India Accounts Receivable Automation Market Size, Share, Trends and Forecast by Component, Deployment, Organization Size, Vertical, and Region, 2025-2033

India Accounts Receivable Automation Market Overview:

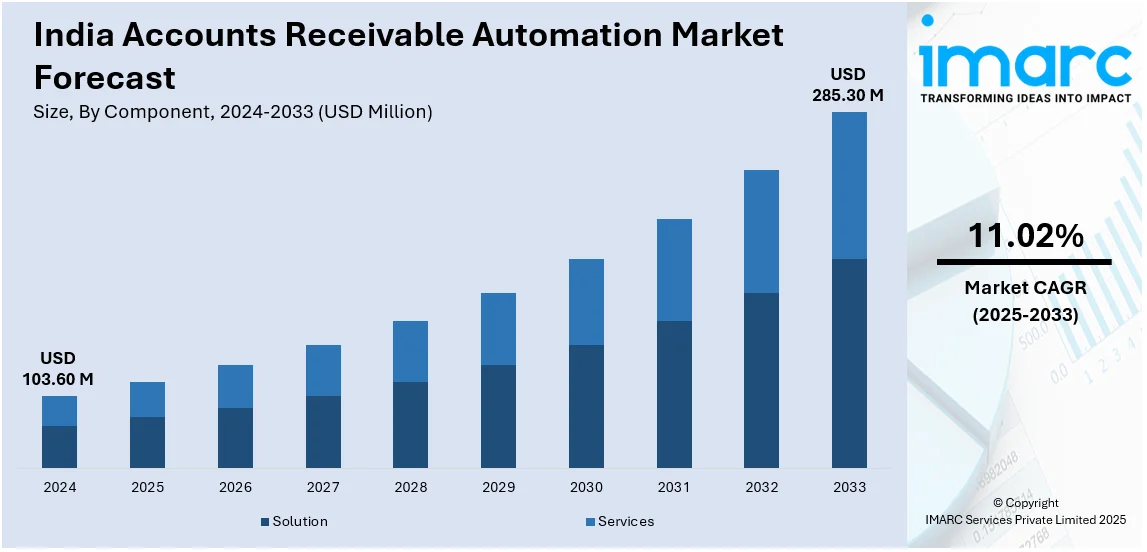

The India accounts receivable automation market size reached USD 103.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 285.30 Million by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of AI and ML for enhanced efficiency and rising focus on cloud-based accounts receivable automation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 103.60 Million |

| Market Forecast in 2033 | USD 285.30 Million |

| Market Growth Rate (2025-2033) | 11.02% |

India Accounts Receivable Automation Market Trends:

Increased Adoption of Artificial Intelligence (AI) and Machine Learning (ML) for Enhanced Efficiency

The main trend in the growing account receivable automation market in India is the adoption of artificial intelligence and machine learning. More and more businesses look to optimize their financial processes. These technologies offer very scalable improvements in efficiency, accuracy, and decision-making processes. For example, in December 2024, Embee Software announced the launch of ARth: an AI end-enabled instrument for effective accounts receivable management. The solution automates follow-ups, invoicing, and risk analysis and integrates with ERP systems for streamlined cash flow and financial operations. With these capabilities, companies automate a wide range of functions, including invoice generation, payment reminders, and payment reconciliation, with minimum manual intervention and human error. Also, AI-powered solutions analyze historical payment patterns to predict cash flow and identify potential payment delays for proactive management of collections and reduction of overdue receivables. Besides, machine learning algorithms make credit risk assessments more accurate and provide personalized collection strategies depending on customer behavior, thereby leading to a more rewarding experience for customers. At the same time, the businesses in India are facing intense competition as well as demands for faster financial operations. The introduction of AI and ML into accounts receivable automation will give a greater competitive advantage. In fact, it will continue to gain momentum as companies invest in AI-enabled platforms to optimize their receivables processes and ensure timely payments while lowering operating expenditures. The advancements in AI and ML continue to focus on transforming accounts receivable management into the most significant driver for financial efficiency and profitability.

