India Agrochemicals Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Market Overview:

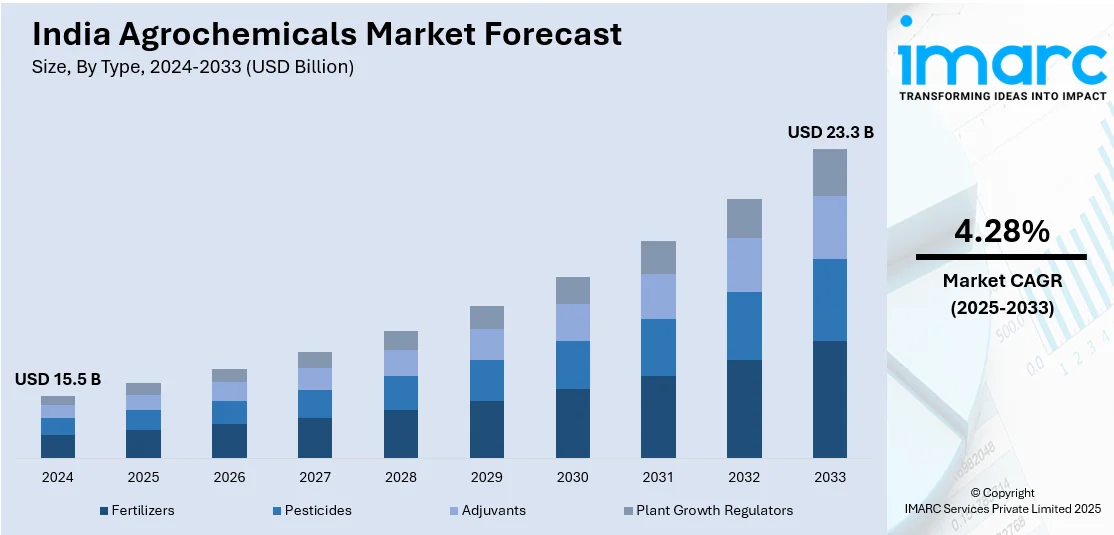

India agrochemicals market size reached USD 15.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.28% during 2025-2033. The increasing advances in agricultural technology, including genetically modified organisms, precision farming, and the development of new and more effective agrochemical formulations, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.5 Billion |

|

Market Forecast in 2033

|

USD 23.3 Billion |

| Market Growth Rate 2025-2033 | 4.28% |

Agrochemicals are chemical substances used in agriculture to enhance crop production and protect crops from pests, diseases, and weeds. They play a crucial role in modern farming by improving yields and ensuring food security. The term encompasses fertilizers, pesticides, herbicides, and other chemical agents employed to optimize plant growth and health. Fertilizers provide essential nutrients like nitrogen, phosphorus, and potassium to enhance soil fertility, while pesticides and herbicides control pests and weeds, safeguarding crops from potential damage. Despite their benefits, the use of agrochemicals has raised concerns about environmental and health impacts, leading to ongoing efforts to develop sustainable and eco-friendly alternatives. Striking a balance between maximizing agricultural productivity and minimizing adverse effects on ecosystems and human health is a key challenge in the responsible management of agrochemicals.

To get more information on this market, Request Sample

India Agrochemicals Market Trends:

The agrochemicals market in India is experiencing robust growth, propelled by several key drivers that underscore its significance in modern agriculture. Firstly, the increasing regional population necessitates higher food production, driving the demand for agrochemicals as indispensable tools for enhancing crop yields. Moreover, the escalating need for sustainable agricultural practices and the quest for efficient resource utilization have led to the adoption of advanced agrochemical solutions, further fueling market expansion. Additionally, the rising awareness of the economic benefits associated with agrochemical usage, such as improved crop quality and reduced post-harvest losses, acts as a strong motivator for farmers to incorporate these products into their cultivation practices. Furthermore, advancements in technology, including the development of precision farming techniques, are encouraging the integration of agrochemicals for optimized and targeted applications. The regional trend towards biopesticides and organic farming methods also contributes to the agrochemicals market growth, as farmers seek environmentally friendly alternatives. Governments' initiatives and policies supporting agricultural modernization and the adoption of innovative farming inputs further drive the market, creating a conducive environment for sustained expansion. In conclusion, a confluence of demographic, technological, and environmental factors positions the regional agrochemicals market on a trajectory of continued growth and evolution.

India Agrochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Fertilizers

- Pesticides

- Adjuvants

- Plant Growth Regulators

The report has provided a detailed breakup and analysis of the market based on the type. This includes fertilizers, pesticides, adjuvants, and plant growth regulators.

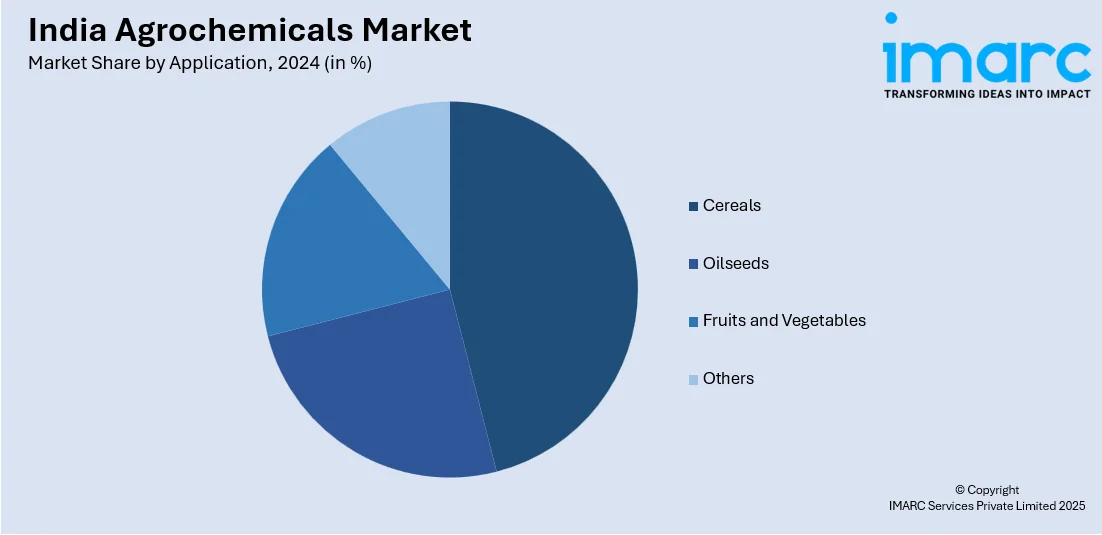

Application Insights:

- Cereals

- Oilseeds

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cereals, oilseeds, fruits and vegetables, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Agrochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fertilizers, Pesticides, Adjuvants, Plant Growth Regulators |

| Applications Covered | Cereals, Oilseeds, Fruits and Vegetables, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India agrochemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India agrochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India agrochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agrochemicals market in India was valued at USD 15.5 Billion in 2024.

The India agrochemicals market is projected to exhibit a CAGR of 4.28% during 2025-2033, reaching a value of USD 23.3 Billion by 2033.

As the country’s population is increasing, farmers are under pressure to produce more from limited land resources, making agrochemicals like fertilizers, pesticides, and herbicides essential for improving crop yield and quality. Government support through subsidies and awareness programs is promoting the use of modern farming inputs. The rise of commercial farming and export-oriented agriculture is also driving the demand for high-efficiency crop protection products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)