In Vitro Diagnostics Market Size, Share, Trends and Forecast by Test Type, Product, Usability, Application, End User, and Region, 2025-2033

In Vitro Diagnostics [IVD] Market Size and Trends:

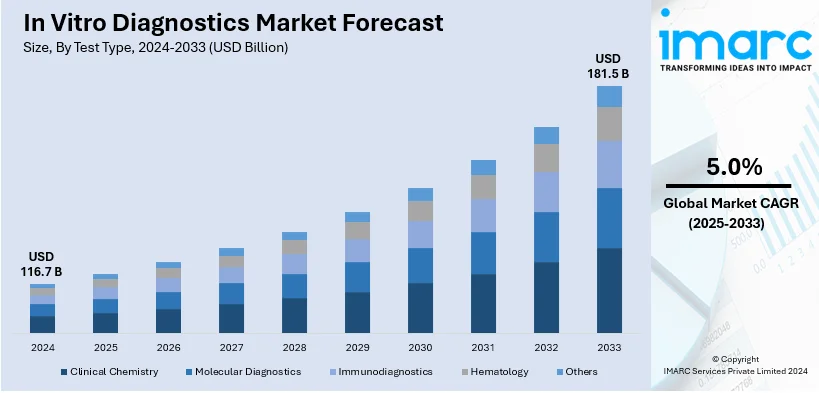

The global in vitro diagnostics market size was valued at USD 116.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 181.5 Billion by 2033, exhibiting a CAGR of 5.0% from 2025-2033. North America currently dominates the market, holding a market share of over 42.7% in 2024. The rising prevalence of infectious diseases, the continuous technological advancements, shifting consumer preferences towards personalized medicine, and increasing geriatric population are among the primary factors driving the in vitro diagnostics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 116.7 Billion |

|

Market Forecast in 2033

|

USD 181.5 Billion |

|

Market Growth Rate 2025-2033

|

5.0%

|

Increased geriatric population is becoming an important factor for the global in vitro diagnostics market growth. The share of the global population over the age of 60 will nearly double between the years 2015 to 2050, from 12% to 22%. In 2050 too, around 80% of geriatric people would be living in low- and middle-income countries. With this, the increased global life expectancy has led to the tremendously increasing population percentage of geriatric patients. Geriatrics and either associated morbidity such as cancer, diabetes, cardiovascular diseases, or neurodegenerative disorders including Alzheimer's disease are now on a worrying trend as their proliferation coincides with increased incidences such as cancer, diabetes, cardiovascular diseases, and neurodegenerative disorders. These diseases require recurrent use of diagnostic tests for early detection and monitoring management and create an ever intensifying need for IVD products. Most Geriatric patients will need extensive health checks covering elaborate diagnostics like; molecular diagnostics, immunoassays to clinical chemistry tests. Such tests, for example, determine disease markers and evaluate treatment response, benefiting the health outcome of the particular age group.

To get more information on this market, Request Sample

The U.S. IVD market is emerging as a major market, holding 94.01% of the total share. In the USA, the in vitro diagnostics market share is broadening due to hysterical advances in the technology of diagnosis, as well as the overhead predominance of chronic and infectious diseases. The increasing requirement for early and accurate detection of disease has steered the extensive attractions for newer diagnostic tools. Point of care, the emergence of testing at such a rapid pace, is expected to yield better patient outcomes within a more timely way. The steady increase in the geriatric population counts among factors that escalate the risk of chronic illness and hence necessitate more frequent diagnostics. Research indicates that older age cohorts, particularly those of 65 years in the United States, will increase to above available double numbers for the period of the next 40 years, hitting the bar of 80 million by 2040. Other areas have been directed by personalized medicine and companion diagnostics that open a window of opportunity for targeted therapy. Policy initiatives and reimbursement measures in support of national diagnostic testing extend market access.

