Incinerator Market Report by Product Type (Moving Grate, Static Hearth, Furnace and Multiple Hearth, Rotary Kiln, Fluidized Bed), End-Use Sector (Municipal Sector, Industrial Sector), and Region 2025-2033

Incinerator Market Size:

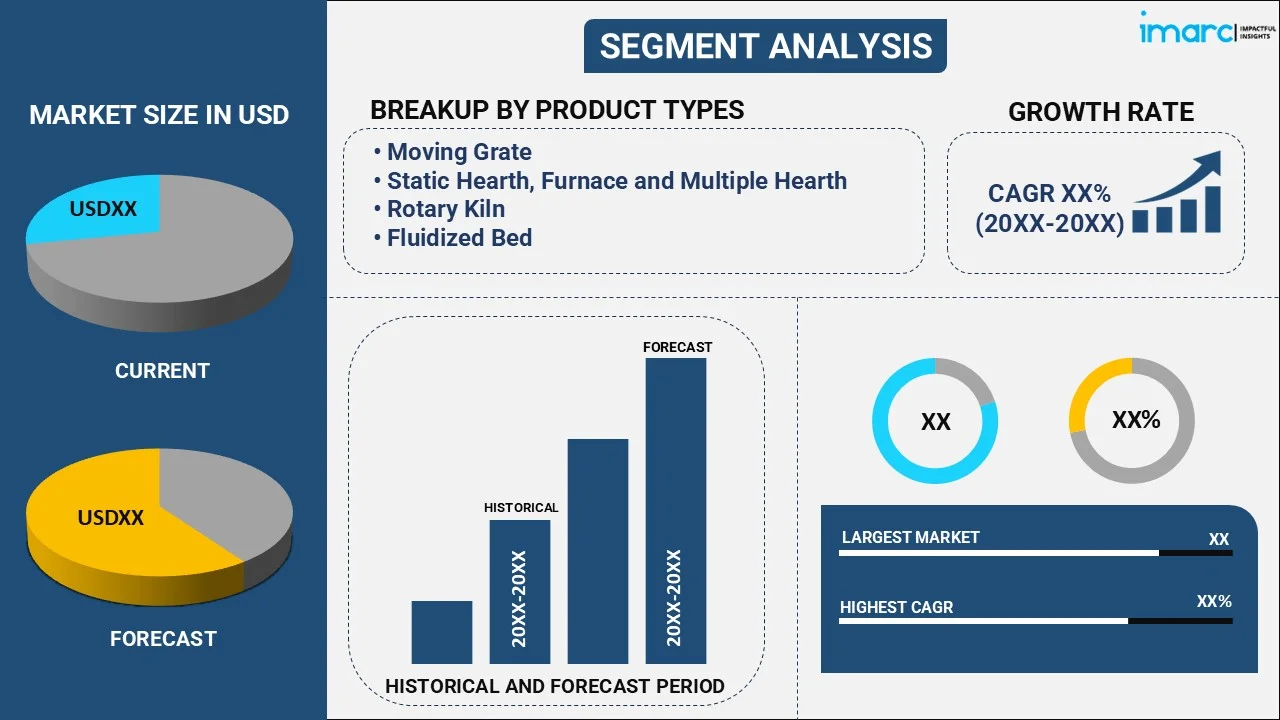

The global incinerator market size reached USD 16.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.8% during 2025-2033. The market is driven by continual improvements in waste management infrastructure, an enhanced focus on greenhouse gas reduction, the paradigm shift towards sustainable waste treatment methods, the rising industrial and chemical waste production, growing public awareness regarding waste management, and decreasing landfill availability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 16.3 Billion |

|

Market Forecast in 2033

|

USD 22.8 Billion |

| Market Growth Rate 2025-2033 | 3.8% |

Incinerator Market Analysis:

- Major Market Drivers: Some of the market drivers propelling the incinerator market growth include the increasing waste generation, stricter environmental regulations, rising demand for waste-to-energy solutions, growing industrial and hazardous waste production, and government policies favoring sustainable waste management practices.

- Key Market Trends: Some of the key market trends include the adoption of advanced incineration technologies, integration of automation and IoT for operational efficiency, increasing investments in waste-to-energy plants, and a growing focus on reducing carbon emissions through efficient waste disposal methods.

- Geographical Trends: Asia Pacific is dominating the market due to rapid urbanization, growing industrial waste, government initiatives to improve waste management infrastructure, and significant investments in waste-to-energy facilities, particularly in countries like China, Japan, and India.

- Competitive Landscape: Some of the key market players include Babcock & Wilcox Co., Covanta Energy Corp., Suez Environnement Co. S.A., Constructions industrielles de la Méditerranée S.A, Gershman, Brickner & Bratton Inc., EEW Energy from Waste Gmbh, Martin Gmbh, Wheelabrator Technologies Inc., Novo Energy LLC, etc.

