India Aluminum Die Casting Market Size, Share, Trends, and Forecast by Process, Application, and Region, 2025-2033

India Aluminum Die Casting Market Overview:

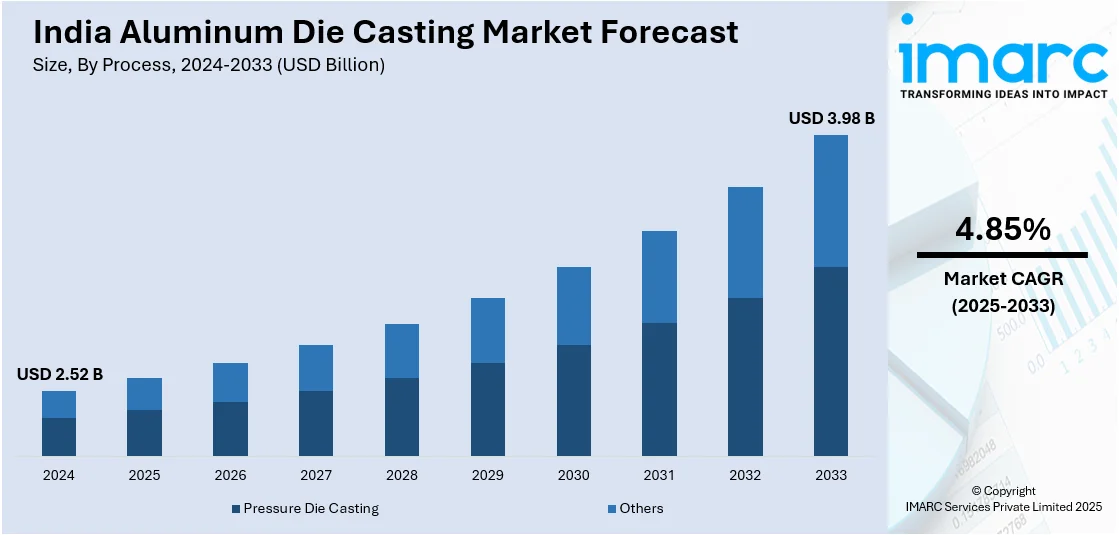

The India aluminum die casting market size reached USD 2.52 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.98 Billion by 2033, exhibiting a growth rate (CAGR) of 4.85% during 2025-2033. The burgeoning expansion of the market is mainly being stimulated by the industrial growth in the automotive, aerospace, and electronics sectors. Further adding to it is the high-pressure die-casting technique and quickly advancing automation, improving production efficiency and accuracy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.52 Billion |

| Market Forecast in 2033 | USD 3.98 Billion |

| Market Growth Rate (2025-2033) | 4.85% |

India Aluminum Die Casting Market Trends:

Surge in Demand from Automotive Industry

The Indian aluminum die casting market is witnessing a significant uptrend on account of burgeoning demand from automobiles for lightweight and sturdy parts. With efficient fuel consumption and sustainability now being the uppermost in major automobile manufacturing organizations, aluminum being lightweight and strong forms the dependence for engine components, transmission parts, and body structure. This is further enhanced by the auto sector's shift toward electric vehicles (EVs), where high-functionality and lightweight components are to build efficiencies in battery operation and range. For instance, as per industry reports, in the first 11 months of 2024, EV sales in India surpassed 1.8 Million units, reflecting a nearly 45% year-on-year increase. Major automobile companies in India are seeking for sophisticated die-casting methods to create intricate and precision-engineered parts, which is driving demand for aluminum die-casting solutions. Moreover, the drive to reduce emissions and meet strict environmental regulations is contributing to higher use of aluminum die-cast components, as they are recyclable and have a lower carbon footprint. This trend is likely to continue growing, as the Indian automotive industry continues to become more modernized and move toward more environmentally friendly manufacturing processes.