In Vitro Diagnostics [IVD] Market Trends:

Continuous Technological Advancements

This advancement in technologies, including next-generation sequencing, molecular diagnostics, and microfluidics, has led to a stronger and more sensitive test with more accurate results. Advanced technologies are, thus augmenting the in vitro diagnostics market statistics. For example, recently, in November 2023, ARUP Laboratories won a CE mark from EU-IVDR for its AAV5 DetectCDx, which is a companion diagnostic to select the eligibility of patients afflicted by severe hemophilia A to go for BioMarin's new gene therapy called Roctavian. Another growth trend is the automation of diagnostic processes, reducing human errors, and increasing efficiency, and this trend will support the market in the near future. For instance, Siemens Healthineers launched the Atellica Solution, a fully automated clinical chemistry and immunoassay system. The system boasts a high throughput, a wide-assay menu, and efficient clinical laboratory performance. Toray Industries, Inc. won marketing approval from Japan's Ministry of Health, Labor, and Welfare for its Toray APOA2-iTQ, used in the diagnosis of pancreatic cancer, during June 2023. Abbott also received U.S. FDA clearance for a new laboratory Traumatic Brain Injury (TBI) blood test in the U.S.

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic illnesses, such as diabetes, cardiovascular disorders, and cancer is catalyzing the in vitro diagnostics market recent opportunities. Besides this, the elevating requirement for in vitro diagnostics in the early detection, monitoring, and management of severe diseases is propelling the growth of the market forward. For instance, according to the International Diabetes Federation Diabetes Atlas Tenth edition, a total of 537 Million individuals (20-79 years old) worldwide has diabetes. By 2030, there will be around 643 Million diabetics globally, and by 2045, the number is expected to reach 783 Million individuals. Moreover, the extensive utilization of IVD tests by healthcare professionals for making informed decisions in treatment, as they facilitate early screening and identification of risk factors, allowing timely preventive measures, is positively influencing the market. For example, Abbott Laboratories launched the Panbio COVID-19 Ag Rapid Test Device, a rapid antigen test for COVID-19. The test delivered the results within 15 minutes and was widely used for screening and surveillance purposes during the pandemic. Furthermore, Roche Diagnostics (Switzerland) launched the Cobas pulse system, a blood glucose management solution featuring mobile digital health capabilities designed to enhance patient care. Also, Roche received the Food and Drug Administration (FDA) approval for VENTANA MMR RxDx Panel to identify patients with dMMR solid tumors who are eligible for anti-PD-1 immunotherapy. Additionally, in December 2023, ARUP Laboratories and Medicover formed a partnership to offer diagnostic and healthcare services across Europe. ARUP Laboratories introduced AAV5 DetectCDx in collaboration with BioMarin Pharmaceutical Inc. to choose therapies for multiple hemophilia A patients.

Increasing Emphasis on Personalized Medicine

The rising focus on personalized medicine, which aims to tailor medical treatment to individual patients based on their genetic makeup, lifestyle, and other factors, is propelling the in vitro diagnostics market demand significantly. The Personalized Medicine Coalition (PMC) reports that personalized medicines represented over one-third (33%) of new U.S. Food and Drug Administration (FDA) drug approvals in 2023, continuing a trend for the fourth consecutive year. In line with this, IVD tests, such as genetic testing and companion diagnostics, provide critical insights into the unique characteristics of patients, enabling targeted therapies and avoiding unnecessary treatments or adverse reactions, which is also augmenting the market dynamics. Moreover, precision diagnostics, enabled by advanced technologies, such as Next-Generation Sequencing (NGS) and companion diagnostics, facilitate the identification of specific disease subtypes and molecular targets. For instance, in August 2023, the Precision the Medicine Centre (PMC) has partnered with the Regional Molecular Diagnostic Service (RMDS) to introduce genomic technology for cancer diagnosis in Northern Ireland. Additionally, in October 2023, the WHO published the Essential Diagnostics List (EDL), a comprehensive list of IVD products that aids countries in making decisions regarding diagnostic tools. It offers evidence-based recommendations and makes sure that essential products are accessible to target people. Furthermore, in August 2023, the Africa CDC collaborated with the Africa Development Agency-New Partnership for Africa's Development (AUDA-NEPAD) to increase access to diagnostic tests across Africa.

