In-Game Advertising Market Size, Share, Trends and Forecast by Type, Device Type, and Region, 2026-2034

In-Game Advertising Market Size and Share:

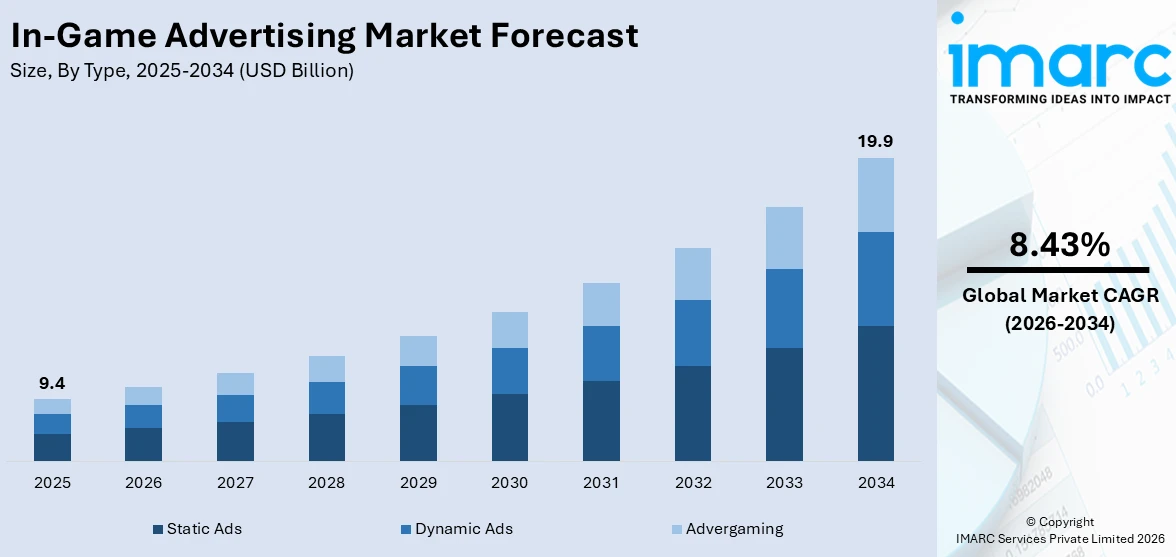

The global in-game advertising market size was valued at USD 9.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 19.9 Billion by 2034, exhibiting a CAGR of 8.43% from 2026-2034. North America currently dominates the market, holding a market share of 36.8% in 2025. The region benefits from advanced digital infrastructure, widespread adoption of gaming platforms, a tech-savvy consumer base, and strong advertiser interest in programmatic and immersive ad formats, all contributing to the in-game advertising market share.

The gaming industry's explosive growth, the increasing use of smartphones, and the expanding availability of the internet for a wide range of demographics are driving the worldwide in-game advertising market. Brands looking to engage audiences in virtual worlds now have a lot of options thanks to the growth of free-to-play gaming models, which rely mostly on advertising revenue. The total efficacy of in-game campaigns is also increased by the growing integration of artificial intelligence and programmatic advertising technologies, which allow for accurate targeting and real-time ad optimization. Advertiser interest is further heightened by the rising popularity of competitive gaming and esports, as these platforms draw sizable, very interested audiences. Furthermore, developments in virtual and augmented reality are creating immersive advertising experiences that appeal to contemporary customers. The shift toward non-intrusive ad formats and rewarded advertising models is also strengthening the in-game advertising market outlook, driving greater acceptance and sustained revenue growth.

For a variety of reasons, the US has become a significant market for in-game advertising. The nation has a strong digital advertising ecosystem that is backed by sophisticated infrastructure, a high internet penetration rate, and the extensive usage of PCs, gaming consoles, and mobile devices. In order to attract younger audiences that are typically more difficult to reach through traditional media, advertisers are using in-game advertisements more and more. Continuous innovation in ad distribution, measurement, and attribution is encouraged by the dominance of large gaming publishers and ad technology companies in the United States. The nation's standing as a top market is further reinforced by the growing use of programmatic and AI-driven advertising solutions. Further supporting the expansion of the in-game advertising business in the region is the growing popularity of esports and live streaming platforms, which provide advertisers a variety of interaction avenues. The expanding adoption of programmatic and AI-driven in-game advertising solutions is further accelerating the in-game advertising market growth across the country.

