In-flight Entertainment and Connectivity Market Size, Share, Trends and Forecast by Aircraft Type, Component Type, Class, Technology, End User, and Region, 2025-2033

In-flight Entertainment and Connectivity Market Size and Share:

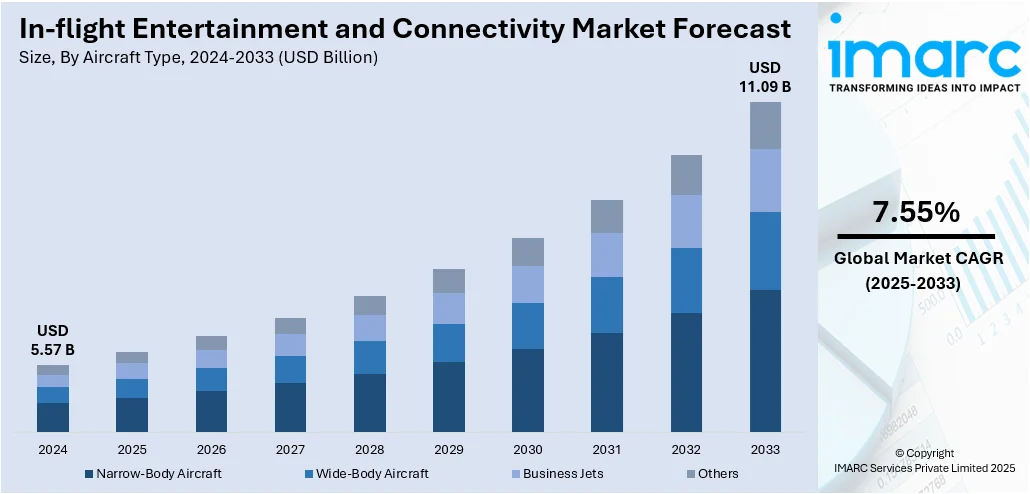

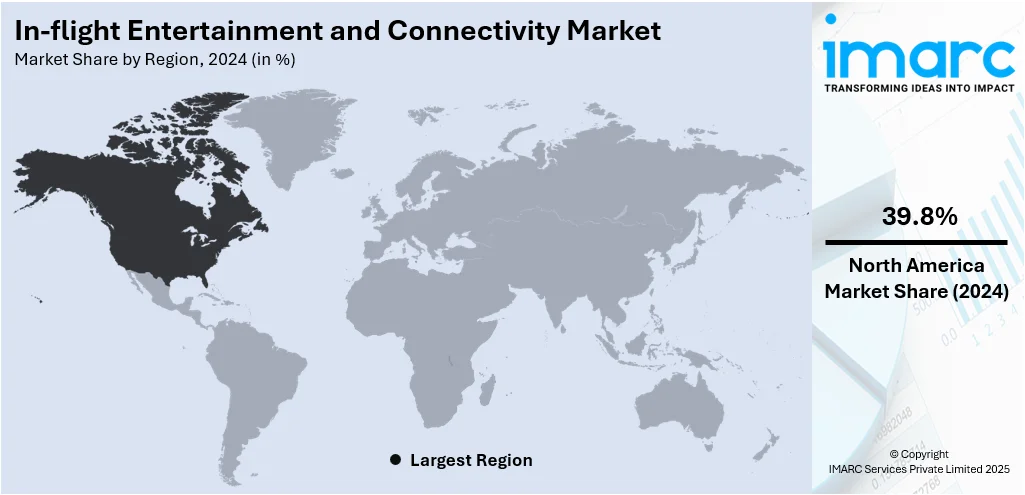

The global in-flight entertainment and connectivity market size was valued at USD 5.57 Billion in 2024. The market is projected to reach USD 11.09 Billion by 2033, exhibiting a CAGR of 7.55% from 2025-2033. North America currently dominates the market, holding a market share of 39.8% in 2024. The surging global air travel, ongoing technological advancements, high investments in research and development (R&D) activities, and rising number of long-haul flights are fueling the market growth. Besides this, increasing focus on passenger well-being is propelling the in-flight entertainment and connectivity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.57 Billion |

|

Market Forecast in 2033

|

USD 11.09 Billion |

| Market Growth Rate (2025-2033) | 7.55% |

At present, the market is driven by the growing passenger expectations for seamless digital experiences while traveling. As air travel is becoming more common among both business and leisure passengers, airlines are investing in advanced entertainment systems and high-speed internet to enhance customer satisfaction and remain competitive. The rising number of long-haul flights is creating the need for onboard engagement through streaming platforms, interactive screens, and real-time communication options. Technological innovations like satellite-based broadband, content personalization, and wireless media streaming are further accelerating the adoption. Airlines are also collaborating with content providers and tech companies to offer curated experiences.

