India Activewear Market Size, Share, Trends and Forecast by Product Type, Material Type, Pricing, Age Group, Distribution Channel, End User, and Region, 2025-2033

India Activewear Market Size and Share:

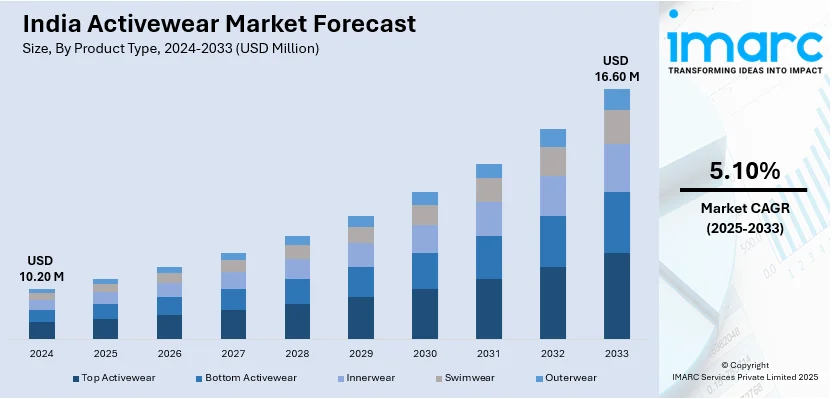

The India activewear market size reached USD 10.20 Million in 2024. The market is expected to reach USD 16.60 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market growth can be attributed to the rising health consciousness among the masses, e-commerce sector growing greatly, and athleisure growing increasingly in appeal. The increasing demand for multifunctional, comfortable and stylish activewear that can transition from out of the gym and to everyday wear is additionally driving the sector's expansion.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product type, the market has been divided into top activewear, bottom activewear, innerwear, swimwear, and outerwear.

- On the basis of material type, the market has been divided into nylon, polyester, cotton, neoprene, polypropylene, and spandex.

- On the basis of pricing, the market has been divided into economy and premium.

- On the basis of age group, the market has been divided into 1–15 years, 16–30 years, 31–44 years, 45–64 years, and more than 65 years.

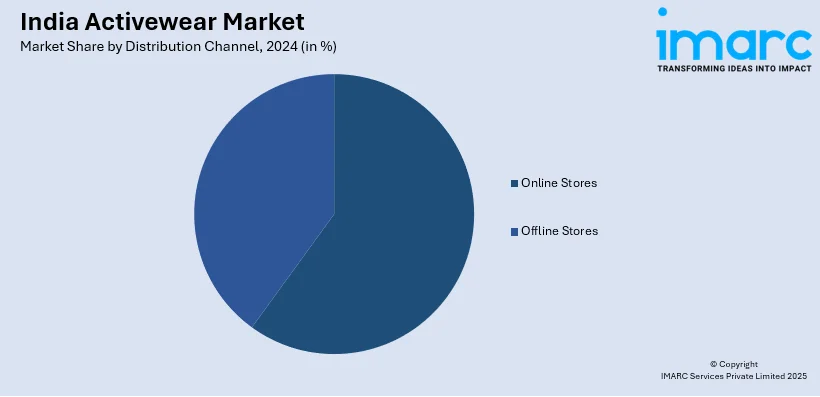

- On the basis of distribution channel, the market has been divided into online stores and offline stores.

- On the basis of end user, the market has been divided into men, women, and kids.

Market Size and Forecast:

- 2024 Market Size: USD 10.20 Million

- 2033 Projected Market Size: USD 16.60 Million

- CAGR (2025-2033): 5.10%

India Activewear Market Trends:

Increasing Number of E-Commerce Platforms

The growing e-commerce penetration is significantly fueling the India activewear market growth by providing accessibility and convenience to customers. Online platforms offer a vast range of activewear brands, styles, and price points for shoppers. Discounts, cashback offers, and easy return policies make online shopping more attractive for fitness-conscious buyers. E-commerce enables direct-to-consumer (D2C) brands to reach customers without requiring physical retail stores or distributors. Mobile shopping apps provide seamless browsing experiences, helping shoppers explore and purchase activewear effortlessly. According to data published by the IBEF, India’s e-commerce industry is expected to reach US$ 325 billion by 2030, highlighting its rapid expansion. This growth is fueling the activewear market, as artificial intelligence (AI)-driven recommendations personalize shopping experiences based on browsing history and preferences. Social commerce integration allows customers to buy activewear directly from influencers’ posts and brand collaborations. Faster delivery options including same-day and next-day services, encourage individuals to prefer online purchases over offline stores.

