Aluminum Extrusion Market Size and Share:

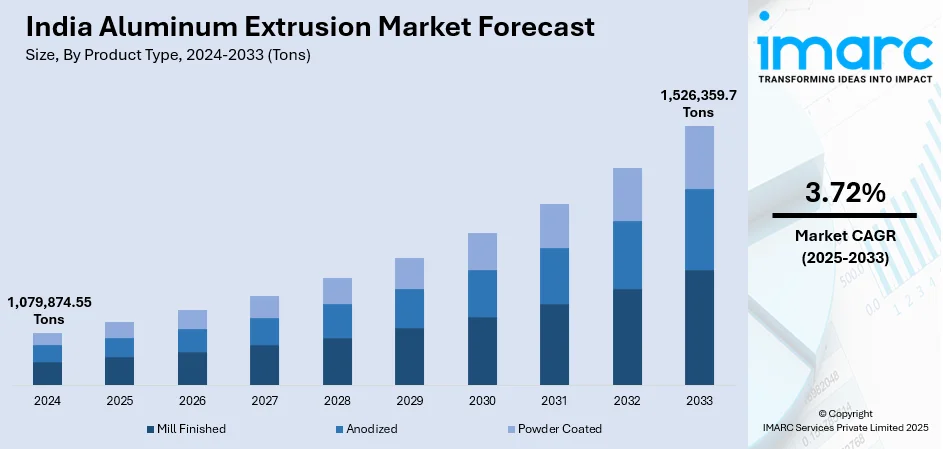

The India aluminum extrusion market size reached a volume of 1,079,874.55 Tons in 2024. The market is expected to reach a volume of 1,526,359.7 Tons by 2033, exhibiting a growth rate (CAGR) of 3.72% during 2025-2033. The market growth is attributed to the rising infrastructure development, rapid urbanization, growth in the automotive and transportation sectors, increasing demand from electrical and consumer goods industries, and the shift toward lightweight, sustainable materials.

Market Insights:

- On the basis of region, the market is divided into North India, West and Central India, South India, and East India.

- Based on the product type, the market is categorized as mill finished, anodized, and powder coated.

- On the basis of the alloy type, the market is segmented into 1000 series aluminum alloy, 2000 series aluminum alloy, 3000 series aluminum alloy, 5000 series aluminum alloy, 6000 series aluminum alloy, and 7000 series aluminum alloy.

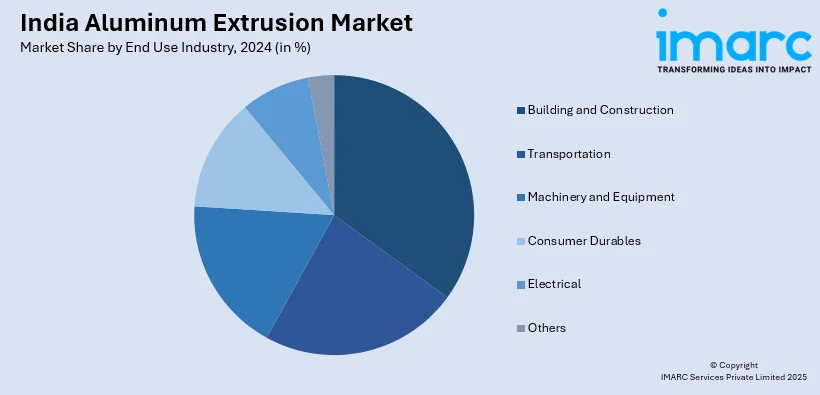

- Based on the end use industry, the market is categorized as building and construction, transportation, machinery and equipment, consumer durables, electrical, and others.

Market Size and Forecast:

- 2024 Market Size: 1,079,874.55 Tons

- 2033 Projected Market Size: 1,526,359.7 Tons

- CAGR (2025-2033): 3.72%

Aluminum extrusion assists in transforming aluminum alloy bars into a determined shape by forcing them through a cross-sectional die. Extruded aluminum is lightweight, cost-efficient and offers high electrical and thermal conductivity. Consequently, it is widely utilized in the construction, transportation and material and equipment industries across India.

To get more information on this market, Request Sample

The market is primarily driven by the extensive utilization of aluminum extrusion in the production of motor vehicles in India. Apart from this, the leading manufacturers are focusing on the manufacturing of lightweight cars to maintain fuel economy. They are substituting steel for aluminum without compromising on the design and size, which is positively influencing the India aluminum extrusion market growth. Furthermore, the sudden outbreak of the coronavirus disease (COVID-19) and lockdown restrictions imposed by the Government of India have slowed down production in various manufacturing units. The aluminum extrusion market will experience growth once lockdown restrictions are relaxed in the country. Moreover, the burgeoning real estate and manufacturing sectors are anticipated to enhance the demand for extruded aluminum in the coming years.

India Aluminum Extrusion Market Trends:

Rising Demand from Construction and Infrastructure Development

The market is experiencing tremendous growth due to increasing demand from the construction and infrastructure sectors. With fast-paced urbanization, government plans such as Smart Cities Mission, and huge investments in metro rail, airports, and housing development schemes, aluminum extrusions are gaining popularity for windows, doors, curtain walls, roofing, and structural elements. Their strength-to-weight ratio, durability, resistance to corrosion, and flexibility of design make them perfect for contemporary applications in architecture. Furthermore, the increasing popularity of energy-efficient building materials in line with the country's sustainable agenda further increases extrusion applications in green buildings. This, in turn, is augmenting the India aluminum extrusion market share. Aluminum can be recycled without deterioration of quality, further increasing its popularity in environmentally friendly projects. In addition, the move towards modular building and prefabricated systems is driving demand increasingly, as extrusions offer standardized, yet tailor-made solutions with shorter construction times. All these put together create construction and infrastructure as one of the most robust growth drivers for the market.