To get more information on this market, Request Sample

The United States has emerged as a major region in the in-flight entertainment and connectivity market owing to many factors. Increasing digital expectations of tech-savvy travelers who demand uninterrupted access to online services during flights are offering a favorable in-flight entertainment and connectivity market outlook. Airlines are prioritizing enhanced passenger experiences through investments in high-speed wireless fidelity (Wi-Fi), on-demand video streaming, and personalized content platforms. The presence of major technology providers and airline companies is encouraging continuous innovations and faster adoption of advanced onboard systems. Additionally, a strong business travel segment is catalyzing consistent demand for seamless connectivity, especially for productivity during flights. As per the IMARC Group, the United States business travel market size reached USD 241.0 Billion in 2024.

In-flight Entertainment and Connectivity Market Trends:

Rising Air Traffic

The aviation industry across various regions is experiencing a consistent rise in the number of passengers, driven by factors like economic growth, increasing middle-class population, and greater accessibility to air travel. For instance, in 2024, domestic air passenger traffic in India increased by 6.12%, totaling 161.3 Million passengers, according to the data released by the Directorate General of Civil Aviation (DGCA). The growing volume of international air travelers is catalyzing the demand for diverse onboard experiences, leading airlines to differentiate through enhanced in-flight entertainment and connectivity offerings. As new routes are added and frequencies on existing ones are rising, especially across developing regions, more aircraft are being equipped with modern digital systems. Long-haul and ultra-long-haul flights, in particular, benefit from advanced entertainment and high-speed internet access to improve passenger comfort. Travelers expect seamless access to movies, music, games, and messaging throughout their journeys. This cultural shift in travel expectations, combined with the sheer rise in flight hours, is enabling airlines to continually upgrade onboard connectivity infrastructure, driving sustained demand across the industry.

Increased Investments

Rising investments in R&D activities to improve software and broadband technology are fueling the in-flight entertainment and connectivity market growth. For instance, in July 2024, Panasonic Avionics Corporation, one of the prominent players in in-flight entertainment and connectivity solutions, unveiled a new software design and development facility in Pune, India. This software was central to every in-flight entertainment and connectivity solution. Expenditure is also being directed towards developing cloud-based content delivery systems that offer dynamic, real-time updates, eliminating traditional content refresh delays. Companies are modernizing legacy systems by integrating artificial intelligence (AI) to personalize user experiences based on preferences and previous usage. Funding is also supporting sustainability efforts by developing lightweight and energy-efficient systems that reduce fuel consumption. In-flight entertainment and connectivity companies are expanding global support centers and maintenance hubs to ensure uninterrupted service across fleets.

Technological Advancements

Advancements in satellite technology are among the major in-flight entertainment and connectivity market trends. Innovations, such as high-throughput satellites (HTS) and Ka-band technology, enable faster and more reliable in-flight connectivity, allowing better streaming services, video calls, and internet browsing. For instance, in August 2023, Panasonic Avionics Corporation (Panasonic Avionics) launched an enhanced GEO Ku-band satellite capacity that provided faster in-flight internet access for airlines and their customers, thereby boosting the in-flight entertainment and connectivity market revenue. New user interface designs and intuitive controls are making in-flight entertainment and connectivity platforms more accessible and engaging for all age groups. Bluetooth-enabled systems allow passengers to connect personal headphones, enhancing comfort. Voice-recognition and language translation tools are being explored to help passengers interact with systems in their preferred language. Some airlines are testing cloud gaming and live event streaming, pushing the boundaries of traditional in-flight content. Real-time system analytics are being employed to monitor usage patterns and deliver performance insights, which airlines can utilize to refine content offerings.