To get more information on this market, Request Sample

Rising Influence of Social Media and Celebrities

Social media and celebrities are significantly influencing India activewear market outlook by shaping customer preferences. Fitness influencers and Bollywood celebrities are promoting activewear brands through sponsored posts and workout videos. Their large follower base creates brand awareness, making buyers more likely to purchase endorsed products. Engaging content like fitness challenges, workout routines, and styling tips encourages users to adopt activewear, which is positively impacting the activewear industry size in India. Social media platforms enable brands to interact directly with fitness enthusiasts, offering personalized recommendations and exclusive deals. The aspirational appeal of celebrities wearing premium activewear brands drives demand for stylish and high-performance clothing. In July 2024, cricketer Hardik Pandya collaborated with FanCode Shop to launch his own activewear brand. This collaboration marks FanCode Shop’s first venture with an athlete, highlighting the growing influence of celebrity-driven activewear. Pandya aims to create a brand that reflects his personal journey and connects with the youth. The exclusive activewear range is available only on FanCode Shop, leveraging the power of e-commerce and social media marketing. According to the India activewear industry report, influencer collaborations with activewear brands result in limited-edition collections, attracting fitness-conscious customers. User-generated content such as reviews and outfit posts, further catalyzes credibility and market penetration. Platforms like Instagram and YouTube serve as major advertising channels, reaching diverse customer segments effectively. Live sessions and Q&A interactions allow brands to educate customers about fabric technology and product benefits, strengthening customer engagement and loyalty.

Climate-Adaptive Technology and AI-Powered Customization

The diverse climatic conditions across India are driving innovative developments in geographically adapted activewear solutions, thereby transforming the activewear market size in India. Brands are increasingly incorporating recycled polyester, organic cotton, bamboo fiber, and innovative bio-based materials in their product lines to meet evolving consumer preferences. They are also developing monsoon-specific activewear incorporating quick-dry technologies, moisture-wicking fabrics, and anti-microbial treatments to combat humidity and bacterial growth during India's intense monsoon seasons. Region-specific fabric innovations are emerging to address extreme weather variations, with cooling fabrics and UV protection technologies designed for North India's scorching heat, while high-humidity resistant materials with enhanced breathability are being developed for coastal regions. The activewear industry in India is embracing AI-powered customization trends that enable personalized fit and design based on individual body measurements, activity preferences, and regional climate requirements. Advanced algorithms analyze consumer data to recommend optimal fabric blends, sizing, and performance features tailored to specific geographical locations and usage patterns. Virtual try-on technologies are revolutionizing online shopping experiences by allowing customers to visualize fit, color combinations, and styling options before purchase, significantly reducing return rates and enhancing customer satisfaction. As per the India activewear market analysis, the integration of augmented reality (AR) and machine learning in e-commerce platforms is enabling brands to provide hyper-personalized shopping experiences that consider local weather patterns and individual preferences. This technological convergence is creating opportunities for both domestic and international brands to develop climate-intelligent activewear solutions that resonate with India's diverse consumer base.

Growth, Opportunities, and Challenges in the India Activewear Market:

- Growth Drivers of the India Activewear Market: The increasing health and fitness awareness among urban populations and rising disposable incomes are propelling substantial market expansion across India. Government initiatives promoting sports participation and healthy lifestyle choices are creating favorable conditions for the India Activewear industry report development. The growing adoption of athleisure trends and work-from-home culture is driving demand for comfortable and versatile activewear products.

- Opportunities in the India Activewear Market: The expanding fitness infrastructure including gyms, yoga studios, and sports academies presents significant distribution and partnership opportunities for activewear brands. Rural market penetration through affordable product lines and regional retail networks offers substantial growth potential for the market. Strategic collaborations with sports personalities, fitness influencers, and educational institutions can enhance brand visibility and consumer adoption.

