India Air Pollution Control Systems Market Size, Share, Trends and Forecast by Product, Type, Application, Pollutant, End User, and Region, 2025-2033

India Air Pollution Control Systems Market Overview:

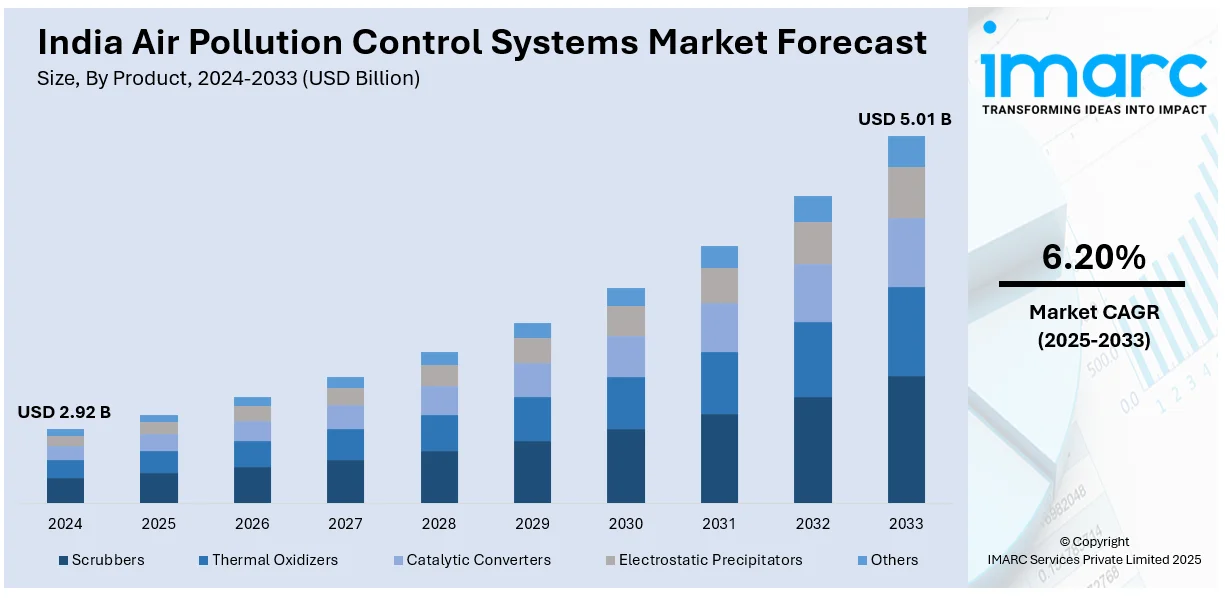

The India air pollution control systems market size reached USD 2.92 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.01 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The India air pollution control systems market share is expanding, driven by the increasing renewable energy installations under major government initiatives, along with the rising execution of stringent environmental regulations, encouraging industries to adopt advanced emission control technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.92 Billion |

| Market Forecast in 2033 | USD 5.01 Billion |

| Market Growth Rate 2025-2033 | 6.20% |

India Air Pollution Control Systems Market Trends:

Expansion of renewable energy projects

The broadening of renewable energy projects is impelling the India air pollution control systems market growth. In March 2025, Jindal India Renewable Energy announced that it obtained a ‘Letter of Acceptance’ for a 300 MW solar and storage project from the government-owned NHPC. The initiative was included in NHPC's tender for solar power projects linked to a 1200 MW inter-state transmission system, featuring 600 MW/1200 MW energy storage solutions. While renewable energy is meant to reduce emissions, certain projects, such as biomass and waste-to-energy plants, generate pollutants that need to be controlled using filtration, scrubbers, and advanced pollution control technologies. As the Government is promoting more renewable energy installations under major initiatives, industries involved in these projects are wagering on air pollution control systems to meet environmental standards. Additionally, hybrid energy setups, which combine conventional and renewable power sources, require efficient pollution control measures to balance emissions. With India’s focus on minimizing dependence on fossil fuels, industries are shifting to cleaner energy alternatives but maintaining air quality remains a priority. Even in solar panel and wind turbine manufacturing, air pollutants from production processes need proper mitigation, further driving the demand for air filtration and purification technologies. As cleaner energy sources like solar, wind, and biomass are becoming more widespread, the requirement for reliable air pollution control systems that ensure compliance while contributing to a greener energy future is high.

To get more information on this market, Request Sample

Increasing government initiatives and investments

The rising government initiatives and investments are offering a favorable India air pollution control systems market outlook. Stringent environmental regulations and clean air policies are motivating industries to adopt advanced emission control technologies. With the growing electric vehicle (EV) production under governmental schemes, there is a strong focus on reducing vehicular emissions, which is driving the demand for air pollution control systems in transportation hubs and urban areas. In March 2024, the government of India announced the ‘Scheme for Promotion of Electric Passenger Car Manufacturing in India (SPMEPCI)’ to encourage the manufacturing of electric vehicles in the country. Programs like the National Clean Air Programme (NCAP) and stricter emission norms by the Central Pollution Control Board (CPCB) are enabling industries to upgrade their pollution control measures. The government is also investing in smart cities and green infrastructure, which includes setting up better air filtration systems in public spaces and industries. Subsidies and incentives for installing pollution control equipment in factories and construction projects are further accelerating adoption. With ongoing investments in sustainable industrial expansion and better air quality monitoring systems, the demand for air pollution control systems is rising significantly across various sectors in India.