In-flight Entertainment and Connectivity Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global in-flight entertainment and connectivity market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on aircraft type, component type, class, technology, and end user.

Analysis by Aircraft Type:

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Business Jets

- Others

Narrow-body aircraft held 53.8% of the market share in 2024. It typically has a fuselage diameter of 3 to 4 meters (10 to 13 feet) and is equipped with a single aisle running through the cabin. It usually accommodates between 100 to 240 passengers, depending on the aircraft's configuration. Narrow-body aircraft is being equipped with in-flight entertainment and connectivity systems, particularly wireless solutions that allow passengers to stream content on personal devices. It often operates multiple flights per day, increasing the opportunities for passengers to access and benefit from in-flight entertainment and connectivity services. The cabin layout of narrow-body aircraft allows efficient integration of seatback screens, wireless streaming systems, and connectivity hardware without compromising space or comfort. Furthermore, their consistent flight schedules and high passenger turnover are driving steady demand for entertainment and connectivity features, enhancing overall travel experiences. The combination of operational prevalence, practical cabin configuration, and ability to deliver in-flight entertainment and connectivity solutions effectively across varied routes establishes narrow-body aircraft as the leading segment in the market.

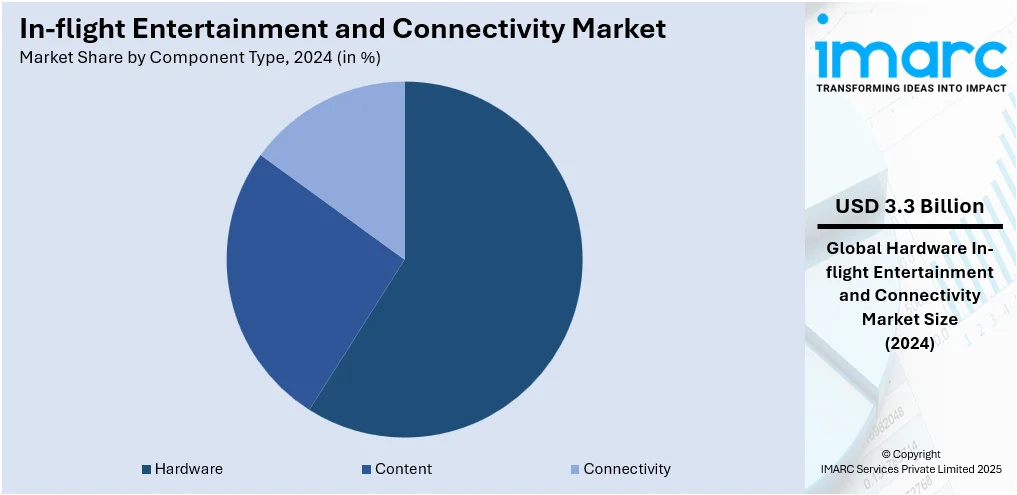

Analysis by Component Type:

- Content

- Hardware

- Connectivity

Hardware accounts for 59.0% of the market share. Hardware components, such as seatback screens, control units, antennas, modems, servers, and wireless access points, are essential for delivering and managing content as well as ensuring stable connectivity throughout a flight. These physical devices form the core infrastructure that supports streaming services, real-time communication, gaming, and passenger engagement tools. Airlines are investing significantly in durable and efficient hardware to improve user experience and differentiate their services, especially in premium cabins. With rising expectations for high-definition video and seamless connectivity, the demand for powerful, high-speed hardware systems is increasing. Moreover, hardware requires regular upgrades and replacements, ensuring a consistent revenue stream for manufacturers. As airlines are expanding fleets or retrofitting existing aircraft, they continue to prioritize robust hardware installation to meet modern traveler demands. Additionally, hardware compatibility with satellite systems and software platforms is enhancing its criticality in this market segment.

