India Acetonitrile Market Size, Share, Trends and Forecast by End Use, and Region, 2025-2033

Market Overview:

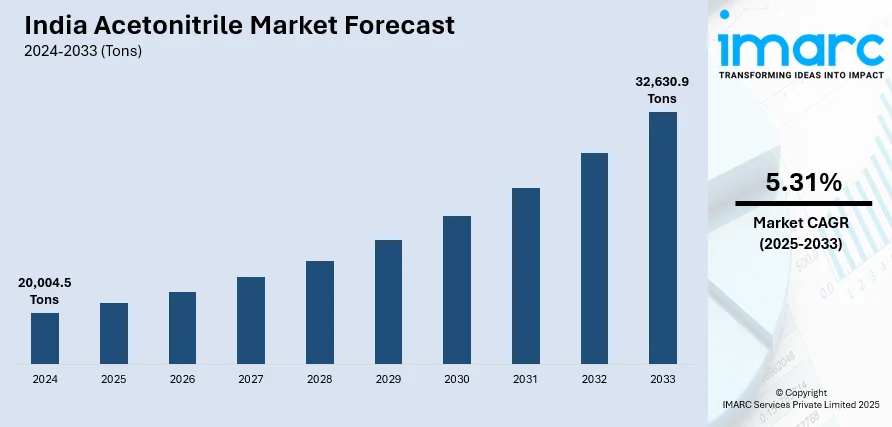

The India acetonitrile market size reached 20,004.5 Tons in 2024. Looking forward, IMARC Group expects the market to reach 32,630.9 Tons by 2033, exhibiting a growth rate (CAGR) of 5.31% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 20,004.5 Tons |

| Market Forecast in 2033 | 32,630.9 Tons |

| Market Growth Rate (2025-2033) | 5.31% |

Acetonitrile is a lethal and colorless solvent, which is also known as methyl cyanide and ethanenitrile. It is a small and simple organic nitrile produced in the form of acrylonitrile and has an ether-like odor. It is commonly available in derivative and solvent variants and is used as an aprotic solvent in the natural synthesis and refinement of butadiene. Acetonitrile is also used in perfumes, acrylic nail removers, batteries and to extract fatty acids from animal and vegetable oils. It is a strong solvent, easily soluble in water and has high chemical stability. In comparison to the traditionally used methanol, acetonitrile reacts endothermically with water and has higher elution strength. As a result, it finds extensive applications across various industries, such as pharmaceutical, automotive and agriculture.

To get more information of this market, Request Sample

The India acetonitrile market is primarily being driven by its widespread adoption as a solvent in the pharmaceutical industry to produce antibiotics and insulin. Moreover, the implementation of various government initiatives, such as National Food Security Mission (NFSM), is leading to the increasing demand for acetonitrile-based agrochemicals, which, in turn, is favoring the market growth. Acetonitrile is also used for synthesizing artificial pesticides and fertilizers and acts as an inert ingredient in pesticides. Additionally, the increasing product utilization as a solvent in liquid chromatography to influence the interaction between sample components and adsorbents in chiral systems is positively impacting the market growth. Other factors, including rising product demand in the chemical processing industry, along with the increasing utilization of acetonitrile for recrystallization of medical drugs, are anticipated to drive the market growth across the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India acetonitrile market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on end use.

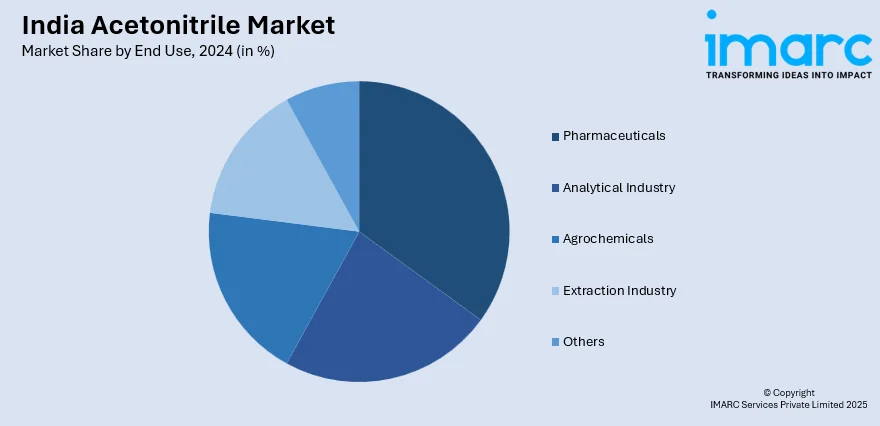

Breakup by End Use:

- Pharmaceuticals

- Analytical Industry

- Agrochemicals

- Extraction Industry

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | ‘000 Tons |

| Segment Coverage | End Use, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India acetonitrile market reached a volume of 20,004.5 Tons in 2024.

We expect the India acetonitrile market to exhibit a CAGR of 5.31% during 2025-2033.

The rising demand for acetonitrile across various industries, such as pharmaceuticals, agrochemicals, and automotive, as it has excellent chemical stability, water solubility, and miscibility with alcohol, acetone, and epoxy resin, is primarily driving the India acetonitrile market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous end-use industries for acetonitrile.

Based on the end use, the India acetonitrile market can be segmented into pharmaceuticals, analytical industry, agrochemicals, extraction industry, and others. Currently, pharmaceuticals hold the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where South India currently dominates the India acetonitrile market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)