In Vitro Diagnostics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global in vitro diagnostics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on test type, product, usability, application, and end user.

Analysis by Test Type:

- Clinical Chemistry

- Molecular Diagnostics

- Immunodiagnostics

- Hematology

- Others

As per the latest in vitro diagnostics market outlook, molecular diagnostics occupies the biggest share in the market and accounts for 23.1%. It provides a greater accuracy and higher sensitivity for disease detection. Molecular diagnostics are capable of detecting low concentrations of target molecules which help them proceed with an early diagnosis and precise monitoring of illnesses. This sensitivity becomes inevitable in diseases such as infectious ones, genetic disorders, and some forms of cancers, because early intervention has a huge influence on treatment success. Advances in personalized medicine are strongly linked with molecular diagnostics. For instance, Medix Biochemica acquired 100% shares of myPOLS Biotec GmbH. By acquiring myPOLS Biotec, Medix Biochemica added to its portfolio of IVD raw materials and increased its selection of reagents for molecular diagnostics. This acquisition expanded the company's global presence and offered customers more advanced scientific and technological capabilities in molecular diagnostics.

Analysis by Product:

- Reagents and Kits

- Instruments

According to the recent in vitro diagnostics market forecast, reagents and kits hold a share of around 67.2% of the market in 2024. Reagents and kits are typically the foundation structures of most diagnostic tests. They mainly contain all chemicals and consumables, which would be needed to conduct specific analyses as well as assess patient samples. Diagnostic labs and health-care facilities almost relied on the reagents and kits available to do several tests; from some routine screenings up to difficult molecular diagnostics. The in vitro diagnostics market revenue is further accelerated due to the user-friendly and standardized reagents and kits, which ensure that there are consistent and reliable results across many laboratories or test sites. These testing kits enable easier tests with less manual preparation and risk of error. For example, Bio-Rad Laboratories Inc.'s SARS-CoV-2 Droplet Digital PCR (ddPCR) test kit has been approved by the FDA with EUA. The SARS-CoV-2 Droplet Digital PCR (ddPCR) Test is performed on the Bio-Rad QX200 and QXDx ddPCR systems. Roche Ltd. also launched the Elecsys Anti-SARS-CoV-2 S antibody test that measures the anti-SARS-CoV-2 antibody spike response generated by the immune system following COVID vaccination or infection.

Analysis by Usability:

- Disposable IVD Devices

- Reusable IVD Devices

Disposable IVD devices are designed for single use. They are never reused once they have been used for an individual patient or test procedure. They come fully pre-sterilized and ready for use, with no need for cleaning, disinfection, or reprocessing for each use. This makes disposable IVD devices very convenient and time-saving for healthcare providers who otherwise would have to deal with complex and time-consuming procedures for reprocessing. However, due to cleaning, sterilization, and maintaining the device following each utilization, reusable IVD devices may be reused many times. It is also commonly composed of strong materials which do not readily compromise when the tests are used repeatedly but ensure functionality. Also, their use offers the advantage of allowing customization in test performance, together with parameters.

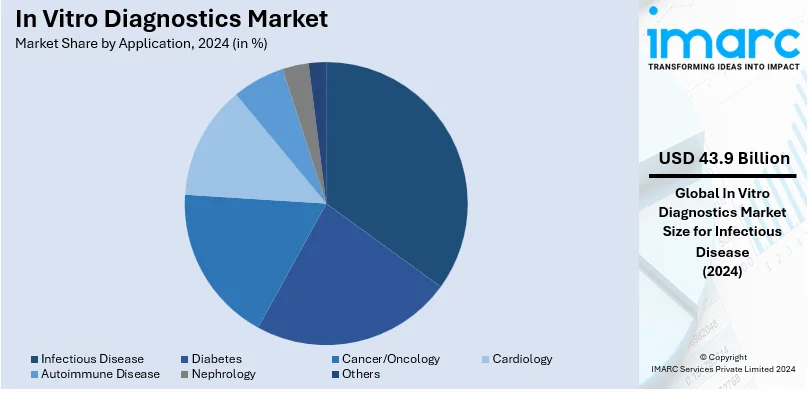

Analysis by Application:

- Infectious Disease

- Diabetes

- Cancer/Oncology

- Cardiology

- Autoimmune Disease

- Nephrology

- Others

Infectious disease is leading the market with approximately 37.6% share in 2024. Infectious diseases are among the leading global health issues and outbreaks that can cause drastic effects on public health and economies. Apart from this, these diseases have a high incidence and prevalence rates, impacting millions of people globally. Some of the common infectious diseases include tuberculosis, influenza, hepatitis, etc., and continue to affect communities around the world. As a result, in vitro diagnostics provide for the prompt and easy identification of infectious agents, which means that healthcare providers can initiate proper therapies, implement infection control measures, and prevent further transmission. For example, in February 2023, BD received EUA from the U.S. FDA for a new molecular diagnostic combined test for SARS-CoV-2, Influenza A+B, and Respiratory Syncytial Virus (RSV).

Analysis by End User:

- Hospitals Laboratories

- Clinical Laboratories

- Point-of-care Testing Centers

- Academic Institutes

- Patients

- Others

Hospital laboratories are essential entities within healthcare facilities. Their tasks are to provide diagnostic test service both to inpatients and outpatients. They hold the availability of several IVD equipment and reagents necessary in doing different tests among these being clinical chemistry, hematology, microbiology, and immunology. Hospitals rely majorly on the prompt diagnosis conducted through their in-housed laboratory to help in diagnosing their patients, treating, or controlling diseases. Apart from this, clinical laboratories are standalone entities that provide diagnostic testing services to healthcare providers, hospitals, clinics, and other medical settings. They deal with high-volume and specialized tests that may not be found in all hospital laboratories. For example, in February 2023, Unilabs announced it was investing over USD 200 Million in Siemens Healthineers' technology and acquiring more than 400 laboratory analyzers to strengthen its laboratory infrastructure. Not only that, the point-of-care testing (POCT) centers are the most rapidly growing segment in the IVD market. These give diagnostic tests at or near a place where the patient cares are being delivered. The POCT centers are especially valuable in emergency rooms, ambulances, nursing homes, and other remote or resource-limited settings where speedy diagnosis is of utmost importance. Additionally, research universities and medical schools further contribute to the market growth by conducting research, development, and education. They significantly contribute to advancing diagnostic technologies, discovering new biomarkers, and evaluating the effectiveness of diagnostic tests. Patients are increasingly making decisions about their healthcare, which includes diagnostic testing.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.7%. North America holds the highest share in the market overview of in vitro diagnostics due to its developed and sophisticated healthcare infrastructure, like modern clinical laboratories, hospitals, and research centers. Moreover, the well-established medical care system along with continuous technological advancement in the IVD industry is catalyzing the growth of the market. Besides this, the increasing investments from the major companies and institutions into research and development activities for the introduction of new diagnostic methods are further driving the market growth in this region. For example, according to the CDC, chronic conditions are the biggest cause of disability and death each year in the United States. Moreover, the SARS-CoV-2 Droplet Digital PCR (ddPCR) test kit by Bio-Rad Laboratories Inc. received Emergency Use Authorization from the US FDA.

Key Regional Takeaways:

United States In Vitro Diagnostics Market Analysis

Factors driving the in vitro diagnostics market in United States include technological progress, the aging population and the rising incidence of chronic diseases. Such high burdens of diseases, including cancer, diabetes, and cardiovascular conditions, increase the need for accurate, timely, and efficient diagnostics. The CDC reports that for the year 2021, there were 1,777,566 new cancer diagnoses, and in 2022, cancer took up 608,366 people's lives, which places a high demand on detection and diagnostic solutions. The surging interest in personalized medicine also means that the use of IVD technologies is stepped up by healthcare providers to provide increasingly targeted and individualized forms of treatment to patients. The FDA's attempt to ease the diagnostic regulatory processes also contributed to innovation and opened the market. The more expansive use of point-of-care testing and home diagnostics is another aspect that would influence healthcare delivery in terms of greater convenience, improved accessibility, and lower costs for the patients. As healthcare expenditure continues to rise and digital health platforms are escalating, the current trends in such dynamisms are bound to continue and shape the U.S. IVD market.