Analysis by Class:

- Economy Class

- Premium Economy Class

- Business Class

- First Class

Business class represents the largest market share in 2024, due to higher passenger expectations and premium service offerings. Business travelers often seek a seamless and productive travel experience, making advanced in-flight entertainment and high-speed connectivity essential components. Airlines are investing heavily in enhancing business class cabins with features like large high-definition screens, noise-cancelling headphones, touchscreen remotes, and personalized content libraries to meet these expectations. Additionally, business class passengers are more likely to require stable internet for work-related tasks, such as video conferencing, email communication, and cloud access, encouraging carriers to provide superior connectivity solutions. The willingness of business travelers to pay a premium for comfort and digital convenience is motivating airlines to prioritize expenditure in cutting-edge in-flight entertainment and connectivity technologies in this class. Furthermore, business class sections often have fewer seats, allowing airlines to provide better bandwidth per user and more individualized entertainment systems.

Analysis by Technology:

- Air-to-Ground Technology

- Satellite Technology

Satellite technology holds 68.0% of the market share. It provides wide-area, high-speed internet coverage, especially over oceans and remote regions where traditional ground-based systems fall short. Airlines rely on satellite networks, such as Ku-band, Ka-band, and high-throughput satellites, to deliver seamless and uninterrupted connectivity across long-haul and international routes. This technology supports bandwidth-intensive applications like video streaming, video conferencing, and real-time messaging, which are increasingly demanded by passengers. Moreover, advancements in satellite systems enable better data speeds, lower latency, and improved coverage, enhancing the overall in-flight digital experience. Unlike air-to-ground systems that are limited to specific regions, satellite communication ensures global connectivity, making it indispensable for international airlines. Leading service providers continuously upgrade their satellite infrastructure to accommodate the growing data traffic and rising customer expectations. Additionally, satellite-based systems support more flexible installation across various aircraft types and fleet sizes, which benefits both new and retrofitted aircraft. As per the in-flight entertainment and connectivity market forecast, with airlines competing to differentiate themselves by offering superior digital services onboard, satellite technology will continue to hold dominance in the industry.

Analysis by End User:

- OEM

- Aftermarket

Aftermarket exhibits a clear dominance in the market because of the growing need among airlines to upgrade and modernize their existing fleets with advanced digital systems. Many carriers operate older aircraft that were not initially equipped with modern in-flight entertainment and connectivity technologies. To meet rising passenger expectations for onboard internet access, streaming services, and personalized content, airlines are investing in retrofitting their fleets. This trend is especially prominent among low-cost and regional carriers seeking to remain competitive without investing in new aircraft. Additionally, the aftermarket segment offers flexibility in choosing tailored solutions from third-party providers, enabling airlines to select cost-effective and scalable systems that match their service goals. The increasing demand for quick installation and integration is also supporting the growth of aftermarket services. Furthermore, as technological advancements continue, relatively newer aircraft may require upgrades to remain compatible with the latest connectivity standards, reinforcing the dominance of the aftermarket segment in the industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 39.8%, enjoys the leading position in the market. The region is noted for its well-established aviation infrastructure, high air travel frequency, and strong presence of major airlines that prioritize passenger experience. According to the recent World Air Transport Statistics (WATS) published by the International Air Transport Association (IATA), the US continued to lead as the largest aviation market globally, reaching 876 Million passengers in 2024, bolstered by a domestic market growth of 5.2% compared to 2023. The region has a large base of frequent flyers, especially business travelers, who demand consistent and high-quality internet access and entertainment options during flights. North American carriers continue to invest heavily in upgrading their systems with cutting-edge technologies, such as high-speed satellite-based internet, personalized entertainment platforms, and wireless streaming services. The presence of leading technology providers and in-flight entertainment and connectivity solution companies headquartered in the region is further strengthening its dominance.

Key Regional Takeaways:

United States In-flight Entertainment and Connectivity Market Analysis

The United States holds 85% of the market share in North America. The United States is witnessing a surge in in-flight entertainment and connectivity adoption due to rising air traffic driven by an increasing number of domestic and international flights. For instance, according to the Bureau of Transportation Statistics (BTS), US airlines transported 67.2 Million scheduled service passengers systemwide (both domestic and international) in February 2025. Airlines are enhancing passenger experience through high-speed connectivity, streaming services, and personalized entertainment systems. As airports are experiencing greater congestion, carriers are focusing on differentiating through onboard services. Business travelers and frequent flyers are also demanding seamless digital access. This increasing air traffic is supporting robust upgrades in onboard systems. Airlines are also integrating satellite-based technologies and expanding partnerships with content providers to retain competitive edge. Rising air traffic is encouraging fleet expansion and retrofitting with advanced systems, reinforcing the demand for reliable entertainment and connectivity infrastructure. The growing preferences for digital engagement during flights, advancements in 5G integration, and rising adoption of personal device streaming models are positively influencing the market.