- Challenges in the India Activewear Market: Intense price competition from international brands and local manufacturers is constraining profit margins and brand differentiation strategies in the market. Consumer preference for premium imported brands over domestic alternatives creates challenges for local players seeking market share expansion. Supply chain disruptions and raw material cost fluctuations pose operational challenges for maintaining consistent product availability and pricing.

India Activewear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, material type, pricing, age group, distribution channel, and end user.

Product Type Insights:

- Top Activewear

- Bottom Activewear

- Innerwear

- Swimwear

- Outerwear

The report has provided a detailed breakup and analysis of the market based on the product type. This includes top activewear, bottom activewear, innerwear, swimwear, and outerwear.

Material Type Insights:

- Nylon

- Polyester

- Cotton

- Neoprene

- Polypropylene

- Spandex

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes nylon, polyester, cotton, neoprene, polypropylene, and spandex.

Pricing Insights:

- Economy

- Premium

The report has provided a detailed breakup and analysis of the market based on the pricing. This includes economy and premium.

Age Group Insights:

- 1–15 Years

- 16–30 Years

- 31–44 Years

- 45–64 Years

- More than 65 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 1–15 years, 16–30 years, 31–44 years, 45–64 years, and more than 65 years.

Distribution Channel Insights:

- Online Stores

- Offline Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online stores and offline stores.

End User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and kids.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Activewear Market News:

- In September 2025, TechnoSport announced an INR 200 crore investment to open 300 exclusive brand outlets (EBOs) across India over the next two years, following a 40% CAGR since 2022. The expansion will focus on modern retail, e-commerce, and brand stores, with the company targeting INR 600 crore in revenues for FY'26 and aiming for INR 1,000 crore by FY'27.

- In August 2025, US-based luxury activewear brand ATHLETIFREAK opened its first Indian store in New Delhi, marking its entry into Asia. Partnering with strategic investors and brand ambassadors Mira and Shahid Kapoor, the brand plans to expand to Mumbai, Bengaluru, and Hyderabad, with India expected to contribute 50% of its global business within two years.

- In July 2025, HRX launched its new campaign "Built for Sweat, Designed for Life," featuring actress Triptii Dimri as the co-ambassador alongside Hrithik Roshan. The campaign highlights HRX's versatile activewear, blending high-performance functionality with everyday style, and aims to expand the brand’s appeal among women. The collection, available on Myntra, includes over 15,000 styles across apparel, footwear, and accessories.

- In January 2025, PUMA India entered the badminton sector with a multi-year partnership with two-time Olympic medallist PV Sindhu. The collaboration will feature activewear of high-performance badminton range, including footwear, apparel, and accessories, aimed at enhancing on-court performance and inspiring athletes across India.

- In June 2024, Columbia Sportswear launched its first Delhi store in Connaught Place, offering a diverse range of products including accessories such as beanies, belts, gloves, caps, sunglasses, and socks.

- In April 2024, Feier introduced its sustainable activewear line in India, combining style and functionality. The collection showcases vibrant designs made from eco-friendly materials, offering affordable choices for fitness enthusiasts. Customers can purchase Feier’s activewear through its official website and select retail partners nationwide.

India Activewear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Top Activewear, Bottom Activewear, Innerwear, Swimwear, Outerwear |

| Material Types Covered | Nylon, Polyester, Cotton, Neoprene, Polypropylene, Spandex |

| Pricings Covered | Economy, Premium |

| Age Groups Covered | 1–15 Years, 16–30 Years, 31–44 Years, 45–64 Years, More than 65 Years |

| Distribution Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India activewear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India activewear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India activewear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India activewear market was valued at USD 10.20 Million in 2024.

The India activewear market is projected to exhibit a CAGR of 5.10% during 2025-2033, reaching a value of USD 16.60 Million by 2033.

The rising health consciousness, e-commerce growth, and the athleisure trend are driving India activewear market share. Celebrity and influencer endorsements also further catalyze the demand by shaping customer preferences and increasing brand visibility, making activewear a preferred choice for both fitness and everyday wear.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)