India Alcoholic Beverages Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavor, Packaging Type, Distribution Channel, and Region, 2025-2033

India Alcoholic Beverages Market Overview:

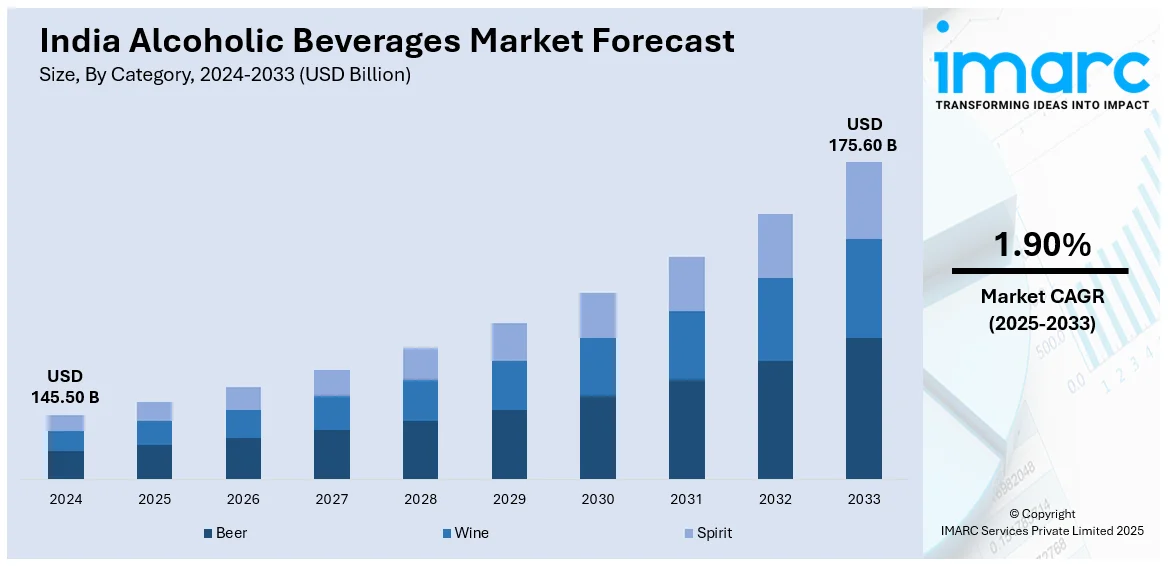

The India alcoholic beverages market size reached USD 145.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 175.60 Billion by 2033, exhibiting a growth rate (CAGR) of 1.90% during 2025-2033. The market is driven by rapid urbanization, changing lifestyles, and the increasing socializing behavior. Moreover, the rise in demand for premium and craft beverages, and growth in bars, restaurants, and e-commerce are further enhancing the India alcoholic beverages market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 145.50 Billion |

| Market Forecast in 2033 | USD 175.60 Billion |

| Market Growth Rate 2025-2033 | 1.90% |

India Alcoholic Beverages Market Trends:

Growing Popularity of Craft and Premium Alcoholic Beverages

The demand for craft and premium alcoholic beverages in India is growing substantially. With urbanization increasing and disposable incomes rising, people are getting more adventurous with the type of alcoholic beverages that they consume. Newer generations, especially millennials and Gen Z, are opting for high-quality, specialty drinks like craft beer, premium wine, and craft spirits. These consumers are more inclined to pay a premium for drinks that provide unique flavors and real experience. Leading brands are responding to changing consumer preferences with innovative product launches and targeted marketing strategies. For instance, in March 2025, United Breweries launched Kingfisher Flavors, featuring Lemon Masala and Mango Berry Twist, targeting affluent Gen Z consumers. The initiative merges Indian street culture with contemporary tastes, focusing on experiential marketing in premium venues. Initial sales are limited to Goa and Daman, with plans for expansion in major cities. Apart from this, the increase in the number of microbreweries, distilleries, and specialty drink makers is adding to the growth of the craft alcohol business. The premiumization trend is also driven by increasing interest in international drinking trends, with consumers seeking global spirits such as single malt whiskies, fine wines, and specialty cocktails. With social drinking evolving, the demand for craft and premium alcoholic drinks is likely to continue rising, particularly in urban centers.

To get more information on this market, Request Sample

Shift Toward Health-Conscious Alcoholic Drinks

Another significant trend influencing the India alcoholic beverages market outlook is the growing demand for health-oriented drinks. As there is greater awareness about health and wellness, Indian consumers are increasingly becoming discerning about the alcoholic drinks they prefer. This has resulted in the popularity of low-alcohol, low-calorie, and sugar-free alcoholic drinks such as light beers, hard seltzers, and organic wines. In line with this, consumers are looking for products that provide functional benefits, including natural ingredients or added vitamins and antioxidants, as part of the overall wellness movement. The trend towards healthier alcoholic beverages is especially prevalent among younger and urban consumers who are more focused on their overall health. Brands are reacting to this trend by innovating and launching products that appeal to this health-oriented consumer segment. With wellness and conscious consumption going mainstream, the market for healthier alcoholic drinks is expected to expand, transforming India’s alcohol market landscape.