Europe In-flight Entertainment and Connectivity Market Analysis

Europe is showing accelerated usage of in-flight entertainment and connectivity, driven by the growing investments in the aviation sector and increasing air travel demand. Airlines are prioritizing passenger satisfaction by modernizing cabins with high-speed internet, audio services, and broadband connectivity. In January 2025, AirBaltic revealed plans to be the first European airline to launch Starlink’s onboard internet service within the first quarter of 2025. Rising expenditure on the aviation sector is supporting fleet upgrades and infrastructure development that includes the integration of digital systems onboard. Increasing air travel demand, especially for both business and leisure purposes, requires airlines to offer engaging experiences that encourage brand loyalty. Carriers are focusing on enhancing their service levels to cater to digitally inclined passengers. Other factors driving the Europe market include the expansion of low-cost carriers integrating digital services, rising adoption of sustainable aviation technologies paired with modern cabins, increasing cross-border collaborations among content providers, and the growing preferences for streaming on personal devices. Regulatory support for digital transformation is also boosting adoption.

Asia-Pacific In-flight Entertainment and Connectivity Market Analysis

The market in the Asia-Pacific region is experiencing robust growth due to the increasing number of airports and flights. As per the India Brand Equity Foundation (IBEF), it is projected that the total count of airplanes will arrive at 1,100 by the year 2027. The expansion of airport infrastructure and low-cost carrier penetration has led to higher competition, encouraging airlines to invest in differentiated passenger experiences. Rising volume of regional and international flights across major hubs is supporting the integration of onboard Wi-Fi and streaming platforms. Passengers are expecting consistent digital access throughout their journey, driving the adoption of content-rich platforms and connectivity hardware. The presence of emerging economies and rapid aviation growth is catalyzing the demand for cost-effective solutions.

Latin America In-flight Entertainment and Connectivity Market Analysis

Latin America is witnessing notable growth in in-flight entertainment and connectivity (IFEC) adoption because of the growing tourism activities in the region, coupled with rising urbanization and disposable incomes. A rising middle-class population with increased purchasing power is leading to more frequent air travel. For instance, Latin America and the Caribbean underwent a rapid urbanization process, making it one of the most urbanized regions in the world. As of March 2025, 82% of the population resided in cities, in contrast to the worldwide average of 58%. Urbanization contributes to increased domestic connectivity, leading carriers to enhance their service levels with entertainment systems and wireless internet.

Middle East and Africa In-flight Entertainment and Connectivity Market Analysis

The Middle East and Africa region is employing in-flight entertainment and connectivity advancements due to the growing international tourism activities. For instance, in January 2025, Dubai received 1.94 Million overnight guests, reflecting a rise of 9% compared to January 2024. Airlines are enhancing their onboard experience to attract international tourists by providing multilingual content, streaming platforms, and uninterrupted internet services. The surge in international tourism is driving airlines to differentiate themselves through advanced digital engagement during flights, supporting regional growth in in-flight entertainment and connectivity offerings.

Competitive Landscape:

Key players are consistently investing in research, innovation, and strategic partnerships. Key companies are developing advanced connectivity solutions that facilitate rapid internet access, smooth streaming, and instantaneous communication. These players are collaborating with airlines to tailor content platforms, optimize user interfaces, and integrate cutting-edge technologies like satellite-based broadband and AI-based personalization. Their focus on enhancing system reliability, reducing latency, and supporting multi-device usage is significantly elevating the passenger experience. Moreover, through global service coverage and scalable solutions, these providers enable airlines to meet evolving passenger expectations. Continuous software upgrades, partnerships with content creators, and maintenance support from these key players are further strengthening airline capabilities, helping drive market expansion and customer satisfaction across diverse travel segments. For instance, in April 2025, Thales unveiled 360Stream, presenting an innovative in-flight entertainment and connectivity solution featuring live event-driven programming and DVR functions at 40,000 feet. The system allowed airlines to offer Live TV and Near-Live highlights throughout any fleet, backed by providers, such as BBC News and CNN.