- Challenges and Opportunities: The market is facing challenges such as high capital costs, public opposition due to environmental concerns, and stringent emission regulations. However, opportunities lie in technological advancements, the expansion of waste-to-energy projects, and the increasing need for sustainable waste treatment solutions globally.

Incinerator Market Trends:

Increasing amount of waste

The increasing trend of urbanization and industrialization is contributing to the growing quantities of waste throughout the world. To deal with this problem effectively, more time would be needed in the near future to burn the waste. There is a growing necessity for efficient waste management techniques like incineration to meet the growing needs. In line with this, the healthcare sector also produces huge quantities of dangerous medical wastes, which call for methods of disposal. Incineration has emerged as the ideal solution for most industries since it kills and eliminates efficiently all microorganisms in waste medical. Furthermore, the modern incinerator with an energy recovery system can utilize the heat generated at the burning stage as electricity or use the same heat for any domestic or industrial purpose. This results in more yield in cash terms and, hence, makes incineration economically more viable. Moreover, developing countries with expanding populations and urbanization are producing more garbage, thus offering opportunities for corporate presence in the incinerator market.

Stricter environmental regulations

Strict environmental norms are driving the market significantly as governments and regulatory bodies force stern rules for the disposal of waste and emissions. Incineration has emerged as a method preferred because it can reduce the volume of waste to a certain degree, and it also generates energy. Especially laws relating to the disposal of hazardous wastes, greenhouse gas emissions, and landfills are profoundly influential. For instance, most countries are enforcing an absolute ban or at least a strict restraint over open landfills. This has pushed industries and municipalities to move toward high technologies for incineration, which comply with emission levels. Also, the cuts in air pollutants, such as dioxins and particulate matter, necessitate more efficient low-emission incineration systems. These pressures are also pushing industries and waste management companies to invest in incineration technologies, thus creating a positive incinerator market outlook.

Rising demand for waste-to-energy solutions

The major driving force of the incinerator market is the rising global demand for waste-to-energy solutions. Waste-to-energy (WtE) technologies convert non-recyclable waste materials into usable forms of energy, thereby providing solutions to two critical aspects: namely, waste disposal and energy generation. WtE solutions have gained vast traction in relation to the emerging trends toward sustainable energy and waste management on a global scale. Recently, governments and industries have resorted to incineration methods to burn waste-to-energy in a quest to reduce their dependence on landfills while simultaneously producing renewable energy. Incinerators are able to manage all forms of waste: municipal, industrial, and hazardous, among others with the production of energy, thus making it an ideal solution for converting waste to energy. In addition, waste-to-energy systems fit in with environmental policies aimed at lowering greenhouse gas emissions and providing a clean source of energy, which is increasing interest in WtE, thereby fostering the growth of the market.

Incinerator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on product type and end-use sector.

Breakup by Product Type:

- Moving Grate

- Static Hearth, Furnace and Multiple Hearth

- Rotary Kiln

- Fluidized Bed

Moving grate dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes moving grate, static hearth, furnace and multiple hearth, rotary kiln, and fluidized bed. According to the report, moving grate represented the largest segment.

The moving grate technology is driving the market growth due to its efficiency in handling numerous waste types. This system is widely used in waste-to-energy plants where wastes are fed into the same continuously for combustion. Moving grate systems are highly appropriate for large wastes of a municipal and industrial nature. This technology burns mixed waste containing non-homogeneous and high-moisture materials, thereby not requiring pre-sorting. Moving grate incinerators also possess high energy recovery rates, aligned with the increasing demand for waste-to-energy practices that are sustainable. The advantage of tight environmental legislation along with low operational and maintenance costs assures movement into a preferred technology, thereby driving market growth.

Breakup by End-Use Sector:

- Municipal Sector

- Industrial Sector

Municipal sector holds the largest share in the market

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes the municipal sector and industrial sector. According to the report, the municipal sector accounted for the largest market share.

The municipal sector is propelling the market as majority of the urban areas are seeking to implement effective means for waste management. Volumes of municipal solid waste have been generated with urbanization, thus increasing the pressure on the existing waste disposal systems. Incinerators, especially waste-to-energy systems, are sustainable waste management systems as it reduces the volume of waste while producing energy. Municipal authorities are using incineration technologies to meet the standards of environmental protection and prevent landfilling. In response to the increased urge from the governments to work for waste management reforms, the municipal sector is upgrading itself with the ultimate technology of incineration that ensures minimum emissions and more energy recovery.

Breakup by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest incinerator market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia Pacific represents the largest regional market for incinerator.