To get more information on this market Request Sample

In-Game Advertising Market Trends:

Rising AI-Driven Programmatic Advertising

The way companies interact with gamers in virtual worlds is changing as a result of the incorporation of artificial intelligence into programmatic advertising systems. In order to provide highly customized ad experiences in real time, AI-driven algorithms now evaluate enormous volumes of player behavioral data, contextual signals, and interaction patterns. Thanks to this development, advertisers may now use dynamic ad insertion that changes based on user choices and gaming sessions rather than static placements. By providing real-time testing, optimization, and performance monitoring without interfering with gaming, the system simplifies campaign administration. Real-time bidding efficiency and AI-powered audience targeting capabilities are driving programmatic ad buying's continued growth in its share of in-game ad placements. With the ability to create creatives that blend in with a variety of gaming environments at scale, this development is especially revolutionary for intrinsic in-game advertising. Larger advertising budgets are being drawn into the gaming channel as a result of the ensuing increases in targeting accuracy and return on investment, which is supporting the industry's ongoing growth. The gaming channel's continued growth is being fueled by higher advertising spending drawn in by the ensuing gains in targeting accuracy and return on investment.

Expansion of Immersive Ad Formats

The development and adoption of immersive and non-intrusive ad formats represent a significant shift in the in-game advertising market trends. Native integrations that improve the game experience rather than disrupt it are becoming more popular as brands shift away from traditional disruptive ad placements. These include sponsored virtual events, branded in-game goods, virtual billboards inside game environments, and interactive product placements that let users interact with branded information naturally. Rewarded advertising is gaining more traction since it provides players with real advantages like in-game money or extra content in return for their interaction with the advertisement. Nowadays, an increasing percentage of players actively engage with branded material within games, demonstrating a high level of openness to effectively integrated advertising forms. The combination of in-game advertising with augmented and virtual reality technology is expanding the creative possibilities even more. Advertisers may produce memorable brand experiences that appeal to gamers thanks to these developing formats, which greatly increase brand recall and buy intent.

Growing Influence of Esports Ecosystem

Significant new prospects for in-game advertising are being created by the competitive gaming and esports industries' explosive expansion. Brands have unique access to highly engaged viewers across several platforms and devices thanks to the enormous global audiences that esports events draw. More opportunities for real-time sponsor involvement during live broadcasts and tournaments have been created by the growing professionalization of competitive gaming and the growth of streaming platforms. Dynamic in-game placements during competitive matches, branded virtual venues, and sponsorship integrations are all becoming commonplace advertising tactics. Key revenue streams are concentrated in large locations, and the growing esports viewership keeps growing significantly year over year. Because of this, esport is an appealing avenue for companies looking to reach younger, tech-savvy consumers. According to the in-game advertising industry projection, the convergence of gaming, streaming, and advertising will continue to spur innovation and investment in this area. Esports is a tempting medium for businesses looking to reach younger, digitally native customers because of its growing viewership. The in-game advertising market forecast indicates that convergence between gaming, streaming, and advertising will continue accelerating investment and innovation within this segment.

In-Game Advertising Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global in-game advertising market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type and device type.