India Air Pollution Control Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, type, application, pollutant, and end user.

Product Insights:

- Scrubbers

- Thermal Oxidizers

- Catalytic Converters

- Electrostatic Precipitators

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes scrubbers, thermal oxidizers, catalytic converters, electrostatic precipitators, and others.

Type Insights:

- Indoor

- Ambient

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes indoor and ambient.

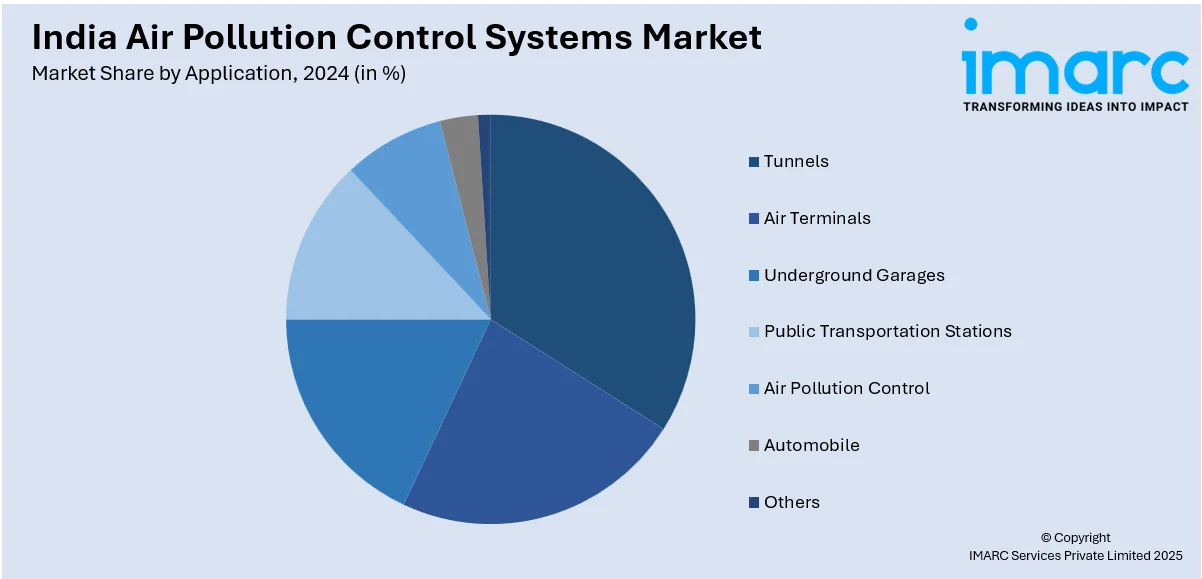

Application Insights:

- Tunnels

- Air Terminals

- Underground Garages

- Public Transportation Stations

- Air Pollution Control

- Automobile

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes tunnels, air terminals, underground garages, public transportation stations, air pollution control, automobile, and others.

Pollutant Insights:

- Gas

- VOC

- Dust

- Others

The report has provided a detailed breakup and analysis of the market based on the pollutant. This includes gas, VOC, dust, and others.

End User Insights:

- Powertrain Management

- Energy and Power

- Mining

- Agriculture

- Semiconductor

- Medical and Pharma

- Commercial and Residential

- Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes powertrain management, energy and power, mining, agriculture, semiconductor, medical and pharma, commercial and residential, transportation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Air Pollution Control Systems Market News:

- In February 2025, the Nagpur Municipal Corporation (NMC) initiated a project worth INR 5.21 Crore in Maharashtra, India. The objective was to set up air pollution control systems at three active crematoriums in Nagpur. The municipal authority obtained INR 1.62 Crore from the Central government's National Clean Air Programme (NCAP) to commence the initiative.

- In December 2024, the Government of India announced plans to reveal the draft of Bharat Stage (BS) VII emission standards by the beginning of 2025. The regulations were anticipated to be tougher, encouraging producers to install sophisticated air pollution control technologies in vehicles.

India Air Pollution Control Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Scrubbers, Thermal Oxidizers, Catalytic Converters, Electrostatic Precipitators, Others |

| Types Covered | Indoor, Ambient |

| Applications Covered | Tunnels, Air Terminals, Underground Garages, Public Transportation Stations, Air Pollution Control, Automobile, Others |

| Pollutants Covered | Gas, VOC, Dust, Others |

| End Users Covered | Powertrain Management, Energy and Power, Mining, Agriculture, Semiconductor, Medical and Pharma, Commercial and Residential, Transportation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India air pollution control systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India air pollution control systems market on the basis of product?

- What is the breakup of the India air pollution control systems market on the basis of type?

- What is the breakup of the India air pollution control systems market on the basis of application?

- What is the breakup of the India air pollution control systems market on the basis of pollutant?

- What is the breakup of the India air pollution control systems market on the basis of end user?

- What is the breakup of the India air pollution control systems market on the basis of region?

- What are the various stages in the value chain of the India air pollution control systems market?

- What are the key driving factors and challenges in the India air pollution control systems market?

- What is the structure of the India air pollution control systems market and who are the key players?

- What is the degree of competition in the India air pollution control systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India air pollution control systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India air pollution control systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India air pollution control systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)