Expanding Applications in the Automotive and Transportation Sector

The automotive and transportation industry is becoming a key driver for the market with growing vehicle production and the increasing use of lightweight materials. As the sector moves towards electric cars (EVs) and fuel-efficient models, aluminum extrusions are being extensively utilized in chassis, body frames, battery housings, roof rails, and heat exchangers owing to their better strength-to-weight ratio. This weight loss directly improves fuel efficiency and increases EV range, supporting India's ambitious goals for clean mobility. Modernization of Indian Railways is also a major driver, with extruded aluminum parts being used to equip metro coaches, passenger trains, and freight wagons to enhance energy efficiency and lower maintenance costs. The government's initiative for electric buses and clean public transport systems is also broadening market opportunities. The need for strong, light, and affordable materials is making aluminum extrusions a top option in India's changing transportation environment.

Growing Adoption of Advanced Manufacturing and Value-Added Products

One of the major trends positively impacting the India aluminum extrusion market outlook is the increased focus on advanced manufacturing techniques and the creation of value-added extrusion products. Firms are spending on cutting-edge technologies like computerized extrusion presses, precision dies, and enhanced surface finishing methods in order to improve product quality, uniformity, and personalization. This paradigm is making it possible to manufacture high-performance extrusions customized for niche industries like aerospace, defense, renewable energy, and electronics. Surface finishes like anodizing, powder coating, and thermal breaks are increasingly being adopted for enhanced corrosion resistance, appearance, and thermal performance to make extrusions fit for high-end use. Furthermore, the advent of Industry 4.0 techniques, such as real-time monitoring of processes and digitalized quality control, is streamlining productivity and minimizing wastage. The growing emphasis on creating sophisticated, complex profiles and manufactured pieces underscores a distinct emphasis away from commodity-grade extrusions towards premium, application-specific solutions, thus revamping the competitive dynamics of the Indian market.

Sustainability, Growth, Opportunities, and Barriers in the India Aluminum Extrusion Market:

- Rise of Sustainable and Eco-Friendly Solutions: Sustainability is becoming a core focus in the India aluminum extrusion market as industries shift toward eco-friendly materials and processes. Aluminum's recyclability, without loss of strength or quality, makes it an attractive choice for reducing carbon footprints in construction, automotive, and packaging applications. Manufacturers are increasingly adopting energy-efficient extrusion processes and utilizing renewable power sources in production to align with India's climate commitments. The push for green buildings, electric vehicles, and circular economy initiatives further reinforces the role of sustainable aluminum extrusions in driving market adoption.

- Market Growth Drivers: The rapid expansion of infrastructure and real estate development is fueling strong demand for aluminum extrusions in India. Rising adoption in automotive and transportation, particularly in electric vehicles and railway modernization, is another major driver. Government policies supporting "Make in India" and renewable energy projects are also stimulating consumption across solar, wind, and power sectors. Additionally, the preference for lightweight, durable, and cost-efficient materials across industries continues to strengthen extrusion demand nationwide.

- Market Opportunities: The growing penetration of electric vehicles offers significant opportunities for aluminum extrusions in battery enclosures, body frames, and structural components. Increasing investment in renewable energy infrastructure, including solar panel frames and wind turbine components, is creating new demand streams. Rising exports of value-added aluminum extrusions to global markets present avenues for India to expand its presence in specialized applications. Moreover, as per the India aluminum extrusion market analysis, technological advancements in surface finishing, fabrication, and digital manufacturing open possibilities for high-performance, customized extrusion solutions.

- Market Challenges: Volatile raw material prices, particularly fluctuations in primary aluminum costs, pose a major challenge for market stability. Intense competition among domestic players and pressure from low-cost imports can impact profitability for manufacturers. Limited adoption of advanced manufacturing technologies in smaller extrusion facilities constrains product innovation and quality standards. Furthermore, regulatory hurdles and the need for continuous investment in sustainable production processes present barriers for long-term industry growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India aluminum extrusion market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, alloy type and end use industry.

Breakup by Product Type:

- Mill Finished

- Anodized

- Powder Coated

Breakup by Alloy Type:

- 1000 Series Aluminum Alloy

- 2000 Series Aluminum Alloy

- 3000 Series Aluminum Alloy

- 5000 Series Aluminum Alloy

- 6000 Series Aluminum Alloy

- 7000 Series Aluminum Alloy

Breakup by End Use Industry:

- Building and Construction

- Transportation

- Machinery and Equipment

- Consumer Durables

- Electrical

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- March 2025: Maan Aluminium Ltd. announced the acquisition of a 13,117-square-metre leasehold property in Devas Industrial Area, Madhya Pradesh, for INR 8.75 Crore, to enhance its aluminium extrusion operations and introduce value-added services. This strategic move follows the installation of a new extrusion press in December 2024, doubling the company's annual production capacity from 12,000 to 24,000 tonnes, and enabling the manufacturing of profiles up to 300 mm across all alloy series from 1000 to 7000. The expansion aims to meet the increasing demand for versatile aluminium profiles in both domestic and international markets.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Segment Coverage | Product Type, Alloy Type, End Use Industry, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The aluminum extrusion market in India reached 1,079,874.55 Tons in 2024.

The aluminum extrusion market in India is projected to exhibit a CAGR of 3.72% during 2025-2033, reaching a volume of 1,526,359.7 Tons by 2033.

The aluminum extrusion market in India is driven by increasing demand from construction, automotive, and industrial sectors. Growth in infrastructure projects, smart cities, and renewable energy initiatives boosts usage. Lightweight, durable, and recyclable properties of aluminum make it ideal for sustainable applications. Rising urbanization, technological advancements, and government support further fuel market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)