To get more information on this market, Request Sample

Technological Advancements in Die Casting Processes

Technological innovations in die casting processes are revolutionizing the Indian aluminum die casting market. For instance, as per industry reports, India currently boasts a 4,400-ton aluminum die-casting machine capable of producing large, high-precision parts, highlighting the country's advanced capabilities in the sector. The changes brought about by advanced techniques of the likes of high-pressure die casting (HPDC), vacuum die casting, and 3D printing are allowing manufacturers to produce more complex, precise, and cost-effective parts. Particularly, HPDC is allowing manufacturers impulsively to produce high-quality components almost free of porosity, which is important in aerospace, automotive, and electronics. Automation and robots are already being applied in die casting, improving production competitiveness through better productivity and reduced labor costs. Additionally, the implementation of computer-aided design (CAD) software and computer-aided engineering (CAE) tools has improved the design and modeling of die-cast components, allowing for much greater precision and performance in production. Such technological improvements faced not only lower production costs but also high-quality production and longevity in the aluminum die-cast products that have continued to spur further market development in India.

India Aluminum Die Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on process and application.

Process Insights:

- Pressure Die Casting

- High Pressure Die Casting

- Low Pressure Die Casting

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes pressure die casting (high pressure die casting and low pressure die casting) and others.

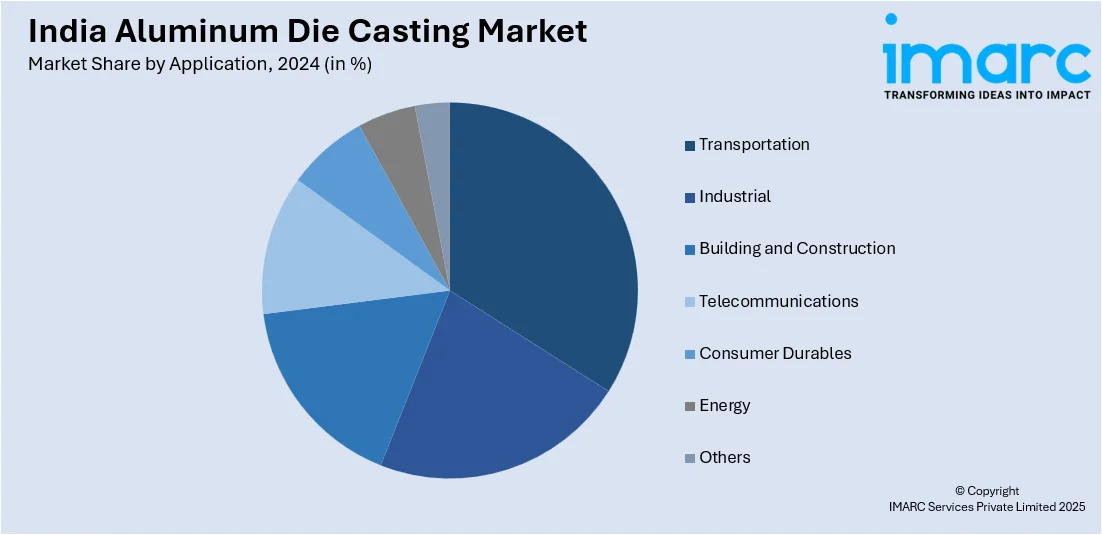

Application Insights:

- Transportation

- General Road Transportation

- Sports Road Transportation

- Heavy Vehicles

- Aerospace and Aviation

- Industrial

- Agriculture Equipment

- Construction Equipment

- Others

- Building and Construction

- Telecommunications

- Consumer Durables

- Energy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transportation (general road transportation, sports road transportation, heavy vehicles and aerospace and aviation), industrial (agriculture equipment, construction equipment and others), building and construction, telecommunications, consumer durables, energy, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aluminum Die Casting Market News:

- In December 2024, Jaya Hind Industries announced the installation of India’s largest 4,400-tonne high-pressure die-casting machine at its Urse plant. This aims to enhance the company’s ability to produce large, complex aluminum parts for electric vehicles, automotive, and heavy-duty applications, improving production efficiency.

India Aluminum Die Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered |

|

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aluminum die casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aluminum die casting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aluminum die casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India aluminum die casting market size reached USD 2.52 Billion in 2024.

The India aluminum die casting market is expected to reach USD 3.98 Billion by 2033, exhibiting a CAGR of 4.85% during 2025-2033.

The market growth is driven by increasing demand from the automotive and aerospace sectors, rising use of lightweight materials for fuel efficiency, advancements in manufacturing technologies, and expanding industrial infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)