Europe In Vitro Diagnostics Market Analysis

Increasing incidence of chronic diseases, growing geriatric population, and sound infrastructure in health care in the region drives the European IVD market. Eurostat has shown that, compared with 2020, preventive healthcare expenditure in the EU has increased by 88.2% in current price terms, rising from 0.38% to 0.65% of GDP in 2021. The uptrend further accelerates the increase in interest towards early diagnosis and prevention. As more people begin suffering from health conditions that appear with aging, like diabetes and cardiovascular diseases, it is all the more imperative to require quick and precise diagnostic tools. Simplified regulatory requirements, as reflected by the European Union's In Vitro Diagnostic Regulation (IVDR), streamlined the procedures, promoting innovation and leading the growth in this market. Advances in molecular diagnostics, genomics, and next-generation sequencing are transforming the IVD landscape, making diagnostic procedures more precise. The trend toward decentralized healthcare, with greater focus on home testing and point-of-care solutions, is reshaping the market and expanding access to healthcare services across the region.

Asia Pacific In Vitro Diagnostics Market Analysis

In the APAC region, the in vitro diagnostics (IVD) market is driven by expanding healthcare access, rising awareness about health conditions, and significant improvements in medical infrastructure. According to the Statistics Bureau of Japan, the population aged 65 years and above reached 36,227 thousand, accounting for 29.1% of the total population in 2023, highlighting the increasing demand for healthcare services tailored to an aging population. The increasing incidence of chronic diseases, such as diabetes and cardiovascular conditions, especially in countries like Japan, China, and India, is driving the demand for advanced diagnostic solutions. Additionally, investments in healthcare systems and the growing middle-class population in emerging markets are accelerating market growth. Technological advancements in diagnostic devices, including automation and artificial intelligence, are enhancing diagnostic efficiency and improving healthcare access, particularly in rural and remote areas. These factors contribute to the overall expansion of the IVD market across the region.

Latin America In Vitro Diagnostics Market Analysis

In Latin America, the in vitro diagnostics (IVD) market is driven by rising healthcare awareness and an increasing emphasis on early diagnosis and preventive healthcare.In Brazil, for example, the NIH estimates that 928,000 deaths occur annually due to chronic diseases, with the high prevalence of overweight being a major contributing factor. This trend is observed across the region, as the increasing burden of chronic conditions like diabetes and cardiovascular prevalence drives the demand for advanced diagnostic tools. Governments are investing in healthcare reforms and expanding access to diagnostic services, particularly in larger countries like Brazil and Mexico, further supporting the growth of the IVD market. Technological advancements in diagnostic equipment are enhancing healthcare delivery, particularly in urban areas where infrastructure improvements are underway.

Middle East and Africa In Vitro Diagnostics Market Analysis

In the Middle East and Africa, the in vitro diagnostics (IVD) market is fueled by the rising prevalence of chronic diseases, increased healthcare investments, and growing health awareness. According to a survey published by PMC, the prevalence of self-reported chronic diseases in the UAE was 23.0%, with obesity, diabetes, and asthma/allergies being the most common conditions. This trend is mirrored across the region, driving the demand for advanced diagnostic solutions. In the Middle East, governments are investing in modern healthcare infrastructure, promoting the adoption of cutting-edge IVD technologies. Additionally, in Africa, initiatives aimed at improving healthcare access and the growing use of point-of-care testing are contributing to market expansion.

Competitive Landscape:

As per the emerging in vitro diagnostics market trends, leading players are focusing on innovation, strategic collaborations, and global expansion to strengthen their positions. Major companies are heavily investing in research and development (R&D) to launch advanced diagnostic solutions, such as molecular testing kits, point-of-care devices, and artificial intelligence (AI)-powered diagnostic tools. Firms are introducing cutting-edge technologies to enhance accuracy, speed, and reliability in disease detection and management. Partnerships and acquisitions are key strategies, as companies are acquiring smaller firms to expand their product portfolios and penetrate niche markets. Collaborations with healthcare providers and research institutions are enabling the development of targeted diagnostic solutions aligned with the growing demand for personalized medicine. Additionally, market leaders are focusing on increasing their presence in emerging economies by establishing manufacturing facilities, distribution networks, and training programs for healthcare professionals.