Evolving Retail Landscape

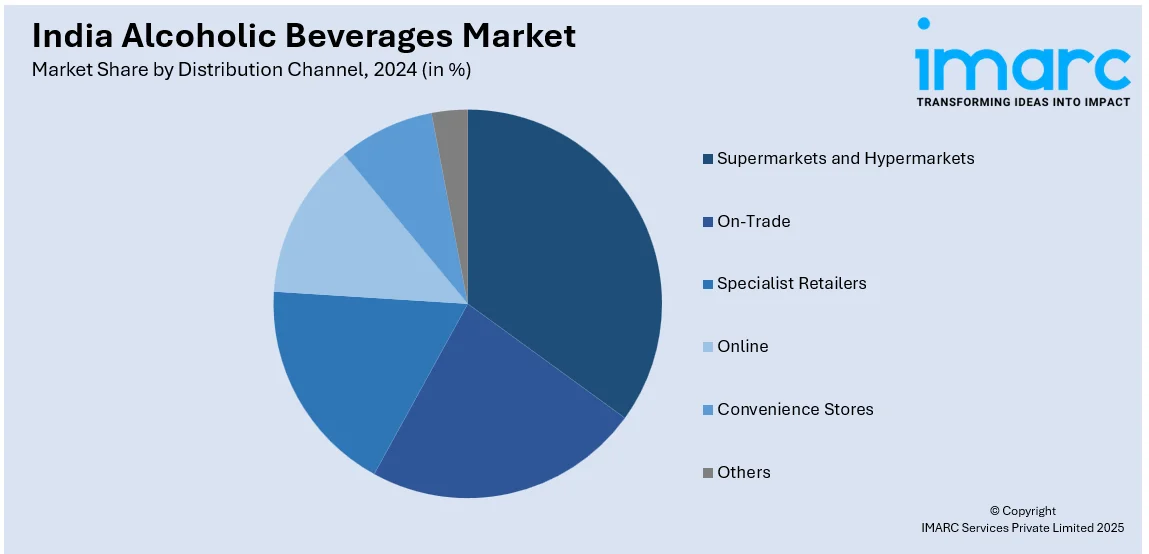

The retail landscape for alcoholic beverages in India is undergoing significant change, driven by the rise of modern trade channels and the gradual liberalization of e-commerce in select states. Supermarkets, hypermarkets, and specialized liquor stores are offering better access to premium brands, enhancing visibility and encouraging impulse purchases. States like Maharashtra, West Bengal, and Odisha have begun allowing home delivery and online ordering, streamlining the purchase experience for consumers. Exclusive brand outlets and tasting rooms are also gaining popularity, especially among urban consumers seeking curated experiences. This shift is encouraging producers to invest in branding, packaging, and digital marketing strategies tailored to organized retail formats. As accessibility improves and distribution networks expand, particularly in Tier 1 and Tier 2 cities, companies are well-positioned to capitalize on this channel growth and further consolidate their position in the India alcoholic beverages market share.

India Alcoholic Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on category, alcoholic content, flavor, packaging type, and distribution channel.

Category Insights:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirit

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

The report has provided a detailed breakup and analysis of the market based on the category. This includes beer, wine (still light wine, sparkling wine), spirit (baijiu, vodka, whiskey, rum, liqueurs, gin, tequila, and others).

Alcoholic Content Insights:

- High

- Medium

- Low

The report has provided a detailed breakup and analysis of the market based on the alcoholic content. This includes high, medium, and low.

Flavor Insights:

- Unflavored

- Flavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes unflavored, and flavored.

Packaging Type Insights:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes glass bottles, tins, plastic bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, on-trade, specialist retailers, online, convenience stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Alcoholic Beverages Market News:

- In January 2025, Anheuser-Busch InBev (AB InBev), the producer of Budweiser beer, announced its plans to set up a new manufacturing facility in Uttar Pradesh. The firm committed Rs 1,000 crore to invest in the project during the current World Economic Forum (WEF) meeting in Davos, where a memorandum of understanding (MoU) was executed.

- In January 2025, Heineken's Indian unit, United Breweries announced its plans to resume beer supplies to Telangana after halting them over pricing disputes and unpaid dues. The decision followed positive talks with the state government, which promised to address financial issues.

India Alcoholic Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcoholic Content Covered | High, Medium, Low |

| Flavors Covered | Unflavored, Flavored |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India alcoholic beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India alcoholic beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India alcoholic beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India alcoholic beverages market was valued at USD 145.50 Billion in 2024.

The India Alcoholic Beverages market is projected to exhibit a CAGR of 1.90% during 2025-2033, reaching a value of USD 175.60 Billion by 2033.

The market is driven by rapid urbanization, evolving consumer lifestyles, and increasing social interactions. The rising preference for premium and craft alcoholic beverages, alongside the growth of bars, restaurants, and e-commerce, is further boosting the demand for diverse alcoholic drink offerings in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)