Analysis by Type:

- Static Ads

- Dynamic Ads

- Advergaming

Static ads hold 43.2% of the market share. Static advertisements are fixed promotional placements embedded directly within gaming environments, offering brands a seamless and non-disruptive means of reaching audiences. These ads integrate naturally into game scenery, appearing as billboards, posters, signage, and environmental branding elements that complement the visual design of the game without requiring modifications to gameplay mechanics or code architecture. Static ads are compatible across multiple gaming platforms, including PC, console, and mobile, enabling advertisers to reach diverse audiences without being constrained by technical limitations or device-specific requirements. For instance, in 2025, approximately 46% of gamers report making purchases influenced by in-game advertisements, reflecting the effectiveness of well-placed static placements in driving consumer action. The increasing popularity of gaming consoles and the expanding free-to-play model across platforms further strengthen the demand for static in-game advertising, making it a dependable and scalable format for brands seeking consistent audience exposure.

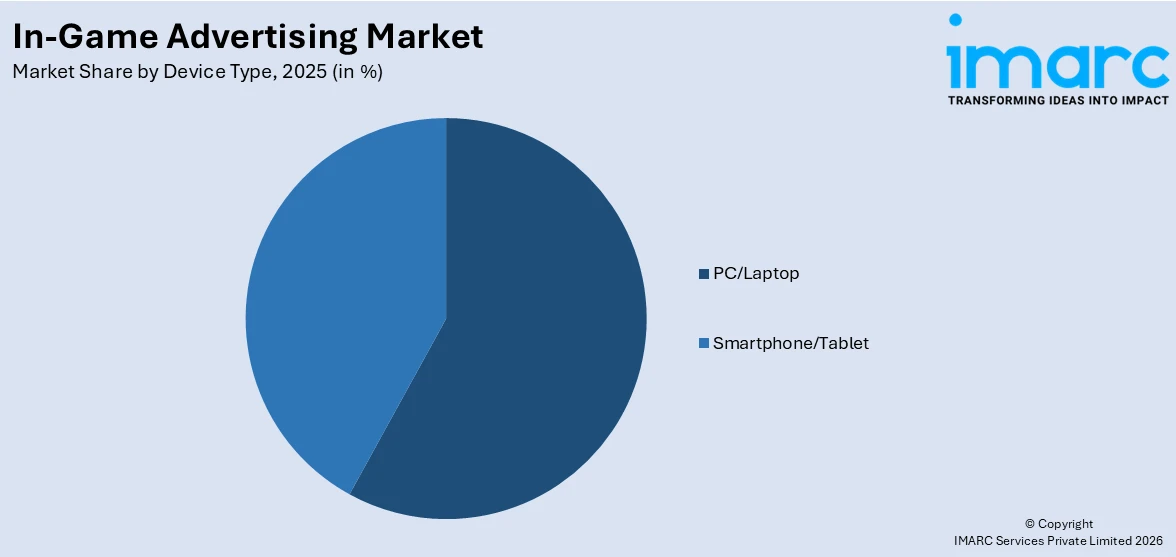

Analysis by Device Type:

Access the comprehensive market breakdown Request Sample

- PC/Laptop

- Smartphone/Tablet

PC/l leads the market with a share of 57.6%. Personal computers and laptops remain the dominant platform for in-game advertising due to their extensive processing capabilities, large display formats, and the established ecosystem of ad-supported gaming titles. The PC gaming environment supports a wide range of advertising formats, from static banner placements and branded virtual billboards to dynamic server-side ad insertions that update in real time based on user profiles and geographic location. The platform attracts both casual and dedicated gamers, providing advertisers access to highly engaged audiences with longer average session durations compared to mobile platforms. PC and console gamers consistently demonstrate higher brand recall rates and longer engagement times with in-game advertisements, making this segment particularly attractive for advertisers. Continued advancements in graphics technology, cloud gaming, and cross-platform integration are further enhancing the advertising potential of the PC and laptop segment, enabling more immersive and visually compelling ad experiences.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 36.8% of the share, enjoys the leading position in the market. The region benefits from a mature digital advertising ecosystem, advanced technological infrastructure, and a large base of active gamers across multiple platforms. The presence of major gaming publishers, ad technology companies, and digital media agencies in the United States and Canada drives continuous innovation in ad formats, targeting methodologies, and performance measurement tools. The widespread adoption of programmatic advertising and AI-driven optimization platforms enables advertisers to deliver personalized and contextually relevant in-game campaigns at scale. The strong growth trajectory of in-game advertising revenue within the North American gaming ecosystem underscores the expanding commercial potential of this channel. The region also benefits from a well-established esports infrastructure and growing streaming audiences, providing brands with additional touchpoints to engage highly engaged gaming communities and further solidifying North America as the global leader in in-game advertising.