To get more information on this market, Request Sample

Rising Focus on Cloud-Based Accounts Receivable Automation Solutions

Cloud-based solutions have become a significant trend in the accounts receivable automation market in India, with businesses increasingly shifting away from traditional on-premise software to cloud-based platforms. The cloud offers numerous advantages, including scalability, cost-effectiveness, and ease of access, making it an attractive option for companies looking to automate and optimize their receivables processes. Cloud-based accounts receivable automation systems enable businesses to manage their receivables more effectively by providing real-time access to critical financial data, enabling better decision-making. This accessibility is particularly valuable for businesses with multiple locations or remote teams, as it ensures that relevant information is available anytime, anywhere. Moreover, cloud solutions often come with regular updates and security enhancements, ensuring that companies stay up-to-date with the latest technology while safeguarding sensitive financial data. Additionally, cloud solutions allow for seamless integration with other enterprise resource planning (ERP) systems, creating a more cohesive financial ecosystem. For instance, in October 2024, The AR platform of Recordent has now been integrated with the Zoho Books Connector thus allowing SMEs to carry out collections seamlessly, assess credit risks, and manage their cash flows thereby improving financial health and creating a sustainable future for themselves. This trend reflects the growing demand for flexible, cost-effective, and secure solutions that can easily scale as businesses grow. As more companies in India embrace cloud-based automation, the market is expected to continue expanding, offering organizations increased operational efficiency, better cash flow management, and reduced overhead costs.

India Accounts Receivable Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, deployment, organization size, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprise

- Small and Medium-Sized Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

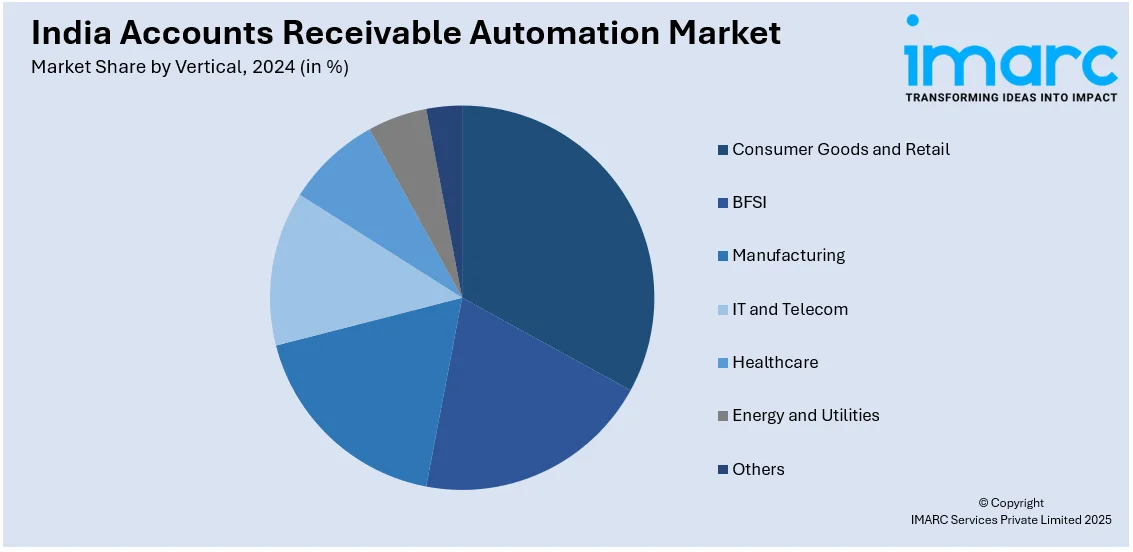

Vertical Insights:

- Consumer Goods and Retail

- BFSI

- Manufacturing

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes consumer goods and retail, BFSI, manufacturing, IT and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Accounts Receivable Automation Market News:

- In March 2023, TanServ Business Process Pvt. Ltd. announced the launch of Inebura, an advanced Accounts Receivable Automation Software. Inebura streamlines the AR process, from credit management to invoicing and reconciliation, enhancing cash flow. With real-time data, customizable dashboards, and intelligent analytics, it enables enterprises to improve decision-making, reduce DSO, and optimize AR management.

India Accounts Receivable Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployments Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Verticals Covered | Consumer Goods and Retail, BFSI, Manufacturing, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India accounts receivable automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India accounts receivable automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India accounts receivable automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The accounts receivable automation market in India was valued at USD 103.60 Million in 2024.

The India accounts receivable automation market is projected to exhibit a CAGR of 11.02% during 2025-2033, reaching a value of USD 285.30 Million by 2033.

The India accounts receivable automation market is driven by increasing demand for operational efficiency, growing adoption of cloud-based financial solutions, and rising pressure to reduce payment delays. Additionally, the push for digital transformation across industries and the need for improved cash flow visibility are fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)