The report provides a comprehensive analysis of the competitive landscape in the in vitro diagnostics market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Agilent Technologies, Inc.

- Beckman Coulter, Inc.

- bioMérieux

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- Illumina, Inc.

- Qiagen N.V

- Shimadzu Corporation

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- October 2024: India’s IVD sector is vital to healthcare. The Central Drugs Standard Control Organisation (CDSCO) has eliminated clinical trial waivers for IVDs, ensuring that only thoroughly evaluated products are approved. This change aligns India’s regulations with global standards and aims to enhance patient safety by ensuring IVDs are tested for effectiveness and safety in local conditions.

- August 2024: Sysmex India, an IVD company headquartered in Mumbai, offers a range of clinical laboratory testing solutions, including haematology and clinical chemistry. With a workforce of more than 250 professionals, it serves a diverse customer base, including hospitals, labs, and medical institutions. Previously, Sysmex marketed its products through a distribution partner, but this partnership has now ended. The company continues to provide client support through its dedicated customer service center.

- November 2023: Newland EMEA, a leader in the AIDC business, has introduced a new in vitro diagnostics (IVD) product line for the healthcare sector. The new devices were showcased at MEDICA, the largest tradeshow for the medical industry, held in Düsseldorf from 13-16 November 2023.

- January 2024: ELITechGroup has gladly announced the debut of the GI Bacterial PLUS ELITe MGB® Kit, a significant addition to its diagnostic portfolio. The in vitro assay is specifically developed to diagnose gastrointestinal bacterial infections, targeting key bacterial pathogens such as Campylobacter spp., Clostridium difficile, Salmonella spp., Shigella spp., and Yersinia enterocolitica. ELITechGroup plans to launch three more kits in the upcoming quarter, expanding coverage to encompass all types of gastrointestinal illnesses.

- April 2024: Revvity's EUROIMMUN business, one of the providers of in-vitro diagnostic products, and ALPCO-GeneProof, A company specializing in molecular diagnostics has announced a strategic partnership aimed at increasing the availability of GeneProof PCR kits across the European Union.

In Vitro Diagnostics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Clinical Chemistry, Molecular Diagnostics, Immunodiagnostics, Hematology, Others |

| Products Covered | Reagents and Kits, Instruments |

| Usabilities Covered | Disposable IVD Devices, Reusable IVD Devices |

| Applications Covered | Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, Others |

| End Users Covered | Hospitals Laboratories, Clinical Laboratories, Point-of-care Testing Centers, Academic Institutes, Patients, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Agilent Technologies, Inc., Beckman Coulter, Inc., bioMérieux, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Qiagen N.V, Shimadzu Corporation, Siemens Healthineers AG, Sysmex Corporation, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the in vitro diagnostics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global in vitro diagnostics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the in vitro diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The In Vitro Diagnostics (IVD) market refers to the global industry centered on diagnostic tests and tools performed on samples like blood, urine, tissues, and other bodily fluids collected outside the human body (in vitro). These diagnostics help detect diseases, conditions, or infections and monitor patients' health status or responses to treatments.

IMARC estimates the in vitro diagnostics market to exhibit a CAGR of 5.0% during 2025-2033, reaching USD 181.5 Billion by 2033.

The in vitro diagnostics market was valued at USD 116.7 Billion in 2024.

The market is growing rapidly due to increasing geriatric population, rising prevalence of chronic diseases, significant technological advancements, and heightened emphasis on personalized medicine.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the in vitro diagnostics market include Abbott Laboratories, Agilent Technologies, Inc., Beckman Coulter, Inc., bioMérieux, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Qiagen N.V, Shimadzu Corporation, Siemens Healthineers AG, Sysmex Corporation, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)