Key Regional Takeaways:

United States In-Game Advertising Market Analysis

The United States holds 88.50% of the market share in North America. The country is the largest contributor to the in-game advertising market within the region, driven by its advanced digital infrastructure, high internet penetration, and the widespread adoption of gaming across demographic segments. The US benefits from a mature advertising technology ecosystem that supports programmatic buying, real-time bidding, and AI-powered audience segmentation, enabling highly targeted in-game campaigns. The dominance of free-to-play gaming models, particularly in mobile and PC segments, has significantly expanded the available advertising inventory. American consumers demonstrate growing acceptance of rewarded and native ad formats, with a relatively low proportion of gamers expressing general dislike toward in-game advertisements. The country also possesses a massive and expanding base of digital gamers, providing advertisers with a substantial addressable audience. The presence of leading game publishers, social gaming platforms, and innovative ad-tech startups further accelerates market expansion. Additionally, the growth of esports viewership and gaming creator content provides advertisers with diversified engagement channels, reinforcing the United States as a critical market for in-game advertising investment.

Europe In-Game Advertising Market Analysis

Europe represents a significant portion of the global in-game advertising market, supported by a diverse gaming audience, strong regulatory frameworks, and increasing advertiser interest in digital entertainment channels. The region benefits from high internet penetration across key markets including Germany, the United Kingdom, France, Italy, and Spain, facilitating broad access to gaming platforms and ad-supported titles. European advertisers are increasingly recognizing the potential of in-game advertising to reach younger demographics and digitally engaged consumers who are difficult to access through traditional media channels. The emphasis on data privacy regulations, including the General Data Protection Regulation, has encouraged the development of privacy-compliant contextual advertising solutions within gaming environments. For instance, the Europe gaming market generated USD 91.61 billion in 2025, demonstrating the substantial scale of the gaming audience available for advertising engagement. The growing popularity of esports, mobile gaming, and cloud gaming services is further expanding the advertising inventory across the continent, while localized content strategies enhance ad relevance and consumer receptivity.

Asia-Pacific In-Game Advertising Market Analysis

The Asia-Pacific region represents a rapidly growing segment of the global in-game advertising market, driven by its massive gaming population, widespread mobile adoption, and expanding digital infrastructure. Countries including China, Japan, India, and South Korea are key contributors, with mobile gaming dominating platform preferences due to high smartphone penetration and affordable internet connectivity. The region accounts for the largest share of global gamers, with over half of the worldwide gaming population residing in Asia-Pacific, reflecting the enormous scale of the addressable advertising audience. Advertisers in the region are increasingly leveraging localized and culturally relevant content strategies to optimize engagement across diverse markets. The rapid expansion of esports, live streaming platforms, and cloud gaming services is further broadening the available advertising channels and attracting growing advertiser interest.

Latin America In-Game Advertising Market Analysis

Latin America is emerging as a promising market for in-game advertising, fueled by rising internet penetration, growing smartphone adoption, and an expanding youth population actively engaged in digital gaming. Mobile gaming dominates the regional landscape, providing advertisers with increasing opportunities to reach consumers through ad-supported titles and rewarded formats. The region is witnessing rising advertiser interest as gaming audiences expand across key markets including Brazil and Mexico. Social gaming and free-to-play models are driving advertising revenue growth, while improving broadband infrastructure supports higher-quality gaming experiences and more sophisticated ad delivery capabilities across the continent.