The report provides a comprehensive analysis of the competitive landscape in the in-flight entertainment and connectivity market with detailed profiles of all major companies, including:

- BAE Systems Plc

- Cobham Limited (Advent International)

- Global Eagle Entertainment Inc.

- Honeywell International Inc.

- Lockheed Martin Corporation

- Lufthansa Systems GmbH & Co. KG (Deutsche Lufthansa AG)

- Panasonic Avionics Corporation (Panasonic Corporation)

- Rockwell Collins Inc. (United Technologies Corporation)

- Thales Group

- The Boeing Company

- Viasat Inc.

Latest News and Developments:

- July 2025: IndiGo began formal discussions with satellite communication companies and released a Request for Proposal to facilitate in-flight entertainment and connectivity on approximately 25 aircraft in 2025. The airline intends to initiate the rollout for its business class travelers, aiming for a probable launch in November 2025 because of prolonged approval timelines.

- July 2025: LATAM Airlines Group revealed intentions to implement in-flight entertainment and connectivity on its wide-body planes for long-haul flights beginning in 2026 with a USD 60 Million investment. The initiative is set to enhance the connectivity services offered on short- and medium-haul flights.

- May 2025: EVA Air introduced an enhanced in-flight entertainment and connectivity service, providing free Wi-Fi to every passenger as part of a summer promotion. The service allowed uninterrupted browsing after the aircraft ascended to 10,000 feet and continued to be complimentary for Business Class and ‘Infinity MileageLands’ members.

- April 2025: Viasat released its advanced in-flight entertainment and connectivity solution, Amara, aimed at providing customized connectivity experiences in commercial aviation. The firm also launched the Viasat Aera antenna, improving intelligent, adaptable, and multi-orbit network efficiency for airlines.

In-flight Entertainment and Connectivity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Narrow-Body Aircraft, Wide-Body Aircraft, Business Jets, Others |

| Component Types Covered | Content, Hardware, Connectivity |

| Classes Covered | Economy Class, Premium Economy Class, Business Class, First Class |

| Technologies Covered | Air-to-Ground Technology, Satellite Technology |

| End Users Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | BAE Systems Plc, Cobham Limited (Advent International), Global Eagle Entertainment Inc., Honeywell International Inc., Lockheed Martin Corporation, Lufthansa Systems GmbH & Co. KG (Deutsche Lufthansa AG), Panasonic Avionics Corporation (Panasonic Corporation), Rockwell Collins Inc. (United Technologies Corporation), Thales Group, The Boeing Company, Viasat Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the in-flight entertainment and connectivity market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global in-flight entertainment and connectivity market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the in-flight entertainment and connectivity industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in-flight entertainment and connectivity market was valued at USD 5.57 Billion in 2024.

The in-flight entertainment and connectivity market is projected to exhibit a CAGR of 7.55% during 2025-2033, reaching a value of USD 11.09 Billion by 2033.

As more people continue to carry smartphones, tablets, and laptops on flights, the demand for rapid internet access, smooth streaming, and instantaneous communication is increasing significantly. Airlines are responding by upgrading their fleets with advanced systems that offer personalized entertainment, connectivity, and e-commerce options. Besides this, the growing competition among airlines is encouraging carriers to differentiate themselves by providing superior onboard experiences.

North America currently dominates the in-flight entertainment and connectivity market, accounting for a share of 39.8% in 2024, due to strong airline competition, early adoption of advanced technologies, and high demand from frequent business travelers. The presence of major in-flight entertainment and connectivity providers and the growing passenger expectations are further driving continuous investments in enhanced onboard digital experiences across the region.

Some of the major players in the in-flight entertainment and connectivity market include BAE Systems Plc, Cobham Limited (Advent International), Global Eagle Entertainment Inc., Honeywell International Inc., Lockheed Martin Corporation, Lufthansa Systems GmbH & Co. KG (Deutsche Lufthansa AG), Panasonic Avionics Corporation (Panasonic Corporation), Rockwell Collins Inc. (United Technologies Corporation), Thales Group, The Boeing Company, Viasat Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)