Asia Pacific is driving the market due to rapid urbanization and industrialization. Increasing pressure on the waste management systems has led the governments in the region to enforce tighter environmental regulations to reduce reliance on landfills and control waste management. As a result, there has been a massive shift toward embracing advanced incineration technologies, mainly waste-to-energy technologies. The main market leaders in this market are China and Japan, which are investing significantly in capital bases for incinerator plants and other related municipal, industrial, and hazardous waste structures. Additionally, Asia Pacific's quest for renewable energy sources, coupled with the reduction of greenhouse gases, supports the growth of the waste-to-energy incinerator market.

Competitive Landscape:

- The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include Babcock & Wilcox Co., Covanta Energy Corp., Suez Environnement Co. S.A., Constructions industrielles de la Méditerranée S.A, Gershman, Brickner & Bratton Inc., EEW Energy from Waste Gmbh, Martin Gmbh, Wheelabrator Technologies Inc., Novo Energy LLC, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the incinerator market are driving growth through technological innovations, strategic partnerships, and long-term service contracts. Leading companies are focusing on securing major projects. For instance, in October 2023, Mitsubishi announced receiving an order from the Fukushima Municipal Government to reconstruct the Abukuma Incineration Plant, replacing it with two advanced stoker-type incinerators. This contract includes a 20-year operation and maintenance agreement, reflecting the growing trend of long-term service solutions in the market. They are also focusing on the development of advanced waste-to-energy technologies, increasing their focus on environmentally friendly and efficient solutions, and expanding their service portfolios to include both small-scale and large-scale incineration projects. The major firms are also investing in innovations aimed at reducing emissions and improving energy recovery, while catering to the rising demand for waste management in urbanized regions. Partnerships, acquisitions, and geographic expansion are also playing crucial roles in their growth strategies.

Incinerator Market News:

- September 5, 2024: Babcock & Wilcox announced that the company has secured a contract to perform front-end engineering and design (FEED) for Varme Energy Inc.'s upcoming waste-to-energy project in Alberta, Canada, which includes carbon capture and sequestration. Under this contract, B&W will be responsible for the engineering and design of the plant’s waste-fired boiler, emissions control technologies, and the post-combustion carbon capture system.

- March 27, 2023: EEW Energy announced that it has signed a letter of intent (LOI) with LyondellBasell, a prominent player in the chemical industry. The LOI outlines plans to explore a potential long-term strategic partnership aimed at extracting and recycling plastics from incineration waste streams. This collaboration could involve the development of waste pre-sorting facilities at or near EEW's incineration plants to segregate plastics before incineration, as well as investment in advanced sorting technologies to enhance the refinement of extracted plastics.

Incinerator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Moving Grate, Static Hearth, Furnace and Multiple Hearth, Rotary Kiln, Fluidized Bed |

| End-Use Sectors Covered | Municipal Sector, Industrial Sector |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Babcock & Wilcox Co., Covanta Energy Corp., Suez Environnement Co. S.A., Constructions industrielles de la Méditerranée S.A, Gershman, Brickner & Bratton Inc., EEW Energy from Waste Gmbh, Martin Gmbh, Wheelabrator Technologies Inc., Novo Energy LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the incinerator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global incinerator market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the incinerator industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global incinerator market was valued at USD 16.3 Billion in 2024.

We expect the global incinerator market to exhibit a CAGR of 3.8% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the rising demand for incinerator to treat biomedical waste, such as Personal Protection Equipment (PPE), gloves and masks, and solid waste generated from quarantine and healthcare centers.

Based on the product type, the global incinerator market has been segmented into moving grate, static hearth, furnace and multiple hearth, rotary kiln, and fluidized bed. Among these, moving grate currently holds the majority of the total market share.

Based on the end-use sector, the global incinerator market can be divided into municipal sector and industrial sector. Currently, the municipal sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into Asia Pacific, North America, Europe, Middle East and Africa, and Latin America, where Asia Pacific currently dominates the global market.

Some of the major players in the global incinerator market include Babcock & Wilcox Co., Covanta Energy Corp., SUEZ Environnement Co. S.A., Constructions Industrielles de la Méditerranée S.A, Gershman, Brickner & Bratton Inc., EEW Energy from Waste GmbH, Martin GmbH, Wheelabrator Technologies Inc., Novo Energy LLC., etc.

The extensive utilization of incinerators for managing chemical wastes, medical wastes, agricultural wastes, building and municipality wastes, etc., is primarily influencing the global incinerator market.

The incinerator market is evolving towards greater sustainability, efficiency, and technological advancements. Key trends in the market include more focused environmental regulations, adoption of advanced emission control technologies, waste-to-energy integration, innovative combustion technologies, and a focus on hazardous waste management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)