Middle East and Africa In-Game Advertising Market Analysis

The Middle East and Africa region represents a high-growth opportunity for the in-game advertising market, supported by favorable demographic trends, increasing mobile connectivity, and government-led investments in digital entertainment infrastructure. The region possesses one of the youngest populations globally, with a significant proportion under the age of 30, driving strong demand for mobile and online gaming. The gaming population across the region continues to expand at a rapid pace year on year. Countries such as Saudi Arabia and the UAE are actively investing in esports infrastructure and gaming ecosystems, while improving internet penetration across Africa is expanding the addressable market for in-game advertising.

Competitive Landscape:

The global in-game advertising market is characterized by intense competition among major technology companies, specialized ad-tech firms, and gaming publishers seeking to monetize their platforms through innovative advertising solutions. Key players are investing heavily in programmatic advertising capabilities, AI-driven optimization tools, and cross-platform ad delivery systems to enhance campaign effectiveness and attract larger advertising budgets. Strategic partnerships between gaming publishers and advertising technology providers are becoming increasingly common, enabling seamless integration of non-disruptive ad formats within premium gaming environments. Companies are also focusing on developing advanced measurement and attribution solutions to demonstrate the effectiveness of in-game advertising campaigns to brand advertisers. The growing emphasis on brand safety, viewability standards, and privacy-compliant targeting is driving competitive differentiation among market participants. Additionally, players are expanding their reach through acquisitions, technology licensing, and collaborations with esports organizations and streaming platforms to capture a broader share of the expanding in-game advertising ecosystem.

The report provides a comprehensive analysis of the competitive landscape in the in-game advertising market with detailed profiles of all major companies, including:

- Activision Blizzard Media Ltd.

- AdInMo Ltd.

- Adverty AB (publ)

- Anzu Virtual Reality Ltd.

- Bidstack Limited

- Electronic Arts Inc.

- HotPlay

- IronSource Ltd. (Unity Technologies)

- Playwire

- RapidFire, Inc.

Latest News and Developments:

- In May 2025, adWMG announced a strategic partnership with Gadsme, unlocking immersive ad formats within Xbox and PlayStation titles. The collaboration enables advertisers to integrate native 3D placements and in-game audio experiences across console and mobile environments. This partnership connects console and mobile ecosystems, creating a unified omnichannel advertising experience for brands.

- In January 2025, Apex Gaming Network partnered with League-M to enhance mobile gaming advertising in Europe. The collaboration introduces seamless ad formats, data-driven audience insights, and improved monetization strategies for game developers. The partnership focuses on creating engaging, non-intrusive advertisements that maximize revenue while maintaining an optimal gaming experience for players.

In-Game Advertising Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Static Ads, Dynamic Ads, Advergaming |

| Device Types Covered | PC/Laptop, Smartphone/Tablet |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Activision Blizzard Media Ltd., AdInMo Ltd., Adverty AB (publ), Anzu Virtual Reality Ltd., Bidstack Limited, Electronic Arts Inc., HotPlay, IronSource Ltd. (Unity Technologies), Playwire, RapidFire, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the in-game advertising market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global in-game advertising market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the in-game advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in-game advertising market was valued at USD 9.4 Billion in 2025.

IMARC estimates the in-game advertising market is expected to exhibit a CAGR of 8.43% during 2026-2034, reaching a value of USD 19.9 Billion by 2034.

The in-game advertising market is primarily driven by the rapid expansion of the gaming industry, increasing smartphone penetration and internet accessibility, the growth of free-to-play gaming models, advancements in programmatic advertising and AI-driven targeting, the expanding esports ecosystem, and the shift toward immersive and non-intrusive ad formats.

North America currently dominates the in-game advertising market, accounting for a share of 36.8%. The region benefits from advanced digital infrastructure, a large and highly engaged gaming audience, the presence of leading ad-tech companies, and strong adoption of programmatic advertising platforms.

Some of the major players in the in-game advertising market include Activision Blizzard Media Ltd., AdInMo Ltd., Adverty AB (publ), Anzu Virtual Reality Ltd., Bidstack Limited, Electronic Arts Inc., HotPlay, IronSource Ltd. (Unity Technologies), Playwire, RapidFire, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)