India Account Reconciliation Software Market Size, Share, Trends, and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

India Account Reconciliation Software Market Overview:

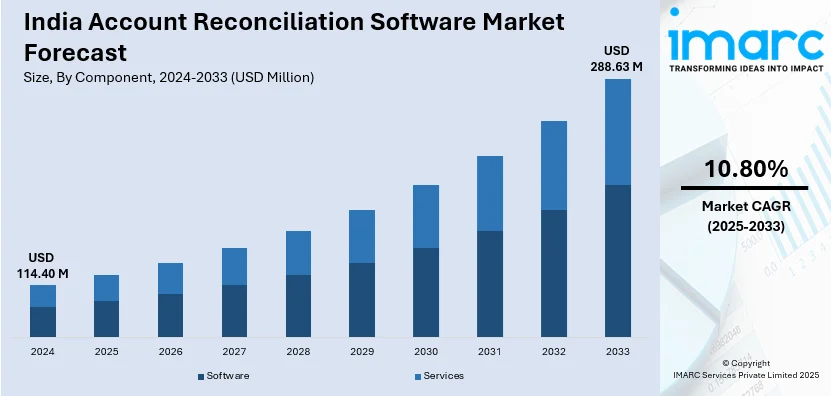

The India account reconciliation software market size reached USD 114.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 288.63 Million by 2033, exhibiting a growth rate (CAGR) of 10.80% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of AI and automation in reconciliation processes and the rising demand for cloud-based reconciliation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 114.40 Million |

| Market Forecast in 2033 | USD 288.63 Million |

| Market Growth Rate 2025-2033 | 10.80% |

India Account Reconciliation Software Market Trends:

Increasing Adoption of AI and Automation in Reconciliation Processes

The India account reconciliation software market is experiencing a considerable boom in sales due to the growing popularity of artificial intelligence and automation in the industry. Organizations focus more on productivity rather than human efforts for efficiency, accuracy, and instantly visible finance, which is driving the need for AI-powered reconciliation solutions. AI reconciliations are offered through a combination of machine learning algorithms to identify anomalies, and fraudulent transactions, and the automation of complex reconciliation tasks to minimize manual effort and human errors. The reconciliation software, which is being adopted by banks, commercial enterprises, and fintech companies, is primarily meant to enhance compliance, reduce operational risks, and ensure regulatory compliance. Digital transformation, accelerated by government initiatives like the Digital India program, is leading the fast adoption of intelligent reconciliation tools. For instance, in February 205, the government invested Rs 10,000 crore in IndiaAI mission, aiming to develop AI models for India's linguistic and cultural diversity, supported by advanced computing. Cloud-based AI reconciliation platforms are fast gaining traction with small and medium enterprises (SMEs) due to their important attributes of scalability, cost-effectiveness, and seamless integration with ERPs and accounting systems. Furthermore, AI reconciliation software fosters cash flow forecasting by giving real-time insights into transactions and balances, thus aiding in financial decision-making. As enterprises continue to modernize their financial operations, there should be a growing demand for AI-based reconciliation software, thereby growing the market space in India.

To get more information on this market, Request Sample

Rising Demand for Cloud-Based Reconciliation Solutions

Cloud-based account reconciliation software is gaining significant traction in India due to its scalability, flexibility, and cost-efficiency. Enterprises are increasingly adopting Software-as-a-Service (SaaS) solutions to streamline financial reconciliation processes and eliminate the need for expensive on-premises infrastructure. The shift toward cloud-based platforms is driven by the growing digitalization of financial operations, increasing volume of transactions, and the need for real-time access to financial data. Cloud-based reconciliation software enables organizations to automate workflows, integrate multiple data sources, and enhance collaboration across departments. Features such as multi-user access, real-time data synchronization, and seamless connectivity with banking systems and ERP platforms are making cloud solutions a preferred choice for businesses of all sizes. For instance, in March 2025, Zoho Corporation, a cloud-based accounting software, announced the launch of Projects Plus, a collaborative platform integrating Zoho apps for seamless project management. It enhances workflow, data democratization, AI, and hybrid project management, driving growth for mid-sized and enterprise organizations. Large enterprises and SMEs are leveraging cloud-based reconciliation tools to improve financial accuracy, reduce reconciliation cycle time, and ensure compliance with evolving regulatory requirements. The rise of remote and hybrid work models has further fueled the adoption of cloud reconciliation solutions, allowing finance teams to manage reconciliation tasks from any location. With increasing cybersecurity measures and data encryption technologies, businesses are gaining confidence in cloud platforms, driving widespread adoption and shaping the future of the Indian account reconciliation software market.

India Account Reconciliation Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and end user.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

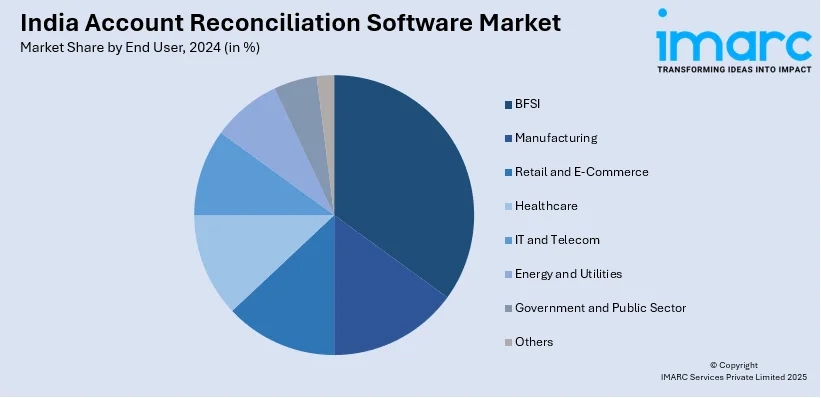

End User Insights:

- BFSI

- Manufacturing

- Retail and E-Commerce

- Healthcare

- IT and Telecom

- Energy and Utilities

- Government and Public Sector

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes BFSI, manufacturing, retail and e-commerce, healthcare, IT and telecom, energy and utilities, government and public sector, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Account Reconciliation Software Market News:

- In February 2025, Grant Thornton Bharat announced partnership with Zoho to enhance digital transformation for Indian mid-market enterprises. This collaboration combines industry expertise with cloud-powered solutions, offering tailored financial management, compliance, and growth strategies, while ensuring faster implementation, seamless integration, and higher ROI without upfront CAPEX investments.

- In September 2024, Tally Solutions announced the launch of TallyPrime 5.0 globally to enhance its Connected Services and simplify business operations for the mid-mass segment. The company aims to increase its user base by 50% over the next three years, targeting a CAGR growth of 30-40% with upcoming product initiatives.

India Account Reconciliation Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | BFSI, Manufacturing, Retail and E-Commerce, Healthcare, IT and Telecom, Energy and Utilities, Government and Public Sector, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India account reconciliation software market performed so far and how will it perform in the coming years?

- What is the breakup of the India account reconciliation software market on the basis of component?

- What is the breakup of the India account reconciliation software market on the basis of deployment mode?

- What is the breakup of the India account reconciliation software market on the basis of organization size?

- What is the breakup of the India account reconciliation software market on the basis of end user?

- What is the breakup of the India account reconciliation software market on the basis of region?

- What are the various stages in the value chain of the India account reconciliation software market?

- What are the key driving factors and challenges in the India account reconciliation software?

- What is the structure of the India account reconciliation software market and who are the key players?

- What is the degree of competition in the India account reconciliation software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India account reconciliation software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India account reconciliation software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India account reconciliation software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)